SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2021

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

MARKET ANNOUNCEMENT

CENTRAIS

ELÉTRICAS BRASILEIRAS S/A CNPJ: 00.001.180/0001-26 | NIRE: 533.0000085-9 PUBLIC COMPANY

Centrais Elétricas Brasileiras S/A

(“Company” or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B; LATIBEX: XELT.O & XELT.B)

hereby informs its shareholders and the market in general, in compliance with the provisions of the Resolution of the Brazilian Securities

Commission ("CVM") No. 44, of August 23, 2021, that the Board of Directors of Eletrobras agreed with the adhesion by Specific

Purpose Companies (“SPEs”) from the hydroelectric generation, in which the Company and/or its Subsidiaries have a shareholding,

to the Stand Still program, promoted by the Banco Nacional de Desenvolvimento Social (“BNDES”), focused on hydroelectric projects

with installed capacity above 50 MW. This program was announced by BNDES in September 2021 and is included among the emergency measures

made available to the market to face the current water scenario.

The consent to the adhesion granted by the Company

comprises the SPEs Norte Energia SA, Santo Antônio Energia SA, Energia Sustentável do Brasil SA (UHE Jirau), Companhia Hidrelétrica

Teles Pires, Companhia Energética SINOP SA and Empresa de Energia São Manoel SA, which may through of this program, obtain

the temporary suspension of the payment of principal and interest under the direct and/or indirect financing contracts (onlending) of

BNDES for up to 7 months, covering, according to the rules of the program, a period that is included between the September 2021 and June

2022.

The table below, shows the SPEs for which consent

was granted to join this program, indicating the debit balances guaranteed by the Eletrobras Companies in the contracts involved in this

operation, as well as the number of contracts per SPE:

This measure will contribute the SPEs to preserve

liquidity, given the water crisis scenario and possible negative consequences in the electricity sector, mainly on default and Generation

Scaling Factor (GSF) effects, which alters the physical guarantee under the Energy Reallocation Mechanism (MRE).

It should be noted that this operation will

not change the interest rates of the contracts, in addition to the fact that, during the period of suspension of payments, the interest

on the financing will be incorporated into the debt balance of the contracts,

with the maturities of these debts remaining unchanged.

This document may contain estimates

and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute

future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

The Company will keep the market informed about

the matter subject on this Announcement.

Rio de Janeiro, October 22, 2021

Elvira Cavalcanti Presta

CFO and Investor Relations Officer

This document may contain estimates

and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute

future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: October 22, 2021

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

|

|

|

|

|

|

By:

|

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

|

|

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

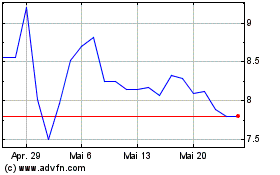

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

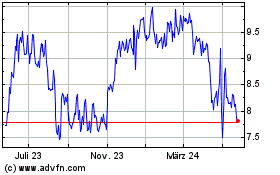

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024