Filed pursuant to Rule 424(b)(3)

Registration No. 333-252515

PROSPECTUS SUPPLEMENT NO. 54

(to Prospectus dated February 16, 2021)

Danimer Scientific, Inc.

Up to 810,899 Shares of Common Stock

Up to 406,981 Shares of Common Stock Issuable Upon Exercise of Warrants and Options

This prospectus supplement supplements the prospectus dated February 16, 2021 (as supplemented or amended from time to time, the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-252515). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission on December 31, 2024 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement. All references to a number of shares of Common Stock in this prospectus supplement have been adjusted to reflect a 1-for-40 reverse stock split (the “Reverse Stock Split”) that was made effective as of 5:01 p.m. Eastern time on November 12, 2024. The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of up to 406,981 shares of our Class A common stock, $0.0001 par value per share (“Common Stock”), which consists of (i) up to 150,000 shares of Common Stock that are issuable upon the exercise of 6,000,000 warrants (the “Private Warrants”) originally issued in a private placement in connection with the initial public offering of Live Oak Acquisition Corp., our predecessor company (“Live Oak”), (ii) up to 250,000 shares of Common Stock that are issuable upon the exercise of 10,000,000 warrants (the “Public Warrants” and, together with the Private Warrants, the “Warrants”) originally issued in the initial public offering of Live Oak and (iii) up to 6,981 shares of Common Stock issuable upon exercise of Non-Plan Legacy Danimer Options. We will receive the proceeds from any exercise of any Warrants for cash.

The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”), or their permitted transferees, of (i) up to 810,899 shares of Common Stock (including up to 150,000 shares of Common Stock that may be issued upon exercise of the Private Warrants) and (ii) up to 6,000,000 Private Warrants. We will not receive any proceeds from the sale of shares of Common Stock or the Private Warrants by the Selling Securityholders pursuant to the Prospectus and this prospectus supplement.

Our registration of the securities covered by the Prospectus and this prospectus supplement does not mean that the Selling Securityholders will offer or sell any of the shares. The Selling Securityholders may sell the shares of Common Stock covered by the Prospectus and this prospectus supplement in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell the shares in the section entitled “Plan of Distribution.”

Our Common Stock is listed on The New York Stock Exchange under the symbol “DNMR”. On December 30, 2024, the closing price of our Common Stock was $4.13. Our Public Warrants were previously traded on The New York Stock Exchange under the symbol “DNMR WS”; however, the Public Warrants ceased trading on the New York Stock Exchange and were delisted following their redemption.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

See the section entitled “Risk Factors” beginning on page 4 of the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December 31, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 30, 2024 |

DANIMER SCIENTIFIC, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39280 |

84-1924518 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

140 Industrial Boulevard |

|

Bainbridge, Georgia |

|

39817 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 229 243-7075 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common stock, $0.0001 par value per share |

|

DNMR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On December 30, 2024, the New York Stock Exchange (“NYSE”) notified Danimer Scientific Inc. (“Danimer” or the “Company”) that it has determined to commence proceedings to delist the Company’s Class A common stock, par value $0.0001 per share (the “Common Stock”), as a result of the Company’s non-compliance with Rule 802.01B of the NYSE Listed Company Manual that requires listing companies to maintain an average global market capitalization of at least $15 million over a period of 30 consecutive trading days. Trading in the Common Stock on the NYSE was suspended after market close on December 30, 2024. The Company is currently assessing whether to appeal the NYSE’s delisting determination. If the Company does not appeal, or unsuccessfully appeals, such determination, the Company expects the NYSE will file a Form 25 with the Securities and Exchange (the “SEC”), which would result in the delisting of the Company’s Class A Common Stock from the NYSE on the tenth day after the Form 25 is filed.

As a result of the suspension in trading and delisting process pending any appeal, the Company anticipates that the Common Stock will begin trading on the OTCQX Market (the “OTCQX Market”), the highest market tier operated by the OTC Market Group, Inc. on December 31, 2024 under its current symbol "DNMR".

The Company can provide no assurance that the Common Stock will continue to trade on this market, whether broker-dealers will continue to provide public quotes of the Common Stock on this market, or whether the trading volume of the Common Stock will be sufficient to provide for an efficient trading market for existing and potential holders of the Common Stock.

The transition to the OTCQX Market is not expected to affect the Company’s business operations or its current SEC reporting obligations.

Item 7.01. Regulation FD Disclosure.

Press Release

On December 31, 2024, the Company issued a press release in connection with the delisting notice of its Common Stock from the NYSE. A copy of the press release is attached to this Current Report as Exhibit 99.1 and is incorporated herein by reference.

Cautionary Statement Concerning Forward-Looking Statements

Statements in this Current Report that are not historical are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, statements regarding the delisting of the Common Stock from the NYSE and trading in the Common Stock on the OTCQX Market, and the impact on the Company’s business operations. Forward-looking statements are based on the Company’s current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict, and significant contingencies, many of which are beyond the Company’s control, that could cause actual results to differ materially and adversely from any of these forward-looking statements. The Company cautions that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements. Potential risks and uncertainties that could cause the actual results of operations or financial condition of the Company to differ materially from those expressed or implied by forward-looking statements in this release include, but are not limited to: potential risks associated with trading on the OTCQX Market, including liquidity constraints and limited regulatory oversight, risks related to our indebtedness may restrict our current and future operations, and we may not be able to comply with the covenants in our credit facilities or refinance or amend our credit facilities on favorable terms, or at all; there is substantial doubt regarding our ability to continue as a going concern; and the other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission, (the “SEC”) on March 29, 2024, as updated by our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2024, filed with the SEC on November 19, 2024 and our other filings with the SEC. These factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this Current Report on Form 8-K. Any such forward-looking statements represent management’s estimates as of the date of this Current Report on Form 8-K. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits.

|

|

|

|

|

|

Exhibit No. |

|

Description |

99.1 |

|

Press Release, dated December 31, 2024 |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Danimer Scientific, Inc |

|

|

|

|

Date: |

December 31, 2024 |

By: |

/s/ Stephen A. Martin |

|

|

|

Stephen A. Martin

Chief Legal Officer and Corporate Secretary |

Danimer Scientific Announces Common Stock Expected to Begin Trading Promptly on OTCQX Marketplace

–Dividend warrants continue to trade on OTCQX marketplace under “DNMRW”–

BAINBRIDGE, GA – December 31, 2024 – Danimer Scientific, Inc. (NYSE: DNMR) (“Danimer” or the “Company”), a leading next generation bioplastics company focused on the development and production of biodegradable materials, today announced that it received notice the New York Stock Exchange (“NYSE”) suspended trading of its common stock on the NYSE effective immediately and started the process to delist its common stock from the NYSE. The start of the delisting process follows the NYSE’s determination under Rule 802.01B of the NYSE Listed Company Manual that the Company did not meet the continued listing standard that requires listed companies to maintain an average global market capitalization of at least $15 million over a period of 30 consecutive trading days.

The Company is assessing whether to appeal this determination and expects trading of its common stock will resume on the OTCQX market under its ticker symbol “DNMR” on December 31, 2024.

The delisting process does not affect Danimer’s business operations. The Company will remain listed on the NYSE pending a possible appeal and completion of all applicable NYSE procedures.

About Danimer Scientific

Danimer is a pioneer in creating more sustainable, more natural ways to make plastic products. For more than a decade, its renewable and sustainable biopolymers have helped create plastic products that are biodegradable and compostable and return to nature instead of polluting our lands and waters. Danimer’s technology can be found in a vast array of plastic end-products that people use every day. Applications for its biopolymers include additives, aqueous coatings, fibers, filaments, films and injection-molded articles, among others. Danimer holds more than 480 granted patents and pending patent applications in more than 20 countries for a range of manufacturing processes and biopolymer formulations. For more information, visit https://danimerscientific.com.

Forward‐Looking Statements

Please note that this press release may use words such as “appears,” “anticipates,” “believes,” “plans,” “expects,” “intends,” “future,” and similar expressions which constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are made based on expectations and beliefs concerning future events impacting the Company and therefore involve a number of risks and uncertainties. The Company cautions that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements. Potential risks and uncertainties that could cause the actual results of operations or financial condition of the Company to differ materially from those expressed or implied by forward-looking statements in this release include, but are not limited to, a determination by the Company regarding an appeal of the NYSE decision to commence delisting proceedings, the outcome of third party entities to transition the Company’s Class A Common Stock to the OTC Market Group platform; whether an over-the-counter trading market for our common stock will develop or persist; our ability to meet any requirements of any stock exchange for listing our securities in the future; the overall level of consumer demand on our products; our ability to maintain sufficient liquidity by realizing near-term revenue growth and related cash returns and preserving cash until such cash returns, if any are obtained; the effect on our borrowing facilities of an event of default, including if an Annual Report on Form 10-K contains a Report of Independent Registered Public Accounting Firm that includes disclosure regarding going concern; our ability to maintain our exchange listing; general economic conditions and other factors affecting consumer confidence, preferences, and behavior; disruption and volatility in the global currency, capital, and credit markets; the financial strength of the Company's customers; the Company's ability to

implement its business strategy, including, but not limited to, its ability to expand its production facilities and plants to meet customer demand for its products and the timing thereof; risks relating to the uncertainty of the projected financial information with respect to the Company; the ability of the Company to execute and integrate acquisitions; changes in governmental regulation, legislation or public opinion relating to our products; the Company’s exposure to product liability or product warranty claims and other loss contingencies; the outcomes of any litigation matters; the impact on our business, operations and financial results from the ongoing conflicts in Ukraine and the Middle East; the impact that global climate change trends may have on the Company and its suppliers and customers; the Company's ability to protect patents, trademarks and other intellectual property rights; any breaches of, or interruptions in, our information systems; the ability of our information technology systems or information security systems to operate effectively, including as a result of security breaches, viruses, hackers, malware, natural disasters, vendor business interruptions or other causes; our ability to properly maintain, protect, repair or upgrade our information technology systems or information security systems, or problems with our transitioning to upgraded or replacement systems; the impact of adverse publicity about the Company and/or its brands, including without limitation, through social media or in connection with brand damaging events and/or public perception; fluctuations in the price, availability and quality of raw materials and contracted products as well as foreign currency fluctuations; our ability to utilize potential net operating loss carryforwards; and changes in tax laws and liabilities, tariffs, legal, regulatory, political and economic risks. More information on potential factors that could affect the Company's financial results is included from time to time in the Company's public reports filed with the Securities and Exchange Commission, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. All forward-looking statements included in this press release are based upon information available to the Company as of the date of this press release and speak only as of the date hereof. The Company assumes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this press release.

Contact:

Investor Relations and Media

Blake Chamblee

Phone: 770-337-6570

ir@danimer.com

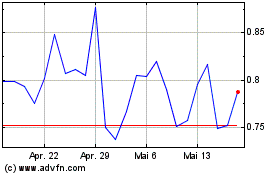

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025