Form 424B3 - Prospectus [Rule 424(b)(3)]

17 Januar 2024 - 6:28PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

File No. 333- 262833

EATON VANCE TAX-MANAGED DIVERSIFIED EQUITY

INCOME FUND

Supplement to Prospectus dated February 18, 2022

The following replaces the Financial Highlights contained in the Prospectus:

| |

Year Ended October 31, |

| |

2023 |

2022 |

2021 |

2020 |

2019 |

| Net asset value – Beginning of year |

$ 11.360 |

$ 14.360 |

$ 11.600 |

$ 11.870 |

$ 11.860 |

| Income (Loss) From Operations |

|

|

|

|

|

| Net investment income(1) |

$ 0.057 |

$ 0.057 |

$ 0.054 |

$ 0.093 |

$ 0.101 |

| Net realized and unrealized gain (loss) |

1.209 |

(1.946) |

3.740 |

0.648 |

0.921 |

| Total income (loss) from operations |

$ 1.266 |

$ (1.889) |

$ 3.794 |

$ 0.741 |

$ 1.022 |

| Less Distributions |

|

|

|

|

|

| From net investment income |

$ (0.114) |

$ (0.056) |

$ (0.054) |

$ (0.093) |

$ (0.100) |

| From net realized gain |

(0.852) |

(0.973) |

(0.445) |

— |

(0.548) |

| Tax return of capital |

— |

(0.086) |

(0.538) |

(0.919) |

(0.364) |

| Total distributions |

$ (0.966) |

$ (1.115) |

$ (1.037) |

$ (1.012) |

$ (1.012) |

| Premium from common shares sold through shelf offering(1) |

$ — |

$ 0.004 |

$ 0.003 |

$ 0.001 |

$ 0.000(2) |

| Net asset value – End of year |

$ 11.660 |

$ 11.360 |

$ 14.360 |

$ 11.600 |

$ 11.870 |

| Market value – End of year |

$ 11.010 |

$ 12.000 |

$ 14.610 |

$ 10.340 |

$ 11.920 |

| Total Investment Return on Net Asset Value(3) |

11.53% |

(13.55)% |

33.85% |

7.02% |

9.24% |

| Total Investment Return on Market Value(3) |

(0.39)% |

(10.24)% |

52.78% |

(5.01)% |

13.53% |

| Ratios/Supplemental Data |

|

|

|

|

|

| Net assets, end of year (000’s omitted) |

$ 1,835,911 |

$1,784,540 |

$ 2,211,925 |

$ 1,759,628 |

$ 1,782,364 |

| Ratios (as a percentage of average daily net assets): |

|

|

|

|

|

| Expenses |

1.07%(4) |

1.07%(4) |

1.07% |

1.08% |

1.07% |

| Net investment income |

0.48% |

0.45% |

0.40% |

0.80% |

0.86% |

| Portfolio Turnover |

63% |

55% |

36% |

40% |

57% |

(See related footnotes.)

| |

Year Ended October 31, |

| |

2018 |

2017 |

2016 |

2015 |

2014 |

| Net asset value – Beginning of year |

$ 11.960 |

$ 11.140 |

$ 12.010 |

$ 12.340 |

$ 11.870 |

| Income (Loss) From Operations |

|

|

|

|

|

| Net investment income(1) |

$ 0.082 |

$ 0.100 |

$ 0.119 |

$ 0.211 |

$ 0.324(6) |

| Net realized and unrealized gain (loss) |

0.830 |

1.732 |

0.023 |

0.471 |

1.157 |

| Total income (loss) from operations |

$ 0.912 |

$ 1.832 |

$ 0.142 |

$ 0.682 |

$ 1.481 |

| Less Distributions |

|

|

|

|

|

| From net investment income |

$ (0.081) |

$ (0.096) |

$ (0.095) |

$ (0.212) |

$ (0.327) |

| From net realized gain |

(0.486) |

(0.285) |

(0.071) |

(0.800) |

— |

| Tax return of capital |

(0.445) |

(0.631) |

(0.846) |

— |

(0.685) |

| Total distributions |

$ (1.012) |

$ (1.012) |

$ (1.012) |

$ (1.012) |

$ (1.012) |

| Anti-dilutive effect of share repurchase program(1) |

$ — |

$ — |

$ — |

$ — |

$ 0.001 |

| Net asset value – End of year |

$ 11.860 |

$ 11.960 |

$ 11.140 |

$ 12.010 |

$ 12.340 |

| Market value – End of year |

$ 11.460 |

$ 11.640 |

$ 10.290 |

$ 11.310 |

$ 11.710 |

| Total Investment Return on Net Asset Value(3) |

7.75% |

17.51% |

1.98% |

6.38% |

13.64% |

| Total Investment Return on Market Value(3) |

6.98% |

23.81% |

0.04% |

5.57% |

19.41% |

| Ratios/Supplemental Data |

|

|

|

|

|

| Net assets, end of year (000’s omitted) |

$ 1,775,555 |

$ 1,787,846 |

$ 1,665,148 |

$ 1,795,490 |

$ 1,844,442 |

| Ratios (as a percentage of average daily net assets): |

|

|

|

|

|

| Expenses(5) |

1.07% |

1.08% |

1.08% |

1.07% |

1.08% |

| Net investment income |

0.66% |

0.86% |

1.05% |

1.72% |

2.65%(6) |

| Portfolio Turnover |

48% |

75% |

86% |

85% |

83% |

| (1) | Computed using average shares outstanding. |

| (2) | Amount is less than $0.0005. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions

reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| (4) | Includes a reduction by the investment adviser of a portion of its adviser fee due to the Fund’s

investment in the Morgan Stanley Institutional Liquidity Funds - Government Portfolio (equal to less than 0.005% of average daily net

assets for the year ended October 31, 2023 and 2022). |

| (5) | Excludes the effect of custody fee credits, if any, of less than 0.005%. Effective September 1, 2015, custody fee credits, which were

earned on cash deposit balances, were discontinued by the custodian. |

| (6) | Net investment income per share includes special dividends which amounted to $0.234 per share. Excluding special dividends, the ratio

of net investment income to average daily net assets would have been 0.74%. |

January 17, 2024

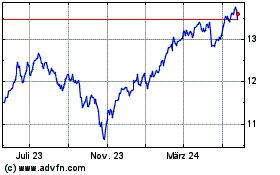

Eaton Vance Tax Managed ... (NYSE:ETY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

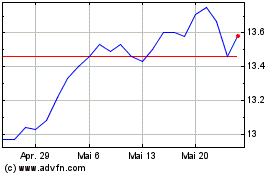

Eaton Vance Tax Managed ... (NYSE:ETY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024