GENWORTH FINANCIAL INC false 0001276520 0001276520 2024-11-06 2024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

November 6, 2024

Date of Report

(Date of earliest event reported)

GENWORTH FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-32195 |

|

80-0873306 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 11011 West Broad Street, Glen Allen, Virginia |

|

23060 |

| (Address of principal executive offices) |

|

(Zip Code) |

(804) 281-6000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common Stock, par value $.001 per share |

|

GNW |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On November 6, 2024, Genworth Financial, Inc. (the “Company”) issued (1) a press release announcing its financial results for the quarter ended September 30, 2024, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference, and (2) a financial supplement for the quarter ended September 30, 2024, a copy of which is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K (including the exhibits) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the company under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. The information contained in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

The following materials are furnished as exhibits to this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

GENWORTH FINANCIAL, INC. |

|

|

|

|

| Date: November 6, 2024 |

|

|

|

By: |

|

/s/ Darren W. Woodell |

|

|

|

|

|

|

Darren W. Woodell |

|

|

|

|

|

|

Vice President and Controller |

|

|

|

|

|

|

(Principal Accounting Officer) |

Exhibit 99.1

Genworth Financial Announces Third Quarter 2024 Results

Strategic Highlights

| |

• |

|

Continued progress on the LTC1 multi-year rate action plan

(MYRAP) with $124M of gross incremental premium approvals; approximately $30B estimated net present value achieved from in-force rate actions (IFAs) since 2012 |

| |

• |

|

Expanded the CareScout Quality Network to 49 states through October, covering over 75% of the aged 65-plus Census population in the United States; on track to achieve 80% to 85% coverage by year-end |

| |

• |

|

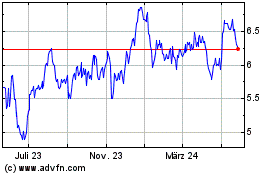

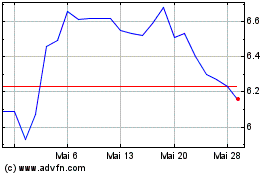

Executed $36M in share repurchases in the quarter; $144M executed year-to-date through October at an average price of $6.29 per share |

| |

• |

|

Repurchased $17M in principal of holding company debt at a discount |

Financial Highlights

| |

• |

|

Net income2 of $85M, or $0.19 per diluted share, and

adjusted operating income2,3 of $48M, or $0.11 per diluted share |

| |

• |

|

Enact reported adjusted operating income of $148M2;

distributed $81M in capital returns to Genworth |

| |

• |

|

U.S. life insurance companies’ RBC4 ratio of 317%5 reflects strong year-to-date statutory pre-tax income |

| |

• |

|

Genworth holding company cash and liquid assets of $369M6 at

quarter-end |

Richmond, VA (November 6, 2024) – Genworth Financial, Inc. (NYSE: GNW) today

reported results for the quarter ended September 30, 2024.

|

|

“Genworth made substantial progress against our strategic priorities in the third quarter, supported by strong performance and capital returns from Enact,” said Tom McInerney, President & CEO. “The expansion of the

CareScout Quality Network is progressing ahead of schedule, and we are excited about our plan to bring a CareScout insurance offering to market next year to help meet increasing demand for long-term care funding solutions. While laying the

foundation for future growth, we remain committed to returning capital to shareholders through our share repurchase program and advancing our multi-year rate action plan to improve the financial condition of our legacy LTC business.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Metrics

(Amounts in millions, except per share data) |

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q3 2023 |

|

| Net income2 |

|

$ |

85 |

|

|

$ |

76 |

|

|

$ |

29 |

|

| Earnings per diluted share2 |

|

$ |

0.19 |

|

|

$ |

0.17 |

|

|

$ |

0.06 |

|

| Adjusted operating income2,3 |

|

$ |

48 |

|

|

$ |

125 |

|

|

$ |

42 |

|

| Adjusted operating income per diluted

share2,3 |

|

$ |

0.11 |

|

|

$ |

0.28 |

|

|

$ |

0.09 |

|

| Weighted-average diluted shares |

|

|

435.8 |

|

|

|

440.7 |

|

|

|

466.0 |

|

1

Consolidated GAAP Financial Highlights

| |

• |

|

Net income in the quarter was driven by Enact, which had very strong operating performance |

| |

• |

|

Net investment gains, net of taxes, increased net income by $52 million in the current quarter, compared

with net investment losses of $48 million in the prior quarter and $34 million in the prior year. The investment gains in the current quarter were driven primarily by

mark-to-market adjustments on limited partnerships and equity securities |

| |

• |

|

Changes in the fair value of market risk benefits and associated hedges, net of taxes, decreased net income by

$17 million in the quarter driven primarily by an unfavorable change in interest rates, compared with increases of $6 million in the prior quarter and $19 million in the prior year |

| |

• |

|

Net investment income, net of taxes, was $614 million in the quarter, down from $638 million in the

prior quarter driven by lower income from policy loans and U.S. Government Treasury Inflation-Protected Securities (TIPS) |

Enact

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Operating Metrics

(Dollar amounts in millions) |

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q3 2023 |

|

| Adjusted operating income2 |

|

$ |

148 |

|

|

$ |

165 |

|

|

$ |

134 |

|

| Primary new insurance written |

|

$ |

13,591 |

|

|

$ |

13,619 |

|

|

$ |

14,391 |

|

| Loss ratio |

|

|

5 |

% |

|

|

(7 |

)% |

|

|

7 |

% |

| Equity7 |

|

$ |

4,097 |

|

|

$ |

3,942 |

|

|

$ |

3,646 |

|

| |

• |

|

Current quarter results reflected a pre-tax reserve release of

$65 million primarily from favorable cure performance. The prior quarter and prior year included pre-tax reserve releases of $77 million and $55 million, respectively |

| |

• |

|

Net investment income of $62 million in the current quarter was up from $55 million in the prior year

from higher yields and higher average invested assets |

| |

• |

|

Primary insurance in-force increased two percent versus the prior year to

$268 billion driven by new insurance written (NIW) and continued elevated persistency |

| |

• |

|

Primary NIW was down six percent versus the prior year primarily driven by Enact’s lower estimated market

share |

| |

• |

|

New delinquencies increased 17 percent to 12,964 from 11,107 in the prior year primarily from continued

seasoning of large, newer books |

2

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Metric |

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q3 2023 |

|

| PMIERs Sufficiency Ratio5,8 |

|

|

173 |

% |

|

|

169 |

% |

|

|

162 |

% |

| |

• |

|

Enact paid a quarterly dividend of $0.185 per share in the current quarter |

| |

• |

|

Estimated PMIERs sufficiency ratio of 173 percent, $2,190 million above requirements

|

Long-Term Care Insurance

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Operating Metrics

(Amounts in millions) |

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q3 2023 |

|

| Adjusted operating loss |

|

$ |

(46 |

) |

|

$ |

(29 |

) |

|

$ |

(71 |

) |

| Premiums |

|

$ |

581 |

|

|

$ |

564 |

|

|

$ |

621 |

|

| Net investment income |

|

$ |

483 |

|

|

$ |

494 |

|

|

$ |

482 |

|

| Liability remeasurement gains (losses) |

|

$ |

(28 |

) |

|

$ |

(43 |

) |

|

$ |

(104 |

) |

| Cash flow assumption updates |

|

|

63 |

|

|

|

24 |

|

|

|

6 |

|

| Actual to expected experience |

|

|

(91 |

) |

|

|

(67 |

) |

|

|

(110 |

) |

| |

• |

|

Premiums increased versus the prior quarter primarily driven by seasonal trends typically observed in the third

quarter and decreased versus the prior year primarily driven by lower renewal premiums as a result of benefit reduction elections in connection with IFAs and legal settlements and from policy terminations |

| |

• |

|

Net investment income decreased from the prior quarter driven by lower TIPS income |

| |

• |

|

Current quarter liability remeasurement loss included adverse actual to expected experience primarily from higher

claims and lower terminations, partially offset by favorable cash flow assumption updates largely related to higher approval amounts of certain IFAs |

| |

• |

|

Prior quarter included a $24 million pre-tax benefit from net

insurance recoveries |

Life and Annuities

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Adjusted Operating Income (Loss)

(Amounts in millions) |

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q3 2023 |

|

| Life Insurance |

|

$ |

(40 |

) |

|

$ |

(23 |

) |

|

$ |

(25 |

) |

| Fixed Annuities |

|

|

6 |

|

|

|

12 |

|

|

|

17 |

|

| Variable Annuities |

|

|

7 |

|

|

|

10 |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Life and Annuities |

|

$ |

(27 |

) |

|

$ |

(1 |

) |

|

$ |

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Life Insurance

| |

• |

|

Current quarter results reflected unfavorable mortality |

| |

• |

|

The prior year included an unfavorable after-tax impact of

$9 million from a voluntary recapture of previously ceded reinsurance |

3

Annuities

| |

• |

|

Current quarter results reflected unfavorable mortality and lower net spread income primarily from block runoff

|

U.S. Life Insurance Companies9 Statutory Results5 and RBC5

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollar amounts in millions) |

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q3 2023 |

|

| Statutory Pre-Tax Income (Loss)5,10 |

|

$ |

(18 |

) |

|

$ |

171 |

|

|

$ |

30 |

|

| Long-Term Care Insurance |

|

|

(9 |

) |

|

|

106 |

|

|

|

21 |

|

| Life Insurance |

|

|

(29 |

) |

|

|

9 |

|

|

|

(40 |

) |

| Fixed Annuities |

|

|

3 |

|

|

|

18 |

|

|

|

32 |

|

| Variable Annuities |

|

|

17 |

|

|

|

38 |

|

|

|

17 |

|

| GLIC Consolidated RBC Ratio4,5 |

|

|

317 |

% |

|

|

319 |

% |

|

|

291 |

% |

| |

• |

|

Statutory pre-tax income was $411 million year-to-date, with a pre-tax loss of $18 million in the current quarter |

| |

• |

|

LTC results reflected a lower pre-tax benefit from IFAs and legal

settlements as the Choice II legal settlement nears completion and the impact of higher new claims as the block ages; prior quarter included a benefit from net insurance recoveries |

| |

• |

|

Life insurance results included unfavorable mortality and seasonal impacts versus the prior quarter; prior year

included $45 million of pre-tax unfavorable impacts from recaptures of previously ceded reinsurance |

| |

• |

|

Fixed annuities results reflected unfavorable mortality and lower net spread income primarily from block runoff

|

| |

• |

|

Variable annuity results included a net benefit from equity markets and interest rates, though lower than prior

quarter |

| |

• |

|

Current quarter estimated GLIC consolidated RBC ratio was 317 percent, down from the prior quarter due to

higher required capital from investment in limited partnerships |

Corporate and Other

| |

• |

|

The current quarter adjusted operating loss was $27 million, up from $10 million in the prior quarter

primarily driven by timing of tax related items and $18 million in the prior year primarily driven by higher expenses related to CareScout growth initiatives |

Holding Company Cash and Liquid Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in millions) |

|

Q3 2024 |

|

|

Q2 2024 |

|

|

Q3 2023 |

|

| Holding Company Cash and Liquid

Assets11 |

|

$ |

369 |

6 |

|

$ |

281 |

6 |

|

$ |

232 |

|

4

| |

• |

|

Cash and liquid assets of $369 million in the quarter, including $162 million of advance cash payments

from the company’s subsidiaries held for future obligations |

| |

• |

|

Cash inflows during the current quarter consisted of $81 million from Enact capital returns and

$60 million from intercompany tax payments held for future obligations |

| |

• |

|

Current quarter cash outflows included $36 million in share repurchases, $12 million related to debt

servicing costs and the repurchase of $17 million in principal of holding company debt at a discount |

Returns to Shareholders

| |

• |

|

In the third quarter of 2024, the company repurchased $36 million of its common stock at an average price of

$6.38 per share leaving 428 million shares outstanding at the end of the quarter |

| |

• |

|

Executed $503 million in share repurchases

program-to-date through October at an average price of $5.54 per share |

About Genworth Financial

Genworth Financial, Inc. (NYSE:

GNW) is a Fortune 500 company focused on empowering families to navigate the aging journey with confidence, now and in the future. Headquartered in Richmond, Virginia, Genworth provides guidance, products, and services that help people understand

their caregiving options and fund their long-term care needs. Genworth is also the parent company of publicly traded Enact Holdings, Inc. (Nasdaq: ACT), a leading U.S. mortgage insurance provider. For more information on Genworth, visit

genworth.com, and for more information on Enact Holdings, Inc. visit enactmi.com.

5

Conference Call Information

Investors are encouraged to read this press release, summary presentation and financial supplement which are now posted on the company’s website,

https://investor.genworth.com.

Genworth will conduct a conference call on November 7, 2024 at 9:00 a.m. (ET) to discuss its third quarter

results, which will be accessible via:

| |

• |

|

Telephone: 888-208-1820 or 323-794-2110 (outside the U.S.); conference ID # 1689846; or |

| |

• |

|

Webcast: https://investor.genworth.com/news-events/ir-calendar

|

Allow at least 15 minutes prior to the call time to register for the call. A replay of the webcast will be available on the

company’s website for one year.

Prior to Genworth’s conference call, Enact will hold a conference call on November 7, 2024 at 8:00 a.m.

(ET) to discuss its third quarter results, which will be accessible via:

| |

• |

|

Telephone: Click here to obtain a dial-in number and unique PIN

for Enact’s live question and answer session; or |

| |

• |

|

Webcast:

https://ir.enactmi.com/news-and-events/events |

Allow at least 15 minutes prior to the call time to register for the call.

Contact Information:

|

|

|

| Investors: |

|

Brian Johnson |

|

|

InvestorInfo@genworth.com |

|

|

| Media: |

|

Amy Rein |

|

|

Amy.Rein@genworth.com |

6

Use of Non-GAAP Measures

Management uses non-GAAP financial measures entitled “adjusted operating income (loss)” and “adjusted

operating income (loss) per share” to evaluate performance and allocate resources. Adjusted operating income (loss) per share is derived from adjusted operating income (loss). The company defines adjusted operating income (loss) as income

(loss) from continuing operations excluding the after-tax effects of income (loss) attributable to noncontrolling interests, net investment gains (losses), changes in fair value of market risk benefits and

associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual non-operating items. A component of the

company’s net investment gains (losses) is the result of estimated future credit losses, the size and timing of which can vary significantly depending on market credit cycles. In addition, the size and timing of other investment gains (losses)

can be subject to the company’s discretion and are influenced by market opportunities, as well as asset-liability matching considerations. The company excludes net investment gains (losses), changes in fair value of market risk benefits and

associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual non-operating items from adjusted operating income

(loss) because, in the company’s opinion, they are not indicative of overall operating performance.

While some of these items may be significant

components of net income (loss) determined in accordance with GAAP, the company believes that adjusted operating income (loss), and measures that are derived from or incorporate adjusted operating income (loss), including adjusted operating income

(loss) per share on a basic and diluted basis, are appropriate measures that are useful to investors because they identify the income (loss) attributable to the ongoing operations of the business. Management also uses adjusted operating income

(loss), among other key performance indicators, as a basis for determining awards and compensation for senior management and to evaluate performance on a basis comparable to that used by analysts. However, the items excluded from adjusted operating

income (loss) have occurred in the past and could, and in some cases will, recur in the future. Adjusted operating income (loss) and adjusted operating income (loss) per share on a basic and diluted basis are not substitutes for net income (loss) or

net income (loss) per share on a basic and diluted basis determined in accordance with GAAP. In addition, the company’s definition of adjusted operating income (loss) may differ from the definitions used by other companies.

Adjustments to reconcile net income (loss) to adjusted operating income (loss) assume a 21 percent tax rate and are net of the portion attributable to

noncontrolling interests. Changes in fair value of market risk benefits and associated hedges are adjusted to exclude changes in reserves, attributed fees and benefit payments.

The tables at the end of this press release provide a reconciliation of net income available to Genworth Financial, Inc.’s common stockholders to

adjusted operating income for the three months ended September 30, 2024 and 2023, as well as the three months ended June 30, 2024 and reflect adjusted operating income (loss) as determined in accordance with accounting guidance related to

segment reporting.

Statutory Accounting Data

The

company presents certain supplemental statutory data for GLIC and its consolidating life insurance subsidiaries that has been prepared on the basis of statutory accounting principles (SAP). GLIC and its consolidating life insurance subsidiaries file

financial statements with state insurance regulatory authorities and the National Association of Insurance Commissioners that are prepared using SAP, an accounting basis either prescribed or permitted by such authorities. Due to differences in

methodology between SAP and GAAP, the values for assets, liabilities and equity, and the recognition of income and expenses, reflected in financial statements prepared in accordance with GAAP are materially different from those reflected in

financial statements prepared under SAP. This supplemental statutory data should not be viewed as an alternative to, or used in lieu of, GAAP.

7

This supplemental statutory data includes the company action level RBC ratio for GLIC and its consolidating

life insurance subsidiaries as well as combined statutory pre-tax earnings from the principal U.S. life insurance companies, GLIC, GLAIC and GLICNY. Statutory pre-tax

earnings represent the net gain from operations, including the impact from in-force rate actions, before dividends to policyholders, refunds to members and federal income taxes and before realized capital

gains or (losses). The combined product level statutory pre-tax earnings are grouped on a consistent basis as those provided on page six of the statutory Annual Statements. Management uses and provides this

supplemental statutory data because it believes it provides a useful measure of, among other things, statutory pre-tax earnings and the adequacy of capital. Management uses this data to measure against its

policy to manage the U.S. life insurance companies with internally generated capital.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,”

“will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Examples of forward-looking statements include statements the

company makes relating to potential dividends or share repurchases; future return of capital by Enact Holdings, Inc. (Enact Holdings), including share repurchases, and quarterly and special dividends; the cumulative economic benefit of approved and

future rate actions contemplated in the company’s long-term care insurance multi-year in-force rate action plan; the timing of any future CareScout insurance offering; future financial performance,

including the expectation that adverse quarterly variances between actual and expected experience could persist resulting in future remeasurement losses in the company’s long-term care insurance business; future financial condition of the

company’s businesses; liquidity and new lines of business or new insurance and other products and services, such as those the company is pursuing with its CareScout business (CareScout); as well as statements the company makes regarding the

potential occurrence of a recession.

Forward-looking statements are based on management’s current expectations and assumptions, which are subject to

inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements due to global political, economic, inflation, business,

competitive, market, regulatory and other factors and risks, including but not limited to, the following:

| |

• |

|

the inability to successfully launch new lines of business, including long-term care insurance and other products

and services the company is pursuing with CareScout; |

| |

• |

|

the company’s failure to maintain self-sustainability of its legacy life insurance subsidiaries, including

as a result of the inability to achieve desired levels of in-force rate actions and/or the timing of future premium rate increases and associated benefit reductions taking longer to achieve than originally

assumed; other regulatory actions negatively impacting the company’s life insurance businesses; |

| |

• |

|

inaccuracies or changes in estimates, assumptions, methodologies, valuations, projections and/or models, which

result in inadequate reserves or other adverse results (including as a result of any changes in connection with quarterly, annual or other reviews, including reviews the company expects to complete in the fourth quarter of 2024);

|

| |

• |

|

the impact on holding company liquidity caused by an inability to receive dividends or any other returns of

capital from Enact Holdings, and limited sources of capital and financing and the need to seek additional capital on unfavorable terms; |

| |

• |

|

adverse changes to the structure or requirements of Federal National Mortgage Association (Fannie Mae), Federal

Home Loan Mortgage Corporation (Freddie Mac) or the U.S. mortgage insurance market; an increase in the number of loans insured through federal government mortgage insurance programs, including those offered by the Federal Housing Administration; the

inability of Enact Holdings and/or its U.S. mortgage insurance subsidiaries to continue to meet the requirements mandated by PMIERs (or any adverse changes thereto), inability to meet minimum statutory capital requirements of applicable regulators

or the mortgage insurer eligibility requirements of Fannie Mae or Freddie Mac; |

8

| |

• |

|

changes in economic, market and political conditions including as a result of elevated inflation, labor shortages

and elevated interest rates, which could heighten the risk of a future recession; unanticipated financial events, which could lead to market-wide liquidity problems and other significant market disruption resulting in losses, defaults or credit

rating downgrades of other financial institutions; deterioration in economic conditions, a recession or a decline in home prices, all of which could be driven by many potential factors; political and economic instability or changes in government

policies, including U.S. federal tax laws or rates, and at regulatory agencies as a result of any change in administration due to the 2024 U.S. presidential election; and fluctuations in international securities markets; |

| |

• |

|

downgrades in financial strength and credit ratings and potential adverse impacts to liquidity; counterparty

credit risks; defaults by counterparties to reinsurance arrangements or derivative instruments; defaults or other events impacting the value of invested assets; |

| |

• |

|

changes in tax rates or tax laws, or changes in accounting and reporting standards; |

| |

• |

|

litigation and regulatory investigations or other actions, including commercial and contractual disputes with

counterparties; |

| |

• |

|

the inability to retain, attract and motivate qualified employees or senior management; |

| |

• |

|

the loss of significant key customers and distribution relationships by Enact Holdings; |

| |

• |

|

the impact from deficiencies in the company’s disclosure controls and procedures or internal control over

financial reporting; |

| |

• |

|

the occurrence of natural or man-made disasters, including geopolitical

tensions and war (including the Russian invasion of Ukraine and the Israel-Hamas conflict), a public health emergency, including pandemics, or climate change; |

| |

• |

|

the inability to effectively manage information technology systems (including artificial intelligence), cyber

incidents or other failures, disruptions or security breaches of the company or its third-party vendors, as well as unknown risks and uncertainties associated with artificial intelligence; |

| |

• |

|

the inability of third-party vendors to meet their obligations to the company; |

| |

• |

|

the lack of availability, affordability or adequacy of reinsurance to protect the company against losses;

|

| |

• |

|

a decrease in the volume of high

loan-to-value home mortgage originations or an increase in the volume of mortgage insurance cancellations; |

| |

• |

|

unanticipated claims against Enact Holdings’ delegated underwriting program; |

| |

• |

|

the impact of medical advances such as genetic research and diagnostic imaging, emerging new technology,

including artificial intelligence and related legislation; and |

| |

• |

|

other factors described in the risk factors contained in Item 1A of the company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on February 29, 2024. |

The company

provides additional information regarding these risks and uncertainties in its Annual Report on Form 10-K. Unlisted factors may present significant additional obstacles to the realization of forward-looking

statements. Accordingly, for the foregoing reasons, the company cautions the reader against relying on any forward-looking statements. The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be required under applicable securities laws.

9

Condensed Consolidated Statements of Income

(Amounts in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

September 30, |

|

|

Three months

ended

June 30,

2024 |

|

| |

|

2024 |

|

|

2023 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Premiums |

|

$ |

874 |

|

|

$ |

915 |

|

|

$ |

855 |

|

| Net investment income |

|

|

777 |

|

|

|

801 |

|

|

|

808 |

|

| Net investment gains (losses) |

|

|

66 |

|

|

|

(43 |

) |

|

|

(61 |

) |

| Policy fees and other income |

|

|

163 |

|

|

|

158 |

|

|

|

167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

1,880 |

|

|

|

1,831 |

|

|

|

1,769 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Benefits and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Benefits and other changes in policy reserves |

|

|

1,213 |

|

|

|

1,199 |

|

|

|

1,151 |

|

| Liability remeasurement (gains) losses |

|

|

34 |

|

|

|

116 |

|

|

|

39 |

|

| Changes in fair value of market risk benefits and associated hedges |

|

|

21 |

|

|

|

(24 |

) |

|

|

(8 |

) |

| Interest credited |

|

|

102 |

|

|

|

127 |

|

|

|

125 |

|

| Acquisition and operating expenses, net of deferrals |

|

|

259 |

|

|

|

228 |

|

|

|

229 |

|

| Amortization of deferred acquisition costs and intangibles |

|

|

62 |

|

|

|

65 |

|

|

|

60 |

|

| Interest expense |

|

|

28 |

|

|

|

30 |

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total benefits and expenses |

|

|

1,719 |

|

|

|

1,741 |

|

|

|

1,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations before income taxes |

|

|

161 |

|

|

|

90 |

|

|

|

143 |

|

| Provision for income taxes |

|

|

40 |

|

|

|

30 |

|

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

|

121 |

|

|

|

60 |

|

|

|

111 |

|

| Loss from discontinued operations, net of taxes |

|

|

(3 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

118 |

|

|

|

60 |

|

|

|

110 |

|

| Less: net income attributable to noncontrolling interests |

|

|

33 |

|

|

|

31 |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income available to Genworth Financial, Inc.’s common stockholders |

|

$ |

85 |

|

|

$ |

29 |

|

|

$ |

76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations available to Genworth Financial, Inc.’s common stockholders

per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.20 |

|

|

$ |

0.06 |

|

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.20 |

|

|

$ |

0.06 |

|

|

$ |

0.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income available to Genworth Financial, Inc.’s common stockholders per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.20 |

|

|

$ |

0.06 |

|

|

$ |

0.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.19 |

|

|

$ |

0.06 |

|

|

$ |

0.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

430.8 |

|

|

|

460.5 |

|

|

|

436.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

435.8 |

|

|

|

466.0 |

|

|

|

440.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10

Reconciliation of Net Income to Adjusted Operating Income

(Amounts in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three

months ended

September 30, |

|

|

Three

months ended

June 30,

2024 |

|

| |

|

2024 |

|

|

2023 |

|

| Net income available to Genworth Financial, Inc.’s common stockholders |

|

$ |

85 |

|

|

$ |

29 |

|

|

$ |

76 |

|

| Add: net income attributable to noncontrolling interests |

|

|

33 |

|

|

|

31 |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

118 |

|

|

|

60 |

|

|

|

110 |

|

| Less: loss from discontinued operations, net of taxes |

|

|

(3 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

|

121 |

|

|

|

60 |

|

|

|

111 |

|

| Less: net income from continuing operations attributable to noncontrolling interests |

|

|

33 |

|

|

|

31 |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations available to Genworth Financial, Inc.’s common

stockholders |

|

|

88 |

|

|

|

29 |

|

|

|

77 |

|

| Adjustments to income from continuing operations available to Genworth Financial, Inc.’s

common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment (gains) losses, net12 |

|

|

(66 |

) |

|

|

43 |

|

|

|

60 |

|

| Changes in fair value of market risk benefits attributable to interest rates, equity markets and

associated hedges13 |

|

|

17 |

|

|

|

(26 |

) |

|

|

(10 |

) |

| (Gains) losses on early extinguishment of debt,

net14 |

|

|

(2 |

) |

|

|

— |

|

|

|

7 |

|

| Expenses related to restructuring |

|

|

— |

|

|

|

— |

|

|

|

4 |

|

| Taxes on adjustments |

|

|

11 |

|

|

|

(4 |

) |

|

|

(13 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income |

|

$ |

48 |

|

|

$ |

42 |

|

|

$ |

125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

| Enact segment |

|

$ |

148 |

|

|

$ |

134 |

|

|

$ |

165 |

|

| Long-Term Care Insurance segment |

|

|

(46 |

) |

|

|

(71 |

) |

|

|

(29 |

) |

| Life and Annuities segment: |

|

|

|

|

|

|

|

|

|

|

|

|

| Life Insurance |

|

|

(40 |

) |

|

|

(25 |

) |

|

|

(23 |

) |

| Fixed Annuities |

|

|

6 |

|

|

|

17 |

|

|

|

12 |

|

| Variable Annuities |

|

|

7 |

|

|

|

5 |

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Life and Annuities segment |

|

|

(27 |

) |

|

|

(3 |

) |

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate and Other |

|

|

(27 |

) |

|

|

(18 |

) |

|

|

(10 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income |

|

$ |

48 |

|

|

$ |

42 |

|

|

$ |

125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income available to Genworth Financial, Inc.’s common stockholders per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.20 |

|

|

$ |

0.06 |

|

|

$ |

0.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.19 |

|

|

$ |

0.06 |

|

|

$ |

0.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.11 |

|

|

$ |

0.09 |

|

|

$ |

0.29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.11 |

|

|

$ |

0.09 |

|

|

$ |

0.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

430.8 |

|

|

|

460.5 |

|

|

|

436.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

435.8 |

|

|

|

466.0 |

|

|

|

440.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

Footnote Definitions

| 1 |

Long-term care insurance. |

| 2 |

All references reflect amounts available to Genworth’s common stockholders. |

| 3 |

This is a financial measure that is not calculated based on U.S. Generally Accepted Accounting Principles

(GAAP). See the Use of Non-GAAP Measures section of this press release for additional information. |

| 4 |

Risk-based capital ratio based on company action level for Genworth Life Insurance Company (GLIC) consolidated.

|

| 5 |

Company estimate for the third quarter of 2024 due to timing of the preparation and filing of the statutory

financial statement filing(s). |

| 6 |

Includes approximately $162 million and $95 million of advance cash payments from the company’s

subsidiaries held for future obligations in the third and second quarters of 2024, respectively. |

| 7 |

Reflects Genworth’s ownership of equity including accumulated other comprehensive income (loss) and

excluding noncontrolling interests of $944 million, $894 million and $822 million in the third and second quarters of 2024 and the third quarter of 2023, respectively. |

| 8 |

The Private Mortgage Insurer Eligibility Requirements (PMIERs) sufficiency ratio is calculated as available

assets divided by required assets as defined within PMIERs. |

| 9 |

Genworth’s principal U.S. life insurance companies: GLIC, Genworth Life and Annuity Insurance Company

(GLAIC) and Genworth Life Insurance Company of New York (GLICNY). |

| 10 |

Net gain from operations before dividends to policyholders, refunds to members and federal income taxes for

GLIC, GLAIC and GLICNY, and before realized capital gains or (losses). |

| 11 |

Holding company cash and liquid assets comprises assets held in Genworth Holdings, Inc. (the issuer of

outstanding public debt) which is a wholly-owned subsidiary of Genworth Financial, Inc. |

| 12 |

Net investment (gains) losses were adjusted for the portion attributable to noncontrolling interests of

$1 million for the three months ended June 30, 2024. |

| 13 |

Changes in fair value of market risk benefits and associated hedges were adjusted to exclude changes in

reserves, attributed fees and benefit payments of $(4) million and $(2) million for the three months ended September 30, 2024 and 2023, respectively, and $(2) million for the three months ended June 30, 2024. |

| 14 |

(Gains) losses on early extinguishment of debt were net of the portion attributable to noncontrolling interests

of $2 million for the three months ended June 30, 2024. |

12

Exhibit 99.2

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

THIRD QUARTER 2024

Note:

Unless

otherwise stated, all references in this financial supplement to income (loss) from continuing operations, income (loss) from continuing operations per share, net income (loss), net income (loss) per share, adjusted operating income (loss), adjusted

operating income (loss) per share, book value and book value per share should be read as income (loss) from continuing operations available to Genworth Financial, Inc.’s common stockholders, income (loss) from continuing operations available to

Genworth Financial, Inc.’s common stockholders per share, net income (loss) available to Genworth Financial, Inc.’s common stockholders, net income (loss) available to Genworth Financial, Inc.’s common stockholders per share, non-U.S.

Generally Accepted Accounting Principles (U.S. GAAP) adjusted operating income (loss) available to Genworth Financial, Inc.’s common stockholders, non-GAAP adjusted operating income (loss) available to Genworth Financial, Inc.’s common

stockholders per share, book value available to Genworth Financial, Inc.’s common stockholders and book value available to Genworth Financial, Inc.’s common stockholders per share, respectively.

2

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

THIRD QUARTER 2024

Dear Investor,

Thank you for your continued interest in Genworth Financial, Inc.

Please see the accompanying press release and summary presentation posted to the company’s website at http://investor.genworth.com for additional

information regarding its third quarter 2024 earnings results.

Investors are encouraged to listen to the company’s earnings call on the third quarter

2024 results at 9:00 a.m. (EDT) on November 7, 2024.

Regards,

Brian Johnson, Investor Relations

InvestorInfo@genworth.com

3

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

THIRD QUARTER 2024

Use of

Non-GAAP Measures

This financial supplement includes the non-GAAP financial measures entitled “adjusted operating income (loss)” and

“adjusted operating income (loss) per share.” Adjusted operating income (loss) per share is derived from adjusted operating income (loss). Management evaluates segment performance and allocates resources on the basis of adjusted operating

income (loss). The company defines adjusted operating income (loss) as income (loss) from continuing operations excluding the after-tax effects of income (loss) attributable to noncontrolling interests, net investment gains (losses), changes in fair

value of market risk benefits and associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual non-operating items. A component of the company’s

net investment gains (losses) is the result of estimated future credit losses, the size and timing of which can vary significantly depending on market credit cycles. In addition, the size and timing of other investment gains (losses) can be subject

to the company’s discretion and are influenced by market opportunities, as well as asset-liability matching considerations. The company excludes net investment gains (losses), changes in fair value of market risk benefits and associated hedges,

gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual non-operating items from adjusted operating income (loss) because, in the company’s opinion, they are

not indicative of overall operating performance.

While some of these items may be significant components of net income (loss) available to Genworth

Financial, Inc.’s common stockholders determined in accordance with U.S. GAAP, the company believes that adjusted operating income (loss) and measures that are derived from or incorporate adjusted operating income (loss), including adjusted

operating income (loss) per share on a basic and diluted basis, are appropriate measures that are useful to investors because they identify the income (loss) attributable to the ongoing operations of the business. Management also uses adjusted

operating income (loss), among other key performance indicators, as a basis for determining awards and compensation for senior management and to evaluate performance on a basis comparable to that used by analysts. However, the items excluded from

adjusted operating income (loss) have occurred in the past and could, and in some cases will, recur in the future. Adjusted operating income (loss) and adjusted operating income (loss) per share on a basic and diluted basis are not substitutes for

net income (loss) available to Genworth Financial, Inc.’s common stockholders or net income (loss) available to Genworth Financial, Inc.’s common stockholders per share on a basic and diluted basis determined in accordance with U.S. GAAP.

In addition, the company’s definition of adjusted operating income (loss) may differ from the definitions used by other companies.

Adjustments to

reconcile net income (loss) available to Genworth Financial, Inc.’s common stockholders to adjusted operating income (loss) assume a 21% tax rate and are net of the portion attributable to noncontrolling interests. Changes in fair value of

market risk benefits and associated hedges are adjusted to exclude changes in reserves, attributed fees and benefit payments.

The table on page 9 of

this financial supplement provides a reconciliation of net income (loss) available to Genworth Financial, Inc.’s common stockholders to adjusted operating income (loss) for the periods presented and reflects adjusted operating income (loss) as

determined in accordance with accounting guidance related to segment reporting. This financial supplement includes other non-GAAP measures management believes enhances the understanding and comparability of performance by highlighting underlying

business activity and profitability drivers. These additional non-GAAP measures are on pages 37 to 39 of this financial supplement.

Statutory

Accounting Data

The company presents certain supplemental statutory data for Genworth Life Insurance Company (GLIC) and its consolidating life

insurance subsidiaries that has been prepared on the basis of statutory accounting principles (SAP). GLIC and its consolidating life insurance subsidiaries file financial statements with state insurance regulatory authorities and the National

Association of Insurance Commissioners that are prepared using SAP, an accounting basis either prescribed or permitted by such authorities. Due to differences in methodology between SAP and U.S. GAAP, the values for assets, liabilities and equity,

and the recognition of income and expenses, reflected in financial statements prepared in accordance with U.S. GAAP are materially different from those reflected in financial statements prepared under SAP. This supplemental statutory data should not

be viewed as an alternative to, or used in lieu of, U.S. GAAP.

This supplemental statutory data includes the impact from in-force rate actions on

pre-tax long-term care insurance statutory earnings. Statutory pre-tax earnings represent the net gain from operations, including the impact from in-force rate actions, before dividends to policyholders, refunds to members and federal income taxes

and before realized capital gains or (losses). Management uses and provides this supplemental statutory data because it believes it provides a useful measure of, among other things, statutory pre-tax earnings and the adequacy of capital. Management

uses this data to measure against its policy to manage the U.S. life insurance companies with internally generated capital.

4

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

THIRD QUARTER 2024

Results

of Operations and Selected Operating Performance Measures

The company taxes its businesses at the U.S. corporate federal income tax rate of 21%. Each

segment is then adjusted to reflect the unique tax attributes of that segment, such as permanent differences between U.S. GAAP and tax law. The difference between the consolidated provision for income taxes and the sum of the provision for income

taxes in each segment is reflected in Corporate and Other.

The annually-determined tax rates and adjustments to each segment’s provision for income

taxes are estimates which are subject to review and could change from year to year. U.S. GAAP generally requires an annualized effective tax rate to be used for interim reporting periods, utilizing projections of full year results. However, in

certain circumstances, it is appropriate to record the actual effective tax rate for the period if a reliable estimate cannot be made for the full year. Although the company used the annualized projected effective tax rate during the interim

reporting period ending March 31, 2024 for all segments, the company concluded that using an actual effective tax rate reflecting actual year-to-date income (loss) provides a better estimate for its Long-Term Care Insurance and Life and Annuities

segments for interim reporting. Accordingly, for the three months ended June 30, 2024 and September 30, 2024, the company utilized the actual effective tax rate for the interim period to record the provision for income taxes for its Long-Term Care

Insurance and Life and Annuities segments and the annualized projected effective tax rate for its Enact segment and Corporate and Other. This method was also utilized for the three months ended March 31, 2023, June 30, 2023 and September 30, 2023.

This financial supplement contains selected operating performance measures including “new insurance written,” “insurance in-force”

and “risk in-force,” which are commonly used in the insurance industry as measures of operating performance.

Management regularly monitors and

reports new insurance written for the company’s Enact segment as a measure of volume of new business generated in a period. The company considers new insurance written to be a measure of the operating performance of its Enact segment because it

represents a measure of new sales of mortgage insurance policies during a specified period, rather than a measure of revenues or profitability during that period.

Management regularly monitors and reports insurance in-force and risk in-force for the company’s Enact segment. Insurance in-force is a measure of the

aggregate unpaid principal balance as of the respective reporting date for loans insured by the company’s U.S. mortgage insurance subsidiaries. Risk in-force is based on the coverage percentage applied to the estimated current outstanding loan

balance. These metrics are presented on a direct basis and exclude reinsurance. The company considers insurance in-force and risk in-force to be measures of the operating performance of its Enact segment because they represent measures of the size

of its business at a specific date which will generate revenues and profits in a future period, rather than measures of its revenues or profitability during that period.

Management also regularly monitors and reports a loss ratio for the company’s Enact segment, which is the ratio of benefits and other changes in policy

reserves to net earned premiums. The company considers the loss ratio to be a measure of underwriting performance and helps to enhance the understanding of the operating performance of the Enact segment.

These operating performance measures enable the company to compare its operating performance across periods without regard to revenues or profitability

related to policies or contracts sold in prior periods or from investments or other sources.

5

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

THIRD QUARTER 2024

Financial Highlights

(amounts in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance Sheet Data |

|

September 30,

2024 |

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

| Total Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other

comprehensive income (loss) |

|

$ |

10,182 |

|

|

$ |

10,146 |

|

|

$ |

10,100 |

|

|

$ |

10,035 |

|

|

$ |

10,276 |

|

| Total accumulated other comprehensive income

(loss)(1) |

|

|

(1,871 |

) |

|

|

(1,687 |

) |

|

|

(2,094 |

) |

|

|

(2,555 |

) |

|

|

(2,220 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Genworth Financial, Inc.’s stockholders’ equity |

|

$ |

8,311 |

|

|

$ |

8,459 |

|

|

$ |

8,006 |

|

|

$ |

7,480 |

|

|

$ |

8,056 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per share |

|

$ |

19.40 |

|

|

$ |

19.49 |

|

|

$ |

18.21 |

|

|

$ |

16.74 |

|

|

$ |

17.80 |

|

| Book value per share, excluding accumulated other comprehensive income (loss) |

|

$ |

23.77 |

|

|

$ |

23.38 |

|

|

$ |

22.98 |

|

|

$ |

22.46 |

|

|

$ |

22.70 |

|

| Common shares outstanding as of the balance sheet date |

|

|

428.4 |

|

|

|

434.0 |

|

|

|

439.6 |

|

|

|

446.8 |

|

|

|

452.7 |

|

|

|

| |

|

Twelve months ended |

|

| Twelve Month Rolling Average ROE |

|

September 30,

2024 |

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

| U.S. GAAP Basis ROE |

|

|

0.9 |

% |

|

|

0.3 |

% |

|

|

0.9 |

% |

|

|

0.7 |

% |

|

|

6.6 |

% |

| Operating ROE(2) |

|

|

0.3 |

% |

|

|

0.2 |

% |

|

|

(0.2 |

)% |

|

|

0.4 |

% |

|

|

6.0 |

% |

|

|

| |

|

Three months ended |

|

| Quarterly Average ROE |

|

September 30,

2024 |

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

| U.S. GAAP Basis ROE |

|

|

3.3 |

% |

|

|

3.0 |

% |

|

|

5.5 |

% |

|

|

(8.4 |

)% |

|

|

1.1 |

% |

| Operating ROE(2) |

|

|

1.9 |

% |

|

|

4.9 |

% |

|

|

3.4 |

% |

|

|

(9.1 |

)% |

|

|

1.6 |

% |

|

|

|

|

|

|

| Basic and Diluted Shares |

|

Three months ended

September 30, 2024 |

|

|

Nine months ended

September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares used in basic earnings per share calculations |

|

|

430.8 |

|

|

|

436.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Potentially dilutive securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance stock units, restricted stock units and other equity-based awards |

|

|

5.0 |

|

|

|

5.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares used in diluted earnings per share calculations |

|

|

435.8 |

|

|

|

442.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

As of September 30, 2024, June 30, 2024, March 31, 2024, December 31, 2023 and September 30, 2023, total

accumulated other comprehensive income (loss) includes $(1,341) million, $624 million, $(334) million, $(1,439) million and $1,826 million, net of taxes, respectively, related to changes in the discount rate used to remeasure the liability for

future policy benefits and related reinsurance recoverables. |

| (2) |

See page 37 herein for a reconciliation of U.S. GAAP Basis ROE to Operating ROE. |

6

Consolidated Quarterly Results

7

GENWORTH FINANCIAL, INC.

FINANCIAL SUPPLEMENT

THIRD QUARTER 2024

Consolidated Net Income (Loss) by Quarter

(amounts in millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

|

2023 |

|

| |

|

3Q |

|

|

2Q |

|

|

1Q |

|

|

Total |

|

|

4Q |

|

|

3Q |

|

|

2Q |

|

|

1Q |

|

|

Total |

|

| REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Premiums |

|

$ |

874 |

|

|

$ |

855 |

|

|

$ |

875 |

|

|

$ |

2,604 |

|

|

$ |

904 |

|

|

$ |

915 |

|

|

$ |

902 |

|

|

$ |

915 |

|

|

$ |

3,636 |

|

| Net investment income |

|

|

777 |

|

|

|

808 |

|

|

|

782 |

|

|

|

2,367 |

|

|

|

810 |

|

|

|

801 |

|

|

|

785 |

|

|

|

787 |

|

|

|

3,183 |

|

| Net investment gains (losses) |

|

|

66 |

|

|

|

(61 |

) |

|

|

49 |

|

|

|

54 |

|

|

|

38 |

|

|

|

(43 |

) |

|

|

39 |

|

|

|

(11 |

) |

|

|

23 |

|

| Policy fees and other income |

|

|

163 |

|

|

|

167 |

|

|

|

158 |

|

|

|

488 |

|

|

|

159 |

|

|

|

158 |

|

|

|

166 |

|

|

|

163 |

|

|

|

646 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

1,880 |

|

|

|

1,769 |

|

|

|

1,864 |

|

|

|

5,513 |

|

|

|

1,911 |

|

|

|

1,831 |

|

|

|

1,892 |

|

|

|

1,854 |

|

|

|

7,488 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BENEFITS AND EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Benefits and other changes in policy reserves |

|

|

1,213 |

|

|

|

1,151 |

|

|

|

1,203 |

|

|

|

3,567 |

|

|

|

1,233 |

|

|

|

1,199 |

|

|

|

1,175 |

|

|

|

1,176 |

|

|

|

4,783 |

|

| Liability remeasurement (gains) losses |

|

|

34 |

|

|

|

39 |

|

|

|

(8 |

) |

|

|

65 |

|

|

|

416 |

|

|

|

116 |

|

|

|

70 |

|

|

|

(15 |

) |

|

|

587 |

|

| Changes in fair value of market risk benefits and associated hedges |

|

|

21 |

|

|

|

(8 |

) |

|

|

(23 |

) |

|

|

(10 |

) |

|

|

14 |

|

|

|

(24 |

) |

|

|

(19 |

) |

|

|

17 |

|

|

|

(12 |

) |

| Interest credited |

|

|

102 |

|

|

|

125 |

|

|

|

125 |

|

|

|

352 |

|

|

|

124 |

|

|

|

127 |

|

|

|

126 |

|

|

|

126 |

|

|

|

503 |

|

| Acquisition and operating expenses, net of deferrals |

|

|

259 |

|

|

|

229 |

|

|

|

236 |

|

|

|

724 |

|

|

|

248 |

|

|

|

228 |

|

|

|

226 |

|

|

|

240 |

|

|

|

942 |

|

| Amortization of deferred acquisition costs and intangibles |

|

|

62 |

|

|

|

60 |

|

|

|

65 |

|

|

|

187 |

|

|

|

63 |

|

|

|

65 |

|

|

|

64 |

|

|

|

72 |

|

|

|

264 |

|

| Interest expense |

|

|

28 |

|

|

|

30 |

|

|

|

30 |

|

|

|

88 |

|

|

|

30 |

|

|

|

30 |

|

|

|

29 |

|

|

|

29 |