Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

06 Juli 2022 - 12:03PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2022

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

– ELETROBRAS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant’s name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form

40-F ¨

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

Yes

¨ No x

ELETROBRAS ANNOUNCES THE CLOSING OF THE PUBLIC

OFFERING OF COMMON SHARES

Centrais Elétricas Brasileiras

S.A. – Eletrobras (“Company” or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR &

EBR.B; LATIBEX: XELT.O & XELT.B) informs its shareholders and the market that on the date hereof it closed its public offering of (i) 732,296,868 common shares issued by the Company

(“Shares”), including in the form of American Depositary Shares (“ADS”), evidenced by American Depositary

Receipts; and (ii) 69,801,516 Shares held by the selling shareholder BNDES Participações S.A. – BNDESPAR (the

“Selling Shareholder”), at the price of R$42.00 per Share, resulting in an aggregate sale price of R$33,688,132,128.00

(the “Global Offering”). The ADSs were offered and sold to the public at a price of U.S.$8.63 per ADS (including an ADS

issuance fee of U.S.$0.05 per ADS).

The Global Offering consisted of an international

offering outside Brazil and a concurrent public offering in Brazil. The international offering included a registered offering of ADSs

in the United States with the U.S. Securities and Exchange Commission under the U.S. Securities Act of 1933, as amended (the “International

Offering”). The Shares were offered directly and as ADS, each of which represented one common share.

The primary offering consisted of the distribution

of new Shares, including in the form of ADSs, issued by the Company. The secondary offering consisted of the distribution of Shares held

by the Selling Shareholder, in the relative proportion indicated in the definitive prospectus of the Global Offering.

Banco BTG Pactual S.A. – Cayman Branch,

BofA Securities, Inc., Goldman Sachs & Co. LLC, Itau BBA USA Securities, Inc., XP Investimentos Corretora de Câmbio, Títulos

e Valores Mobiliários S.A., Banco Bradesco BBI S.A., Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC, J.P. Morgan

Securities LLC and Morgan Stanley & Co. LLC served as international underwriters with respect to the International Offering of the

ADSs.

BTG Pactual US Capital, LLC, BofA Securities,

Inc., Goldman Sachs & Co. LLC, Itau BBA USA Securities, Inc., XP Investments US, LLC, Bradesco Securities, Inc., Citigroup Global

Markets Inc., Credit Suisse Securities (USA) LLC, J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, Inc. and Safra Securities

LLC acted as international placement agents with respect to the International Offering of Shares (not in the form of ADSs) sold outside

Brazil on behalf of the Brazilian underwriters (except for Caixa Econômica Federal).

Rio de Janeiro,

July 5, 2022.

| /s/ Elvira Cavalcanti Presta | |

| | Elvira Cavalcanti Presta | |

CFO and Investor Relations Officer

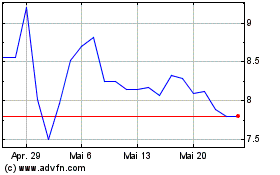

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

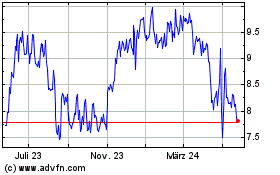

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024