Highwoods Acquires McKinney & Olive in Uptown Dallas in 50/50 Joint Venture with Granite Properties

16 Dezember 2022 - 1:00PM

Highwoods Properties, Inc. (NYSE:HIW) has acquired

McKinney & Olive, a 557,000 square foot trophy mixed-use asset

in the heart of Uptown Dallas, in a 50/50 joint venture with

Granite Properties.

McKinney & Olive, which was delivered in

2016 and is currently 99% leased, offers 507,000 square feet of

multi-customer office space, 50,000 square feet of retail space and

a one-acre piazza surrounded by walkable amenities steps away from

Klyde Warren Park and the Dallas Arts District. McKinney &

Olive, which has easy access to Dallas North Tollway, Woodall

Rogers Freeway, I-75 and public transportation, is located just

four blocks from 23Springs, a mixed-use development encompassing

626,000 square feet of multi-customer office and 16,000 square feet

of retail that the Company is developing in a 50/50 joint venture

with Granite Properties.

Ted Klinck, President and CEO, stated, “We are

thrilled to expand our presence in the dynamic Dallas market by

once again partnering with Granite Properties to acquire this

landmark office tower in Uptown Dallas. McKinney & Olive is a

solid bull’s eye with its prime infill location in a top tier

submarket and financially sound, diversified customer base. Plus,

with rents estimated to be 35% below-market, McKinney & Olive

provides meaningful NOI upside potential.”

“We have long-emphasized the importance of

having a strong balance sheet with dry powder to capitalize on

exactly this type of strategic opportunity – acquiring a singularly

iconic asset such as McKinney & Olive at or below estimated

replacement cost. We remain committed to maintaining a strong

balance sheet and plan to focus primarily on accelerating our

non-core dispositions in 2023 as the investment sales market

stabilizes,” added Mr. Klinck.

The joint venture’s total investment (at 100%)

is expected to be $394.7 million, which includes $1.7 million of

near-term building improvements and $2.0 million of transaction

costs. During 2023, McKinney & Olive is expected to generate

cash net operating income of $22.0 million (at 100%) and GAAP net

operating income of $26.2 million (at 100%).

A presentation highlighting the acquisition can

be accessed through the link below and in the Investors section of

the Company’s website at www.highwoods.com.

McKinney & Olive Acquisition

About HighwoodsHighwoods

Properties, Inc., headquartered in Raleigh, is a publicly-traded

(NYSE:HIW) real estate investment trust (“REIT”) and a member of

the S&P MidCap 400 Index. The Company is a

fully-integrated office REIT that owns, develops, acquires, leases

and manages properties primarily in the best business districts

(BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh,

Richmond and Tampa. For more information about Highwoods, please

visit our website at www.highwoods.com.

Forward-Looking StatementsSome

of the information in this press release may contain

forward-looking statements. Such statements include, in particular,

statements about the total investment, estimated replacement cost

and below-market rents, projected leasing activity and expected net

operating income of acquired properties. You can identify

forward-looking statements by our use of forward-looking

terminology such as “may,” “will,” “expect,” “anticipate,”

“estimate,” “continue” or other similar words. Although we believe

that our plans, intentions and expectations reflected in or

suggested by such forward-looking statements are reasonable, we

cannot assure you that our plans, intentions or expectations will

be achieved.

Factors that could cause actual results to

differ materially from Highwoods' current expectations include,

among others, the following: buyers may not be available and

pricing may not be adequate with respect to planned dispositions of

non-core assets; comparable sales data on which we based our

expectations with respect to the sales price of non-core assets may

not reflect current market trends; the extent to which the ongoing

COVID-19 pandemic impacts our financial condition, results of

operations and cash flows depends on future developments, which are

highly uncertain and cannot be predicted with confidence, including

the scope, severity and duration of the pandemic and its impact on

the U.S. economy and potential changes in customer behavior that

could adversely affect the use of and demand for office space; the

financial condition of our customers could deteriorate or further

worsen, which could be further exacerbated by the COVID-19

pandemic; our assumptions regarding potential losses related to

customer financial difficulties due to the COVID-19 pandemic could

prove incorrect; counterparties under our debt instruments,

particularly our revolving credit facility, may attempt to avoid

their obligations thereunder, which, if successful, would reduce

our available liquidity; we may not be able to lease or re-lease

second generation space, defined as previously occupied space that

becomes available for lease, quickly or on as favorable terms as

old leases; we may not be able to lease newly constructed buildings

as quickly or on as favorable terms as originally anticipated; we

may not be able to complete development, acquisition, reinvestment,

disposition or joint venture projects as quickly or on as favorable

terms as anticipated; development activity in our existing markets

could result in an excessive supply relative to customer demand;

our markets may suffer declines in economic and/or office

employment growth; unanticipated increases in interest rates could

increase our debt service costs; unanticipated increases in

operating expenses could negatively impact our operating results;

natural disasters and climate change could have an adverse impact

on our cash flow and operating results; we may not be able to meet

our liquidity requirements or obtain capital on favorable terms to

fund our working capital needs and growth initiatives or repay or

refinance outstanding debt upon maturity; and the Company could

lose key executive officers.

This list of risks and uncertainties, however,

is not intended to be exhaustive. You should also review the other

cautionary statements we make in “Risk Factors” set forth in our

2021 Annual Report on Form 10-K. Given these uncertainties, you

should not place undue reliance on forward-looking statements. We

undertake no obligation to publicly release the results of any

revisions to these forward-looking statements to reflect any future

events or circumstances or to reflect the occurrence of

unanticipated events.

|

Contact: |

Brendan

Maiorana |

| |

Executive Vice President and Chief Financial Officer |

| |

brendan.maiorana@highwoods.com |

| |

919-872-4924 |

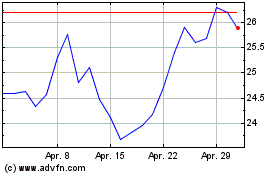

Highwoods Properties (NYSE:HIW)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Highwoods Properties (NYSE:HIW)

Historical Stock Chart

Von Jul 2023 bis Jul 2024