Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

19 November 2024 - 5:26PM

Edgar (US Regulatory)

as

of

September

30,

2024

(Unaudited)

The

European

Equity

Fund,

Inc.

Shares

Value

($)

Common

Stocks

95.9%

Germany

24.2%

Air

Freight

&

Logistics

1.6%

Deutsche

Post

AG

26,298

1,174,613

Diversified

Telecommunication

Services

3.2%

Deutsche

Telekom

AG

(Registered)

83,257

2,451,582

Health

Care

Providers

&

Services

2.0%

Fresenius

SE

&

Co

KGaA*

40,019

1,528,479

Independent

Power

&

Renewable

Electricity

Producers

0.9%

RWE

AG

18,682

681,227

Insurance

3.3%

Allianz

SE

(Registered)

7,564

2,489,774

Interactive

Media

&

Services

1.4%

Scout24

SE

144A

12,092

1,042,277

Machinery

2.0%

Daimler

Truck

Holding

AG

17,444

654,575

Knorr-Bremse

AG

9,357

833,677

1,488,252

Multi-Utilities

1.3%

E.ON

SE

65,340

973,665

Passenger

Airlines

0.8%

Deutsche

Lufthansa

AG

(Registered)

81,593

599,053

Pharmaceuticals

1.5%

Merck

KGaA

6,583

1,160,559

Semiconductors

&

Semiconductor

Equipment

1.1%

Infineon

Technologies

AG

23,718

832,574

Software

2.1%

SAP

SE

6,979

1,591,697

Textiles,

Apparel

&

Luxury

Goods

2.0%

adidas

AG

3,033

805,106

Puma

SE

16,346

683,958

1,489,064

Trading

Companies

&

Distributors

1.0%

Brenntag

SE

10,610

792,952

Total

Germany

(Cost

$15,222,544)

18,295,768

Shares

Value

($)

France

17.3%

Building

Products

2.2%

Cie

de

Saint-Gobain

SA

18,311

1,669,655

Construction

&

Engineering

1.6%

Vinci

SA

10,591

1,240,240

Electrical

Equipment

0.2%

Schneider

Electric

SE

615

162,084

Insurance

3.8%

AXA

SA

56,414

2,173,551

SCOR

SE

28,500

637,914

2,811,465

IT

Services

0.9%

Capgemini

SE

3,101

671,086

Media

1.3%

Vivendi

SE

85,716

992,763

Oil,

Gas

&

Consumable

Fuels

1.7%

TotalEnergies

SE

19,869

1,296,935

Personal

Care

Products

1.9%

L'Oreal

SA

3,224

1,446,310

Pharmaceuticals

1.9%

Sanofi

SA

12,217

1,402,705

Textiles,

Apparel

&

Luxury

Goods

1.8%

LVMH

Moet

Hennessy

Louis

Vuitton

SE

1,769

1,358,996

Total

France

(Cost

$11,297,884)

13,052,239

United

Kingdom

15.5%

Banks

3.6%

HSBC

Holdings

PLC

302,012

2,710,045

Commercial

Services

&

Supplies

0.7%

Rentokil

Initial

PLC

115,540

564,556

Electric

Utilities

0.2%

SSE

PLC

7,371

186,112

Hotels,

Restaurants

&

Leisure

2.7%

Compass

Group

PLC

63,078

2,024,876

Media

1.2%

Informa

PLC

83,569

919,097

Oil,

Gas

&

Consumable

Fuels

2.4%

Shell

PLC

54,481

1,771,549

Pharmaceuticals

1.8%

AstraZeneca

PLC

8,552

1,328,840

Shares

Value

($)

Professional

Services

2.0%

RELX

PLC

31,571

1,485,484

Trading

Companies

&

Distributors

0.9%

Ashtead

Group

PLC

8,718

676,381

Total

United

Kingdom

(Cost

$8,269,240)

11,666,940

Switzerland

8.6%

Chemicals

3.1%

DSM-Firmenich

AG

9,121

1,258,412

Sika

AG

(Registered)

3,153

1,047,013

2,305,425

Food

Products

1.9%

Nestle

SA

(Registered)

13,981

1,408,211

Pharmaceuticals

2.2%

Roche

Holding

AG

5,062

1,623,921

Semiconductors

&

Semiconductor

Equipment

0.7%

STMicroelectronics

NV

18,529

550,979

Textiles,

Apparel

&

Luxury

Goods

0.7%

Cie

Financiere

Richemont

SA

''A''

(Registered)

3,520

558,359

Total

Switzerland

(Cost

$6,801,141)

6,446,895

Netherlands

7.7%

Automobiles

0.7%

Stellantis

NV

36,346

503,205

Banks

3.2%

ABN

AMRO

Bank

NV

(CVA)

144A

67,370

1,218,153

ING

Groep

NV

65,131

1,182,683

2,400,836

Semiconductors

&

Semiconductor

Equipment

3.8%

ASML

Holding

NV

3,463

2,881,010

Total

Netherlands

(Cost

$3,105,812)

5,785,051

Denmark

6.6%

Air

Freight

&

Logistics

1.4%

DSV

A/S

5,317

1,100,280

Pharmaceuticals

5.2%

Novo

Nordisk

A/S

''B''

33,158

3,905,029

Total

Denmark

(Cost

$1,673,288)

5,005,309

Shares

Value

($)

Sweden

4.1%

Banks

2.4%

Swedbank

AB

''A''

85,000

1,805,887

Machinery

1.7%

Atlas

Copco

AB

''A''

68,091

1,319,987

Total

Sweden

(Cost

$2,024,768)

3,125,874

Spain

3.5%

Banks

2.4%

Banco

Santander

SA

345,506

1,773,565

Specialty

Retail

1.1%

Industria

de

Diseno

Textil

SA

14,554

862,959

Total

Spain

(Cost

$2,043,521)

2,636,524

United

States

3.3%

Construction

Materials

3.3%

CRH

PLC

(Cost

$1,354,353)

(a)

27,092

2,476,820

Italy

2.6%

Banks

1.7%

Intesa

Sanpaolo

SpA

309,588

1,325,619

Beverages

0.9%

Davide

Campari-Milano

NV

76,418

648,031

Total

Italy

(Cost

$1,871,645)

1,973,650

Ireland

1.8%

Containers

&

Packaging

1.8%

Smurfit

WestRock

PLC

(Cost

$1,428,553)

26,343

1,320,386

Norway

0.7%

Banks

0.7%

DNB

Bank

ASA

(Cost

$481,615)

24,076

494,589

Total

Common

Stocks

(Cost

$55,574,364)

72,280,045

Shares

Value

($)

Preferred

Stocks

1.6%

Germany

1.6%

Automobiles

1.6%

Porsche

Automobil

Holding

SE

12,572

576,264

Volkswagen

AG

5,686

603,737

1,180,001

Total

Germany

(Cost

$2,520,052)

1,180,001

Total

Preferred

Stocks

(Cost

$2,520,052)

1,180,001

Cash

Equivalents

2.2%

DWS

Central

Cash

Management

Government

Fund,

4.93%

(Cost

$1,630,527)

(b)

1,630,527

1,630,527

%

of

Net

Assets

Value

($)

Total

Investment

Portfolio

(Cost

$59,724,943)

99.7

75,090,573

Other

Assets

and

Liabilities,

Net

0.3

295,717

Net

Assets

100.0

75,386,290

For

purposes

of

its

industry

concentration

policy,

the

Fund

classifies

issuers

of

portfolio

securities

at

the

industry

sub-group

level. Certain

of

the

categories

in

the

above

Schedule

of

Investments

consist

of

multiple

industry

sub-groups

or

industries.

For

information

on

the

Fund’s

policies

regarding

the

valuation

of

investments

and

other

significant

accounting

policies,

please

refer

to

the

Fund’s

most

recent

semi-annual

or

annual

financial

statements.

A

summary

of

the

Fund’s

transactions

with

affiliated

investments

during

the

period

ended

September

30,

2024

are

as

follows:

Net

Change

Value

($)

at

12/31/2023

Purchases

Cost

($)

Sales

Proceeds

($)

Net

Real-

ized

Gain/

(Loss)

($)

in

Unreal-

ized

Appreci-

ation/

(Depreci-

ation)

($)

Income

($)

Capital

Gain

Distri-

butions

($)

Number

of

Shares

at

9/30/2024

Value

($)

at

9/30/2024

Securities

Lending

Collateral

0.0%

DWS

Government

&

Agency

Securities

Portfolio

''DWS

Government

Cash

Institutional

Shares'',

4.82%

(b)

(c)

–

0

(d)

–

–

–

10,586

–

–

–

Cash

Equivalents

2.2%

DWS

Central

Cash

Management

Government

Fund,

4.93%

(b)

1,250,300

7,107,746

6,727,519

–

–

62,439

–

1,630,527

1,630,527

1,250,300

7,107,746

6,727,519

–

–

73,025

–

1,630,527

1,630,527

*

Non-income

producing

security.

(a)

CRH

PLC

is

domiciled

in

United

States

and

is

listed

on

the

London

Stock

Exchange.

(b)

Affiliated

fund

managed

by

DWS

Investment

Management

Americas,

Inc.

The

rate

shown

is

the

annualized

seven-day

yield

at

period

end.

(c)

Represents

cash

collateral

held

in

connection

with

securities

lending.

Income

earned

by

the

Fund

is

net

of

borrower

rebates.

(d)

Represents

the

net

increase

(purchases

cost)

or

decrease

(sales

proceeds)

in

the

amount

invested

in

cash

collateral

for

the

period

ended

September

30,

2024.

144A:

Securities

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933.

These

securities

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

CVA:

Credit

Valuation

Adjustment

(e)

See

Schedule

of

Investments

for

additional

detailed

categorizations

.

Fair

Value

Measurements

Various

inputs

are

used

in

determining

the

value

of

the

Fund’s

investments.

These

inputs

are

summarized

in

three

broad

levels.

Level

1

includes

quoted

prices

in

active

markets

for

identical

securities.

Level

2

includes

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

prepayment

speeds

and

credit

risk).

Level

3

includes

significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

in

determining

the

fair

value

of

investments).

The

level

assigned

to

the

securities

valuations

may

not

be

an

indication

of

the

risk

associated

with

investing

in

those

securities.

The

following

is

a

summary

of

the

inputs

used

as

of

September

30,

2024

in

valuing

the

Fund’s

investments.

Assets

Level

1

Level

2

Level

3

Total

Common

Stocks

and/or

Other

Equity

Investments

(e)

Germany

$

19,475,769

$

—

$

—

$

19,475,769

France

13,052,239

—

—

13,052,239

United

Kingdom

11,666,940

—

—

11,666,940

Switzerland

6,446,895

—

—

6,446,895

Netherlands

5,785,051

—

—

5,785,051

Denmark

5,005,309

—

—

5,005,309

Sweden

3,125,874

—

—

3,125,874

Spain

2,636,524

—

—

2,636,524

United

States

2,476,820

—

—

2,476,820

Italy

1,973,650

—

—

1,973,650

Ireland

1,320,386

—

—

1,320,386

Norway

494,589

—

—

494,589

Short-Term

Instruments

(e)

1,630,527

—

—

1,630,527

Total

$

75,090,573

$

—

$

—

$

75,090,573

OBTAIN

AN

OPEN-END

FUND

PROSPECTUS

To

obtain

a

summary

prospectus,

if

available,

or

prospectus,

download

one

from

fundsus.dws.com,

talk

to

your

financial

representative

or

call

(800)

728-3337.

We

advise

you

to

carefully

consider

the

product's

objectives,

risks,

charges

and

expenses

before

investing.

The

summary

prospectus

and

prospectus

contain

this

and

other

important

information

about

the

investment

product.

Please

read

the

prospectus

carefully

before

you

invest

.

CLOSED-END

FUNDS

The

shares

of

most

closed-end

funds,

including

the

Fund,

are

not

continuously

offered.

Once

issued,

shares

of

closed-end

funds

are

bought

and

sold

in

the

open

market.

Shares

of

closed-end

funds

frequently

trade

at

a

discount

to

net

asset

value.

The

price

of

the

fund’s

shares

is

determined

by

a

number

of

factors,

several

of

which

are

beyond

the

control

of

the

fund.

Therefore,

the

fund

cannot

predict

whether

its

shares

will

trade

at,

below

or

above

net

asset

value.

The

brand

DWS

represents

DWS

Group

GmbH

&

Co.

KGaA

and

any

of

its

subsidiaries

such

as

DWS

Distributors,

Inc.,

which

offers

investment

products,

or

DWS

Investment

Management

Americas

Inc.

and

RREEF

America

L.L.C.,

which

offer

advisory

services.

NO

BANK

GUARANTEE

|

NOT

FDIC

INSURED

|

MAY

LOSE

VALUE

EEA-PH3

R-080548-2

(1/25)

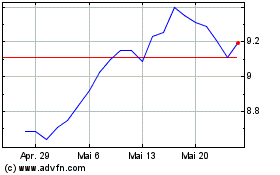

European Equity (NYSE:EEA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

European Equity (NYSE:EEA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025