0000043196

GRAY TELEVISION INC

false

--12-31

Q2

2024

16

17

0

0

1,500,000

1,500,000

650,000

650,000

650,000

650,000

650

650

0

0

200,000,000

200,000,000

111,166,022

107,179,827

90,824,445

87,227,481

0

0

25,000,000

25,000,000

11,237,386

10,413,993

8,842,764

8,162,266

20,341,577

19,952,346

2,394,622

2,251,727

2

http://fasb.org/us-gaap/2024#SecuredOvernightFinancingRateSofrMember

300

13

5.875

7.0

4.75

5.375

6.2

5.6

1

0.08

0.08

0.08

0.08

0.08

0.08

0.08

1

1

21

5

1

2

false

false

false

false

For awards subject to future performance conditions, amounts assume target performance.

00000431962024-01-012024-06-30

0000043196us-gaap:CommonClassAMember2024-01-012024-06-30

0000043196us-gaap:CommonStockMember2024-01-012024-06-30

xbrli:shares

0000043196us-gaap:CommonStockMember2024-08-02

0000043196us-gaap:CommonClassAMember2024-08-02

thunderdome:item

iso4217:USD

00000431962024-06-30

00000431962023-12-31

iso4217:USDxbrli:shares

0000043196gtn:CommonStockNoParValueMember2024-06-30

0000043196gtn:CommonStockNoParValueMember2023-12-31

0000043196gtn:ClassACommonStockNoParValueMember2024-06-30

0000043196gtn:ClassACommonStockNoParValueMember2023-12-31

0000043196gtn:BroadcastingSegmentMember2024-04-012024-06-30

0000043196gtn:BroadcastingSegmentMember2023-04-012023-06-30

0000043196gtn:BroadcastingSegmentMember2024-01-012024-06-30

0000043196gtn:BroadcastingSegmentMember2023-01-012023-06-30

0000043196gtn:ProductionCompaniesSegmentMember2024-04-012024-06-30

0000043196gtn:ProductionCompaniesSegmentMember2023-04-012023-06-30

0000043196gtn:ProductionCompaniesSegmentMember2024-01-012024-06-30

0000043196gtn:ProductionCompaniesSegmentMember2023-01-012023-06-30

00000431962024-04-012024-06-30

00000431962023-04-012023-06-30

00000431962023-01-012023-06-30

0000043196us-gaap:AllOtherSegmentsMember2024-04-012024-06-30

0000043196us-gaap:AllOtherSegmentsMember2023-04-012023-06-30

0000043196us-gaap:AllOtherSegmentsMember2024-01-012024-06-30

0000043196us-gaap:AllOtherSegmentsMember2023-01-012023-06-30

0000043196gtn:O2024Q2DividendsMember2024-04-012024-06-30

0000043196gtn:O2023Q2DividendsMember2023-04-012023-06-30

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-31

0000043196us-gaap:CommonStockMember2022-12-31

0000043196us-gaap:RetainedEarningsMember2022-12-31

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2022-12-31

0000043196us-gaap:TreasuryStockCommonMember2022-12-31

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

00000431962022-12-31

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-31

0000043196us-gaap:CommonStockMember2023-01-012023-03-31

0000043196us-gaap:RetainedEarningsMember2023-01-012023-03-31

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0000043196us-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

00000431962023-01-012023-03-31

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonStockMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockMemberus-gaap:RetainedEarningsMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockMemberus-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonStockMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:RetainedEarningsMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-31

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-03-31

0000043196us-gaap:CommonStockMember2023-03-31

0000043196us-gaap:RetainedEarningsMember2023-03-31

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-03-31

0000043196us-gaap:TreasuryStockCommonMember2023-03-31

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

00000431962023-03-31

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-04-012023-06-30

0000043196us-gaap:CommonStockMember2023-04-012023-06-30

0000043196us-gaap:RetainedEarningsMember2023-04-012023-06-30

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0000043196us-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-04-012023-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonStockMember2023-04-012023-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:RetainedEarningsMember2023-04-012023-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0000043196us-gaap:RestrictedStockMember2023-04-012023-06-30

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-06-30

0000043196us-gaap:CommonStockMember2023-06-30

0000043196us-gaap:RetainedEarningsMember2023-06-30

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-06-30

0000043196us-gaap:TreasuryStockCommonMember2023-06-30

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

00000431962023-06-30

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-31

0000043196us-gaap:CommonStockMember2023-12-31

0000043196us-gaap:RetainedEarningsMember2023-12-31

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2023-12-31

0000043196us-gaap:TreasuryStockCommonMember2023-12-31

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-03-31

0000043196us-gaap:CommonStockMember2024-01-012024-03-31

0000043196us-gaap:RetainedEarningsMember2024-01-012024-03-31

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2024-01-012024-03-31

0000043196us-gaap:TreasuryStockCommonMember2024-01-012024-03-31

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-31

00000431962024-01-012024-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonStockMember2024-01-012024-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:RetainedEarningsMember2024-01-012024-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2024-01-012024-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:TreasuryStockCommonMember2024-01-012024-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-31

0000043196us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-31

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-03-31

0000043196us-gaap:CommonStockMember2024-03-31

0000043196us-gaap:RetainedEarningsMember2024-03-31

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2024-03-31

0000043196us-gaap:TreasuryStockCommonMember2024-03-31

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-31

00000431962024-03-31

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-04-012024-06-30

0000043196us-gaap:CommonStockMember2024-04-012024-06-30

0000043196us-gaap:RetainedEarningsMember2024-04-012024-06-30

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2024-04-012024-06-30

0000043196us-gaap:TreasuryStockCommonMember2024-04-012024-06-30

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-30

0000043196us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-06-30

0000043196us-gaap:CommonStockMember2024-06-30

0000043196us-gaap:RetainedEarningsMember2024-06-30

0000043196us-gaap:CommonClassAMemberus-gaap:TreasuryStockCommonMember2024-06-30

0000043196us-gaap:TreasuryStockCommonMember2024-06-30

0000043196us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-30

xbrli:pure

utr:Rate

0000043196gtn:BroadcastMusicIncMember2024-02-082024-02-08

0000043196us-gaap:LandMember2024-06-30

0000043196us-gaap:LandMember2023-12-31

0000043196us-gaap:BuildingAndBuildingImprovementsMember2024-06-30

0000043196us-gaap:BuildingAndBuildingImprovementsMember2023-12-31

utr:Y

0000043196us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2024-06-30

0000043196us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2024-06-30

0000043196us-gaap:EquipmentMember2024-06-30

0000043196us-gaap:EquipmentMember2023-12-31

0000043196us-gaap:EquipmentMembersrt:MinimumMember2024-06-30

0000043196us-gaap:EquipmentMembersrt:MaximumMember2024-06-30

0000043196us-gaap:ConstructionInProgressMember2024-06-30

0000043196us-gaap:ConstructionInProgressMember2023-12-31

0000043196gtn:WellsFargoBankNAMember2023-02-23

0000043196gtn:WellsFargoBankNAMember2024-01-012024-06-30

0000043196gtn:SpecialPurposeSubsidiarySPVMember2024-01-012024-06-30

0000043196gtn:SpecialPurposeSubsidiarySPVMember2023-01-012023-06-30

0000043196gtn:WellsFargoBankNAMember2023-01-012023-12-31

0000043196gtn:WellsFargoBankNAMember2023-12-31

0000043196gtn:WellsFargoBankNAMember2024-06-30

0000043196gtn:WellsFargoBankNAMember2023-06-30

0000043196gtn:WellsFargoBankNAMember2023-01-012023-06-30

0000043196gtn:DeferredRevenueMember2023-12-31

0000043196gtn:AdvertisingDepositLiabilitiesMember2024-06-30

0000043196gtn:AdvertisingDepositLiabilitiesMember2023-12-31

0000043196gtn:OtherDepositLiabilitiesMember2024-06-30

0000043196gtn:OtherDepositLiabilitiesMember2023-12-31

0000043196gtn:CoreAdvertisingMember2024-04-012024-06-30

0000043196gtn:CoreAdvertisingMember2023-04-012023-06-30

0000043196gtn:CoreAdvertisingMember2024-01-012024-06-30

0000043196gtn:CoreAdvertisingMember2023-01-012023-06-30

0000043196gtn:PoliticalAdvertisingMember2024-04-012024-06-30

0000043196gtn:PoliticalAdvertisingMember2023-04-012023-06-30

0000043196gtn:PoliticalAdvertisingMember2024-01-012024-06-30

0000043196gtn:PoliticalAdvertisingMember2023-01-012023-06-30

0000043196us-gaap:AdvertisingMember2024-04-012024-06-30

0000043196us-gaap:AdvertisingMember2023-04-012023-06-30

0000043196us-gaap:AdvertisingMember2024-01-012024-06-30

0000043196us-gaap:AdvertisingMember2023-01-012023-06-30

0000043196gtn:RetransmissionConsentMember2024-04-012024-06-30

0000043196gtn:RetransmissionConsentMember2023-04-012023-06-30

0000043196gtn:RetransmissionConsentMember2024-01-012024-06-30

0000043196gtn:RetransmissionConsentMember2023-01-012023-06-30

0000043196gtn:ProductionCompaniesMember2024-04-012024-06-30

0000043196gtn:ProductionCompaniesMember2023-04-012023-06-30

0000043196gtn:ProductionCompaniesMember2024-01-012024-06-30

0000043196gtn:ProductionCompaniesMember2023-01-012023-06-30

0000043196us-gaap:ServiceOtherMember2024-04-012024-06-30

0000043196us-gaap:ServiceOtherMember2023-04-012023-06-30

0000043196us-gaap:ServiceOtherMember2024-01-012024-06-30

0000043196us-gaap:ServiceOtherMember2023-01-012023-06-30

0000043196us-gaap:SalesChannelDirectlyToConsumerMember2024-04-012024-06-30

0000043196us-gaap:SalesChannelDirectlyToConsumerMember2023-04-012023-06-30

0000043196us-gaap:SalesChannelDirectlyToConsumerMember2024-01-012024-06-30

0000043196us-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-06-30

0000043196us-gaap:SalesChannelThroughIntermediaryMember2024-04-012024-06-30

0000043196us-gaap:SalesChannelThroughIntermediaryMember2023-04-012023-06-30

0000043196us-gaap:SalesChannelThroughIntermediaryMember2024-01-012024-06-30

0000043196us-gaap:SalesChannelThroughIntermediaryMember2023-01-012023-06-30

0000043196gtn:Notes2026Member2024-06-30

0000043196gtn:Notes2026Member2023-12-31

0000043196gtn:Notes2027Member2024-06-30

0000043196gtn:Notes2027Member2023-12-31

0000043196gtn:Notes2029Member2024-06-30

0000043196gtn:Notes2029Member2023-12-31

0000043196gtn:Notes2030Member2024-06-30

0000043196gtn:Notes2030Member2023-12-31

0000043196gtn:Notes2031Member2024-06-30

0000043196gtn:Notes2031Member2023-12-31

0000043196gtn:The2019TermLoanMember2024-06-30

0000043196gtn:The2019TermLoanMember2023-12-31

0000043196gtn:The2021TermLoanMember2024-06-30

0000043196gtn:The2021TermLoanMember2023-12-31

0000043196gtn:The2024TermLoanMember2024-06-30

0000043196gtn:The2024TermLoanMember2023-12-31

0000043196us-gaap:RevolvingCreditFacilityMember2024-06-30

0000043196us-gaap:RevolvingCreditFacilityMember2023-12-31

0000043196gtn:SeniorCreditFacilityMember2024-06-30

0000043196gtn:SeniorCreditFacilityMember2023-12-31

0000043196gtn:Notes2029Member2024-06-03

0000043196gtn:The2024TermLoanMember2024-06-03

0000043196gtn:The2024RevolvingCreditFacilityMember2024-06-032024-06-03

0000043196gtn:The2019TermLoanMember2024-06-302024-06-30

0000043196gtn:Notes2026Member2024-06-03

0000043196gtn:The2024TermLoanMember2024-06-04

0000043196gtn:SecondAmendmentExtendingMaturityDateToDecember12026Member2024-06-04

0000043196gtn:ThirdAmendmentIncreasingAggregateCommitmentsTo1275MillionMember2024-06-042024-06-04

0000043196gtn:ThirdAmendmentIncreasingAggregateCommitmentsTo1275MillionMember2024-06-04

0000043196gtn:The2024TermLoanMemberus-gaap:FederalFundsEffectiveSwapRateMember2024-06-042024-06-04

0000043196gtn:The2024TermLoanMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-06-042024-06-04

0000043196gtn:The2024TermLoanMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-06-04

0000043196gtn:The2024TermLoanMemberus-gaap:BaseRateMember2024-06-042024-06-04

0000043196gtn:The2024TermLoanMember2024-06-042024-06-04

0000043196gtn:The2024RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-06-042024-06-04

0000043196gtn:The2024RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-06-042024-06-04

0000043196gtn:The2024RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:BaseRateMember2024-06-042024-06-04

0000043196gtn:The2024RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:BaseRateMember2024-06-042024-06-04

0000043196gtn:The2024RevolvingCreditFacilityMembersrt:MinimumMember2024-06-042024-06-04

0000043196gtn:The2024RevolvingCreditFacilityMembersrt:MaximumMember2024-06-042024-06-04

00000431962024-06-042024-06-04

00000431962024-06-04

0000043196gtn:DebtRepurchaseAgreementUsingLiquidityMember2024-05-062025-12-31

0000043196gtn:Notes2027Membergtn:DebtRepurchaseAgreementUsingLiquidityMember2024-04-012024-06-30

0000043196gtn:DebtRepurchaseAgreementUnderRule10b51Member2024-06-242024-06-24

0000043196gtn:Notes2027Membergtn:DebtRepurchaseAgreementUnderRule10b51Membersrt:ScenarioForecastMember2024-07-082024-09-30

0000043196us-gaap:InterestRateCapMembersrt:ScenarioForecastMember2025-12-31

0000043196us-gaap:InterestRateCapMember2023-12-31

0000043196us-gaap:InterestRateCapMember2024-01-012024-06-30

0000043196us-gaap:InterestRateCapMember2023-01-012023-06-30

0000043196gtn:The2019SeniorCreditFacilityMember2024-06-30

0000043196gtn:O2024Q1dividendsMember2024-01-012024-03-31

0000043196gtn:O2024Q1dividendsMembergtn:ClassACommonStockNoParValueMember2024-01-012024-03-31

0000043196gtn:O2024Q2DividendsMembergtn:ClassACommonStockNoParValueMember2024-04-012024-06-30

0000043196gtn:O2023Q1DividendsMember2023-01-012023-03-31

0000043196gtn:O2023Q1DividendsMembergtn:ClassACommonStockNoParValueMember2023-01-012023-03-31

0000043196gtn:O2023Q2DividendsMembergtn:ClassACommonStockNoParValueMember2023-04-012023-06-30

0000043196gtn:GrayPensionPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-06-30

0000043196gtn:ProfitSharingContributionMember2023-01-012023-06-30

0000043196us-gaap:RestrictedStockMember2023-12-31

0000043196us-gaap:RestrictedStockMember2022-12-31

0000043196us-gaap:RestrictedStockMember2024-01-012024-06-30

0000043196us-gaap:RestrictedStockMember2023-01-012023-06-30

0000043196us-gaap:RestrictedStockMember2024-06-30

0000043196us-gaap:RestrictedStockMember2023-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMember2023-12-31

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMember2022-12-31

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMember2024-01-012024-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMember2023-01-012023-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMember2024-06-30

0000043196us-gaap:RestrictedStockMemberus-gaap:CommonClassAMember2023-06-30

0000043196us-gaap:RestrictedStockUnitsRSUMember2023-12-31

0000043196us-gaap:RestrictedStockUnitsRSUMember2022-12-31

0000043196us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-30

0000043196us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-30

0000043196us-gaap:RestrictedStockUnitsRSUMember2024-06-30

0000043196us-gaap:RestrictedStockUnitsRSUMember2023-06-30

0000043196srt:MinimumMember2024-06-30

0000043196srt:MaximumMember2024-06-30

0000043196us-gaap:DeferredLeaseRevenueMember2024-06-30

0000043196us-gaap:DeferredLeaseRevenueMember2023-12-31

00000431962024-04-012024-07-02

0000043196gtn:BroadcastLicensesMember2024-06-30

0000043196gtn:BroadcastLicensesMember2023-12-31

0000043196gtn:GoodwillNotAmortizableMember2024-06-30

0000043196gtn:GoodwillNotAmortizableMember2023-12-31

0000043196gtn:IntangibleAssetsNotSubjectToAmortizationMember2024-06-30

0000043196gtn:IntangibleAssetsNotSubjectToAmortizationMember2023-12-31

0000043196gtn:NetworkAffiliateMember2024-06-30

0000043196gtn:NetworkAffiliateMember2023-12-31

0000043196us-gaap:OtherIntangibleAssetsMember2024-06-30

0000043196us-gaap:OtherIntangibleAssetsMember2023-12-31

0000043196gtn:IntangibleAssetsSubjectToAmortizationMember2024-06-30

0000043196gtn:IntangibleAssetsSubjectToAmortizationMember2023-12-31

0000043196srt:MinimumMembersrt:ScenarioForecastMemberus-gaap:SubsequentEventMember2024-07-012024-12-31

0000043196srt:MaximumMembersrt:ScenarioForecastMemberus-gaap:SubsequentEventMember2024-07-012024-12-31

0000043196us-gaap:StateAndLocalJurisdictionMember2024-06-30

0000043196us-gaap:OperatingSegmentsMembergtn:BroadcastingSegmentMember2024-01-012024-06-30

0000043196us-gaap:OperatingSegmentsMembergtn:ProductionCompaniesSegmentMember2024-01-012024-06-30

0000043196us-gaap:MaterialReconcilingItemsMember2024-01-012024-06-30

0000043196us-gaap:OperatingSegmentsMembergtn:BroadcastingSegmentMember2024-06-30

0000043196us-gaap:OperatingSegmentsMembergtn:ProductionCompaniesSegmentMember2024-06-30

0000043196us-gaap:MaterialReconcilingItemsMember2024-06-30

0000043196us-gaap:OperatingSegmentsMembergtn:BroadcastingSegmentMember2023-01-012023-06-30

0000043196us-gaap:OperatingSegmentsMembergtn:ProductionCompaniesSegmentMember2023-01-012023-06-30

0000043196us-gaap:MaterialReconcilingItemsMember2023-01-012023-06-30

0000043196us-gaap:OperatingSegmentsMembergtn:ProductionCompaniesSegmentMember2023-01-012024-06-30

0000043196us-gaap:OperatingSegmentsMembergtn:BroadcastingSegmentMember2023-12-31

0000043196us-gaap:OperatingSegmentsMembergtn:ProductionCompaniesSegmentMember2023-12-31

0000043196us-gaap:MaterialReconcilingItemsMember2023-12-31

0000043196gtn:SaleOfTelevisionStationsKCWYAndKGWNMemberus-gaap:SubsequentEventMember2024-07-012024-07-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark one)

| ☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the quarterly period ended June 30, 2024 or |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to . |

Commission file number: 1-13796

| Gray Television, Inc. |

| (Exact name of registrant as specified in its charter) |

| Georgia | | 58-0285030 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | | |

| 4370 Peachtree Road, NE, Atlanta, Georgia | | 30319 |

| (Address of principal executive offices) | | (Zip code) |

| (404) 504-9828 |

| (Registrant's telephone number, including area code) |

| |

| Not Applicable |

| (Former name, former address and former fiscal year, if changed since last report.) |

Securities registered pursuant to Section 12(b) of the Act:

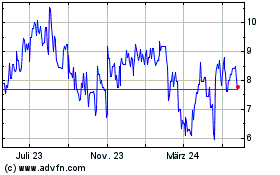

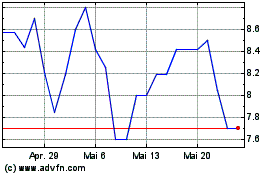

| Title of each Class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock (no par value) | GTN.A | New York Stock Exchange |

| common stock (no par value) | GTN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practical date.

| Common Stock (No Par Value) | | Class A Common Stock (No Par Value) |

| 90,824,445 shares outstanding as of August 2, 2024 | | 8,842,764 shares outstanding as of August 2, 2024 |

INDEX

GRAY TELEVISION, INC.

| PART I. |

FINANCIAL INFORMATION |

PAGE |

| |

|

|

| Item 1. |

Financial Statements |

|

| |

|

|

| |

Condensed consolidated balance sheets (Unaudited) - June 30, 2024 and December 31, 2023 |

3 |

| |

|

|

| |

Condensed consolidated statements of operations (Unaudited) - three-months and six-months ended June 30, 2024 and 2023 |

5 |

| |

|

|

| |

Condensed consolidated statements of comprehensive income (loss) (Unaudited) – three-months and six-months ended June 30, 2024 and 2023 |

6 |

| |

|

|

| |

Condensed consolidated statements of stockholders' equity (Unaudited) – three-months and six-months ended June 30, 2024 and 2023 |

7 |

| |

|

|

| |

Condensed consolidated statements of cash flows (Unaudited) - six-months ended June 30, 2024 and 2023 |

8 |

| |

|

|

| |

Notes to condensed consolidated financial statements (Unaudited) |

9 |

| |

|

|

| Item 2. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

25 |

| |

|

|

| Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

34 |

| |

|

|

| Item 4. |

Controls and Procedures |

34 |

| |

|

|

| PART II. |

OTHER INFORMATION |

|

| |

|

|

| Item 1. |

Legal Proceedings |

34 |

| |

|

|

| Item 1A. |

Risk Factors |

34 |

| |

|

|

| Item 5. |

Other Information |

34 |

| |

|

|

| Item 6. |

Exhibits |

35 |

| |

|

|

| SIGNATURES |

|

36 |

| PART I. |

FINANCIAL INFORMATION |

| Item 1. |

Financial Statements |

| GRAY TELEVISION, INC. | |

| CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) | |

| (in millions) | |

| | | | | | | | | |

| | | June 30, | | | December 31, | |

| | | 2024 | | | 2023 | |

| Assets: | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash | | $ | 75 | | | $ | 21 | |

| Accounts receivable, less allowance for credit losses of $16 and $17, respectively | | | 344 | | | | 342 | |

| Current portion of program broadcast rights, net | | | 5 | | | | 18 | |

| Income tax refunds receivable | | | - | | | | 21 | |

| Prepaid income taxes | | | 65 | | | | 18 | |

| Prepaid and other current assets | | | 49 | | | | 48 | |

| Total current assets | | | 538 | | | | 468 | |

| | | | | | | | | |

| Property and equipment, net | | | 1,582 | | | | 1,601 | |

| Operating leases right of use asset | | | 70 | | | | 75 | |

| Broadcast licenses | | | 5,320 | | | | 5,320 | |

| Goodwill | | | 2,643 | | | | 2,643 | |

| Other intangible assets, net | | | 352 | | | | 415 | |

| Investments in broadcasting and technology companies | | | 86 | | | | 85 | |

| Deferred pension assets | | | 19 | | | | 17 | |

| Other | | | 24 | | | | 16 | |

| Total assets | | $ | 10,634 | | | $ | 10,640 | |

See notes to condensed consolidated financial statements.

| GRAY TELEVISION, INC. |

| CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

| (in millions, except for share data) |

| | | June 30, | | | December 31, | |

| | | 2024 | | | 2023 | |

| Liabilities and stockholders’ equity: | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 32 | | | $ | 23 | |

| Employee compensation and benefits | | | 85 | | | | 110 | |

| Accrued interest | | | 49 | | | | 63 | |

| Accrued network programming fees | | | 39 | | | | 37 | |

| Other accrued expenses | | | 49 | | | | 57 | |

| Federal and state income taxes | | | 11 | | | | 22 | |

| Current portion of program broadcast obligations | | | 5 | | | | 20 | |

| Deferred revenue | | | 23 | | | | 23 | |

| Dividends payable | | | 15 | | | | 14 | |

| Current portion of operating lease liabilities | | | 10 | | | | 11 | |

| Current portion of long-term debt | | | 13 | | | | 15 | |

| Total current liabilities | | | 331 | | | | 395 | |

| | | | | | | | | |

| Long-term debt, less current portion and deferred financing costs | | | 6,125 | | | | 6,145 | |

| Program broadcast obligations, less current portion | | | 1 | | | | 1 | |

| Deferred income taxes | | | 1,349 | | | | 1,359 | |

| Operating lease liabilities, less current portion | | | 64 | | | | 69 | |

| Other | | | 59 | | | | 50 | |

| Total liabilities | | | 7,929 | | | | 8,019 | |

| | | | | | | | | |

| Commitments and contingencies (Note 9) | | | | | | | | |

| | | | | | | | | |

| Series A Perpetual Preferred Stock, no par value; cumulative; redeemable; designated 1,500,000 shares, issued and outstanding 650,000 shares at each date and $650 aggregate liquidation value at each date | | | 650 | | | | 650 | |

| | | | | | | | | |

| Stockholders’ equity: | | | | | | | | |

| Common stock, no par value; authorized 200,000,000 shares, issued 111,166,022 shares and 107,179,827 shares, respectively, and outstanding 90,824,445 shares and 87,227,481 shares, respectively | | | 1,191 | | | | 1,174 | |

| Class A common stock, no par value; authorized 25,000,000 shares, issued 11,237,386 shares and 10,413,993 shares, respectively, and outstanding 8,842,764 shares and 8,162,266 shares, respectively | | | 54 | | | | 50 | |

| Retained earnings | | | 1,152 | | | | 1,084 | |

| Accumulated other comprehensive loss, net of income tax benefit | | | (25 | ) | | | (23 | ) |

| | | | 2,372 | | | | 2,285 | |

| Treasury stock at cost, common stock, 20,341,577 shares and 19,952,346 shares, respectively | | | (284 | ) | | | (282 | ) |

| Treasury stock at cost, Class A common stock, 2,394,622 shares and 2,251,727 shares, respectively | | | (33 | ) | | | (32 | ) |

| Total stockholders’ equity | | | 2,055 | | | | 1,971 | |

| Total liabilities and stockholders’ equity | | $ | 10,634 | | | $ | 10,640 | |

See notes to condensed consolidated financial statements.

| GRAY TELEVISION, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) |

| (in millions, except for per share data) |

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue (less agency commissions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Broadcasting |

|

$ |

808 |

|

|

$ |

801 |

|

|

$ |

1,607 |

|

|

$ |

1,580 |

|

| Production companies |

|

|

18 |

|

|

|

12 |

|

|

|

42 |

|

|

|

34 |

|

| Total revenue (less agency commissions) |

|

|

826 |

|

|

|

813 |

|

|

|

1,649 |

|

|

|

1,614 |

|

| Operating expenses before depreciation, amortization and gain on disposal of assets, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Broadcasting |

|

|

565 |

|

|

|

552 |

|

|

|

1,148 |

|

|

|

1,107 |

|

| Production companies |

|

|

14 |

|

|

|

11 |

|

|

|

35 |

|

|

|

70 |

|

| Corporate and administrative |

|

|

28 |

|

|

|

30 |

|

|

|

56 |

|

|

|

56 |

|

| Depreciation |

|

|

36 |

|

|

|

35 |

|

|

|

72 |

|

|

|

70 |

|

| Amortization of intangible assets |

|

|

32 |

|

|

|

50 |

|

|

|

63 |

|

|

|

99 |

|

| (Gain) loss on disposal of assets, net |

|

|

(1 |

) |

|

|

16 |

|

|

|

(1 |

) |

|

|

26 |

|

| Operating expenses |

|

|

674 |

|

|

|

694 |

|

|

|

1,373 |

|

|

|

1,428 |

|

| Operating income |

|

|

152 |

|

|

|

119 |

|

|

|

276 |

|

|

|

186 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Miscellaneous income (expense), net |

|

|

2 |

|

|

|

(1 |

) |

|

|

112 |

|

|

|

(3 |

) |

| Interest expense |

|

|

(118 |

) |

|

|

(109 |

) |

|

|

(233 |

) |

|

|

(213 |

) |

| Loss from early extinguishment of debt |

|

|

(7 |

) |

|

|

- |

|

|

|

(7 |

) |

|

|

(3 |

) |

| Income (loss) before income taxes |

|

|

29 |

|

|

|

9 |

|

|

|

148 |

|

|

|

(33 |

) |

| Income tax expense (benefit) |

|

|

7 |

|

|

|

5 |

|

|

|

38 |

|

|

|

(6 |

) |

| Net income (loss) |

|

|

22 |

|

|

|

4 |

|

|

|

110 |

|

|

|

(27 |

) |

| Preferred stock dividends |

|

|

13 |

|

|

|

13 |

|

|

|

26 |

|

|

|

26 |

|

| Net income (loss) attributable to common stockholders |

|

$ |

9 |

|

|

$ |

(9 |

) |

|

$ |

84 |

|

|

$ |

(53 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic per share information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to common stockholders |

|

$ |

0.09 |

|

|

$ |

(0.10 |

) |

|

$ |

0.89 |

|

|

$ |

(0.58 |

) |

| Weighted-average shares outstanding |

|

|

95 |

|

|

|

93 |

|

|

|

94 |

|

|

|

92 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted per share information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to common stockholders |

|

$ |

0.09 |

|

|

$ |

(0.10 |

) |

|

$ |

0.88 |

|

|

$ |

(0.58 |

) |

| Weighted-average shares outstanding |

|

|

96 |

|

|

|

93 |

|

|

|

95 |

|

|

|

92 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared per common share |

|

$ |

0.08 |

|

|

$ |

0.08 |

|

|

$ |

0.16 |

|

|

$ |

0.16 |

|

See notes to condensed consolidated financial statements.

| GRAY TELEVISION, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited) |

| (in millions) |

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

22 |

|

|

$ |

4 |

|

|

$ |

110 |

|

|

$ |

(27 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustment - fair value of interest rate caps |

|

|

(3 |

) |

|

|

11 |

|

|

|

(3 |

) |

|

|

(4 |

) |

| Income tax (benefit) expense |

|

|

(1 |

) |

|

|

3 |

|

|

|

(1 |

) |

|

|

(1 |

) |

| Other comprehensive (loss) income, net |

|

|

(2 |

) |

|

|

8 |

|

|

|

(2 |

) |

|

|

(3 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income (loss) |

|

$ |

20 |

|

|

$ |

12 |

|

|

$ |

108 |

|

|

$ |

(30 |

) |

See notes to condensed consolidated financial statements.

| GRAY TELEVISION, INC. |

| CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY (Unaudited) |

| (in millions, except for number of shares) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

| |

|

|

Class A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A |

|

|

Common |

|

|

Other |

|

|

|

|

|

| |

|

|

Common Stock |

|

|

Common Stock |

|

|

Retained |

|

|

Treasury Stock |

|

|

Treasury Stock |

|

|

Comprehensive |

|

|

|

|

|

| |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Earnings |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Loss |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2022 |

|

|

|

9,675,139 |

|

|

$ |

45 |

|

|

|

105,104,057 |

|

|

$ |

1,150 |

|

|

$ |

1,242 |

|

|

|

(2,130,724 |

) |

|

$ |

(31 |

) |

|

|

(19,636,786 |

) |

|

$ |

(278 |

) |

|

$ |

(12 |

) |

|

$ |

2,116 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(31 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(31 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock dividends |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock dividends |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustment to fair value of interest rate cap, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(11 |

) |

|

|

(11 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 401(k) Plan |

|

|

|

- |

|

|

|

- |

|

|

|

819,898 |

|

|

|

9 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

9 |

|

| 2022 Equity and Incentive Compensation Plan: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted stock awards |

|

|

|

25,022 |

|

|

|

- |

|

|

|

12,227 |

|

|

|

- |

|

|

|

- |

|

|

|

(92,196 |

) |

|

|

(1 |

) |

|

|

(129,636 |

) |

|

|

(2 |

) |

|

|

- |

|

|

|

(3 |

) |

| Restricted stock unit awards |

|

|

|

- |

|

|

|

- |

|

|

|

247,953 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(80,622 |

) |

|

|

(1 |

) |

|

|

- |

|

|

|

(1 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 31, 2023 |

|

|

|

9,700,161 |

|

|

$ |

45 |

|

|

|

106,184,135 |

|

|

$ |

1,161 |

|

|

$ |

1,191 |

|

|

|

(2,222,920 |

) |

|

$ |

(32 |

) |

|

|

(19,847,044 |

) |

|

$ |

(281 |

) |

|

$ |

(23 |

) |

|

$ |

2,061 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock dividends |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock dividends |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustment to fair value of interest rate cap, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2017 Equity and Incentive Compensation Plan: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted stock awards |

|

|

|

713,832 |

|

|

|

- |

|

|

|

995,692 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(69,028 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repurchase of common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

7 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at June 30, 2023 |

|

|

|

10,413,993 |

|

|

$ |

45 |

|

|

|

107,179,827 |

|

|

$ |

1,168 |

|

|

$ |

1,175 |

|

|

|

(2,222,920 |

) |

|

$ |

(32 |

) |

|

|

(19,916,072 |

) |

|

$ |

(281 |

) |

|

$ |

(15 |

) |

|

$ |

2,060 |

|

| . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2023 |

|

|

|

10,413,993 |

|

|

$ |

50 |

|

|

|

107,179,827 |

|

|

$ |

1,174 |

|

|

$ |

1,084 |

|

|

|

(2,251,727 |

) |

|

$ |

(32 |

) |

|

|

(19,952,346 |

) |

|

$ |

(282 |

) |

|

$ |

(23 |

) |

|

$ |

1,971 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

88 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

88 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock dividends |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock dividends |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(8 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustment to fair value of interest rate cap, net of tax |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 401(k) Plan |

|

|

|

- |

|

|

|

- |

|

|

|

1,765,444 |

|

|

|

9 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

9 |

|

| 2022 Equity and Incentive Compensation Plan: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted stock awards |

|

|

|

823,393 |

|

|

|

- |

|

|

|

1,126,296 |

|

|

|

- |

|

|

|

- |

|

|

|

(142,895 |

) |

|

|

(1 |

) |

|

|

(146,470 |

) |

|

|

(1 |

) |

|

|

- |

|

|

|

(2 |

) |

| Restricted stock unit awards |

|

|

|

- |

|

|

|

- |

|

|

|

564,793 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(188,400 |

) |

|

|

(1 |

) |

|

|

- |

|

|

|

(1 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

|

- |

|

|

|

2 |

|

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 31, 2024 |

|

|

|

11,237,386 |

|

|

$ |

52 |

|

|

|

110,636,360 |

|

|

$ |

1,187 |

|

|

$ |

1,151 |

|

|

|

(2,394,622 |

) |

|

$ |

(33 |

) |

|

|

(20,287,216 |

) |

|

$ |

(284 |

) |

|

$ |

(23 |

) |

|

$ |

2,050 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

22 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

22 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock dividends |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock dividends |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(8 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustment to fair value of interest rate cap, net of tax |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(2 |

) |

|

|

(2 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2022 Equity and Incentive Compensation Plan: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted stock awards |

|

|

|

- |

|

|

|

- |

|

|

|

529,662 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(54,361 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

|

- |

|

|

|

2 |

|

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at June 30, 2024 |

|

|

|

11,237,386 |

|

|

$ |

54 |

|

|

|

111,166,022 |

|

|

$ |

1,191 |

|

|

$ |

1,152 |

|

|

|

(2,394,622 |

) |

|

$ |

(33 |

) |

|

|

(20,341,577 |

) |

|

$ |

(284 |

) |

|

$ |

(25 |

) |

|

$ |

2,055 |

|

See notes to condensed consolidated financial statements.

| GRAY TELEVISION, INC. |

|

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) |

|

| (in millions) |

|

| |

|

|

|

|

|

|

|

|

| |

|

Six Months Ended |

|

| |

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| Operating activities: |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

110 |

|

|

$ |

(27 |

) |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

72 |

|

|

|

70 |

|

| Amortization of intangible assets |

|

|

63 |

|

|

|

99 |

|

| Amortization of deferred loan costs |

|

|

7 |

|

|

|

7 |

|

| Amortization of restricted stock awards |

|

|

12 |

|

|

|

9 |

|

| Amortization of program broadcast rights |

|

|

13 |

|

|

|

20 |

|

| Payments on program broadcast obligations |

|

|

(15 |

) |

|

|

(21 |

) |

| Deferred income taxes |

|

|

(10 |

) |

|

|

(6 |

) |

| (Gain) loss on disposal of assets, net |

|

|

(1 |

) |

|

|

26 |

|

| Gain on sale of investment |

|

|

(110 |

) |

|

|

- |

|

| Loss from early extinguishment of debt |

|

|

7 |

|

|

|

3 |

|

| Other |

|

|

1 |

|

|

|

11 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable, net |

|

|

(1 |

) |

|

|

321 |

|

| Income tax receivable or prepaid |

|

|

(26 |

) |

|

|

(24 |

) |

| Other current assets |

|

|

(1 |

) |

|

|

4 |

|

| Accounts payable |

|

|

8 |

|

|

|

(21 |

) |

| Employee compensation, benefits and pension cost |

|

|

(25 |

) |

|

|

(27 |

) |

| Accrued network fees and other expenses |

|

|

7 |

|

|

|

16 |

|

| Accrued interest |

|

|

(14 |

) |

|

|

2 |

|

| Income taxes payable |

|

|

(11 |

) |

|

|

(3 |

) |

| Net cash provided by operating activities |

|

|

86 |

|

|

|

459 |

|

| |

|

|

|

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

|

|

| Acquisitions of television businesses and licenses, net of cash acquired |

|

|

- |

|

|

|

(6 |

) |

| Proceeds from sale of television station |

|

|