0001672013false00016720132024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 29, 2024

| | |

| Acushnet Holdings Corp. |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 001-37935 | 45-2644353 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 333 Bridge Street | Fairhaven, | Massachusetts | 02719 |

| (Address of principal executive offices) | | | (Zip Code) |

(800) 225‑8500

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock - $0.001 par value per share | | GOLF | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 29, 2024, Acushnet Holdings Corp. (the “Company”) issued a press release announcing the Company’s results of operations for the full year and fourth quarter ended December 31, 2023. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

The information contained in this Current Report on Form 8-K and Exhibit 99.1 shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ACUSHNET HOLDINGS CORP. |

| |

| By: | /s/ Sean Sullivan |

| Name: | Sean Sullivan |

| Title: | Executive Vice President, Chief Financial Officer |

Date: February 29, 2024

Exhibit 99.1

Acushnet Holdings Corp. Announces

Full Year and Fourth Quarter 2023 Financial Results,

Declares Increased Quarterly Cash Dividend, Announces Increased Share Repurchase Authorization,

Introduces 2024 Outlook

Key Highlights:

•Full year net sales of $2.4 billion, up 4.9% year over year, up 6.2% in constant currency

•Full year net income attributable to Acushnet Holdings Corp. of $198.4 million, down $0.9 million year over year

•Full year Adjusted EBITDA of $376.1 million, up $37.7 million, or 11.1%, year over year

•Fourth quarter net sales of $413.0 million, down 7.7% year over year, down 8.6% in constant currency

•Fourth quarter net loss attributable to Acushnet Holdings Corp. of $26.8 million, down $26.7 million year over year

•Fourth quarter Adjusted EBITDA loss of $1.5 million, down $26.9 million year over year

•Increased quarterly cash dividend by 10.3% to $0.215 per share

•The Company provided its full year 2024 Outlook, with expected net sales of $2.45 to $2.50 billion and Adjusted EBITDA of $385 to $405 million. On a constant currency basis, consolidated net sales are expected to be in the range of up 3.2% to up 5.3%.

FAIRHAVEN, MA – February 29, 2024 – Acushnet Holdings Corp. (NYSE: GOLF) ("Acushnet"), the global leader in the design, development, manufacture and distribution of performance-driven golf products, today reported financial results for the full year and fourth quarter ended December 31, 2023.

“2023 was a strong year for Acushnet with the company delivering 6% full year constant currency sales growth, adjusted EBITDA growth of 11% and significant capital returns to shareholders,” said David Maher, Acushnet Company’s President and Chief Executive Officer. “Titleist golf balls posted healthy sales gains, led by the successful Pro V1 and Pro V1x launch and continued strengthening of our golf ball supply chain, while Titleist golf clubs growth was driven by new T-Series irons and expanded club fitting capabilities. Titleist golf gear grew in all categories and our performance apparel business was led by FJ apparel, which posted a double digit increase over 2022.”

Maher continued, “The golf industry is healthy, and we are encouraged by the sport’s energy and appeal with participation vibrant across regions. Looking to 2024, we are planning for growth across all of our segments and expect to make several investments to expand upon our product development, operations, golfer connection and digital engagement capabilities to best support our trade partners and golfers. Acushnet associates are focused on developing innovative products and services to help dedicated golfers play their very best in support of the company’s enduring commitment to drive sustainable growth and shareholder value creation.”

Summary of Full Year 2023 Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Year ended

December 31, | | Increase/(Decrease) | | Constant Currency Increase |

| (in millions) | | 2023 | | 2022 | | $ change | | % change | | $ change | | % change |

| Net sales | | $ | 2,382.0 | | | $ | 2,270.3 | | | $ | 111.7 | | | 4.9 | % | | $ | 141.6 | | | 6.2 | % |

| Net income attributable to Acushnet Holdings Corp | | $ | 198.4 | | | $ | 199.3 | | | $ | (0.9) | | | (0.5) | % | | | | |

| Adjusted EBITDA | | $ | 376.1 | | | $ | 338.4 | | | $ | 37.7 | | | 11.1 | % | | | | |

Consolidated net sales for the full year increased 4.9%, or 6.2% on a constant currency basis, primarily driven by higher sales volumes in Titleist golf balls, Titleist golf clubs and Titleist golf gear, partially offset by lower sales volumes in FootJoy golf wear, mainly footwear, and products that are not allocated to one of our four reportable segments.

On a geographic basis, consolidated net sales in the United States were higher driven by increases of 14.2% in Titleist golf balls, 11.8% in Titleist golf clubs, 6.7% in Titleist golf gear and 2.5% in FootJoy golf wear. The increase in Titleist golf balls was primarily driven by higher sales volumes and higher average selling prices of Pro V1 and Pro V1x golf balls. The increase in Titleist golf clubs was primarily driven by higher sales volumes and higher average selling prices of our T-Series irons and Scotty Cameron Super Select putters, as well as higher sales volumes of our TSR hybrids, partially offset by lower sales volumes of second model year SM9 wedges. The increase in Titleist golf gear was primarily driven by higher sales volumes of golf bags and higher average selling prices in travel. The increase in FootJoy golf wear was primarily driven by higher sales volumes of apparel and higher average selling prices of apparel and footwear, largely offset by lower sales volumes of footwear.

Net sales in regions outside of the United States were down 1.0%, or increased 1.9% on a constant currency basis. Net sales increased in Rest of World, partially offset by decreases in Korea and EMEA, on a constant currency basis. The increase in Rest of World was due to net sales increases across all reportable segments, primarily in Titleist golf balls and Titleist golf clubs. In Korea, the decrease was due to lower sales volumes of products that are not allocated to one of our four reportable segments and lower sales volumes in FootJoy golf wear, partially offset by net sales increases in all other reportable segments. In EMEA, the decrease was due to lower sales volumes in FootJoy golf wear and lower sales volumes of products that are not allocated to one of our four reportable segments, partially offset by increases in all other reportable segments. In Japan, net sales were flat with increases in Titleist golf balls and Titleist golf gear offset by net sales decreases in Titleist golf clubs and FootJoy golf wear.

Segment specifics:

•12.2% increase in net sales (13.5% on a constant currency basis) of Titleist golf balls, largely due to higher sales volumes and higher average selling prices of our latest generation Pro V1 and Pro V1x golf balls launched in the first quarter of 2023.

•8.0% increase in net sales (9.5% on a constant currency basis) of Titleist golf clubs, largely due to higher sales volumes and higher average selling prices of our T-Series irons launched in the third quarter of 2023 and Scotty Cameron Super Select putters launched in the first quarter of 2023, as well as higher

sales volumes of our TSR hybrids launched in the first quarter of 2023, partially offset by lower sales volumes of second model year SM9 wedges.

•5.5% increase in net sales (7.0% on a constant currency basis) of Titleist golf gear primarily driven by higher sales volumes across all product categories, except gloves, and higher average selling prices across all product categories.

•3.5% decrease in net sales (2.1% on a constant currency basis) in FootJoy golf wear primarily due to sales volume decrease in footwear partially offset by sales volume increase in apparel.

Net income attributable to Acushnet Holdings Corp. decreased $0.9 million to $198.4 million, down 0.5% year over year, primarily as a result of an increase in interest expense, net, partially offset by lower income tax expense and other expense, net, as well as higher income from operations.

Adjusted EBITDA was $376.1 million, up 11.1% year over year. Adjusted EBITDA margin was 15.8% versus 14.9% for the prior year period.

Summary of Fourth Quarter 2023 Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Three months ended December 31, | | Increase/(Decrease) | | Constant Currency Decrease |

| (in millions) | | 2023 | | 2022 | | $ change | | % change | | $ change | | % change |

| Net sales | | $ | 413.0 | | | $ | 447.4 | | | $ | (34.4) | | | (7.7) | % | | $ | (38.4) | | | (8.6) | % |

| Net loss attributable to Acushnet Holdings Corp | | $ | (26.8) | | | $ | (0.1) | | | $ | (26.7) | | | * | | | | |

| Adjusted EBITDA | | $ | (1.5) | | | $ | 25.4 | | | $ | (26.9) | | | (105.9) | % | | | | |

_______________________________________________________________________________

*Percentage change not meaningful

Consolidated net sales for the quarter decreased 7.7%, or 8.6% on a constant currency basis. The decrease was primarily due to a decrease in Titleist golf clubs as a result of lower sales volumes of second model year TSR drivers and TSR fairways which were launched in the third quarter of 2022 and lower sales volumes in FootJoy golf wear, primarily footwear. These decreases were partially offset by an increase in Titleist golf balls primarily due to higher sales volumes and average selling prices of ProV1 and ProV1x golf balls.

On a geographic basis, consolidated net sales in the United States were lower primarily as a result of decreases of 22.3% in FootJoy golf wear and 18.4% in Titleist golf clubs. The decrease in FootJoy golf wear was primarily due to lower sales volumes in footwear and apparel. The decrease in Titleist golf clubs was primarily due to lower sales volumes of second model year drivers and fairways as discussed above.

Net sales in regions outside the United States decreased 3.6%, or 5.7% on a constant currency basis primarily due to net sales decreases in Japan, EMEA and Korea. In Japan, net sales decreased primarily due to lower sales volumes in Titleist golf clubs mainly due to lower sales volumes of second model year drivers and fairways as discussed above. In EMEA, net sales decreased primarily due to lower sales volumes of products that are not allocated to one of our four reportable segments, partially offset by net sales increases in Titleist golf balls, Titleist golf clubs and Titleist golf gear. In Korea, the decrease was primarily due to lower net sales of products that are not allocated to one of our four reportable segments and lower net sales in FootJoy golf wear. In Rest of World, a net sales increase in Titleist golf balls was partially offset by net sales decreases in all other reportable segments.

Segment specifics:

•5.4% increase in net sales (4.9% on a constant currency basis) of Titleist golf balls, largely due to higher sales volumes and average selling prices of ProV1 and ProV1x golf balls, partially offset by lower sales volumes of performance models.

•16.8% decrease in net sales (17.1% on a constant currency basis) of Titleist golf clubs as sales volumes of our new T-Series irons launched in the third quarter of 2023 were more than offset by lower sales volumes of TSR drivers and TSR fairways launched in the third quarter of 2022.

•2.5% decrease in net sales (3.7% on a constant currency basis) of Titleist golf gear primarily due to lower sales volumes in gloves and headwear.

•13.3% decrease in net sales (14.2% on a constant currency basis) in FootJoy golf wear primarily due to lower sales volumes in footwear.

Net loss attributable to Acushnet Holdings Corp. for the quarter was $26.7 million, compared to $0.1 million for the same period in 2022. This change was primarily a result of a decrease in income from operations, partially offset by a decrease in income tax expense. The decrease in income from operations was due to lower gross profit, primarily due to decreased sales volumes in Titleist golf clubs and FootJoy golf wear, as discussed above, and higher operating expenses. Operating expenses increased across all reportable segments, except FootJoy golf wear, primarily due to higher employee-related expenses.

Adjusted EBITDA was a loss of $1.5 million, compared to a gain of $25.4 million in the prior year. Adjusted EBITDA margin was (0.4)% for the fourth quarter versus 5.7% for the prior year period.

Cash Dividend and Share Repurchase

Acushnet's Board of Directors today declared an increase of its quarterly cash dividend of 10.3% to $0.215 per share of its common stock. The dividend will be payable on March 22, 2024 to shareholders of record as of March 8, 2024. The number of shares outstanding as of February 23, 2024 was 63,494,735.

During the quarter, the Company repurchased 510,594 shares of its common stock on the open market at an average price of $53.68 for an aggregate of $27.4 million. On November 3, 2023, the Company purchased 1,824,994 shares of its common stock from Magnus Holdings Co., Ltd., a wholly-owned subsidiary of Fila Holdings Corp., for an aggregate of $100.0 million in satisfaction of its previously disclosed share repurchase obligation. On February 15, 2024, the Company's Board of Directors authorized the Company to repurchase up to an additional $300.0 million of its issued and outstanding common stock, bringing the total authorization up to $1.0 billion since the share repurchase program was established in 2018.

2024 Outlook

•Consolidated net sales are expected to be approximately $2,450 to $2,500 million.

•Consolidated net sales on a constant currency basis are expected to be in the range of up 3.2% to 5.3%.

•Adjusted EBITDA is expected to be approximately $385 to $405 million.

The Company plans to share additional details of the 2024 Outlook during its investor conference call.

Investor Conference Call

Acushnet will hold a conference call at 8:30 am (Eastern Time) on February 29, 2024 to discuss the financial results and host a question and answer session. A live webcast of the conference call will be accessible at www.AcushnetHoldingsCorp.com/ir. A replay archive of the webcast will be available shortly after the call concludes.

About Acushnet Holdings Corp.

We are the global leader in the design, development, manufacture and distribution of performance-driven golf products, which are widely recognized for their quality excellence. Driven by our focus on dedicated and discerning golfers and the golf shops that serve them, we believe we are the most authentic and enduring company in the golf industry. Our mission - to be the performance and quality leader in every golf product category in which we compete - has remained consistent since we entered the golf ball business in 1932. Today, we are the steward of two of the most revered brands in golf – Titleist, one of golf’s leading performance equipment brands, and FootJoy, one of golf’s leading performance wearable brands. Additional information can be found at www.acushnetholdingscorp.com.

Forward-Looking Statements

This press release includes forward-looking statements that reflect our current views with respect to, among other things, our 2024 outlook, our operations and our financial performance. These forward-looking statements are included throughout this press release and relate to matters such as our industry, business strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information such as our anticipated consolidated net sales, consolidated net sales on a constant currency basis and Adjusted EBITDA. We use words like “guidance,” “outlook,” “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “future,” “will,” “seek,” “foreseeable” and similar terms and phrases to identify forward-looking statements in this press release.

The forward-looking statements contained in this press release are based on management’s current expectations and are subject to uncertainty and changes in circumstances. We cannot assure you that future developments affecting us will be those that we have anticipated. Actual results may differ materially from these expectations due to changes in global, regional or local economic, business, competitive, market, regulatory and other factors, many of which are beyond our control. Important factors that could cause or contribute to such differences include: a reduction in the number of rounds of golf played or in the number of golf participants; unfavorable weather conditions may impact the number of playable days and rounds played in a given year; consumer spending habits and macroeconomic factors may affect the number of rounds of golf played and related spending on golf products; demographic factors may affect the number of golf participants and related spending on our products; changes to the Rules of Golf with respect to equipment; a significant disruption in the operations of our manufacturing, assembly or distribution facilities; our ability to procure raw materials or components of our products; a disruption in the operations of our suppliers; the cost of raw materials and components; currency transaction and translation risk; our ability to successfully manage the frequent introduction of new products or satisfy changing consumer preferences, quality and regulatory standards; our reliance on technical innovation and high-quality products; our ability to adequately enforce and protect our intellectual property rights; involvement in lawsuits to protect, defend or enforce our intellectual property rights; our ability to prevent infringement of intellectual property rights by others; changes to patent laws; intense competition and our ability to maintain a competitive advantage in each of our markets; limited opportunities for future growth in sales of certain of our products, including golf balls, golf shoes and golf gloves; our customers’ financial condition, their levels of business activity and their ability to pay trade obligations; a decrease in corporate spending on our custom logo golf balls; our ability to maintain and further develop our sales channels; consolidation of retailers or concentration of retail market share; our ability to maintain and enhance our brands; seasonal fluctuations of our business; fluctuations of our business based on the timing of new product introductions; risks associated with doing business globally; compliance with laws, regulations and policies, including the U.S. Foreign Corrupt Practices Act or other applicable anti-corruption legislation; our ability to secure professional golfers to endorse or use our products; negative publicity relating to us or the golfers who use our products or the golf industry in general; our ability to accurately forecast demand for our products; a disruption in the service, or a significant increase in the cost, of our primary delivery and shipping services or a significant disruption at shipping ports; our ability to maintain our information systems to adequately perform their functions; cybersecurity risks; our ability to comply with data privacy and security laws; the ability of our eCommerce systems to function effectively; impairment of goodwill and identifiable intangible assets; our ability to attract and/or retain management and other key employees and hire qualified management, technical and manufacturing personnel; our ability to prohibit sales of our products by unauthorized retailers or distributors; our ability to grow our presence in existing international markets and expand into additional international markets; tax uncertainties, including potential changes in tax laws, unanticipated tax liabilities and limitations on utilization of tax attributes after any change of control; adequate levels of coverage of our insurance policies; product liability, warranty and recall claims; litigation and other regulatory proceedings; compliance with environmental, health and safety laws and regulations; our ability to secure additional capital at all or on terms acceptable to us and potential dilution of holders of our common stock; lack of assurance of positive returns on capital investments; risks associated with acquisitions and investments; our estimates or judgments relating to our critical accounting estimates; terrorist activities and international political instability; occurrence of natural disasters or

pandemic diseases; a high degree of leverage, ability to service our indebtedness, ability to incur more indebtedness and restrictions in the agreements governing our indebtedness; our use of derivative financial instruments; the ability of our controlling shareholder to control significant corporate activities, and that our controlling shareholder’s interests may conflict with yours; our status as a controlled company; the market price of shares of our common stock; share repurchase program execution and effects thereof; our ability to maintain effective internal controls over financial reporting; our ability to pay dividends; our status as a holding company; dilution from future issuances or sales of our common stock; anti-takeover provisions in our organizational documents and Delaware law; reports from securities analysts; and the other factors set forth in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission ("SEC") on March 1, 2023 as it may be updated by our periodic reports subsequently filed with the SEC, including, when available, the Annual Report on Form 10-K for the year ended December 31, 2023. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, our actual results may vary in material respects from those projected in these forward-looking statements.

Any forward-looking statement made by us in this press release speaks only as of the date of this press release. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, investments or other strategic transactions we may make. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws.

Media Contact:

AcushnetPR@icrinc.com

Investor Contact:

IR@AcushnetGolf.com

ACUSHNET HOLDINGS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended December 31, | | Year ended December 31, |

| (in thousands, except share and per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | | $ | 412,961 | | | $ | 447,404 | | | $ | 2,381,995 | | | $ | 2,270,336 | |

| Cost of goods sold | | 203,167 | | | 223,771 | | | 1,129,484 | | | 1,091,103 | |

| Gross profit | | 209,794 | | | 223,633 | | | 1,252,511 | | | 1,179,233 | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | 213,425 | | | 196,146 | | | 888,145 | | | 833,422 | |

| Research and development | | 17,553 | | | 13,860 | | | 64,839 | | | 56,393 | |

| Intangible amortization | | 3,510 | | | 2,020 | | | 14,222 | | | 7,885 | |

| | | | | | | | |

| (Loss) income from operations | | (24,694) | | | 11,607 | | | 285,305 | | | 281,533 | |

| Interest expense, net | | 11,054 | | | 5,367 | | | 41,288 | | | 13,269 | |

| Other expense, net | | 407 | | | 3,001 | | | 2,417 | | | 8,829 | |

| (Loss) income before income taxes | | (36,155) | | | 3,239 | | | 241,600 | | | 259,435 | |

| Income tax (benefit) expense | | (9,733) | | | 1,565 | | | 42,993 | | | 54,351 | |

| Net (loss) income | | (26,422) | | | 1,674 | | | 198,607 | | | 205,084 | |

| Less: Net income attributable to noncontrolling interests | | (386) | | | (1,732) | | | (178) | | | (5,806) | |

| Net (loss) income attributable to Acushnet Holdings Corp. | | $ | (26,808) | | | $ | (58) | | | $ | 198,429 | | | $ | 199,278 | |

| | | | | | | | |

| Net (loss) income per common share attributable to Acushnet Holdings Corp.: | | | | | | | | |

| Basic | | $ | (0.41) | | | $ | — | | | $ | 2.96 | | | $ | 2.77 | |

| Diluted | | (0.41) | | | — | | | 2.94 | | | 2.75 | |

| Weighted average number of common shares: | | | | | | | | |

| Basic | | 64,841,674 | | | 69,754,797 | | | 67,063,933 | | | 71,958,879 | |

| Diluted | | 64,841,674 | | | 69,754,797 | | | 67,517,105 | | | 72,560,098 | |

ACUSHNET HOLDINGS CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| | | | | | | | | | | | | | |

| | December 31, | | December 31, |

| (in thousands, except share and per share amounts) | | 2023 | | 2022 |

| Assets | | | | |

| Current assets | | | | |

Cash, cash equivalents and restricted cash ($12,532 and $14,376 attributable to the FootJoy golf shoe joint venture ("FootJoy JV")) | | $ | 65,435 | | | $ | 58,904 | |

| Accounts receivable, net | | 201,352 | | | 216,695 | |

Inventories ($9,621 and $17,866 attributable to the FootJoy JV) | | 615,535 | | | 674,684 | |

| Prepaid and other assets | | 114,370 | | | 108,793 | |

| Total current assets | | 996,692 | | | 1,059,076 | |

Property, plant and equipment, net ($9,044 and $10,089 attributable to the FootJoy JV) | | 295,343 | | | 254,472 | |

Goodwill ($32,312 and $32,312 attributable to the FootJoy JV) | | 225,302 | | | 224,814 | |

| Intangible assets, net | | 537,407 | | | 525,903 | |

| Deferred income taxes | | 31,454 | | | 47,551 | |

Other assets ($1,972 and $2,083 attributable to the FootJoy JV) | | 110,479 | | | 81,991 | |

| Total assets | | $ | 2,196,677 | | | $ | 2,193,807 | |

| Liabilities, Redeemable Noncontrolling Interests and Shareholders' Equity | | | | |

| Current liabilities | | | | |

| Short-term debt | | $ | 28,997 | | | $ | 40,336 | |

| Current portion of long-term debt | | 351 | | | — | |

Accounts payable ($6,059 and $11,914 attributable to the FootJoy JV) | | 150,514 | | | 166,998 | |

| Accrued taxes | | 46,398 | | | 40,922 | |

Accrued compensation and benefits ($1,233 and $1,651 attributable to the FootJoy JV) | | 111,136 | | | 98,245 | |

Accrued expenses and other liabilities ($1,687 and $3,380 attributable to the FootJoy JV) | | 113,739 | | | 202,124 | |

| Total current liabilities | | 451,135 | | | 548,625 | |

| Long-term debt | | 671,819 | | | 527,509 | |

| Deferred income taxes | | 7,080 | | | 5,896 | |

| Accrued pension and other postretirement benefits | | 69,634 | | | 74,234 | |

Other noncurrent liabilities ($0 and $2,145 attributable to the FootJoy JV) | | 84,137 | | | 54,177 | |

| Total liabilities | | 1,283,805 | | | 1,210,441 | |

| | | | |

| Redeemable noncontrolling interests | | 9,785 | | | 6,663 | |

| Shareholders' equity | | | | |

Common stock, $0.001 par value, 500,000,000 shares authorized; 63,429,243 and 76,321,523 shares issued | | 63 | | | 76 | |

| Additional paid-in capital | | 808,615 | | | 960,685 | |

| Accumulated other comprehensive loss, net of tax | | (104,349) | | | (109,668) | |

| Retained earnings | | 159,906 | | | 473,130 | |

Treasury stock, at cost; 8,892,425 shares as of December 31, 2022 (including 2,000,839 of accrued share repurchase) | | — | | | (385,167) | |

| Total equity attributable to Acushnet Holdings Corp. | | 864,235 | | | 939,056 | |

| Noncontrolling interests | | 38,852 | | | 37,647 | |

| Total shareholders' equity | | 903,087 | | | 976,703 | |

| Total liabilities, redeemable noncontrolling interests and shareholders' equity | | $ | 2,196,677 | | | $ | 2,193,807 | |

ACUSHNET HOLDINGS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | | | | |

| | Year ended December 31, |

| (in thousands) | 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net income | $ | 198,607 | | | $ | 205,084 | |

| Adjustments to reconcile net income to cash flows provided by (used in) operating activities | | | |

| Depreciation and amortization | 51,356 | | | 41,706 | |

| Unrealized foreign exchange loss | 1,507 | | | 13,568 | |

| Amortization of debt issuance costs | 927 | | | 2,000 | |

| Share-based compensation | 29,709 | | | 24,083 | |

| Loss (gain) on disposals of property, plant and equipment | 99 | | | (3,294) | |

| Deferred income taxes | 15,413 | | | 9,060 | |

| Changes in operating assets and liabilities | 74,209 | | | (359,994) | |

| | | |

| Cash flows provided by (used in) operating activities | 371,827 | | | (67,787) | |

| Cash flows from investing activities | | | |

| Additions to property, plant and equipment | (75,364) | | | (61,364) | |

| Additions to intangible assets | (25,235) | | | (65,000) | |

| Business acquisitions | — | | | (18,400) | |

| Other, net | (887) | | | 4,542 | |

| Cash flows used in investing activities | (101,486) | | | (140,222) | |

| Cash flows from financing activities | | | |

| Proceeds from short-term borrowings, net | — | | | 3,362 | |

| | | |

| | | |

| Proceeds from credit facilities | 1,527,896 | | | 976,953 | |

| Repayments of credit facilities | (1,739,308) | | | (414,104) | |

| Proceeds from senior unsecured notes | 350,000 | | | — | |

| | | |

| Repayments of term loan facility | — | | | (315,000) | |

| Purchases of common stock | (334,088) | | | (189,111) | |

| Payment of debt issuance costs | (6,328) | | | (2,583) | |

| Dividends paid on common stock | (52,480) | | | (52,239) | |

| Dividends paid to noncontrolling interests | — | | | (1,601) | |

| Payment of employee restricted stock tax withholdings | (11,495) | | | (10,661) | |

| Other, net | 1,078 | | | (3,600) | |

| Cash flows used in financing activities | (264,725) | | | (8,584) | |

| Effect of foreign exchange rate changes on cash, cash equivalents and restricted cash | 915 | | | (6,180) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 6,531 | | | (222,773) | |

| Cash, cash equivalents and restricted cash, beginning of year | 58,904 | | | 281,677 | |

| Cash, cash equivalents and restricted cash, end of year | $ | 65,435 | | | $ | 58,904 | |

ACUSHNET HOLDINGS CORP.

Supplemental Net Sales Information (Unaudited)

Full Year Net Sales by Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year ended | | | | Constant Currency |

| | December 31, | | Increase/(Decrease) | | Increase/(Decrease) |

| (in millions) | | 2023 | | 2022 | | $ change | | % change | | $ change | | % change |

| Titleist golf balls | | $ | 761.7 | | | $ | 678.8 | | | $ | 82.9 | | | 12.2 | % | | $ | 91.3 | | | 13.5 | % |

| Titleist golf clubs | | 658.6 | | | 609.6 | | | 49.0 | | | 8.0 | % | | 58.2 | | | 9.5 | % |

| Titleist golf gear | | 216.2 | | | 204.9 | | | 11.3 | | | 5.5 | % | | 14.3 | | | 7.0 | % |

| FootJoy golf wear | | 596.4 | | | 618.0 | | | (21.6) | | | (3.5) | % | | (12.7) | | | (2.1) | % |

Full Year Net Sales by Region

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year ended | | | | Constant Currency |

| | December 31, | | Increase/(Decrease) | | Increase/(Decrease) |

| (in millions) | | 2023 | | 2022 | | $ change | | % change | | $ change | | % change |

| United States | | $ | 1,350.0 | | | $ | 1,227.8 | | | $ | 122.2 | | | 10.0 | % | | $ | 122.2 | | | 10.0 | % |

| EMEA | | 314.7 | | | 321.5 | | | (6.8) | | | (2.1) | % | | (4.6) | | | (1.4) | % |

| Japan | | 149.4 | | | 161.0 | | | (11.6) | | | (7.2) | % | | 0.2 | | | 0.1 | % |

| Korea | | 301.8 | | | 312.7 | | | (10.9) | | | (3.5) | % | | (5.2) | | | (1.7) | % |

| Rest of World | | 266.1 | | | 247.3 | | | 18.8 | | | 7.6 | % | | 29.0 | | | 11.7 | % |

| Total net sales | | $ | 2,382.0 | | | $ | 2,270.3 | | | $ | 111.7 | | | 4.9 | % | | $ | 141.6 | | | 6.2 | % |

Fourth Quarter Net Sales by Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | | | | | Constant Currency |

| | | December 31, | | Increase/(Decrease) | | Increase/(Decrease) |

| (in millions) | | 2023 | | 2022 | | $ change | | % change | | $ change | | % change |

| Titleist golf balls | | $ | 139.6 | | | $ | 132.4 | | | $ | 7.2 | | | 5.4 | % | | $ | 6.5 | | | 4.9 | % |

| Titleist golf clubs | | 108.8 | | | 130.7 | | | (21.9) | | | (16.8) | % | | (22.4) | | | (17.1) | % |

| Titleist golf gear | | 31.6 | | | 32.4 | | | (0.8) | | | (2.5) | % | | (1.2) | | | (3.7) | % |

| FootJoy golf wear | | 96.2 | | | 110.9 | | | (14.7) | | | (13.3) | % | | (15.8) | | | (14.2) | % |

Fourth Quarter Net Sales by Region

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | Constant Currency |

| | December 31, | | Increase/(Decrease) | | Increase/(Decrease) |

| (in millions) | | 2023 | | 2022 | | $ change | | % change | | $ change | | % change |

| United States | | $ | 226.2 | | | $ | 253.6 | | | $ | (27.4) | | | (10.8) | % | | $ | (27.4) | | | (10.8) | % |

| EMEA | | 48.2 | | | 46.7 | | | 1.5 | | | 3.2 | % | | (1.2) | | | (2.6) | % |

| Japan | | 31.2 | | | 42.4 | | | (11.2) | | | (26.4) | % | | (10.1) | | | (23.8) | % |

| Korea | | 60.5 | | | 58.6 | | | 1.9 | | | 3.2 | % | | (0.5) | | | (0.9) | % |

| Rest of World | | 46.9 | | | 46.1 | | | 0.8 | | | 1.7 | % | | 0.8 | | | 1.7 | % |

| Total net sales | | $ | 413.0 | | | $ | 447.4 | | | $ | (34.4) | | | (7.7) | % | | $ | (38.4) | | | (8.6) | % |

ACUSHNET HOLDINGS CORP.

Reconciliation of GAAP to Non-GAAP Measures

(Unaudited)

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). However, this release includes the non-GAAP financial measures of net sales in constant currency, Adjusted EBITDA and Adjusted EBITDA margin. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant to understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net sales, net income or other measures of profitability or performance under GAAP. You should be aware that the Company’s presentation of these measures may not be comparable to similarly-titled measures used by other companies.

We use net sales on a constant currency basis to evaluate the sales performance of our business in period over period comparisons and for forecasting our business going forward. Constant currency information allows us to estimate what our sales performance would have been without changes in foreign currency exchange rates. This information is calculated by taking the current period local currency sales and translating them into U.S. dollars based upon the foreign currency exchange rates for the applicable comparable prior period. This constant currency information should not be considered in isolation or as a substitute for any measure derived in accordance with GAAP. Our presentation of constant currency information may not be consistent with the manner in which similar measures are derived or used by other companies.

We define Adjusted EBITDA in a manner consistent with the term “Consolidated EBITDA” as it is defined in our credit agreement. Adjusted EBITDA represents net income (loss) attributable to Acushnet Holdings Corp. adjusted for interest expense, net, income tax expense (benefit), depreciation and amortization; and other items defined in our credit agreement, including: share-based compensation expense; restructuring and transformation costs; certain transaction fees; extraordinary, unusual or non-recurring losses or charges; indemnification expense (income); certain pension settlement costs; certain other non-cash (gains) losses, net and the net income (loss) relating to noncontrolling interests.

We present Adjusted EBITDA as a supplemental measure because it excludes the impact of certain items that we do not consider indicative of our ongoing operating performance. We primarily use Adjusted EBITDA to evaluate the effectiveness of our business strategies, assess our consolidated operating performance and make decisions regarding pricing of our products, go to market execution and costs to incur across our business.

We believe Adjusted EBITDA provides useful information to investors regarding our consolidated operating performance. By presenting Adjusted EBITDA, we provide a basis for comparison of our business operations between different periods by excluding items that we do not believe are indicative of our core operating performance.

Adjusted EBITDA is not a measurement of financial performance under GAAP. It should not be considered an alternative to net income attributable to Acushnet Holdings Corp. as a measure of our operating performance or any other measure of performance derived in accordance with GAAP. In addition, Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items, or affected by similar non-recurring items. Adjusted EBITDA has limitations as an analytical tool, and you should not consider such measure either in isolation or as a substitute for analyzing our results as reported under

GAAP. Our definition and calculation of Adjusted EBITDA is not necessarily comparable to other similarly titled measures used by other companies due to different methods of calculation.

We also use Adjusted EBITDA margin on a consolidated basis, which measures our Adjusted EBITDA as a percentage of net sales, because our management uses it to evaluate the effectiveness of our business strategies, assess our consolidated operating performance and make decisions regarding pricing of our products, go to market execution and costs to incur across our business. We present Adjusted EBITDA margin as a supplemental measure of our operating performance because it excludes the impact of certain items that we do not consider indicative of our ongoing operating performance. Adjusted EBITDA margin is not a measurement of financial performance under GAAP. It should not be considered an alternative to any measure of performance derived in accordance with GAAP.

The following table presents reconciliations of net (loss) income attributable to Acushnet Holdings Corp. to Adjusted EBITDA for the periods presented (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Year ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net (loss) income attributable to Acushnet Holdings Corp. | | $ | (26,808) | | | $ | (58) | | | $ | 198,429 | | | $ | 199,278 | |

| Interest expense, net | | 11,054 | | | 5,367 | | | 41,288 | | | 13,269 | |

| Income tax (benefit) expense | | (9,733) | | | 1,565 | | | 42,993 | | | 54,351 | |

| Depreciation and amortization | | 13,175 | | | 10,812 | | | 51,356 | | | 41,706 | |

| Share-based compensation | | 8,340 | | | 5,924 | | | 29,709 | | | 24,083 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Other extraordinary, unusual or non-recurring items, net (1) | | 2,087 | | | 70 | | | 12,185 | | | (85) | |

| | | | | | | | |

| Net income attributable to noncontrolling interests | | 386 | | | 1,732 | | | 178 | | | 5,806 | |

| Adjusted EBITDA | | $ | (1,499) | | | $ | 25,412 | | | $ | 376,138 | | | $ | 338,408 | |

| Adjusted EBITDA margin | | (0.4) | % | | 5.7 | % | | 15.8 | % | | 14.9 | % |

___________________________________

(1) For the three months and year ended December 31, 2023, includes costs associated with the optimization of our distribution and custom fulfillment capabilities.

A reconciliation of non-GAAP Adjusted EBITDA, as forecasted for 2024, to the closest corresponding GAAP measure, net income (loss), is not available without unreasonable efforts on a forward-looking basis due to the high variability and low visibility of certain charges that may impact our GAAP results on a forward-looking basis, such as the measures and effects of share-based compensation and other extraordinary, unusual or non-recurring items, net.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

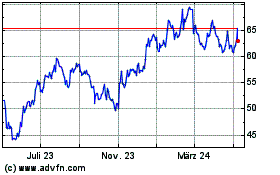

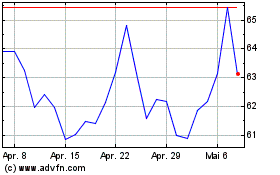

Acushnet (NYSE:GOLF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Acushnet (NYSE:GOLF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024