Herbalife Ltd. (NYSE:HLF) today reported second quarter net

sales increased 20.5 percent to $688.8 million. The record revenue

reflects volume point growth of 19.9 percent and an increase in

Average Active Sales Leaders of 11.9 percent, both compared to the

second quarter of 2009.

For the quarter ended June 30, 2010, the company reported net

income of $81.9 million, or $1.32 per diluted share compared to

$48.3 million or $0.77 per diluted share in the second quarter of

2009, primarily reflecting the contribution margin from higher

volume combined with a lower effective tax rate, partially offset

by the impact of foreign currency fluctuations.

For the quarter ended June 30, 2010, the company generated cash

flow from operations of $83.0 million, paid dividends of $12.0

million, invested $12.3 million in capital expenditures and

repurchased $51.2 million in common stock. The company’s net debt

balance at the end of the second quarter was $73.1 million,

reflecting an improvement of $26.4 million from December 31,

2009.

“This quarter our distributors have truly outdone themselves and

delivered the three highest months of volume in our 30-year

history, which far exceeded even our most optimistic expectations,”

said Chairman and Chief Executive Officer Michael O. Johnson. “Not

only was our growth broad-based, but some of the countries we have

been operating in the longest like the United States, Mexico and

Korea are each experiencing double-digit growth even though they

have been open 30, 20 and 15 years respectively. These results

demonstrate the opportunity in front of us as our distributors

continue to build sustainable businesses with long-term

customers.”

During the second quarter the company hosted approximately

43,000 people at Extravaganzas in Nanjing, China, Rio de Janiero,

Brazil and Singapore.

Second Quarter 2010 Regional Key Metrics1,

2

Regional Breakdown

2Q'10 2Q'10 Volume

2Q'10 Average Active

Region

Points % Chg Average Active Sales

Leaders (Mil) (Y/Y) Sales

Leaders % Chg (Y/Y) North America 242.8 21.1 %

49,120 15.0 % Asia Pacific 191.6 52.8 % 34,871 36.1 % EMEA 127.5

8.6 % 32,904 3.3 % Mexico 137.8 10.8 % 36,848 9.5 % South &

Central America 96.2 (1.9 %) 27,173 0.7 % China 41.2 25.7 %

6,676 4.9 % Worldwide Total 837.1 19.9 %

180,132 11.9 %

Emerging and

Established Market Breakdown

2Q'10 2Q'10 Volume 2Q'10 Average

Active

Region

Points % Chg Average Active Sales

Leaders (Mil) (Y/Y) Sales

Leaders % Chg (Y/Y) Emerging Markets 417.9

16.2 % 100,349 11.3 % Established Markets 419.2 23.8 %

87,517 13.5 %

Updated 2010 Guidance

Based on current business trends, the company’s third quarter

2010 and fiscal 2010 guidance is provided below.

Third Quarter - The company’s third quarter 2010 diluted

earnings per share guidance range is $0.99 to $1.03 on volume point

and net sales growth of 13.0 percent to 15.0 percent compared to

the same period in 2009 and an effective tax rate range of 30.5

percent to 31.5 percent. The company’s third quarter 2010 capital

expenditures are expected to be in the range of $20.0 million to

$25.0 million.

Fiscal 2010 - The company’s new full-year diluted earnings per

share guidance is $4.30 to $4.401 on volume point growth of 12.0

percent to 14.0 percent and a net sales increase of 15.0 percent to

17.0 percent compared to 2009, respectively, along with an

effective tax rate range of 29.0 percent to 30.0 percent3.

Full-year 2010 capital expenditures are expected to be in the range

of $70.0 million to $80.0 million.

1 “Emerging” markets are being defined as those countries which

the World Bank categorizes as having “low” or “medium” GDP per

capita, while “Established” are those that the World Bank considers

to have “high” GDP per capita.

2 Supplemental tables that include additional business metrics

can be found at http://www.ir.herbalife.com

3 FY’10 guidance excludes the impact from the first quarter

implementation of highly inflationary accounting in Venezuela.

Dividend Update

The company’s board of directors has authorized a 25 percent

increase in the quarterly cash dividend from $0.20 to $0.25 per

share to shareholders of record effective August 12, 2010, payable

on August 26, 2010.

“The company’s first priority with cash flow generated from

operations has always been to make investments in initiatives that

enhance and support our distributors in growing their business,”

said Chief Financial Officer John DeSimone. “With the company’s

strong financial position and positive outlook, we believe we will

be able to continue to make significant additional investments in

our business while at the same time accelerating returns to

shareholders through this increase in our cash dividend and the

continued execution of our $1.0 billion share buyback

authorization.“

Second Quarter Earnings Conference Call

Herbalife's senior management team will host an investor

conference call Tuesday, August 3, 2010 at 8 a.m. PDT (11 a.m. EDT)

to discuss its recent financial results and provide an update on

current business trends.

The dial-in number for this conference call for domestic callers

is 866-903-5314 and 706-634-5671 for international callers

(conference ID 82531104). Live audio of the conference call will be

simultaneously webcast in the investor relations section of the

company's website at http://ir.herbalife.com.

An audio replay will be available following the completion of

the conference call in MP3 format or by dialing 800-642-1687 for

domestic callers or 706-645-9291 for international callers

(playback ID 66642385). The webcast of the teleconference

will be archived and available on Herbalife's website.

About Herbalife Ltd.

Herbalife Ltd. (NYSE:HLF) is a global network marketing company

that sells weight-management, nutrition, and personal care products

intended to support a healthy lifestyle. Herbalife products are

sold in 73 countries through a network of approximately 2.1 million

independent distributors. The company supports the Herbalife Family

Foundation and its Casa Herbalife program to help bring good

nutrition to children. Herbalife’s Web site contains a significant

amount of information about Herbalife, including financial and

other information for investors at http://ir.herbalife.com. The company

encourages investors to visit its Web site from time to time, as

information is updated and new information is posted.

Disclosure Regarding Forward-Looking Statements

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements other than statements of historical fact are

“forward-looking statements” for purposes of federal and state

securities laws, including any projections of earnings, revenue or

other financial items; any statements of the plans, strategies and

objectives of management for future operations; any statements

concerning proposed new services or developments; any statements

regarding future economic conditions or performance; any statements

of belief; and any statements of assumptions underlying any of the

foregoing. Forward-looking statements may include the words “may,”

“will,” “estimate,” “intend,” “continue,” “believe,” “expect” or

“anticipate” and any other similar words.

Although we believe that the expectations reflected in any of

our forward-looking statements are reasonable, actual results could

differ materially from those projected or assumed in any of our

forward-looking statements. Our future financial condition and

results of operations, as well as any forward-looking statements,

are subject to change and to inherent risks and uncertainties, such

as those disclosed or incorporated by reference in our filings with

the Securities and Exchange Commission. Important factors that

could cause our actual results, performance and achievements, or

industry results to differ materially from estimates or projections

contained in our forward-looking statements include, among others,

the following:

• any collateral impact resulting from the ongoing worldwide

financial “crisis,” including the availability of liquidity to us,

our customers and our suppliers or the willingness of our customers

to purchase products in a recessionary economic environment• our

relationship with, and our ability to influence the actions of, our

distributors;• improper action by our employees or distributors in

violation of applicable law;• adverse publicity associated with our

products or network marketing organization;• changing consumer

preferences and demands;• our reliance upon, or the loss or

departure of any member of, our senior management team which could

negatively impact our distributor relations and operating results;•

the competitive nature of our business;• regulatory matters

governing our products, including potential governmental or

regulatory actions concerning the safety or efficacy of our

products, and network marketing program including the direct

selling market in which we operate;• third party legal challenges

to our network marketing program;• risks associated with operating

internationally and the effect of economic factors, including

foreign exchange, inflation, pricing and currency devaluation

risks, especially in countries such as Venezuela;•

uncertainties relating to the application of transfer pricing,

duties, value added taxes, and other tax regulations, and changes

thereto;• uncertainties relating to interpretation and enforcement

of recently enacted legislation in China governing direct selling;•

our inability to obtain the necessary licenses to expand our direct

selling business in China;• adverse changes in the Chinese economy,

Chinese legal system or Chinese governmental policies• our

dependence on increased penetration of existing markets;•

contractual limitations on our ability to expand our business;• our

reliance on our information technology infrastructure and outside

manufacturers;• the sufficiency of trademarks and other

intellectual property rights;• product concentration;•

changes in tax laws, treaties or regulations, or their

interpretation;• taxation relating to our

distributors;• product liability claims; and• whether

we will purchase any of our shares in the open markets or

otherwise.

We do not undertake any obligation to update or release any

revisions to any forward-looking statement or to report any events

or circumstances after the date hereof or to reflect the occurrence

of unanticipated events, except as required by law.

RESULTS OF

OPERATIONS:

Herbalife Ltd. Consolidated Statements of Income (In thousands,

except per share data) (Unaudited)

Quarter Ended Six Months Ended

6/30/2010 6/30/2009

6/30/2010 6/30/2009 North

America $ 166,437 $ 138,389 $ 317,696 $ 261,464 Mexico 80,918

66,352 152,767 125,591 South and Central America 82,797 85,404

174,126 160,668 EMEA 135,553 126,575 266,377 249,888 Asia Pacific

171,850 114,539 312,863 228,483 China 51,251 40,546

83,610 67,394 Worldwide net sales 688,806 571,805

1,307,439 1,093,488 Cost of Sales 136,561 122,442

277,033

(1)

224,842 Gross Profit 552,245 449,363 1,030,406 868,646

Royalty Overrides 224,780 186,750 432,099 362,282 SGA

211,110 190,794 417,993

(1)

372,252 Operating Income 116,355 71,819 180,314 134,112

Interest Expense - net 2,146 1,338 4,099

3,050 Income before income taxes 114,209 70,481 176,215

131,062 Income Taxes 32,276 22,228 42,411

(1)

41,267 Net Income $ 81,933 $ 48,253 $ 133,804 $ 89,795

Basic Shares 59,527 61,642 59,843 61,583 Diluted Shares

62,103 62,929 62,389 62,413 Basic EPS $ 1.38 $ 0.78 $ 2.24 $

1.46 Diluted EPS $ 1.32 $ 0.77 $ 2.14 $ 1.44 Dividends

declared per share $ 0.20 $ 0.20 $ 0.40 $ 0.40

1 Includes impact of

items related to adoption of highly-inflationary accounting in

Venezuela that are further discussed in Schedule B –

"Reconciliation of Non-GAAP Financial Measures” Herbalife

Ltd. Consolidated Balance Sheets (In thousands) (Unaudited)

Jun 30, Dec 31,

2010

2009 ASSETS Current Assets: Cash &

cash equivalents $ 170,218 $ 150,801 Receivables, net 85,411 76,958

Inventories 152,035 145,962 Prepaid expenses and other current

assets 114,097 101,181 Deferred income taxes 53,546

38,600 Total Current Assets 575,307 513,502

Property and equipment, net 167,320 178,009 Deferred compensation

plan assets 16,724 17,410 Deferred financing cost, net 1,250 1,498

Other assets 22,587 21,306 Marketing related intangibles and other

intangible assets, net 311,091 311,782 Goodwill 102,899

102,543 Total Assets $ 1,197,178 $

1,146,050 LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities: Accounts payable $ 48,318 $ 37,330 Royalty

Overrides 141,017 144,689 Accrued compensation 52,100 65,043

Accrued expenses 117,090 107,943 Current portion of long term debt

3,071 12,402 Advance sales deposits 51,770 22,261 Income taxes

payable 29,126 40,298 Total Current

Liabilities 442,492 429,966 Non-current liabilities

Long-term debt, net of current portion 240,280 237,931 Deferred

compensation 17,358 16,629 Deferred income taxes 79,273 77,613

Other non-current liabilities 23,659 24,600

Total Liabilities 803,062 786,739 Contingencies

Shareholders' equity: Common shares 118 120 Additional paid

in capital 232,735 222,882 Accumulated other comprehensive loss

(39,126 ) (23,396 ) Retained earnings 200,389

159,705 Total Shareholders' Equity 394,116

359,311 Total Liabilities and

Shareholders' Equity $ 1,197,178 $ 1,146,050

Herbalife Ltd. Consolidated Statements of Cash Flows (In thousands)

(Unaudited) Six Months Ended

6/30/2010 6/30/2009

CASH FLOWS FROM OPERATING ACTIVITIES Net

income $ 133,804 $ 89,795 Adjustments to reconcile net income to

net cash provided by operating activities: Depreciation and

amortization 34,403 29,686 (Excess) Deficiency in tax benefits from

share-based payment arrangements (4,705 ) 982 Share-based

compensation expenses 10,820 10,024 Amortization of discount and

deferred financing costs 248 244 Deferred income taxes (15,053 )

(1,657 ) Unrealized foreign exchange transaction (gain) loss

(12,345 ) 2,545 Foreign exchange loss from adoption of highly

inflationary accounting in Venezuela 15,131 — Other 1,619 154

Changes in operating assets and liabilities: Receivables (11,616 )

(4,938 ) Inventories (12,172 ) 12,022 Prepaid expenses and other

current assets (15,099 ) 971 Other assets (2,229 ) (679 ) Accounts

payable 13,781 1,202 Royalty overrides 1,072 (3,622 ) Accrued

expenses and accrued compensation 5,670 (19,587 ) Advance sales

deposits 30,937 17,164 Income taxes payable (4,604 ) (12,599 )

Deferred compensation plan liability 729 557

NET CASH PROVIDED BY OPERATING ACTIVITIES 170,391

122,264 CASH FLOWS FROM INVESTING ACTIVITIES

Purchases of property (23,917 ) (26,801 ) Proceeds from sale of

property 6 60 Deferred compensation plan assets 686

(252 ) NET CASH USED IN INVESTING ACTIVITIES (23,225

) (26,993 ) CASH FLOWS FROM FINANCING ACTIVITIES Dividends

paid (24,061 ) (24,617 ) Borrowings from long-term debt 229,000

59,000 Principal payments on long-term debt (235,715 ) (97,009 )

Share repurchases (79,220 ) (972 ) Excess (Deficiency in) tax

benefits from share-based payment arrangements 4,705 (982 )

Proceeds from exercise of stock options and sale of stock under

employee stock purchase plan 4,400 791

NET CASH USED IN FINANCING ACTIVITIES (100,891 )

(63,789 ) EFFECT OF EXCHANGE RATE CHANGES ON CASH (26,858 )

(893 ) NET CHANGE IN CASH AND CASH EQUIVALENTS 19,417 30,589

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD 150,801

150,847 CASH AND CASH EQUIVALENTS, END OF

PERIOD $ 170,218 $ 181,436 CASH PAID DURING THE

PERIOD Interest paid $ 4,988 $ 6,560 Income taxes

paid, net $ 58,718 $ 54,473 NON CASH ACTIVITIES

Assets acquired under capital leases and other long-term debt $ —

$ 327

Herbalife Ltd Volume Points by

Region (Unaudited, In thousands)

Three Months Ended June 30, 2010 2009 % Change North

America 242,819 200,457 21.1 % Asia Pacific (excluding China)

191,628 125,410 52.8 % EMEA 127,470 117,346 8.6 % Mexico 137,752

124,270 10.8 % South & Central America 96,155 97,968 (1.9 %)

China 41,224 32,802 25.7 % Worldwide 837,048 698,253 19.9 %

SUPPLEMENTAL INFORMATION

SCHEDULE A: FINANCIAL

GUIDANCE

2010 Guidance

For the Three Months Ending

September 30, 2010 and Twelve Months Ending December 31,

2010

Three Months Ending Twelve Months Ending September

30, 2010 December 31, 2010

Low High

Low High Volume point growth vs

2009 13.0 % 15.0 % 12.0 % 14.0 % Net sales growth vs 2009 13.0 %

15.0 % 15.0 % 17.0 % EPS 1 $ 0.99 $ 1.03 $ 4.30 $ 4.40 Cap Ex ($

millions) $ 20.0 $ 25.0 $ 70.0 $ 80.0 Effective Tax Rate 1 30.5 %

31.5 % 29.0 % 30.0 %

1 FY’10 guidance excludes the

impact from the first quarter implementation of highly inflationary

accounting in Venezuela.

SCHEDULE B: RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

(Unaudited), (Dollars in Thousands, Except Per Share

Data)

In addition to its reported results, the Company has included

in the tables below adjusted results that the Securities and

Exchange Commission defines as “non-GAAP financial measures.”

Management believes that such non-GAAP financial measures, when

read in conjunction with the Company’s reported results, can

provide useful supplemental information for investors analyzing

period to period comparisons of the Company’s results.

The following is a reconciliation of net income and diluted

earnings per share, presented and reported in accordance with U.S.

generally accepted accounting principles, to net income adjusted

for certain items:

Herbalife Ltd. Supplemental Schedule Non-GAAP Financial Measures

(In thousands, except per share data) (Unaudited)

Quarter Ended 6/30/2010 Reported

Adjusting Adjusted

(GAAP) Items

(Non-GAAP) Net Sales $ 688,806 $ 688,806 Cost of Sales

136,561 136,561 Gross Profit 552,245 552,245

Royalty Overrides 224,780 224,780 SGA 211,110

211,110 Operating Income 116,355 116,355 Interest Expense - net

2,146 2,146 Income before income taxes 114,209

114,209 Income Taxes 32,276 32,276 Net Income

$ 81,933 $ 81,933 Diluted EPS $ 1.32 $ 1.32

Herbalife Ltd. Supplemental Schedule Non-GAAP Financial

Measures (In thousands, except per share data) (Unaudited)

Quarter Ended 6/30/2009

Reported Adjusting Adjusted

(GAAP)

Items (Non-GAAP) Net Sales $ 571,805 $

571,805 Cost of Sales 122,442 122,442 Gross

Profit 449,363 449,363 Royalty Overrides 186,750 186,750 SGA

190,794 $ (814 )

1

189,980 Operating Income 71,819 814 72,633 Interest Expense

- net 1,338 1,338 Income before income taxes

70,481 814 71,295 Income Taxes 22,228 (277 )

1

21,951 Net Income $ 48,253 $ 1,091 $ 49,344

Diluted EPS $ 0.77 $ 0.02 $ 0.78

2

1 Related to international income

tax audit settlement

2 Amounts may not total due to rounding Herbalife Ltd.

Supplemental Schedule Non-GAAP Financial Measures (In thousands,

except per share data) (Unaudited)

Six Months Ended 6/30/2010 Reported Venezuela

Adjusted

(GAAP) Items

(Non-GAAP) Net Sales $ 1,307,439 $ 1,307,439 Cost of

Sales 277,033 $ (12,715 )

1

264,318 Gross Profit 1,030,406 12,715 1,043,121 Royalty

Overrides 432,099 432,099 SGA 417,993 (11,390 )

2

406,603 Operating Income 180,314 24,105 204,419 Interest

Expense - net 4,099 4,099 Income before income

taxes 176,215 24,105 200,320 Income Taxes 42,411

14,452

3

56,863 Net Income $ 133,804 $ 9,653 $ 143,457

Diluted EPS $ 2.14 $ 0.15 $ 2.30

4

1 Incremental U.S. dollar

costs of 2009 imports which were recorded at the unfavorable

parallel market exchange rate and were not devalued

based on 2010 exchange rates but rather recorded at their

historical dollar costs as products were sold

2 Includes $15,131 foreign

exchange loss related to remeasurement of Venezuela's monetary

assets and liabilities resulting from adoption of highly

inflationary accounting and $3,741 foreign exchange gain resulting

from receipt of U.S. dollar approved by CADIVI at the official

exchange rate relating to 2009 product importations which were

previously registered with CADIVI

3 Favorable income

taxes related to Venezuela becoming highly inflationary economy

4 Amounts may not total

due to rounding

Herbalife Ltd. Supplemental Schedule Non-GAAP Financial

Measures (In thousands, except per share data) (Unaudited)

Six Months Ended 6/30/2009 Reported

Adjusting Adjusted

(GAAP)

Items (Non-GAAP) Net Sales $ 1,093,488 $

1,093,488 Cost of Sales 224,842 224,842 Gross

Profit 868,646 868,646 Royalty Overrides 362,282 362,282 SGA

372,252 $ (1,404 )

1

370,848 Operating Income 134,112 1,404 135,516 Interest

Expense - net 3,050 3,050 Income before income

taxes 131,062 1,404 132,466 Income Taxes 41,267 (92 )

1

41,175 Net Income $ 89,795 $ 1,496 $ 91,291

Diluted EPS $ 1.44 $ 0.02 $ 1.46

1 Related to restructuring charge of

$590 with tax benefit of $185 and an international income tax audit

settlement of $814 with tax charge of $277.

The following is a reconciliation of total long-term debt to net

debt:

6/30/2010 12/31/2009 Total long-term

debt (current and long-term portion) $ 243,351 $ 250,333 Less: Cash

and cash equivalents 170,218 150,801 Net debt $

73,133 $ 99,532

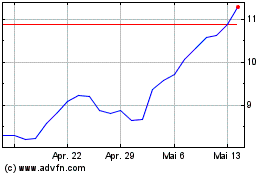

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024