UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | |

| FORM 11-K |

| (Mark One) |

| |

| ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended December 31, 2023 |

| |

| OR |

| |

| TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from ________________________to_______________________ |

| |

| Commission File Number: 001-37483 |

| |

| | A. Full title of the plan and address of the plan, if different from that of the issuer named below: |

| |

| HEWLETT PACKARD ENTERPRISE 401(k) PLAN |

| |

|

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

| |

| HEWLETT PACKARD ENTERPRISE COMPANY

1701 East Mossy Oaks Road Spring, Texas 77389 |

Hewlett Packard Enterprise 401(k) Plan

Financial Statements and Supplemental Schedules

December 31, 2023 and 2022 and For the Year Ended December 31, 2023

Contents

| | | | | |

| |

| |

Audited Financial Statements | |

| |

| |

| |

| |

Supplemental Schedules | |

| |

| |

| |

| |

| |

| Exhibit Index | |

| |

Report of Independent Registered Public Accounting Firm

To the Plan Participants and the Plan Administrator of Hewlett Packard Enterprise 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Hewlett Packard Enterprise 401(k) Plan (the “Plan”) as of December 31, 2023 and 2022, and the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan at December 31, 2023 and 2022, and the changes in its net assets available for benefits for the year ended December 31, 2023, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Schedules Required by ERISA

The accompanying supplemental schedules of assets (held at end of year) as of December 31, 2023, and delinquent participant contributions for the year then ended (referred to as the “supplemental schedules”), have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The information in the supplemental schedules is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and

other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedules. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

We have served as the Plan’s auditor since 2016.

San Jose, California

June 13, 2024

Hewlett Packard Enterprise 401(k) Plan

Statements of Net Assets Available for Benefits

| | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, |

| | | 2023 | | 2022 |

| | | (In thousands) |

| Assets | | | | |

| Investments, at fair value | | $ | 7,726,484 | | $ | 6,853,791 |

| Synthetic investment contracts, at contract value | | | 456,855 | | | 560,437 |

| Total investments | | | 8,183,339 | | | 7,414,228 |

| | | | | | |

| Receivables: | | | | |

| Notes receivable from participants | 41,652 | | 40,763 |

| Employer contributions | 26,144 | | 26,001 |

| Total receivables | | 67,796 | | 66,764 |

| Total assets | | 8,251,135 | | 7,480,992 |

| | | | | |

| Net assets available for benefits | | $ | 8,251,135 | | $ | 7,480,992 |

| | | | | |

| See accompanying notes. | | | |

Hewlett Packard Enterprise 401(k) Plan

Statement of Changes in Net Assets Available for Benefits

| | | | | | | | | | | | | | |

| | Year Ended |

| | December 31, 2023 |

| | (In thousands) |

| Additions | |

| Investment income: | | | |

| Net realized and unrealized appreciation in fair value of investments | $ | 1,174,999 | |

| Interest and dividends | | 17,299 | |

| Total investment income | 1,192,298 | |

| | | | |

| Contributions: | |

| Employer | | 93,684 | |

| Participants | | 251,573 | |

| Rollovers | | 32,017 | |

| Total contributions | | 377,274 | |

| Interest income on notes receivable from participants | | 2,443 | |

| Total additions | | 1,572,015 | |

| | |

| Deductions | |

| Benefits paid directly to participants | | 800,733 | |

| Administrative expenses and other fees | | 1,139 | |

| Total deductions | | 801,872 | |

| | |

| Net increase | | 770,143 | |

| | |

| Net assets available for benefits: | |

| Beginning of year | | 7,480,992 | |

| End of year | $ | 8,251,135 | |

| | |

| See accompanying notes. | |

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements

1. Description of the Plan

The following brief description of the Hewlett Packard Enterprise 401(k) Plan (the Plan) provides only general information. Participants should refer to the summary plan description for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan covering eligible employees of Hewlett Packard Enterprise Company (the Company, Employer, Plan Sponsor, or HPE) and designated domestic subsidiaries who are on the U.S. payroll and who are employed as regular full-time, regular part-time or limited-term employees. The Plan was established on November 1, 2015. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). The Plan’s recordkeeper and trustee is Fidelity Workplace Services LLC (Fidelity) and Fidelity Management Trust Company (FMTC), respectively.

Investments

Assets of the Plan are invested in a five-tier investment structure. Tier 1 includes nine Birth Date Funds and the Conservative Portfolio. The Birth Date Funds’ investment strategies are designed to become more conservative as participants grow older. The Conservative Portfolio’s investment strategy is designed for a participant who has a low tolerance for risk and/or a shorter time horizon for investing. Tier 2 includes five actively-managed institutional funds from the main asset classes - stocks, bonds, and short-term investments. Tier 3 includes four index funds that seek to mirror a specific market index by investing in similar equities and bonds that the index funds are benchmarked against. Tier 4 includes the HPE Stock Fund which consists of the Company’s common stock and a cash component. Tier 5 is a self-directed brokerage window that offers thousands of brand-name mutual funds and exchange-traded funds (ETFs) through an affiliate of Fidelity. All investments are participant-directed.

The Plan includes an employee stock ownership plan feature (the ESOP) within the meaning of Section 4975(e)(7) of the Internal Revenue Code of 1986, as amended (the Code). The ESOP is maintained as part of the Plan and is designed to invest primarily in the Company’s common stock. The purpose of the ESOP is to permit eligible participants the option of having dividends on the Company’s common stock re-invested in the Plan or paid directly to them in cash.

If a participant’s account balance currently has more than 20% invested in the HPE Stock Fund, the participant will not be forced to reduce his or her holdings in the HPE Stock Fund; however, the investment election for ongoing contributions and loan repayments will be limited to a maximum of 20% in the HPE Stock Fund. Any percentage above the 20% limit for ongoing contributions and loan repayments will automatically be directed to the appropriate Birth Date Fund based generally on the year the participant was born. In addition, future requested exchanges into the HPE Stock Fund will be blocked if the requested change will cause the participant to exceed the 20% limit or if the participant is already at or above the 20% limit. Finally, if the participant chooses to rebalance his or her portfolio, the respective holdings in the

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

HPE Stock Fund will be limited to a maximum of 20% regardless of the current investments in the HPE Stock Fund.

Contributions

The Company matching contribution is equal to 100% of the first 4% of eligible compensation a participant contributes each payroll period. The Company matching contribution will be funded after the end of the calendar quarter. In order to qualify for the quarterly Company matching contribution, a participant must be employed by HPE or a member of its affiliated group on the last day of the quarter or have terminated employment during the calendar quarter as a result of such participant’s death, or in connection with a sale or other disposition by the Company of the business unit in which the participant was employed.

In addition, a participant is entitled to receive the Company matching contribution “true-up” in an amount equal to the difference between 100% of the first 4% of eligible compensation a participant contributed during a plan year and the sum of Company matching contributions contributed on behalf of such participant during the calendar year, if the participant is an eligible employee with HPE at the end of the calendar year (with a few limited exceptions) or terminates employment due to the approved termination events.

Participants may contribute, up to 50% of their eligible compensation on a per payroll period basis, as defined in the plan document and subject to Code Section 401(a)(17). Employees can choose pre-tax contributions, after-tax Roth 401(k) contributions, non-Roth after-tax contributions or a combination of the three, subject to the aggregate limits. Contributions are also subject to annual limits specified under the Code. The Code’s annual limit on pre-tax and Roth 401(k) contributions was $22,500 for 2023. The Plan’s annual limit on non-Roth after-tax contributions is established by the plan administrator in its discretion and was $22,500 for 2023. Participants who are age 50 or older by the end of the plan year can contribute an additional $7,500 above the foregoing annual limits. Contributions can be made as whole or fractional percentages of eligible compensation. Pre-tax contributions and after-tax Roth 401(k) contributions are eligible for the Company matching contributions. Non-Roth after-tax contributions and catch-up contributions are not eligible for the Company matching contributions.

Eligible employees are enrolled automatically in the Plan at a 3% pre-tax contribution rate in the Birth Date Fund based generally on the year the eligible employee was born.

The Plan also accepts rollover contributions of amounts representing distributions from other qualified defined benefit or defined contribution plans, including amounts from a Roth deferred account, as described in Section 402A(e)(1) of the Code, to the extent the rollover is permitted under Section 402(c) of the Code.

Vesting

Participants are fully-vested at all times with regard to their pre-tax, Roth 401(k) and non-Roth after-tax contributions and earnings thereon.

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

In general, participants become fully-vested in their Company matching contributions and earnings thereon upon completion of one year of vesting service. In addition, a participant becomes 100% vested in their Company matching contributions, and earnings thereon, at attainment of age 65, death before termination of employment, or termination of employment due to a partial or total disability while receiving long-term disability benefits under the Hewlett Packard Enterprise Disability Plan.

Participants are also fully vested in their Company matching contributions, and earnings thereon, if they terminate employment in connection with a sale or divestiture by the Company of the business unit in which the participant had been employed, pursuant to the terms of certain service schedules under the approved termination events, or as set forth in the plan document.

Participant Accounts

Each participant’s account is credited with the participant’s contributions, applicable Company matching contributions, and plan earnings, and is charged with an allocation of administrative expenses. Plan earnings are allocated to each participant’s account based on the ratio of the participant’s account balance and share of net earnings of their respective elected investment options. Allocations are determined in accordance with the provisions of the plan document. The benefit to which a participant is entitled is the benefit that can be provided from the vested portion of the participant’s account.

Notes Receivable from Participants

The Plan offers two types of loans, which are general-purpose loans and primary residence loans. The repayment period for a general-purpose loan may not exceed five years, and the repayment period for a primary residence loan may not exceed 15 years.

Participants may borrow from their accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their vested account balances. Loans are secured by the participant’s vested account. Interest rates remain fixed for the life of the loan and are based on a rate that is commensurate with interest charged for loans that would be made under similar circumstances. For the applicable period, that was determined to be the prevailing prime rate plus 1%. Principal and interest are paid ratably through payroll deductions. Participant loans are classified as notes receivable from participants on the Statements of Net Assets Available for Benefits and are valued at their unpaid principal balance, plus accrued but unpaid interest. Interest income on notes receivable from participants is recorded when earned. Related fees are recorded as administrative expenses and are recorded when incurred. No allowance for credit losses has been recorded as of December 31, 2023 and 2022. Participants can continue to repay their loans post-termination, as long as they have not taken a distribution from their accounts.

Forfeitures

If a participant terminates employment before becoming fully vested in their Company matching contributions, the non-vested Company matching contributions (and earnings thereon) are

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

forfeited at the earlier of the date the participant receives a distribution or incurs a five-year break-in-service. Forfeited balances are restored if the participant returns to an eligible status within five years of termination and repays any amount previously distributed. Forfeited balances of terminated participants’ non-vested accounts are used to reduce future Company matching contributions, restore previously forfeited balances, pay eligible plan expenses, or for any other permitted use.

Approximately $2.3 million of unallocated forfeitures were used to reduce Company matching contributions for 2023. As of December 31, 2023 and 2022, the balance of unallocated forfeiture totaled $0.3 million and $0.2 million, respectively.

Payment of Benefits

On termination, death, or retirement, participants may elect to receive their vested account balance in a lump-sum or in installments. Lump-sum payments may be made in cash or whole shares of stock for distribution from the HPE Stock Fund. Installment distributions are also permitted for participants eligible to begin receiving their minimum required distributions. Hardship withdrawals and in-service withdrawals are permitted if certain criteria are met. Participants may also, at any time, withdraw all or part of their rollover accounts.

Administrative Expenses and Investment Management Fees

Certain expenses of the Plan for administrative services are paid directly by the Plan, except to the extent the Company chooses to pay such expenses. Each participant is charged a fixed amount of $34 per year for recordkeeping services. Certain investment management fees related to investment options are paid directly to the Plan’s investment managers.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right to discontinue its contributions and to terminate the Plan, in each case, at any time for any reason subject to the provisions of ERISA. In the event that the Plan is terminated, participants would become 100% vested in their accounts.

2. Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements have been prepared in accordance with U.S. generally accepted accounting principles (GAAP).

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates that affect the amounts reported in the financial statements and accompanying notes and supplemental schedules. Actual results could differ from those estimates.

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

Investment Valuation and Income Recognition

The Plan’s investments are stated at fair value with the exception of fully benefit-responsive investment contracts, which are stated at contract value. See Note 3 for discussion on fair value measurements. See Note 7 for discussion of the fully benefit-responsive investment contracts.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded as earned. Dividends are recorded on the ex-dividend date. Net appreciation (depreciation) in the fair value of investments includes the Plan’s gains and losses on investments bought and sold, as well as held during the year.

Benefit Payments

Benefit payments are recorded when paid.

3. Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the measurement date.

Fair Value Hierarchy

Valuation techniques used by the Plan are based upon observable and unobservable inputs. Observable or market inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Plan’s consideration of market assumptions based on the best information available. Assets and liabilities are classified in the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement:

Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 – Quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, and inputs other than quoted prices that are observable for the assets and liabilities and market-corroborated inputs. The Plan holds no level 2 assets.

Level 3 – Unobservable inputs for the asset or liability. The Plan holds no level 3 assets.

The fair value hierarchy gives the highest priority to observable inputs and lowest priority to unobservable inputs.

Valuation Techniques

The following is a description of the valuation techniques used to measure fair value. There were no changes in the techniques used to measure fair value for the year ended December 31, 2023.

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

Collective investment/common collective trusts: Valued at the net asset value (NAV) practical expedient established by the fund’s issuer on the last business day of the plan year, based on the fair value of the assets underlying the funds. There is a 15-day redemption waiting period for the collective investment trusts.

Common stocks, ETFs and mutual funds held in self-directed brokerage accounts: Valued at the closing price reported on the active market on which the individual securities are traded.

Short-term investments: Valued at cost plus accrued interest, which approximates fair value.

The methods described above may produce a fair value estimate that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the plan administrator believes its valuation techniques are appropriate and consistent with other market participants, the use of different techniques or assumptions to estimate fair value could result in a different fair value measurement at the reporting date.

The following table sets forth the Plan’s assets and liabilities at fair value as of December 31, 2023, by level, within the fair value hierarchy.

| | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2023 (In thousands) |

| Total | Level 1 |

Investments, at fair value: | | |

Common collective trusts at NAV | $ | 2,352,015 | | |

Collective investment trusts at NAV | | 4,759,604 | | |

Self-directed brokerage accounts | | 534,923 | | $ | 534,923 | |

Short-term investments | | 15,268 | | | 15,268 | |

HPE common stock fund | | 64,674 | | | 64,674 | |

Total investments, at fair value | $ | 7,726,484 | | $ | 614,865 | |

The following table sets forth the Plan’s assets and liabilities at fair value as of December 31, 2022, by level, within the fair value hierarchy:

| | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2022 (In thousands) |

| Total | Level 1 |

Investments, at fair value: | | |

Common collective trusts at NAV | $ | 2,015,398 | | | |

Collective investment trusts at NAV | 4,331,149 | | | |

Self-directed brokerage accounts | 427,216 | | | $ | 427,216 | |

Short-term investments | 15,486 | | | 15,486 | | |

HPE common stock fund | 64,542 | | | 64,542 | | |

Total investments, at fair value | $ | 6,853,791 | | | $ | 507,244 | |

Transfers between Levels

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

The availability of observable market data is monitored to assess the appropriate classification of assets and liabilities within the fair value hierarchy. Changes in economic conditions, changes in observability of significant inputs, or changes in model-based valuation techniques may require the transfer of an asset or liability between levels of the fair value hierarchy. In such instances, the transfer is reported at the beginning of the reporting period. For the year ended December 31, 2023, there were no transfers between levels.

4. Income Tax Status

The Plan has received a determination letter from the Internal Revenue Service (IRS) dated April 26, 2018, stating that the Plan is tax-qualified under Section 401(a) of the Code, and the related trust is tax exempt under section 501(a) of the Code. Subsequent to this determination by the IRS, the Plan was amended and restated. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The plan sponsor has indicated that it will take the necessary steps, if any, to bring the Plan's operations into compliance with the Code and to maintain the tax qualified status of the Plan.

Plan management evaluates uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2023, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

5. Related Party and Party-in-Interest Transactions

The Plan engages in certain transactions involving the Company, BlackRock, Inc. (“BlackRock”), FMTC, and affiliates of Fidelity, which are, or have at certain times in the audited period been, parties-in-interest under the provisions of ERISA. These transactions involve the purchase and sale of the Company’s common stock, the payment of investment management fees to BlackRock, the payment of trustee fees to FMTC, and investments in money market and mutual funds and a self-directed brokerage feature managed by affiliates of Fidelity. These transactions are covered by an exemption from the prohibited transaction provisions of ERISA and the Code.

At December 31, 2023 and 2022, the Plan held approximately 3.8 million and 4 million shares, respectively, of common stock of the Company, with fair values of approximately $64.3 million and $64.1 million, respectively. The Plan made purchases of $3.7 million and sales of $7.6 million of the Company’s common stock, and recorded dividend income of $1.9 million from the Company’s common stock during 2023.

In addition, the Plan held approximately $2,352 million and $2,015 million of the Blackrock Common Collective Trust Funds as of December 31, 2023 and 2022, respectively. BlackRock

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

beneficially owned approximately 9.9% and 10.3% of outstanding shares of the Company’s common stock as of December 31, 2023 and 2022, respectively.

As of December 31, 2023 and 2022, the Plan held investments issued by affiliates of Fidelity totaling $335 million and $278 million, respectively.

6. Risk and Uncertainties

Investment securities are exposed to various risks, such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities held by the Plan, it is at least reasonably possible that changes in fair value may occur and that such changes could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

The global challenges resulting from public health crises, such as the novel coronavirus pandemic (“COVID-19”), and actions taken by central banks around the world to fight inflation have led to volatility in financial markets and have affected, and may continue to affect, the fair value of the Plan assets. We are unable to predict the extent to which these events and central banks actions may impact financial markets and fair value of the Plan assets.

7. Investment in Fully Benefit-Responsive Investment Contracts

The Plan holds a portfolio of synthetic guaranteed investment contracts (“GICs”). These contracts meet the fully benefit-responsive investment contract criteria and therefore are reported at contract value. Contract value is the relevant measure of fully benefit-responsive investment contracts because this is the amount received by participants if they were to initiate permitted transactions under the terms of the Plan. Contract value represents contributions made under each contract, plus earnings, less participant’s withdrawals and administrative expenses. The GICs had a contract value of approximately $456.9 million and $560.4 million at December 31, 2023 and 2022, respectively.

The Plan invests in investment contracts through the Invesco Stable Value Fund (the “Fund”). The Fund invests primarily in fully benefit-responsive investment contracts in a wrapper contract structure (also known as synthetic GICs). In a wrapper contract structure, the wrapper contracts are issued by insurance companies or banks and the underlying investments are high quality fixed income securities or investment funds held in trust for plan participants. The wrapper contracts amortize the realized and unrealized gains and losses on the underlying fixed income investments, typically over the expected duration of the investments through adjustments to the future interest crediting rate on each contract which is reset on a monthly basis. The issuer of the wrapper contract provides assurance that the adjustments to the interest crediting rate do not result in a future interest crediting rate that is less than zero. An interest crediting rate less than zero would result in a loss of principal or accrued interest.

The key factors that influence future interest crediting rates for a wrapper contract include: the level of market interest rates, the amount and timing of participant activity into/out of the wrapper contract, the investment returns generated by the fixed income investments that back the wrapper contract, and the duration of the underlying investments backing the wrapper contract.

Hewlett Packard Enterprise 401(k) Plan

Notes to Financial Statements (continued)

Certain employer initiated events may limit the ability of the Plan to transact at contract value with the issuer. These events include, but are not limited to, full or partial termination of the Plan, a material adverse change to the provisions of the Plan, an employer election to withdraw from the contract to switch to a different investment provider, an employer’s bankruptcy, layoffs, corporate spin-offs, mergers, divestitures, or other workforce restructurings, or if the terms of a successor plan do not meet the contract issuer’s underwriting criteria for issuance of a replacement contract with identical terms. The Plan Administrator believes that no events are probable of occurring that might limit the ability of the Plan to transact at contract value.

In addition, certain events allow the issuer to terminate the contracts with the Plan and settle at an amount different from the contract value. These events may be different under each contract and include, but are not limited to, loss of the Plan’s qualified status, an uncured material breach of responsibility, or material adverse changes to the provisions of the Plan.

8. Reconciliation of Financial Statements to the Form 5500

A reconciliation of net assets available for benefits per the financial statements to the net assets available for benefits per the Form 5500, was as follows:

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| (In thousands) |

| Net assets available for benefits per the financial statements | $ | 8,251,135 | | | $ | 7,480,992 | |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts | (36,433) | | | (48,402) | |

| Net assets available for benefits per the Form 5500 | $ | 8,214,702 | | | $ | 7,432,590 | |

A reconciliation of net income per the financial statements to benefits paid to participants per the Form 5500, was as follows:

| | | | | |

| Year Ended December 31, 2023 |

| (In thousands) |

| Net increase in net assets available for benefits, per the financial statements | $ | 770,143 | |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts 2023 | (36,433) | |

Adjustment from contract value to fair value for fully benefit-responsive investment contracts 2022 | 48,402 | |

Net increase in net assets available for benefits, per the Form 5500 | $ | 782,112 | |

9. Subsequent Events

HPE has evaluated subsequent events through June 13, 2024, the date the financial statements were available to be issued.

Hewlett Packard Enterprise 401(k) Plan

EIN: 47-3298624 PN: 001

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) (b) Identity of Issue, Borrower, Lessor, or Similar Party | | (c) Description of Investment, Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value | (e) Current Value | |

| | | | |

| | | | |

| Short-Term Investment: | | | |

| * | FIDELITY | FIDELITY GOVT MONEY MARKET FUND | $ 15,267,695 | |

| * | FIDELITY | FIDELITY MONEY MARKET GOVT PORTFOLIO CLASS I | 738 | |

| | Total Short-Term Investment | | 15,268,433 | | |

| Hewlett Packard Enterprise Stock Fund: | | | |

| * | HEWLETT PACKARD ENTERPRISE COMPANY COMMON STOCK | 64,320,923 | | |

| * | FIDELITY | FIDELITY GOVT MONEY MARKET FUND | 352,744 | | |

| | Total HPE Stock Fund | | 64,673,667 | | |

| | | | | |

| Common Collective Trust Funds: | | | |

| | BLACKROCK | ACWI EX-US INDEX FUND | 180,000,798 | | |

| | BLACKROCK | US DEBT INDEX FUND | 176,786,029 | | |

| | BLACKROCK | RUSSELL 2500 INDEX FUND | 468,411,279 | | |

| | BLACKROCK | RUSSELL 1000 INDEX FD CL F | 1,526,817,306 | | |

| | Total Common Collective Trust Funds | 2,352,015,412 | | |

| | | | | |

| Collective Investment Trust Funds: | | | |

| | MERCER TRUST COMPANY | BIRTHDATE FUND 1950 CIT SHARE CLASS 2 | 229,071,080 | | |

| | MERCER TRUST COMPANY | BIRTHDATE FUND 1955 CIT SHARE CLASS 2 | 151,784,152 | | |

| | MERCER TRUST COMPANY | BIRTHDATE FUND 1960 CIT SHARE CLASS 2 | 480,399,714 | | |

| | MERCER TRUST COMPANY | BIRTHDATE FUND 1965 CIT SHARE CLASS 2 | 562,114,758 | | |

| | MERCER TRUST COMPANY | BIRTHDATE FUND 1970 CIT SHARE CLASS 2 | 422,650,628 | | |

| | MERCER TRUST COMPANY | BIRTHDATE FUND 1975 CIT SHARE CLASS 2 | 298,729,814 | | |

| | MERCER TRUST COMPANY | BIRTHDATE FUND 1980 CIT SHARE CLASS 2 | 219,182,991 | | |

| | MERCER TRUST COMPANY | BIRTHDATE FUND 1985 CIT SHARE CLASS 2 | 171,117,807 | | |

| | MERCER TRUST COMPANY | BIRTHDATE FUND 1990 CIT SHARE CLASS 2 | 194,341,614 | | |

| | MERCER TRUST COMPANY | CONSERVATIVE PORTFOLIO | 152,810,657 | | |

| | MERCER TRUST COMPANY | DIVERSIFIED REAL ASSET FUND | 104,576,649 | | |

| | MERCER TRUST COMPANY | NON-US EQUITY FUND | 276,883,952 | | |

| | MERCER TRUST COMPANY | US ALL CAP EQUITY FUND | 1,311,474,805 | | |

| | MERCER TRUST COMPANY | US CORE PLUS FIXED INCOME FUND | 184,465,755 | | |

| | Total Collective Investment Trust Funds | 4,759,604,376 | | |

| | | | | |

| Self-Directed Brokerage Accounts: | | | |

| | SELF-DIRECTED BROKERAGE ACCOUNTS | 534,922,892 | | |

| | | | | |

| Synthetic Investment Contracts: | | | |

| | LINCOLN NATIONAL LIFE INS: | | | |

| | INVESCO TRUST CO. | INVESCO SHORT TERM BOND FUND | 33,089,647 | | |

| | INVESCO TRUST CO. | INVESCO INTERMEDIATE FUND | 7,399,744 | | |

| | INVESCO TRUST CO. | JENNISON INTERNEDIATE FUND | 7,406,614 | | |

| | INVESCO TRUST CO. | PIMCO INTERMEDIATE FUND | 3,694,256 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES INTERMEDIATE FUND | 3,696,494 | | |

| | INVESCO TRUST CO. | INVESCO CORE FIXED INCOME FUND | 3,694,363 | | |

| | INVESCO TRUST CO. | PIMCO CORE FIXED INCOME FUND | 3,698,087 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES CORE FIXED INCOME FUND | 3,697,787 | | |

| | INVESCO TRUST CO. | DODGE & COX CORE FIXED INCOME FUND | 3,698,615 | | |

| | | | 70,075,607 | | |

| | MASSMUTUAL: | | | |

| | INVESCO TRUST CO. | INVESCO SHORT TERM BOND FUND | 33,086,920 | | |

Hewlett Packard Enterprise 401(k) Plan

EIN: 47-3298624 PN: 001

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | INVESCO TRUST CO. | INVESCO INTERMEDIATE FUND | 7,398,991 | | |

| | INVESCO TRUST CO. | JENNISON INTERNEDIATE FUND | 7,405,860 | | |

| | INVESCO TRUST CO. | PIMCO INTERMEDIATE FUND | 3,693,880 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES INTERMEDIATE FUND | 3,696,118 | | |

| | INVESCO TRUST CO. | INVESCO CORE FIXED INCOME FUND | 3,693,987 | | |

| | INVESCO TRUST CO. | PIMCO CORE FIXED INCOME FUND | 3,697,711 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES CORE FIXED INCOME FUND | 3,697,410 | | |

| | INVESCO TRUST CO. | DODGE & COX CORE FIXED INCOME FUND | 3,698,239 | | |

| | | | 70,069,116 | | |

| | MET TOWER LIFE: | | | |

| | INVESCO TRUST CO. | INVESCO SHORT TERM BOND FUND | 33,086,969 | | |

| | INVESCO TRUST CO. | INVESCO INTERMEDIATE FUND | 7,399,002 | | |

| | INVESCO TRUST CO. | JENNISON INTERNEDIATE FUND | 7,405,871 | | |

| | INVESCO TRUST CO. | PIMCO INTERMEDIATE FUND | 3,693,886 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES INTERMEDIATE FUND | 3,696,123 | | |

| | INVESCO TRUST CO. | INVESCO CORE FIXED INCOME FUND | 3,693,992 | | |

| | INVESCO TRUST CO. | PIMCO CORE FIXED INCOME FUND | 3,697,716 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES CORE FIXED INCOME FUND | 3,697,416 | | |

| | INVESCO TRUST CO. | DODGE & COX CORE FIXED INCOME FUND | 3,698,244 | | |

| | | | 70,069,219 | | |

| | NATIONWIDE LIFE INSURANCE: | | | |

| | INVESCO TRUST CO. | INVESCO SHORT TERM BOND FUND | 33,086,947 | | |

| | INVESCO TRUST CO. | INVESCO INTERMEDIATE FUND | 7,398,997 | | |

| | INVESCO TRUST CO. | JENNISON INTERNEDIATE FUND | 7,405,867 | | |

| | INVESCO TRUST CO. | PIMCO INTERMEDIATE FUND | 3,693,884 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES INTERMEDIATE FUND | 3,696,121 | | |

| | INVESCO TRUST CO. | INVESCO CORE FIXED INCOME FUND | 3,693,990 | | |

| | INVESCO TRUST CO. | PIMCO CORE FIXED INCOME FUND | 3,697,714 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES CORE FIXED INCOME FUND | 3,697,413 | | |

| | INVESCO TRUST CO. | DODGE & COX CORE FIXED INCOME FUND | 3,698,242 | | |

| | | | 70,069,175 | | |

| | PACIFIC LIFE INSURANCE: | | | |

| | INVESCO TRUST CO. | INVESCO SHORT TERM BOND FUND | 33,087,149 | | |

| | INVESCO TRUST CO. | INVESCO INTERMEDIATE FUND | 7,399,042 | | |

| | INVESCO TRUST CO. | JENNISON INTERNEDIATE FUND | 7,405,912 | | |

| | INVESCO TRUST CO. | PIMCO INTERMEDIATE FUND | 3,693,906 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES INTERMEDIATE FUND | 3,696,143 | | |

| | INVESCO TRUST CO. | INVESCO CORE FIXED INCOME FUND | 3,694,012 | | |

| | INVESCO TRUST CO. | PIMCO CORE FIXED INCOME FUND | 3,697,736 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES CORE FIXED INCOME FUND | 3,697,436 | | |

| | INVESCO TRUST CO. | DODGE & COX CORE FIXED INCOME FUND | 3,698,264 | | |

| | | | 70,069,600 | | |

| | STATE STREET BANK: | | | |

| | INVESCO TRUST CO. | INVESCO SHORT TERM BOND FUND | 33,086,679 | | |

| | INVESCO TRUST CO. | INVESCO INTERMEDIATE FUND | 7,398,938 | | |

| | INVESCO TRUST CO. | JENNISON INTERNEDIATE FUND | 7,405,807 | | |

| | INVESCO TRUST CO. | PIMCO INTERMEDIATE FUND | 3,693,854 | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES INTERMEDIATE FUND | 3,696,091 | | |

| | INVESCO TRUST CO. | INVESCO CORE FIXED INCOME FUND | 3,693,960 | | |

| | INVESCO TRUST CO. | PIMCO CORE FIXED INCOME FUND | 3,697,684 | | |

Hewlett Packard Enterprise 401(k) Plan

EIN: 47-3298624 PN: 001

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | INVESCO TRUST CO. | LOOMIS SAYLES CORE FIXED INCOME FUND | 3,697,384 | | |

| | INVESCO TRUST CO. | DODGE & COX CORE FIXED INCOME FUND | 3,698,212 | | |

| | | | 70,068,609 | | |

| | | | | |

| | Total Synthetic Investment Contracts: | 420,421,326 | | |

| | | | | |

| | Total Investments | | $ 8,146,906,106 | |

| | | | | |

| * | Participant Loans | Interest rates ranging from 3.50% to 10.50% and maturity dates through 2038 | $ 41,652,120 | |

| * Party-in-interest | | | |

| NOTE: Column (d) cost, has been omitted as all investments are participant-directed. | | |

Hewlett Packard Enterprise 401(k) Plan

EIN: 47-3298624; PN: 001

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions

Year Ended December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Participant Contributions Transferred Late to Plan | | Total That Constitute Nonexempt Prohibited Transactions | | |

| | | | |

| | Check Here if Late Participant Loan Repayments are Included: X | | Contributions Not Corrected | Contributions Corrected Outside VFCP | Contributions Pending Correction in VFCP** | | Total Fully Corrected Under VFCP and PTE 2002-51*** |

| | | |

| | | |

Year* | | | |

| 2021 | | $90 | | — | | — | | — | | | $ | 92 | |

| 2022 | | $26,038 | | — | | — | | — | | | $ | 26,233 | |

Total: | | $26,128 | | | | | | |

* Reflects the year in which the participant contributions were transferred late.

** Amounts in this column do not reflect the lost earnings that the Company transmitted to the Plan during plan year 2023 in connection with filing the corresponding Forms 5330 and Voluntary Fiduciary Correction Program application.

*** Amounts in this column include both the principal amount of the participant contributions transmitted late and also the lost earnings that the Company transmitted to the Plan during plan year 2023 in connection with filing the corresponding Forms 5330 and Voluntary Fiduciary Correction Program application.

SIGNATURE

The Plan. Pursuant to the requirements of the Securities and Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plans) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HEWLETT PACKARD ENTERPRISE 401(k) PLAN |

| | |

| | |

| | |

| June 13, 2024 | By: | /s/ David Antczak |

| | David Antczak |

| | Senior Vice President, General Counsel

and Corporate Secretary |

EXHIBIT INDEX

| | | | | |

Exhibit Number | Description |

| |

| |

Exhibit 23.1

| | | | | |

|

| Consent of Independent Registered Public Accounting Firm |

| |

We consent to the incorporation by reference in the Registration Statements (Form S-8 No. 333-265378 and No. 333-207680) pertaining to the 401(k) Plan of Hewlett Packard Enterprise Company of our report dated June 13, 2024, with respect to the financial statements and schedules of the Hewlett Packard Enterprise 401(k) Plan included in this Annual Report (Form 11-K) for the year ended December 31, 2023. |

| /s/ Ernst & Young LLP |

San Jose, California June 13, 2024 | |

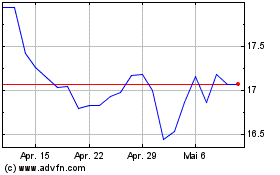

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

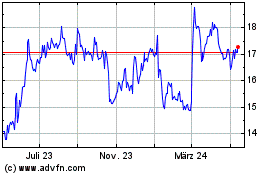

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

Von Jun 2023 bis Jun 2024