- Fourth quarter worldwide volume

growth of 13 percent compared to the prior year period.

- Fourth quarter EPS of $1.15

increased 15 percent, and adjusted1 EPS of $1.28

increased 28 percent, both as compared to the prior year

period.

- Raises FY'14 adjusted2

diluted EPS guidance to a range of $5.85 to $6.05, reflecting

the impact of the recent financial transactions and subsequent

share repurchase.

- Annual sales leader retention of

approximately 51.8 percent.

- Generated $773 million in operating

cash flow in fiscal 2013.

- Board of Directors approved a $0.30

per share quarterly dividend.

Herbalife Ltd. (NYSE: HLF) today reported fourth quarter net

sales of $1.3 billion, reflecting an increase of 20 percent

compared to the same period in 2012, on volume point growth of 13

percent. Net income for the quarter was $123.5 million, or $1.15

per diluted share. On an adjusted basis, adjusted1 net income for

the quarter was $137.2 million, or $1.28 per diluted share, as

compared to 2012 fourth quarter net income3 of $112.2 million and

EPS of $1.00.

For the twelve months ended December 31, 2013, the company

reported record net sales of $4.8 billion, an 18 percent increase,

on 13 percent growth in volume compared to 2012. For the same

period, the company reported net income of $527.5 million, or $4.91

per diluted share. On an adjusted basis, adjusted1 net income of

$577.4 million, or $5.37 per diluted share, reflected increases of

24 percent and 36 percent respectively, over 2012 net income3 of

$464.0 million and EPS of $3.94.

"Herbalife delivered another year of record financial

performance achieved through the consistent execution of key

strategies to expand daily consumption of our products," said

Michael O. Johnson, Herbalife's chairman and CEO. "The global

obesity epidemic continues to expand around the world, having an

adverse impact on community health. Our independent Members are

uniquely positioned, with education, coaching, and nutritious,

industry-leading products to help their customers live healthier

lives."

For the year ended December 31, 2013, Herbalife generated cash

flow from operations of $772.9 million, an increase of 36 percent

compared to 2012; paid dividends of $123.1 million; invested $162.5

million in capital expenditures; and repurchased $297.4 million in

common shares outstanding under our previous share repurchase

program.

Herbalife recently announced that the Board of Directors

approved an increase in its share repurchase authorization to $1.5

billion. Following repurchases made in connection with the

company’s recent financing transaction on February 7, 2014, the

remaining authorized capacity under the repurchase program is $814

million.

Fourth Quarter and Fiscal 2013 Key

Metrics4,5

Regional Volume Point and Average Active Sales Leader

Metrics

Volume Points

(Mil) Average Active Sales Leaders Region

4Q'13 Yr/Yr % Chg 4Q'13 Yr/Yr % Chg

North America 287.0 7% 73,511 8% Asia Pacific 292.4

-4% 73,792 6% EMEA 183.9 17% 53,776 14% Mexico 218.7 5% 66,535 8%

South & Central America 278.6 25% 65,690 29% China 102.7

103% 17,416 39%

Worldwide Total

1,363.3 13% 339,744

13% Volume

Points (Mil) Average Active Sales Leaders

Region FY 2013 Yr/Yr % Chg FY 2013

Yr/Yr % Chg North America 1,249.9 8% 72,058 9%

Asia Pacific 1,225.4 2% 71,542 13% EMEA 698.0 16% 49,650 13% Mexico

864.3 6% 63,581 10% South & Central America 966.2 31% 58,090

29% China 333.6 62% 14,808 27%

Worldwide Total 5,337.4 13%

318,740 15%

2013 Annual Sales Leader Requalification

By the end of January of each year, sales leaders are required

to re-qualify to retain their sales leader status. A record number

of sales leaders were retained in 2013. The overall pool of sales

leaders needing to re-qualify increased by approximately 10%

compared to the prior year and we retained 10% more of them than in

the prior year. While size of the group needing to re-qualify

increased for the year, our overall retention rate remained fairly

constant at 51.8%.

2014 First Quarter and Full Year Guidance

Forward guidance excludes the impact of expenses (primarily for

legal and advisory services) relating to the company's response to

information put into the marketplace by a short seller, which

information the company believes to be inaccurate and misleading,

and the impact of non-cash interest costs associated with the

company’s Convertible Notes. Forward guidance is based on the

average daily exchange rates of the first two weeks of January.

Included in the guidance is the use of the GAAP rate for Venezuela

of 6.3 to 1 for January results and 10 to 1 for the balance of the

year and excludes the potential impact of future devaluation of the

Venezuelan bolivar and any future repatriation of existing cash

balances in Venezuela.

Three Months Ending Twelve Months Ending March 31,

2014 December 31, 2014

Low High

Low High Volume Point Growth vs

2013 6.5% 8.5% 6.5% 8.5% Net Sales Growth vs 2013 8.0% 10.0% 7.5%

9.5% Diluted EPS as adjusted $1.25 $1.29 $5.85 $6.05 Cap Ex ($

millions) $35.0 $45.0 $165.0 $185.0 Effective Tax Rate 27.5% 29.5%

28.0% 30.0%

Announces Quarterly Dividend

Herbalife reported today that its Board of Directors has

approved a dividend of $0.30 per share to shareholders of record

March 4, 2014, payable on March 18, 2014.

Fourth Quarter and Fiscal 2013 Earnings Conference

Call

Herbalife senior management will host an investor conference

call to discuss its recent financial results and provide an update

on current business trends on Wednesday, February 19, 2013 at 8

a.m. PST (11 a.m. EST).

The dial-in number for this conference call for domestic callers

is (877) 317-1296 and (706) 634-5671 for international callers

(conference ID 31194371). Live audio of the conference call will be

simultaneously webcast in the investor relations section of the

Company's website at http://ir.herbalife.com.

An audio replay will be available following the completion of

the conference call in MP3 format or by dialing (855) 859-2056 for

domestic callers or (404) 537-3406 for international callers

(conference ID 31194371). The webcast of the teleconference will be

archived and available on Herbalife's website.

About Herbalife Ltd.

Herbalife Ltd. (NYSE:HLF) is a global nutrition company

that sells weight-management, nutrition and personal care products

intended to support a healthy lifestyle. Herbalife products are

sold in more than 90 countries to and through a network of

independent members. The Company supports the Herbalife Family

Foundation and its Casa Herbalife program to help bring good

nutrition to children. Herbalife's website contains a significant

amount of financial and other information about the company at

http://ir.Herbalife.com. The company encourages investors to visit

its website from time to time, as information is updated and new

information is posted.

1 See Schedule A – “Reconciliation of Non-GAAP Financial

Measures” for more detail.

2 Adjusted diluted EPS excludes non-cash interest expense

associated with the company’s Convertible Notes.

3 There were no non-GAAP adjustments reported against the

company’s 2012 fourth quarter or full-year U.S. GAAP results.

4 Supplemental tables that include additional business metrics

can be found at http://www.ir.herbalife.com.

5 Worldwide Average Active Sales Leaders may not equal the sum

of the Average Active Sales Leaders in each region due to the

calculation being an average of Sales Leaders active in a period,

not a summation, and the fact that some sales leaders are active in

more than one region but are counted only once in the worldwide

amount.

FORWARD-LOOKING STATEMENTS

Although we believe that the expectations reflected in any of

our forward-looking statements are reasonable, actual results could

differ materially from those projected or assumed in any of our

forward-looking statements. Our future financial condition and

results of operations, as well as any forward-looking statements,

are subject to change and to inherent risks and uncertainties, such

as those disclosed or incorporated by reference in our filings with

the Securities and Exchange Commission. Important factors that

could cause our actual results, performance and achievements, or

industry results to differ materially from estimates or projections

contained in our forward-looking statements include, among others,

the following:

- any collateral impact resulting from

the ongoing worldwide financial environment, including the

availability of liquidity to us, our customers and our suppliers or

the willingness of our customers to purchase products in a

difficult economic environment;

- our relationship with, and our ability

to influence the actions of, our Members;

- improper action by our employees or

Members in violation of applicable law;

- adverse publicity associated with our

products or network marketing organization, including our ability

to comfort the marketplace and regulators regarding our compliance

with applicable laws;

- changing consumer preferences and

demands;

- our reliance upon, or the loss or

departure of any member of, our senior management team which could

negatively impact our Member relations and operating results;

- the competitive nature of our

business;

- regulatory matters governing our

products, including potential governmental or regulatory actions

concerning the safety or efficacy of our products and network

marketing program, including the direct selling market in which we

operate;

- legal challenges to our network

marketing program;

- risks associated with operating

internationally and the effect of economic factors, including

foreign exchange, inflation, disruptions or conflicts with our

third party importers, pricing and currency devaluation risks,

especially in countries such as Venezuela;

- uncertainties relating to the

application of transfer pricing, duties, value added taxes, and

other tax regulations, and changes thereto;

- uncertainties relating to

interpretation and enforcement of legislation in China governing

direct selling;

- uncertainties relating to the

interpretation, enforcement or amendment of legislation in India

governing direct selling;

- our inability to obtain the necessary

licenses to expand our direct selling business in China;

- adverse changes in the Chinese economy,

Chinese legal system or Chinese governmental policies;

- our dependence on increased penetration

of existing markets;

- contractual limitations on our ability

to expand our business;

- our reliance on our information

technology infrastructure and outside manufacturers;

- the sufficiency of trademarks and other

intellectual property rights;

- product concentration;

- changes in tax laws, treaties or

regulations, or their interpretation;

- taxation relating to our Members;

- product liability claims;

- whether we will purchase any of our

shares in the open markets or otherwise; and

- share price volatility related to,

among other things, speculative trading and certain traders

shorting our common shares.

We do not undertake any obligation to update or release any

revisions to any forward-looking statement or to report any events

or circumstances after the date hereof or to reflect the occurrence

of unanticipated events, except as required by law.

RESULTS OF OPERATIONS:

Herbalife Ltd. and Subsidiaries Condensed Consolidated Statements

of Income (In thousands, except per share amounts) (Unaudited)

Three

Months Ended Twelve Months Ended

12/31/2013

12/31/2012 12/31/2013

12/31/2012 North America $ 210,302 $ 197,052 $

907,999 $ 841,243 Mexico 142,599 132,070 562,369 496,101 South and

Central America 290,344 203,252 973,456 688,799 EMEA 197,644

164,684 735,253 627,801 Asia Pacific 279,603 295,166 1,174,607

1,139,867 China 148,387 67,096 471,624

278,519 Worldwide net sales 1,268,879 1,059,320 4,825,308 4,072,330

Cost of Sales 251,807 211,105 963,423

812,583 Gross Profit 1,017,072 848,215 3,861,885 3,259,747 Royalty

Overrides 380,735 355,658 1,497,556 1,338,633 Selling, General and

Administrative Expenses 454,478 332,764

1,629,052 1,259,667 Operating Income 181,859 159,793 735,277

661,447 Interest Expense - net 2,902 2,453

18,560 10,541 Income before income taxes 178,957 157,340

716,717 650,906 Income Taxes 55,417 45,133

189,192 186,944 Net Income 123,540 112,207

527,525 463,962 Basic Shares 101,211 107,444

102,620 112,359 Diluted Shares 107,234 112,230 107,445 117,856

Basic EPS $ 1.22 $ 1.04 $ 5.14 $ 4.13 Diluted EPS $ 1.15 $

1.00 $ 4.91 $ 3.94 Dividends declared per share $ 0.30 $

0.30 $ 1.20 $ 1.20 Herbalife Ltd. and Subsidiaries Condensed

Consolidated Balance Sheets (In thousands) (Unaudited) Dec

31, Dec 31,

2013

2012 ASSETS Current Assets: Cash &

cash equivalents $ 972,974 $ 333,534 Receivables, net 100,326

116,139 Inventories 351,201 339,411 Prepaid expenses and other

current assets 148,774 145,624 Deferred income taxes 69,845

49,339 Total Current Assets 1,643,120 984,047

Net Property, plant and equipment 318,860 242,886 Deferred

compensation plan assets 26,821 24,267 Other assets 63,713 48,805

Deferred financing cost, net 4,896 7,462 Marketing related

intangibles and other intangible assets, net 310,801 311,186

Goodwill 105,490 105,490 Total Assets $

2,473,701 $ 1,724,143 LIABILITIES AND

SHAREHOLDERS' EQUITY Current Liabilities: Accounts payable $ 82,665

$ 75,209 Royalty overrides 266,952 243,351 Accrued compensation

111,905 95,220 Accrued expenses 267,501 181,523 Current portion of

long-term debt 81,250 56,302 Advance sales deposits 68,079 49,432

Income taxes payable 43,826 61,325

Total Current Liabilities 922,178 762,362 Non-current

liabilities Long-term debt, net of current portion 850,019 431,305

Deferred compensation plan liability 37,226 29,454 Deferred income

taxes 66,026 62,982 Other non-current liabilities 46,806

42,557 Total Liabilities 1,922,255 1,328,660

Commitments and Contingencies Shareholders' equity:

Common shares 101 107 Paid-in capital in excess of par value

323,860 303,975 Accumulated other comprehensive loss (19,794 )

(31,695 ) Retained earnings 247,279 123,096

Total Shareholders' Equity 551,446

395,483 Total Liabilities and Shareholders'

Equity $ 2,473,701 $ 1,724,143 Herbalife Ltd.

and Subsidiaries Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

Twelve Months Ended

12/31/2013

12/31/2012 CASH FLOWS FROM

OPERATING ACTIVITIES Net income $ 527,525 $ 463,962

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization 84,739 74,384 Excess tax benefits

from share-based payment arrangements (15,566 ) (29,684 ) Share

based compensation expenses 29,492 27,906 Amortization of discount

and deferred financing costs 2,579 1,797 Deferred income taxes

(24,910 ) (7,758 ) Unrealized foreign exchange transaction loss

(gain) 5,757 2,121 Foreign exchange loss from Venezuela currency

devaluation 15,116 - Other 15,410 532 Changes in operating assets

and liabilities: Receivables 9,224 (28,186 ) Inventories (39,878 )

(82,177 ) Prepaid expenses and other current assets (9,405 ) 249

Other assets (9,408 ) (5,288 ) Accounts payable 10,844 17,034

Royalty overrides 28,765 41,868 Accrued expenses and accrued

compensation 86,039 39,440 Advance sales deposits 21,959 17,790

Income taxes 26,821 28,042 Deferred compensation plan liability

7,772 5,752 NET CASH PROVIDED BY

OPERATING ACTIVITIES 772,875 567,784

CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property, plant

and equipment (146,958 ) (121,524 ) Proceeds from sale of property,

plant and equipment 186 280 Investments in Venezuelan bonds (4,050

) - Deferred compensation plan assets - (3,756

) NET CASH USED IN INVESTING ACTIVITIES (150,822 )

(125,000 ) CASH FLOWS FROM FINANCING ACTIVITIES Dividends paid

(123,055 ) (135,091 ) Borrowings from long-term debt 763,180

1,430,560 Principal payments on long-term debt (319,483 )

(1,146,580 ) Deferred financing costs - (4,460 ) Share repurchases

(306,441 ) (556,727 ) Excess tax benefits from share-based payment

arrangements 15,566 29,684

Proceeds from exercise of stock options

and sale of stock under employee stock purchase plan

975 11,373 NET CASH PROVIDED BY (USED

IN) FINANCING ACTIVITIES 30,742 (371,241 )

EFFECT OF EXCHANGE RATE CHANGES ON CASH (13,355 )

3,216 NET CHANGE IN CASH AND CASH EQUIVALENTS 639,440 74,759

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR 333,534

258,775 CASH AND CASH EQUIVALENTS, END OF YEAR

972,974 333,534 CASH PAID DURING THE YEAR

Interest paid $ 23,046 $ 14,268 Income taxes paid $

197,078 $ 169,725 NON CASH ACTIVITIES Accrued capital

expenditures $ 29,625 $ 15,310

SUPPLEMENTAL INFORMATION

SCHEDULE A: RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(unaudited and unreviewed), (dollars in thousands,

except per share data)

In addition to its reported results, the Company has included

in the tables below adjusted results that the Securities and

Exchange Commission defines as “non-GAAP financial measures.”

Management believes that such non-GAAP financial measures, when

read in conjunction with the Company’s reported results, can

provide useful supplemental information for investors in analyzing

period to period comparisons of the Company’s results.

The following is a reconciliation of net

income, presented and reported in accordance with U.S. generally

accepted accounting principles, to net income adjusted for certain

items:

Three Months Ended Twelve Months

Ended 12/31/2013 12/31/2012 12/31/2013 12/31/2012 (in thousands)

Net income, as reported $ 123,540 $ 112,207 $ 527,525 $

463,962

Venezuela devaluation impact (net of

($1,442) and $5,354 tax benefit for the three and twelve months

ended December 31, 2013, respectively) (1)(2)

1,442 - 9,761 -

Expenses incurred responding to attacks on

the Company's business model (net of $1,372 and $4,613 tax benefit

for the three and twelve months ended December 31, 2013,

respectively)(1)

3,938 - 24,527 -

Expenses incurred for the re-audit of 2010

to 2012 financial statements due to resignation of KPMG (net of

$2,524 and $4,853 tax benefit for the three and twelve months ended

December 31, 2013)(1)

8,269 - 15,570 - Net income, as

adjusted $ 137,189 $ 112,207 $ 577,383 $ 463,962

The following is a reconciliation of

diluted earnings per share, presented and reported in accordance

with U.S. generally accepted accounting principles, to diluted

earnings per share adjusted for certain items:

Three Months Ended Twelve Months Ended 12/31/2013

12/31/2012 12/31/2013 12/31/2012 Diluted earnings per share,

as reported $ 1.15 $ 1.00 $ 4.91 $ 3.94

Venezuela devaluation impact (net of

($1,442) and $5,354 tax benefit for the three and twelve months

ended December 31, 2013, respectively) (1)(2)

0.01 - 0.09 -

Expenses incurred responding to attacks on

the Company's business model (net of $1,372 and $4,613 tax benefit

for the three and twelve months ended December 31, 2013,

respectively)(1)

0.04 - 0.23 -

Expenses incurred for the re-audit of 2010

to 2012 financial statements due to resignation of KPMG (net of

$2,524 and $4,853 tax benefit for the three and twelve months ended

December 31, 2013)(1)

0.08 - 0.14 - Diluted earnings per

share, as adjusted $ 1.28 $ 1.00 $ 5.37 $ 3.94

(1) The income tax impact of the non-GAAP

adjustments is based on items affecting the Company's 2013 full

year GAAP effective tax rate. Adjustments to items unrelated to

these non-GAAP adjustments have had an effect on the income tax

impact of the non-GAAP adjustments in periods subsequent to the

underlying non-GAAP adjustments.

(2) The amount for the three months ended

December 31, 2013 relates to the change in tax benefit, as

explained in note 1, for the Venezuela devaluation that was

recorded in the first quarter.

The following is a reconciliation of total long-term debt to net

debt:

12/31/2013 12/31/2012 Total

long-term debt (current and long-term portion) $ 931,269 $ 487,607

Less: Cash and cash equivalents 972,974

333,534 Net debt $ (41,705 ) $ 154,073

Herbalife Ltd.Media Contact:Barbara HendersonSVP, Worldwide

Corp. Comm.213-745-0517orInvestor Contact:Amy GreeneVP, Investor

Relations213-745-0474

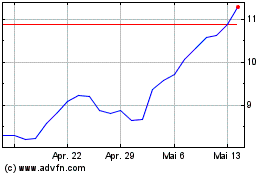

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024