HilltopSecurities Public Entity Survey Results Now Available

26 September 2024 - 2:00PM

Business Wire

Over 1,200 Respondents Identify Challenges,

Priorities Facing Public Entities

Hilltop Securities Inc. (HilltopSecurities) has released the

results of its 2024 Public Entity Survey, highlighting the key

priorities and challenges facing municipalities, school districts,

and other public entities across the United States. The complete

survey results are available here.

“As a leading municipal investment bank and wealth advisory firm

with more than 78 years of history in public finance,

HilltopSecurities is deeply invested in assisting public entities

address the challenges and opportunities that directly affect their

communities,” said HilltopSecurities President and CEO Brad Winges.

“Our public entity survey provides important insights for the

issuers, investors, and other market participants who play an

important role in this vital sector of our economy. We are excited

for the opportunity to expand this annual survey in future

years.”

The survey was conducted from May to August of this year with

responses submitted by more than 1,200 public sector employees and

municipal market participants from all 50 states and the District

of Columbia. The survey responses provided insights on a range of

topics including:

- Challenges facing public entities

- Top priorities for debt issuance

- Impact of remote work

- Labor and staffing

- Importance of the municipal bond tax-exemption

Of those taking the survey, employees of cities, counties, and

school districts accounted for 75% of the responses. The majority

of the remaining responses were from special district, state, and

utility employees. Labor and staffing, along with aging

infrastructure, were the top two areas cited as the biggest

challenges facing public entities.

“We were extremely pleased at the level of engagement and

participation in this first annual Public Entity Survey that

touches on the most important issues facing the public sector and

the municipal markets,” said HilltopSecurities Co-Head of Public

Finance David Medanich.

Co-Head of Public Finance Mike Bartolotta added,

“HilltopSecurities is uniquely positioned to gather and analyze

information about the key priorities and challenges facing public

entities across the nation. We look forward to providing more

insight on these important topics in the future.”

About Hilltop Securities Inc.

HilltopSecurities is a full-service municipal investment bank

and wealth advisory firm providing a full suite of financial

services for public entities, institutional investors, housing

finance agencies, broker-dealers, and individual investors. Founded

in 1946, its primary areas of focus include public finance, capital

markets, structured finance, retail brokerage, clearing services,

and securities lending. Hilltop Securities Inc.’s goal is to build

long-term relationships to help communities, businesses, and

individuals thrive. A wholly owned subsidiary of Hilltop Holdings

Inc. (NYSE: HTH), HilltopSecurities’ affiliates include Momentum

Independent Network, HilltopSecurities Asset Management,

HilltopSecurities Insurance, PlainsCapital Bank, and PrimeLending.

Learn more at HilltopSecurities.com. Member: NYSE/FINRA/SIPC.

Forward-Looking Statements Disclaimer

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements anticipated in

such statements. Forward-looking statements speak only as of the

date they are made and, except as required by law, we do not assume

any duty to update forward-looking statements. Such forward-looking

statements include, but are not limited to, statements concerning

such things as our plans, objectives, strategies, expectations,

intentions and other statements that are not statements of

historical fact, and may be identified by words such as “believe,”

“continue,” “expects,” “expand,” “focus,” “may,” “plan,” “seeks,”

“will” or “would” or the negative of these words and phrases or

similar words or phrases. See the risk factors described in Hilltop

Holdings Inc.’s most recent Annual Report on Form 10-K and

subsequent Quarterly Reports on Form 10-Q and other reports that

are filed with the Securities and Exchange Commission. All

forward-looking statements are qualified in their entirety by this

cautionary statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926482067/en/

Hilltop Holdings Inc. Ben Brooks 214.252.4047

ben.brooks@hilltop.com

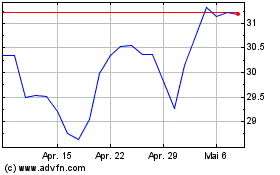

Hilltop (NYSE:HTH)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

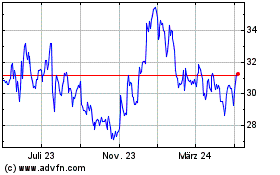

Hilltop (NYSE:HTH)

Historical Stock Chart

Von Dez 2023 bis Dez 2024