Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

29 Oktober 2024 - 11:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2024

Commission File Number 001-34175

| ECOPETROL S.A. |

|

(Exact name of registrant as specified in its charter)

|

| N.A. |

|

(Translation of registrant’s name into English)

|

| COLOMBIA |

|

(Jurisdiction of incorporation or organization)

|

| Carrera 13 No. 36 – 24 |

| BOGOTA D.C. – COLOMBIA |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Ecopetrol S.A. |

|

| |

|

|

| |

By: |

/s/ Alfonso Camilo Barco |

|

| |

|

Name: |

Alfonso Camilo Barco |

|

| |

|

Title: |

Chief

Financial Officer |

|

Date: October 28,

2024

Ecopetrol S.A. announces full redemption of its Notes

due 2026

Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC) (“Ecopetrol”

or the “Company”) announces that, continuing with its comprehensive debt management strategy, it will redeem the outstanding

balance of its 5.375% notes maturing in June 2026 (CUSIP: 279158 AL3 / ISIN: US279158AL39) (the “2026 Notes”), which were

issued in 2015. The outstanding balance of the 2026 Notes is USD 447,168,000.

The expected redemption date of the 2026 Notes

is November 21, 2024. The redemption price is expected to be approximately USD 1,010.31 per USD 1,000.00 principal amount outstanding

(preliminarily calculated at USD 451,778,154.18 for 100% of the 2026 Notes outstanding), plus accrued and unpaid interest up to the redemption

date equivalent to USD 21.35 per USD 1,000 principal amount outstanding (estimated at USD 9,547,347.33 for 100% of the 2026 Notes outstanding),

which would amount to USD 1,031.66 per USD 1,000 principal amount outstanding (approximately USD 461,325,501.51 for 100% of the 2026 Notes

outstanding). The final redemption price is expected to be calculated on November 18, 2024.

The redemption of the 2026 Notes is in line with

the Company’s financial plan and confirms Ecopetrol’s commitment to proactively manage its debt maturing in 2026.

For

more information, please refer to this link.

Bogota D.C., October 28, 2024

-----------------------------------------

Ecopetrol is the largest

company in Colombia and one of the main integrated energy companies in the American continent, with more than 19,000 employees. In Colombia,

it is responsible for more than 60% of the hydrocarbon production of most transportation, logistics, and hydrocarbon refining systems,

and it holds leading positions in the petrochemicals and gas distribution segments. With the acquisition of 51.4% of ISA’s shares,

the company participates in energy transmission, the management of real-time systems (XM), and the Barranquilla - Cartagena coastal highway

concession. At the international level, Ecopetrol has a stake in strategic basins in the American continent, with Drilling and Exploration

operations in the United States (Permian basin and the Gulf of Mexico), Brazil, and, through ISA and its subsidiaries, Ecopetrol holds

leading positions in the power transmission business in Brazil, Chile, Peru, and Bolivia, road concessions in Chile, and the telecommunications

sector.

For more information, please contact:

Head of Capital Markets (a)

Lina María Contreras Mora

Email: investors@ecopetrol.com.co

Head of Corporate Communications

Marcela Ulloa

Email: marcela.ulloa@ecopetrol.com.co

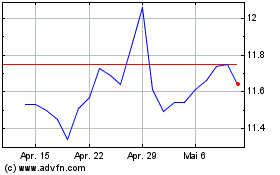

Ecopetrol (NYSE:EC)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

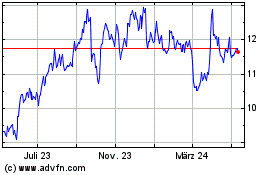

Ecopetrol (NYSE:EC)

Historical Stock Chart

Von Mär 2024 bis Mär 2025