Highwoods Obtains $200M Secured Loan

28 März 2023 - 10:05PM

Highwoods Properties, Inc. (NYSE:HIW) announces it

has obtained a $200 million, 5-year secured loan provided by a life

insurance company at a fixed rate of 5.69% secured by Bank of

America Tower at Legacy Union in Uptown Charlotte.

Ted Klinck, President and CEO of Highwoods,

stated “We are very pleased with this loan execution, which will

further fortify our already healthy balance sheet, enhance our

liquidity and position Highwoods to take advantage of future growth

opportunities.”

The proceeds have been used to reduce amounts

outstanding on the Company’s revolving credit facility and for

general corporate purposes.

About HighwoodsHighwoods

Properties, Inc., headquartered in Raleigh, is a publicly-traded

(NYSE:HIW) real estate investment trust (“REIT”) and a member of

the S&P MidCap 400 Index. The Company is a

fully-integrated office REIT that owns, develops, acquires, leases

and manages properties primarily in the best business districts

(BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh,

Richmond and Tampa. For more information about Highwoods, please

visit our website at www.highwoods.com.

Forward-Looking StatementsSome

of the information in this press release may contain

forward-looking statements. Such statements include, in particular,

statements about the Company’s liquidity and future growth

opportunities. You can identify forward-looking statements by our

use of forward-looking terminology such as “may,” “will,” “expect,”

“anticipate,” “estimate,” “continue” or other similar words.

Although we believe that our plans, intentions and expectations

reflected in or suggested by such forward-looking statements are

reasonable, we cannot assure you that our plans, intentions or

expectations will be achieved.

Factors that could cause our actual results to

differ materially from Highwoods’ current expectations include,

among others, the following: the financial condition of our

customers could deteriorate; our assumptions regarding potential

losses related to customer financial difficulties could prove

incorrect; counterparties under our debt instruments, particularly

our revolving credit facility, may attempt to avoid their

obligations thereunder, which, if successful, would reduce our

available liquidity; we may not be able to lease or re-lease second

generation space, defined as previously occupied space that becomes

available for lease, quickly or on as favorable terms as old

leases; we may not be able to lease newly constructed buildings as

quickly or on as favorable terms as originally anticipated; we may

not be able to complete development, acquisition, reinvestment,

disposition or joint venture projects as quickly or on as favorable

terms as anticipated; development activity in our existing markets

could result in an excessive supply relative to customer demand;

our markets may suffer declines in economic and/or office

employment growth; unanticipated increases in interest rates could

increase our debt service costs; unanticipated increases in

operating expenses could negatively impact our operating results;

natural disasters and climate change could have an adverse impact

on our cash flow and operating results; we may not be able to meet

our liquidity requirements or obtain capital on favorable terms to

fund our working capital needs and growth initiatives or repay or

refinance outstanding debt upon maturity; and the Company could

lose key executive officers.

This list of risks and uncertainties, however,

is not intended to be exhaustive. You should also review the other

cautionary statements we make in “Risk Factors” set forth in our

2022 Annual Report on Form 10-K. Given these uncertainties, you

should not place undue reliance on forward-looking statements. We

undertake no obligation to publicly release the results of any

revisions to these forward-looking statements to reflect any future

events or circumstances or to reflect the occurrence of

unanticipated events.

| Contact: |

Brendan MaioranaExecutive Vice

President and Chief Financial

Officerbrendan.maiorana@highwoods.com919-872-4924 |

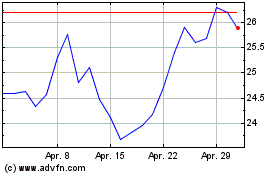

Highwoods Properties (NYSE:HIW)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Highwoods Properties (NYSE:HIW)

Historical Stock Chart

Von Jul 2023 bis Jul 2024