SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2023

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Completion

of the acquisition and consolidation of the Baguari HPP

Rio de Janeiro, October 17,

2023, Centrais Elétricas Brasileiras S/A - Eletrobras, in addition to the market announcements disclosed on April 14, 2023 and

May 31, 2023, informs that, after the implementation of the conditions precedent, it has concluded, on October 16, 2023, the consolidation

of 100% of the Baguari HPP. The transaction, concluded in two stages, totals R$ 875 million.

The Baguari HPP has an installed

capacity of 140 MW and a physical guarantee of 82 MWm, with a concession contract until March 2046. The asset has contracts in the regulated

environment (ACR) for about 90% of its physical guarantee, until the end of 2039, at a value of R$ 305/MWh (current value). Baguari also

has GSF SP 97 insurance, contributing to greater cash flow predictability. In the second quarter of 2023, Baguari HPP companies had net

cash of R$ 88 million.

Eletrobras now consolidates

100% of the share capital of Baguari I Geração de Energia S.A. (Baguari I) and Baguari Energia S.A. (Baguari Energia), which

together make up the Baguari Consórcio, which operates the Baguari HPP, aggregating an EBITDA of approximately R$ 126 million (2022).

Figure 1 –

Corporate Structure Before and After Transaction Completion

About the transaction

The first stage of the transaction,

on October 6, 2023, Furnas Centrais Elétricas S.A. (Furnas), acquired Cemig Geração e Transmissão S.A.'s stake

in Baguari Energia, now a wholly-owned subsidiary of Furnas. The amount paid to Cemig GT was R$ 421 million, including the respective

adjustments.

In the second stage, Baguari

Energia today acquired Baguari I from Neoenergia S.A. for R$ 454 million, already considering the respective adjustments.

The operations

reinforce Eletrobras' commitment to the rationalization of its equity interests and simplification of its structure as provided for in

its Strategic Plan, reinforcing its leadership in renewables.

Eduardo Haiama

Vice President of Finance

and Investor Relations

This document may contain estimates and

projections that are not statements of fact that have occurred in the past, but reflect the beliefs and expectations of our management

and may constitute estimates and projections about future events within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. The words "believes",

"may", "may", "estimate",

"continue", "anticipates", "intends",

"hopes"and similar ones aim to identify estimates that necessarily

involve risks and uncertainties, known or not. Known risks and uncertainties include, but are not limited to: general economic, regulatory,

political and commercial conditions in Brazil and abroad, variations in interest rates, inflation and the value of the Brazilian Real,

changes in volumes and patterns of consumer use of electricity, competitive conditions, our level of indebtedness, the possibility of

receiving payments related to our receivables, changes in rainfall and water levels in the reservoirs used to operate our hydroelectric

plants, our financing and capital investment plans, existing and future government regulations, and other risks described in our annual

report and other documents filed with the SEC. Estimates and projections speak only as of the date on which they were expressed and we

undertake no obligation to update any such estimates or projections due to the occurrence of new information or upcoming events. The future

results of the Companies' operations and initiatives may differ from current expectations and the investor should not rely solely on the

information contained herein. This material contains calculations that may not reflect accurate results due to rounding performed.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: October 17, 2023

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Eduardo Haiama

|

|

| |

Eduardo Haiama

Vice-President of Finance and Investor Relations |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

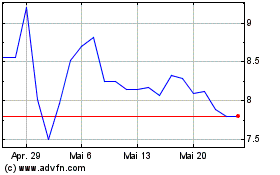

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

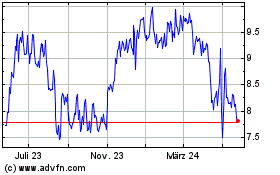

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024