0000033002false00000330022024-06-172024-06-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): June 17, 2024 |

ENNIS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Texas |

1-5807 |

75-0256410 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2441 Presidential Pkwy. |

|

Midlothian, Texas |

|

76065 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 972 775-9801 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $2.50 per share |

|

EBF |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On June 17, 2024, Ennis, Inc. issued a press release announcing its financial results for the three months ended May 31, 2024. A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Ennis, Inc. |

|

|

|

|

Date: |

June17, 2024 |

By: |

/s/ Vera Burnett |

|

|

|

Vera Burnett

Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

ENNIS, INC. REPORTS RESULTS FOR THE

QUARTER ENDED MAY 31, 2024 AND DECLARES QUARTERLY DIVIDEND

Midlothian, TX. June 17, 2024 -- Ennis, Inc. (the “Company”), (NYSE: EBF), today reported financial results for the first quarter ended May 31, 2024. Highlights include:

•Revenues were $103.1 million for the quarter compared to $111.3 million for the same quarter last year, a decrease of $8.2 million or 7.4%.

•Earnings per diluted share for the current quarter were $0.41 compared to $0.45 for the comparative quarter last year.

•Our gross profit margin for the quarter was 30.0% compared to 30.6% for the comparative quarter last year.

Financial Overview

The Company’s revenues for the first quarter ended May 31, 2024 were $103.1 million compared to $111.3 million for the same quarter last year, a decrease of $8.2 million, or 7.4%. Gross profits totaled $30.9 million for a gross profit margin of 30.0%, as compared to $34.0 million, or 30.6%, for the same quarter last year. Net earnings for the quarter were $10.7 million, or $0.41 per diluted share, as compared to $11.6 million, or $0.45 per diluted share for the same quarter last year.

Keith Walters, Chairman, Chief Executive Officer and President, commented by stating, “Our results for the quarter were within our expectations given softening demand amidst an uncertain economic environment. While we experienced a decline compared to the first quarter of our previous fiscal year, our gross profit margin showed a 160-basis point increase over the previous quarter as revenues, profits and earnings per share all increased this quarter. Our EBITDA increased from $18.1 million last quarter to $19.0 million this quarter. While revenues have decreased compared to the same quarter last year, our EBITDA as a percentage of sales has held steady at 18.4%.

"In the first quarter we completed the integration of our ERP system at two of our recent acquisitions and are beginning to see improved performance. This along with our disciplined cost management and pricing strategies contributed to our improved margins over the sequential quarter, despite continued pressure from soft market conditions with increasingly competitive pricing.

"We believe we have one of the strongest balance sheets in the industry, with no debt and significant cash. During the quarter, with cash on hand we repurchased 91,883 shares of our common stock in the open market at an average price of $19.79 per share and increased our investment in U.S. government treasury bills $2.6 million while we continue to pursue greater returns through additional acquisition opportunities. Our profitability and strong financial condition will allow us to continue operations and fund acquisitions without incurring debt. Given those strengths, we also anticipate timely access to credit should larger acquisition opportunities materialize. We continue to focus on delivering profitability and returns to our shareholders."

Reconciliation Non-GAAP Measure

To provide important supplemental information to both management and investors regarding financial and business trends used in assessing its results of operations, from time to time the Company reports the non-GAAP financial measure of EBITDA (EBITDA is calculated as net earnings before interest expense, tax expense, depreciation, and amortization). The Company may also report adjusted gross profit margin, adjusted earnings and adjusted diluted earnings per share, each of which is a non-GAAP financial measure.

Management believes that these non-GAAP financial measures provide useful information to investors as a supplement to reported GAAP financial information. Management reviews these non-GAAP financial measures on a regular basis and uses them to evaluate and manage the performance of the Company’s operations. Other companies may calculate non-GAAP financial measures differently than the Company, which limits the usefulness of the Company’s non-GAAP measures for comparison with these other companies. While management believes the Company’s non-GAAP financial measures are useful in evaluating the Company, when this information is reported it should be considered as supplemental in nature and not as a substitute or an alternative for, or superior to, the related financial information prepared in accordance with GAAP. These measures should be evaluated only in conjunction with the Company’s comparable GAAP financial measures.

The following table reconciles EBITDA, a non-GAAP financial measure, for the three-months ended May 31, 2024 and 2023 to the most comparable GAAP measure, net earnings (dollars in thousands).

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

May 31, |

|

|

May 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

Net earnings |

|

$ |

10,687 |

|

|

$ |

11,635 |

|

Income tax expense |

|

|

4,054 |

|

|

|

4,525 |

|

Interest expense |

|

|

— |

|

|

|

— |

|

Depreciation and amortization |

|

|

4,243 |

|

|

|

4,344 |

|

EBITDA (non-GAAP) |

|

$ |

18,984 |

|

|

$ |

20,504 |

|

% of sales |

|

|

18.4 |

% |

|

|

18.4 |

% |

In Other News

On June 14, 2024 the Board of Directors declared a quarterly cash dividend of 25.0 cents per share on the Company’s common stock. The dividend is payable on August 5, 2024 to shareholders of record on July 5, 2024.

About Ennis

Founded in 1909, the Company is one of the largest private-label printed business product suppliers in the United States. Headquartered in Midlothian, Texas, Ennis has production and distribution facilities strategically located throughout the USA to serve the Company’s national network of distributors. Ennis manufactures and sells business forms, other printed business products, printed and electronic media, integrated forms and labels, presentation products, flex-o-graphic printing, advertising specialties, internal bank forms, plastic cards, secure and negotiable documents, specialty packaging, direct mail, envelopes, tags and labels and other custom products. For more information, visit www.ennis.com.

Safe Harbor under the Private Securities Litigation Reform Act of 1995

Certain statements that may be contained in this press release that are not historical facts are forward-looking statements that involve a number of known and unknown risks, uncertainties and other factors that could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievement expressed or implied by such forward-looking statements. The words “anticipate,” “preliminary,” “expect,” “believe,” “intend” and similar expressions identify forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for such forward-looking statements. In order to comply with the terms of the safe harbor, the Company notes that a variety of factors could cause actual results and experience to differ materially from the anticipated results or other expectations expressed in such forward-looking statements. These statements are subject to numerous

uncertainties, which include, but are not limited to, the erosion of demand for our printer business documents as the result of digital technologies, risk or uncertainties related to the completion and integration of acquisitions, and the limited number of available suppliers and variability in the prices of paper and other raw materials. Other important information regarding factors that may affect the Company’s future performance is included in the public reports that the Company files with the Securities and Exchange Commission, including but not limited to, its Annual Report on Form 10-K for the fiscal year ending February 29, 2024. The Company does not undertake, and hereby disclaims, any duty or obligation to update or otherwise revise any forward-looking statements to reflect events or circumstances occurring after the date of this release, or to reflect the occurrence of unanticipated events, although its situation and circumstances may change in the future. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The inclusion of any statement in this release does not constitute an admission by the Company or any other person that the events or circumstances described in such statement are material.

For Further Information Contact:

Mr. Keith S. Walters, Chairman, Chief Executive Officer and President

Ms. Vera Burnett, Chief Financial Officer

Mr. Dan Gus, General Counsel and Secretary

Ennis, Inc.

2441 Presidential Parkway

Midlothian, Texas 76065

Phone: (972) 775-9801

Fax: (972) 775-9820

www.ennis.com

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Condensed Consolidated Operating Results |

|

May 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

Net Sales |

|

$ |

103,108 |

|

|

$ |

111,294 |

|

Cost of goods sold |

|

|

72,204 |

|

|

|

77,253 |

|

Gross profit |

|

|

30,904 |

|

|

|

34,041 |

|

Selling, general and administrative |

|

|

17,170 |

|

|

|

18,343 |

|

Loss (gain) from disposal of assets |

|

|

4 |

|

|

|

— |

|

Income from operations |

|

|

13,730 |

|

|

|

15,698 |

|

Other income |

|

|

1,011 |

|

|

|

462 |

|

Earnings before income taxes |

|

|

14,741 |

|

|

|

16,160 |

|

Income tax expense |

|

|

4,054 |

|

|

|

4,525 |

|

Net earnings |

|

$ |

10,687 |

|

|

$ |

11,635 |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

Basic |

|

|

26,156,928 |

|

|

|

25,839,651 |

|

Diluted |

|

|

26,279,646 |

|

|

|

25,979,533 |

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

Basic |

|

$ |

0.41 |

|

|

$ |

0.45 |

|

Diluted |

|

$ |

0.41 |

|

|

$ |

0.45 |

|

|

|

|

|

|

|

|

|

|

May 31, |

|

|

February 29, |

|

Condensed Consolidated Balance Sheet Information |

|

|

2024 |

|

|

|

2024 |

|

Assets |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash |

|

$ |

91,363 |

|

|

$ |

81,597 |

|

Short-term investments |

|

|

32,326 |

|

|

|

29,325 |

|

Accounts receivable, net |

|

|

43,909 |

|

|

|

47,209 |

|

Inventories, net |

|

|

41,003 |

|

|

|

40,037 |

|

Prepaid expenses |

|

|

2,537 |

|

|

|

3,214 |

|

Total Current Assets |

|

|

211,138 |

|

|

|

201,382 |

|

Property, plant & equipment, net |

|

|

55,106 |

|

|

|

54,965 |

|

Operating lease right-of-use assets, net |

|

|

8,836 |

|

|

|

9,827 |

|

Goodwill and intangible assets, net |

|

|

130,747 |

|

|

|

132,676 |

|

Other assets |

|

|

340 |

|

|

|

340 |

|

Total Assets |

|

$ |

406,167 |

|

|

$ |

399,190 |

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

15,542 |

|

|

$ |

11,846 |

|

Accrued expenses |

|

|

17,176 |

|

|

|

17,541 |

|

Current portion of operating lease liabilities |

|

|

4,075 |

|

|

|

4,414 |

|

Total Current Liabilities |

|

|

36,793 |

|

|

|

33,801 |

|

Other non-current liabilities |

|

|

15,001 |

|

|

|

15,548 |

|

Total liabilities |

|

|

51,794 |

|

|

|

49,349 |

|

Shareholders' Equity |

|

|

354,373 |

|

|

|

349,841 |

|

Total Liabilities and Shareholders' Equity |

|

$ |

406,167 |

|

|

$ |

399,190 |

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

May 31, |

|

Condensed Consolidated Cash Flow Information |

|

|

2024 |

|

|

|

2023 |

|

Cash provided by operating activities |

|

$ |

23,105 |

|

|

$ |

21,726 |

|

Cash used in investing activities |

|

|

(5,052 |

) |

|

|

(7,129 |

) |

Cash used in financing activities |

|

|

(8,287 |

) |

|

|

(6,459 |

) |

Change in cash |

|

|

9,766 |

|

|

|

8,138 |

|

Cash at beginning of period |

|

|

81,597 |

|

|

|

93,968 |

|

Cash at end of period |

|

$ |

91,363 |

|

|

$ |

102,106 |

|

v3.24.1.1.u2

Document And Entity Information

|

Jun. 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 17, 2024

|

| Entity Registrant Name |

ENNIS, INC.

|

| Entity Central Index Key |

0000033002

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

1-5807

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Tax Identification Number |

75-0256410

|

| Entity Address, Address Line One |

2441 Presidential Pkwy.

|

| Entity Address, City or Town |

Midlothian

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

76065

|

| City Area Code |

972

|

| Local Phone Number |

775-9801

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $2.50 per share

|

| Trading Symbol |

EBF

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

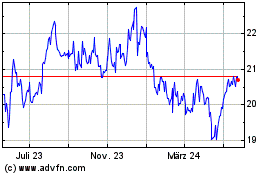

Ennis (NYSE:EBF)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

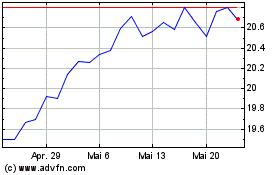

Ennis (NYSE:EBF)

Historical Stock Chart

Von Dez 2023 bis Dez 2024