SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February, 2022

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

ANNOUNCEMENT OF TRANSACTION WITH RELATED PARTY

CENTRAIS ELÉTRICAS

BRASILEIRAS S/A CNPJ: 00.001.180/0001-26 | NIRE: 533.0000085-9 PUBLIC COMPANY

Centrais Elétricas Brasileiras S/A (“Company”

or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B; LATIBEX: XELT.O & XELT.B) hereby in compliance

with Annex 30-XXXIII of CVM Instruction No. 552, dated October 9, 2014, informs its shareholders and the market in general of the following

related party transaction:

| Related Party Names |

Company: Centrais Elétricas Brasileiras S.A (“Eletrobras”);

Eletrobras Subsidiaries: (i) Furnas Centrais Elétricas (Furnas”);

and (ii) Companhia de Geração e Transmissão de Energia Elétrica do Sul do Brasil (“CGT Eletrosul”);

Beneficiary of the operation (Beneficiary): SPE HPP Teles Pires (“Teles

Pires”);

Creditor: National Bank for Economic and Social Development (“BNDES”) |

| Issuer Relationships |

Eletrobras

Subsidiaries: Companies under the direct control of the Company;

Beneficiary

of the operation: Company with equity interest held by designated Eletrobras Subsidiaries

and which has the Company as Guarantor of the financial operations signed with the Creditors;

Creditor:

Financial institution with the same controller as the Company, the Federal Government. |

| Date of the transaction |

12/08/2021.

|

| Object of the Agreement |

This is an amendment to the Financing Agreement with

the objective of formalizing the Beneficiary's adherence to the conditions of the Standstill program promoted by BNDES.

The aforementioned standstill program is among

the emergency measures made available by BNDES to the market since March 2020 to deal with the adverse financial effects of the coronavirus

pandemic. For the specific case of hydroelectric plants, the current standstill program is part not only of the pandemic context, but

also of facing the 2021 water crisis. |

This document may contain estimates and forecasts

that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute future

events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange

Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

| Main Terms and Conditions |

The temporary suspension of the payment of principal and interest

on the Financing Agreement will be formalized for 7 (seven) months, in the period between December 15, 2021 and June 15, 2022, without

changing the final term of the amortization period, the interest rate and the final term of the Agreement. The suspended installments

will be capitalized to the debit balance.

Taking as a reference the base date of the most recent financial

statement (09/30/2021), the portion of the debt balance temporarily suspended regarding the amount guaranteed by the Eletrobras Group

in the Beneficiary's financing is approximately R$ 571 million.

Other Relevant Terms and Conditions:

I.

In the event of direct and/or mixed Project Finance operations, which have conditions for issuing

a statement on the physical conclusion and achievement of the Project's economic-financial performance and/or for the exemption of personal

guarantees, it will be observed, cumulatively:

a.

The such conditions will not be considered fulfilled, by BNDES and/or Financial Agent, until the

year following the final term of suspension of payments referred to in this Resolution; e

b.

The period of suspension of payments shall be expunged from the analysis as to compliance with such

conditions

II.

The Beneficiary will not be considered in default if it does not reach the economic and financial

indicators contractually established for the year(s) in which payments are suspended;

III.

The Benefeciary to whom the aforementioned suspension of payments is granted will be prohibited from:

a.

The distribution of dividends and interest on equity for the years in which there is a suspended

portion(s) above the minimum mandatory under the terms of Law No. 6,404/1976 and, in the event of normative omission and the corporate

act, the distribution of profits and interest on equity related to the years in which there is a suspended portion(s) above 25% of the

company's adjusted net income; Such prohibition will be in force until the end of the fiscal year immediately following the last fiscal

year in which there is a suspended installment(s);

b.

The distribution of dividends accrued under the heading of the Balance Sheet as a reserve of any

kind and interest on equity related to years prior to those in which there is suspended installment(s), during the years in which there

is suspended installment(s);

c.

The reduction of its share capital, during the years in which there is a suspended portion(s); and

d.

The payment of loans to shareholders or other companies of its Economic Group, during the years in

which there is a suspended installment(s).

|

This document may contain estimates and forecasts

that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute future

events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange

Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

| Detailed reasons why the Company's Management considers that the transaction observed commutative conditions or provides for adequate compensatory payment |

The standstill program is promoted by a state-controlled bank,

with the intention of supporting the country's economy in the scenario of water scarcity and uncertainties. It is observed that it is

offered under the same conditions to all borrowers, regardless of whether they are related parties, state or private, as long as they

meet the criteria established by the bank.

From the Beneficiary's point of view, adhesion presents commutative

conditions, as it preserves the contractual conditions currently established and, at the same time, preventively mitigates potential adverse

financial impacts arising from the water context.

From the perspective of the Company and its Subsidiaries, the

guarantor and shareholders of the Beneficiary, respectively, the mitigation of risks for this company within the scope of the standstill

program is a measure considered relevant, given the roles exercised by the Company and its Subsidiaries vis-à-vis the Beneficiary

in their financing contracts. |

| Eventual participation of the counterparty, its partners or administrators in the decision process of the issuer's subsidiary regarding the transaction or the negotiation of the transaction as representatives of the Company, describing these interests. |

The decision within the scope of the Company was established based on technical and financial assessments that supported the execution of the contractual amendment within the deadline, with this decision-making process being processed independently and in the appropriate levels of the Company's Governance. |

Rio de Janeiro, February 16, 2022

Elvira Cavalcanti Presta

CFO and Investor Relations Officer

This document may contain estimates and forecasts

that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute future

events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange

Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: February 16, 2022

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

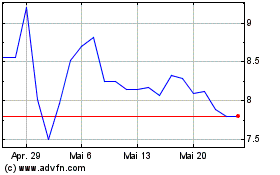

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

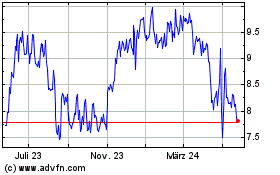

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024