Herbalife Ltd. (NYSE:HLF) today reported that fourth quarter net

sales increased 17 percent and local currency net sales increased

19 percent compared to the same time period in 2009. Net income for

the quarter of $81.0 million, or $1.31 per diluted share compares

to 2009 fourth quarter adjusted1 net income and EPS of $61.7

million and $0.98, respectively.

For the twelve months ended December 31, 2010, the company

reported record net sales of $2.7 billion, an 18 percent increase

on 14 percent volume growth compared to 2009. For the same period,

the company’s reported adjusted1 net income of $297.0 million, or

$4.77 per diluted share improved 43 percent and 45 percent

respectively compared to the adjusted1 2009 results of $207.1

million or $3.28 per diluted share. On a reported basis, EPS of

$4.67 increased 45 percent compared to 2009.

The full year improvements in earnings were predominantly a

result of strong volume growth. For the second consecutive quarter

and for the year ended December 31, 2010, as compared to full year

2009, each of the company’s six regions experienced volume growth.

“The continued broad-based growth we are experiencing further

confirms the strength of the business methods our Distributors are

using,” said Chairman and Chief Executive Officer Michael O.

Johnson. “Our nutrition products have never been more relevant, our

Distributors’ engagement has never been higher and their methods

are reaching more consumers every day.”

For the year ended December 31, 2010, the company generated cash

flow from operations of $380.4 million, an increase of 33.4 percent

compared to 2009, paid dividends of $53.7 million, invested $68.1

million in capital expenditures and repurchased $150.1 million in

common shares as part of its $1 billion share repurchase

authorization program. The company has reduced its net debt by

$111.9 million from December 2009 levels.

1See Schedule B – “Reconciliation of Non-GAAP Financial

Measures” for more detail.

Fourth Quarter and Full Year 2010

Regional Key Metrics2,3

Regional Volume Point and Average Active Sales Leader

Metrics

Volume Points (Mil) Avg Active Sales

Leaders Region 4Q'10

Yr/Yr %Chg

FY'10

Yr/Yr %Chg

4Q'10

Yr/Yr %Chg

North America 200.2 8.0 % 888.5 13.9 % 51,174

13.0 % Asia Pacific 188.0 23.6 % 723.6 26.8 % 39,531 22.7 %

EMEA 125.3 8.5 % 486.6 4.3 % 35,552 5.4 % Mexico 154.8 26.5 % 563.0

14.1 % 41,485 15.7 % South & Central America 122.9 12.5 % 427.4

3.7 % 31,348 5.8 % China 38.0 29.3 % 144.2

25.1 % 7,851 31.3 %

Worldwide

Total 829.2 16.1 %

3,233.3 13.9 %

202,178 14.4 %

Volume Points (Mil) Avg Active Sales Leaders

4Q'10

Yr/Yr %Chg

FY'10

Yr/Yr %Chg

4Q'10

Yr/Yr %Chg

Emerging Markets 457.2 19.3 % 1,677.6 12.5 % 112,715 20.4 %

Established Markets 372.0 12.5 % 1,555.7

15.6 % 93,301 13.1 %

Worldwide

Total 829.2 16.1 %

3,233.3 13.9 %

202,178 14.4 %

2 “Emerging markets” are defined herein as those countries that

the World Bank categorized as having “low” or “medium” GDP per

capita, while “Established markets” are defined as those countries

categorized by the World Bank as having “high” GDP per capita.

3 Supplemental tables that include additional business metrics

can be found at http://www.ir.herbalife.com

2010 Annual Sales Leader Requalification

By January of each year, sales leaders are required to

re-qualify. In February of each year, we remove from the rank of

sales leaders those individuals who did not satisfy the sales

leader qualification requirements during the preceding 12-months.

For the latest 12-month re-qualification period ending January

2011, 48.9 percent of the eligible sales leaders re-qualified,

reflecting an improvement from 43.0 percent in 2009.

Updated 2011 Guidance

Based on current business trends and foreign currency rates, the

company’s first quarter and fiscal 2011 guidance is provided

below.

First Quarter – The company’s first quarter 2011 diluted

earnings per share guidance range is $1.17 to $1.21 on volume point

growth of 14.0 percent to 16.0 percent and net sales growth of 18.0

percent to 20.0 percent compared to the same period in 2010,

respectively, and an effective tax rate range of 28.0 percent to

29.0 percent. The company’s first quarter 2011 capital expenditures

are expected to be in the range of $18.0 million to $23

million.

Fiscal 2011 – The company’s fiscal 2011 diluted earnings per

share guidance range is $5.15 to $5.40 on volume point growth of

8.0 percent to 10.0 percent and net sales growth of 13.0 percent to

15.0 percent compared to the same period in 2010, respectively, and

an effective tax rate range of 28.0 percent to 29.0 percent. The

company’s fiscal 2011 capital expenditures are expected to be in

the range of $80.0 million to $90.0 million.

Board of Directors Approved Stock Split

The Herbalife Board of Directors has approved a two-for-one

split of Herbalife’s Common Shares, subject to shareholder

approval. If approved by the shareholders, the stock split would be

effected by the subdivision of each outstanding Common Share of a

par value of $0.002 each into two Common Shares of a par value of

$0.001 each and a proportional amendment of the authorized share

capital. Shareholder approval of the stock split will be sought by

the company during its annual general meeting of Shareholders which

will be held on April 28, 2011.

“We are pleased to announce this pending two-for-one stock

split,” said John DeSimone, chief financial officer at Herbalife.

“This decision by the board of directors acknowledges our track

record of providing our shareholders solid long-term returns and

demonstrates our confidence in the company’s positive outlook for

future growth. We believe that the pending stock split will improve

liquidity in our stock and is representative of our ongoing

commitment to shareholder value.” The Board of Directors

established May 10, 2011, as the record date for the stock split.

Each shareholder of record as of the close of business on the

record date will receive one additional Common Share for every

share held. The new shares will be distributed on or about May 17,

2011.

Announces Quarterly Dividend

The company reported today that its board of directors approved

a $0.25 per share dividend to shareholders of record effective

March 8, 2011 payable on March 22, 2011.

Fourth Quarter Earnings Conference Call

Herbalife’s senior management team will host an investor

conference call Wednesday, February 23, 2011 at 11 a.m. EST (8 a.m.

PST) to discuss its recent financial results and provide an update

on current business trends.

The dial-in number for this conference call for domestic callers

is 866.903.5314 and 706.634.5671 for international callers

(conference ID 82536023). Live audio of the conference call will be

simultaneously webcast in the investor relations section of the

company's website at http://ir.herbalife.com.

An audio replay will be available following the completion of

the conference call in MP3 format or by dialing 800.642.1687 for

domestic callers or 706.645.9291 for international callers

(conference ID 82536023). The webcast of the teleconference will be

archived and available on Herbalife's website.

About Herbalife Ltd.

Herbalife Ltd. (NYSE:HLF) is a global network marketing company

that sells weight-management, nutrition, and personal care products

intended to support a healthy lifestyle. Herbalife products are

sold in 75 countries through a network of approximately 2.1 million

independent distributors. The company supports the Herbalife Family

Foundation and its Casa Herbalife program to help bring good

nutrition to children. Herbalife's website contains a significant

amount of information about Herbalife, including financial and

other information for investors at http://ir.Herbalife.com. The

company encourages investors to visit its website from time to

time, as information is updated and new information is posted.

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements other than statements of historical fact are

“forward-looking statements” for purposes of federal and state

securities laws, including any projections of earnings, revenue or

other financial items; any statements of the plans, strategies and

objectives of management for future operations; any statements

concerning proposed new services or developments; any statements

regarding future economic conditions or performance; any statements

of belief; and any statements of assumptions underlying any of the

foregoing. Forward-looking statements may include the words “may,”

“will,” “estimate,” “intend,” “continue,” “believe,” “expect” or

“anticipate” and any other similar words.

Although we believe that expectations reflected in any of our

forward-looking statements are reasonable, actual results could

differ materially from those projected or assumed in any of our

forward-looking statements. Our future financial condition and

results of operations, as well as any forward-looking statements,

are subject to change and to inherent risks and uncertainties, such

as those disclosed or incorporated by reference in our filings with

the Securities and Exchange Commission. Important factors that

could cause our actual results, performance and achievements, or

industry results to differ materially from estimates or projections

contained in our forward-looking statements include, among others,

the following:

- any collateral impact resulting from

the ongoing worldwide financial “crisis,” including the

availability of liquidity to us, our customers and our suppliers or

the willingness of our customers to purchase products in a

recessionary economic environment;

- our relationship with, and our ability

to influence the actions of, our distributors;

- improper action by our employees or

distributors in violation of applicable law;

- adverse publicity associated with our

products or network marketing organization;

- changing consumer preferences and

demands;

- our reliance upon, or the loss or

departure of any member of, our senior management team which could

negatively impact our distributor relations and operating

results;

- the competitive nature of our

business;

- regulatory matters governing our

products, including potential governmental or regulatory actions

concerning the safety or efficacy of our products and network

marketing program, including the direct selling market in which we

operate;

- third party legal challenges to our

network marketing program;

- risks associated with operating

internationally and the effect of economic factors, including

foreign exchange, inflation, disruptions or conflicts with our

third-party importers, pricing and currency devaluation risks,

especially in countries such as Venezuela;

- uncertainties relating to the

application of transfer pricing, duties, value added taxes, and

other tax regulations, and changes thereto;

- uncertainties relating to

interpretation and enforcement of recently enacted legislation in

China governing direct selling;

- our inability to obtain the necessary

licenses to expand our direct selling business in China;

- adverse changes in the Chinese economy,

Chinese legal system or Chinese governmental policies;

- our dependence on increased penetration

of existing markets;

- contractual limitations on our ability

to expand our business;

- our reliance on our information

technology infrastructure and outside manufacturers;

- the sufficiency of trademarks and other

intellectual property rights;

- product concentration;

- changes in tax laws, treaties or

regulations, or their interpretation;

- taxation relating to our

distributors;

- product liability claims; and

- whether we will purchase any of our

shares in the open market or otherwise.

We do not undertake any obligation to update or release any

revisions to any forward-looking statements or to report any events

or circumstances after the date hereof or to reflect the occurrence

of unanticipated events, except as required by law.

RESULTS OF OPERATIONS:

Herbalife Ltd. Consolidated Statements of Income (In thousands,

except per share data) (unaudited)

Quarter Ended Year Ended

12/31/2010

12/31/2009 12/31/2010

12/31/2009 North America $ 140,898 $ 126,715 $

614,126 $ 529,009 Mexico 97,716 69,132 333,981 263,013 South and

Central America 121,277 113,223 390,433 366,925 EMEA 140,146

130,932 527,744 504,154 Asia Pacific 189,081 151,468 683,499

509,191 China 49,238 39,401 184,443

152,285 Worldwide net sales 738,356 630,871 2,734,226 2,324,577

Cost of Sales 148,513 136,515 558,811

493,134 Gross Profit 589,843 494,356 2,175,415 1,831,443 Royalty

Overrides 244,088 204,580 900,248 761,501 SGA 239,512

205,691 887,655 773,911 Operating Income 106,243

84,085 387,512 296,031 Interest Expense 1,944 1,836 9,664 9,613

Interest Income 818 820 2,247 4,510

Income before income taxes 105,117 83,069 380,095 290,928 Income

Taxes 24,127 27,413 89,562 87,582 Net

Income 80,990 55,656 290,533 203,346

Basic Shares 59,082 60,492 59,502 61,221 Diluted Shares

62,058 63,004 62,256 63,097 Basic EPS $ 1.37 $ 0.92 $ 4.88 $

3.32 Diluted EPS $ 1.31 $ 0.88 $ 4.67 $ 3.22 Dividends

declared per share $ 0.25 $ 0.20 $ 0.90 $

0.80

Herbalife Ltd. Consolidated Balance Sheets (In thousands)

(unaudited) Dec 31, Dec 31,

2010 2009

ASSETS Current Assets: Cash & cash equivalents $ 190,550 $

150,801 Receivables, net 85,612 76,958 Inventories 182,467 145,962

Prepaid expenses and other current assets 93,963 101,181 Deferred

income taxes 42,994 38,600 Total

Current Assets 595,586 513,502 Property, plant and

equipment, net 177,427 178,009 Deferred compensation plan assets

18,536 17,410 Deferred financing cost, net 998 1,498 Other assets

25,880 21,306 Marketing related intangibles and other intangible

assets, net 310,894 311,782 Goodwill 102,899

102,543 Total Assets $ 1,232,220 $ 1,146,050

LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities: Accounts payable $ 43,784 $ 37,330 Royalty Overrides

162,141 144,689 Accrued compensation 69,376 65,043 Accrued expenses

141,867 107,943 Current portion of long term debt 3,120 12,402

Advance sales deposits 35,145 22,261 Income taxes payable

15,383 40,298 Total Current Liabilities

470,816 429,966 Non-current liabilities Long-term debt, net

of current portion 175,046 237,931 Deferred compensation 20,167

16,629 Deferred income taxes 55,572 77,613 Other non-current

liabilities 23,407 24,600 Total

Liabilities 745,008 786,739 Commitments and Contingencies

Shareholders' equity: Common shares 118 120 Additional paid

in capital 257,375 222,882 Accumulated other comprehensive loss

(27,285 ) (23,396 ) Retained earnings 257,004

159,705 Total Shareholders' Equity 487,212

359,311 Total Liabilities and

Shareholders' Equity $ 1,232,220 $ 1,146,050

Herbalife Ltd.

Consolidated Statements of Cash Flows

(In thousands)

(unaudited)

Year Ended

12/31/2010

12/31/2009 CASH

FLOWS FROM OPERATING ACTIVITIES Net income $ 290,533 $ 203,346

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 68,621 62,437

Excess tax benefits from share-based payment arrangements (16,410 )

(3,266 ) Share based compensation expenses 22,969 20,907

Amortization of discount and deferred financing costs 500 491

Deferred income taxes (24,631 ) (11,226 ) Unrealized foreign

exchange transaction loss (gain) (7,142 ) 4,809 Foreign exchange

loss from adoption of highly inflationary accounting in Venezuela

15,131 — Other 2,527 340 Changes in operating assets and

liabilities: Receivables (7,593 ) 2,361 Inventories (31,516 )

(1,742 ) Prepaid expenses and other current assets 10,254 (7,781 )

Other assets (3,485 ) 2,109 Accounts payable 6,650 (9,500 ) Royalty

overrides 15,732 9,102 Accrued expenses and accrued compensation

31,092 (3,461 ) Advance sales deposits 12,439 8,779 Income taxes

payable (8,807 ) 4,700 Deferred compensation plan liability

3,538 2,651 NET CASH PROVIDED BY OPERATING

ACTIVITIES 380,402 285,056 CASH

FLOWS FROM INVESTING ACTIVITIES Purchases of property, plant and

equipment (68,125 ) (59,768 ) Proceeds from sale of property, plant

and equipment 115 102 Deferred compensation plan assets (1,126 )

(1,656 ) Acquisition of business - (10,000 )

NET CASH USED IN INVESTING ACTIVITIES (69,136 )

(71,322 ) CASH FLOWS FROM FINANCING ACTIVITIES Dividends

paid (53,740 ) (48,721 ) Borrowings from long-term debt 427,000

211,974 Principal payments on long-term debt (499,451 ) (313,089 )

Share repurchases (160,008 ) (74,641 ) Excess tax benefits from

share-based payment arrangements 16,410 3,266 Proceeds from

exercise of stock options and sale of stock under employee stock

purchase plan 15,309 7,884 NET CASH

USED IN FINANCING ACTIVITIES (254,480 ) (213,327 )

EFFECT OF EXCHANGE RATE CHANGES ON CASH (17,037 )

(453 ) NET CHANGE IN CASH AND CASH EQUIVALENTS 39,749 (46 ) CASH

AND CASH EQUIVALENTS, BEGINNING OF YEAR 150,801

150,847 CASH AND CASH EQUIVALENTS, END OF YEAR $

190,550 $ 150,801 CASH PAID DURING THE PERIOD

Interest paid $ 9,295 $ 10,011 Income taxes paid $

111,497 $ 95,139 NON CASH ACTIVITIES Assets acquired

under capital leases and other long-term debt $ 576 $ 388

Regional Volume Point and Average Active Sales Leader Metrics

– 4Q’10 & FY’10

Volume Points (Mil) Average Active Sales

Leaders

Region 4Q'10

Yr/Yr %Chg

FY'10

Yr/Yr %Chg

4Q'10

Yr/Yr %Chg

FY'10

Yr/Yr %Chg

North America 200.2 8.0 % 888.5 13.9 % 51,174

13.0 % 49,305 13.9 % Asia Pacific 188.0 23.6 %

723.6 26.8 % 39,531 22.7 % 35,899 25.8 % EMEA 125.3 8.5 % 486.6 4.3

% 35,552 5.4 % 33,531 2.9 % Mexico 154.8 26.5 % 563.0 14.1 % 41,485

15.7 % 38,084 10.2 % South & Central America 122.9 12.5 % 427.4

3.7 % 31,348 5.8 % 28,821 3.2 % China 38.0 29.3 %

144.2 25.1 % 7,851 31.3 % 6,848

15.7 %

Worldwide Total 829.2

16.1 % 3,233.3 13.9

% 202,178 14.4 %

185,774 11.5 %

Volume Points (Mil) Average Active

Sales Leaders 4Q'10

Yr/Yr %Chg

FY'10

Yr/Yr %Chg

4Q'10

Yr/Yr %Chg

FY'10

Yr/Yr %Chg

Emerging Markets 457.2 19.3 % 1,677.6 12.5 112,715 20.4 % 102,782

22.6 % Established Markets 372.0 12.5 %

1,555.7 15.6 93,301 13.1 %

88,137 31.3 %

Worldwide Total 829.2

16.1 % 3,233.3

13.9 % 202,178 14.4

% 185,774 11.5 %

SUPPLEMENTAL INFORMATION

Schedule A: Financial Guidance

2011 Guidance

For the Three Months Ending March 31, 2011 and Twelve Months

Ending December 31, 2011

Three Months EndingMarch 31, 2011

Twelve Months EndingDecember 31, 2011

Low High Low

High Volume point growth vs 2010 14.0 % 16.0 % 8.0 %

10.0 % Net sales growth vs 2010 18.0 % 20.0 % 13.0 % 15.0 %

EPS

$ 1.17 $ 1.21 $ 5.15 $ 5.40 Cap Ex ($ millions) $ 18.0 $ 23.0 $

80.0 $ 90.0

Effective Tax Rate

28.0 % 29.0 % 28.0 % 29.0 %

SCHEDULE B: RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

(unaudited), (Dollars in Thousand, Except Per Share

Data)

In addition to its reported results, the Company has included

in the tables below adjusted results that the Securities and

Exchange Commission defines as “non-GAAP financial measures.”

Management believes that such non-GAAP financial measures, when

read in conjunction with the Company’s reported results, can

provide useful supplemental information for investor in analyzing

period to period comparisons of the Company’s results.

The following is a reconciliation of net income and diluted

earnings per share, presented and reported in accordance with U.S.

generally accepted accounting principles, to net income adjusted

for certain items:

Herbalife Ltd. Supplemental Schedule Non-GAAP Financial Measures

(In thousands, except per share data) (Unaudited)

Quarter Ended 12/31/2010 Reported Adjusting

Adjusted

(GAAP) Items

(Non-GAAP) Net Sales $ 738,356 $ 738,356 Cost of Sales

148,513 148,513 Gross Profit 589,843 589,843

Royalty Overrides 244,088 244,088 SGA 239,512

239,512 Operating Income 106,243 106,243 Interest Expense - net

1,126 1,126 Income before income taxes 105,117

105,117 Income Taxes 24,127 24,127 Net Income

$ 80,990 $ - $ 80,990 Diluted EPS $ 1.31 $ - $ 1.31

Herbalife Ltd. Supplemental Schedule Non-GAAP Financial

Measures (In thousands, except per share data) (Unaudited)

Twelve Months Ended 12/31/2010 Reported Adjusting

Adjusted

(GAAP) Items

(Non-GAAP) Net Sales $ 2,734,226 $ 2,734,226 Cost of

Sales 558,811 $ (12,715 )

(1)

546,096 Gross Profit 2,175,415 12,715 2,188,130 Royalty

Overrides 900,248 900,248 SGA 887,655 (11,390

)

(2)

876,265 Operating Income 387,512 24,105 411,617 Interest

Expense - net 7,417 7,417 Income

before income taxes 380,095 24,105 404,200 Income Taxes

89,562 17,680

(3)

107,242 Net Income $ 290,533 $ 6,425 $

296,958 Diluted EPS $ 4.67 $ 0.10

$ 4.77 1 Incremental U.S. dollar costs of 2009

imports in Venezuela which were recorded at the unfavorable

parallel market exchange rate and were not devalued based on 2010

exchange rates but rather recorded at their historical dollar costs

as products were sold 2 Includes $15,131 foreign exchange

loss related to remeasurement of Venezuela's monetary assets and

liabilities resulting from adoption of highly inflationary

accounting and $3,741 foreign exchange gain resulting from receipt

of U.S. dollar approved by CADIVI at the official exchange rate

relating to 2009 product importations which were previously

registered with CADIVI 3 Includes $14,452 favorable income

taxes related to Venezuela becoming highly inflationary economy and

$3,228 tax benefit from an international income tax audit

settlement Herbalife Ltd. Supplemental Schedule Non-GAAP

Financial Measures (In thousands, except per share data)

(Unaudited) Quarter Ended 12/31/2009 Reported

Adjusting Adjusted

(GAAP)

Items (Non-GAAP) Net Sales $

630,871 $ 630,871 Cost of Sales 136,515

(12,544 )

(1)

123,971 Gross Profit 494,356 12,544 506,900 Royalty

Overrides 204,580 204,580 SGA 205,691 $ 2,368

(2)

208,059 Operating Income 84,085 10,176 94,261 Interest

Expense - net 1,016 1,016

Income before income taxes 83,069 10,176 93,245 Income Taxes

27,413 4,099

(3)

31,512 Net Income $ 55,656 $ 6,077

$ 61,733 Diluted EPS $ 0.88 $ 0.10

$ 0.98 1 Related to incremental U.S.

dollar costs of imports into Venezuela at the unfavorable parallel

market exchange rate rather than the official currency exchange

rate 2 Related to foreign exchange gain for Venezuela

resulting from receipt of U.S. dollars approved by CADIVI at the

official exchange rate 3 Includes $3,562 tax benefit of

Venezuela items and tax benefit of $537 from an international

income tax audit settlement Herbalife Ltd. Supplemental

Schedule Non-GAAP Financial Measures (In thousands, except per

share data) (Unaudited) Twelve Months Ended

12/31/2009 Reported Adjusting Adjusted

(GAAP)

Items (Non-GAAP) Net Sales $ 2,324,577 $

2,324,577 Cost of Sales 493,134 (12,544 )

(1)

480,590 Gross Profit 1,831,443 12,544 1,843,987 Royalty

Overrides 761,501 761,501 SGA 773,911 $ 257

(2)

774,168 Operating Income 296,031 12,287 308,318 Interest

Expense - net 5,103 5,103 Income before

income taxes 290,928 12,287 303,215 Income Taxes 87,582

8,536

(3)

96,118 Net Income $ 203,346 $ 3,751 $ 207,097

Diluted EPS $ 3.22 $ 0.06 $ 3.28

1 Related to incremental U.S. dollar costs of imports into

Venezuela at the unfavorable parallel market exchange rate rather

than the official currency exchange rate 2 Includes $1,297

restructuring charges, $814 expense from an international income

tax audit settlement and $2,368 foreign exchange gain for Venezuela

resulting from receipt of U.S. dollars approved by CADIVI at the

official exchange rate 3 Includes $4,852 tax benefit from

expiration of certain statutes of limitation, tax charge of $277

from an international income tax audit settlement, $399 tax benefit

of restructuring charges and $3,562 tax benefit of Venezuela items

The following is a reconciliation of total long-term debt to net

debt:

12/31/2010 12/31/2009

Total long-term debt (current and long-term portion) $ 178,166 $

250,333 Less: Cash and cash equivalents 190,550

150,801 Net debt $ (12,384 ) $ 99,532

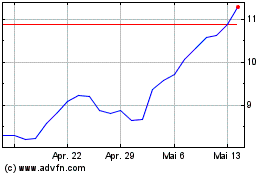

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024