Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

31 März 2023 - 12:08PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2023

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

ANNOUNCEMENT OF TRANSACTION WITH RELATED PARTY

CENTRAIS ELÉTRICAS BRASILEIRAS S/A

CNPJ: 00.001.180/0001-26 | NIRE: 3330034676-7

PUBLIC COMPANY

Centrais Elétricas Brasileiras

S/A (“Company” or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR &

EBR.B; LATIBEX: XELT.O & XELT.B) hereby in compliance with Annex F of CVM Resolution No. 80, dated March 29, 2022, informs its shareholders

and the market in general of the following related party transaction:

| Related Party Names |

Companhia de Geração e Transmissão de Energia Elétrica do Sul do Brasil (“CGT Eletrosul”) and Elos Foundation |

| Issuer Relationships |

CGT Eletrosul is a subsidiary of Eletrobras.

Elos Foundation is a Closed Supplementary

Pension Entity – EFPC, in which CGT Eletrosul participates as “Sponsor”, considering the Supplementary Pension Plans

offered to its employees and which are under the management of said Entity. |

| Date of the transaction |

03/20/2023

|

| Object of the Agreement |

Equation of the technical deficit of the

BD Elos/Eletrosul Plan, calculated on 12/31/2021, exclusively comprising the portion referring to CGT Eletrosul, as Sponsor of the aforementioned

Supplementary Pension Plan.

We clarify that said operation will not

have an impact on CGT Eletrosul's liabilities, since the actuarial deficit of the BD Elos/Eletrosul Plan is already provided for in the

Company's Financial Statements. |

| Main Terms and Conditions |

Transaction value: BRL 65,761,306.35 (sixty-five

million, seven hundred and sixty-one thousand, three hundred and six reais and thirty-five cents), on 12/31/2021. The amortization will

occur in 219 (two hundred and nineteen) monthly and consecutive installments, corrected by the Price Table, plus the annual interest rate

equivalent to 5.09% (five point zero nine percent) per year and updated monthly, as of the date basis, by the variation of the National

Consumer Price Index (INPC), published by the Brazilian Institute of Geography and Statistics (IBGE), or another index that may replace

it, applied with a lag of one month. It is important to emphasize that the value of the operation refers only to the responsibilities

of CGT Eletrosul, as Sponsor of the BD Elos/Eletrosul Plan, contributing, on an equal basis, alongside the Participants and Assisted,

in the proportion of 50% for each Party. Thus, the total amount of the calculation is BRL 131,728,329.15, with the Participants and Assisted

Members being liable for the amount of BRL 65,864,164.57. Fundação Elos will be responsible for R$ 102,858.22, as it is

also a Sponsor of the Plan.

|

This document may contain estimates

and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute

future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

| Detailed reasons why the Company's Management considers that the transaction observed commutative conditions or provides for adequate compensatory payment |

It should be clarified, initially, that the transaction

in question does not involve the payment of compensatory amounts or remuneration to the Related Party. This is a debt constitution operation,

the object of which is to transfer values from CGT Eletrosul to the BD Elos/Eletrosul Plan, managed by Elos Foundation, with the specific

objective of maintaining its economic and financial balance, considering the deficit result of the said Plan determined at the end of

the 2021 financial year, which requires, in accordance with the applicable legislation, the adoption of balancing measures, effective

until April 2023.

As for the commutativity of the operation, it should

be noted that this was attested by the technical team of CGT Eletrosul, considering that the agreed debt has costs compatible with the

Company's new funding from the market and adheres to the actuarial goal of the BD Elos/Eletrosul Plan. |

| Eventual participation of the counterparty, its partners or administrators in the decision process of the issuer's subsidiary regarding the transaction or the negotiation of the transaction as representatives of the Company, describing these interests. |

CGT Eletrosul participates in the management of Fundação

Elos through its representatives in the Deliberative Council and in the Executive Board of the Entity.

In the case of the Deliberative Council, it is composed

of 6 members, 3 of which are representatives of the Sponsors and 3 of the Participants and Assisted Members, who are elected among their

peers. As Elos Foundation is a multi-sponsored Entity, in which Engie, in addition to CGT Eletrosul, participate, the first Company has

2 vacancies in the Deliberative Council, while the second only 1, considering the equity and number of participants of each Pension Plan

Complement sponsored. The Presidency of the Deliberative Council is exercised by the representative of CGT Eletrosul, who has, in addition

to his vote, the casting vote. The Board's resolutions are taken by simple majority, considering the members present.

As for the Executive Board, it is composed of three

members, two representatives of the Sponsors and a representative elected by the Participants and Assisted. Currently, the representative

of CGT Eletrosul occupies the position of Financial/Administrative Director and the representative of Engie is the Superintendent Director.

The representative of the Participants and Assisted Persons is the Security Director, the technical area responsible for reporting the

solution plans within the scope of Fundação Elos. The deliberations of the Foundation's Executive Board are taken by simple

majority, considering its members present. |

Rio de Janeiro, March 30, 2023

Elvira Cavalcanti Presta

CFO and Investor Relations Officer

This document may contain estimates

and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute

future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: March 30, 2023

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

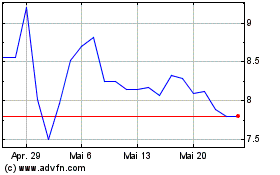

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

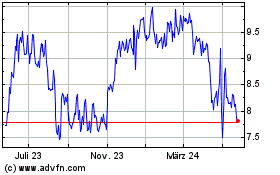

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024