UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[x] Definitive Additional Materials

[ ] Soliciting Material Under Rule 14a-12

DANIMER SCIENTIFIC, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

[x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

DANIMER SCIENTIFIC, INC.

140 Industrial Boulevard

Bainbridge, GA 39817

SUPPLEMENT TO THE PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

July 9, 2024

This proxy statement supplement, dated June 7, 2024 (this “Supplement”), amends and supplements the definitive proxy statement on Schedule 14A (the “Proxy Statement”) filed by Danimer Scientific, Inc. (the “Company”) with the Securities and Exchange Commission (the “SEC”) on May 30, 2024 and made available to the Company’s stockholders in connection with the Company’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually via live webcast on July 9, 2024, at 11:00 a.m., Eastern Time. Capitalized terms used in this Supplement and not otherwise defined have the meanings ascribed to them in the Proxy Statement.

We are providing this Supplement to update the voting standard for, and effects of abstentions and “broker non-votes” (if any) on, Proposal 3: an amendment and restatement of the Company’s Fourth Amended and Restated Certificate of Incorporation to increase the authorized number of shares of the Company’s Class A common stock, par value $0.0001 per share (“Proposal 3” or the “Share Increase Proposal”) in accordance with Section 242(d)(2) of the Delaware General Corporation Law and to update the information with respect to the effect of the “broker non-votes” rules to Proposal 3 (Share Increase Proposal).

We are also providing this Supplement to disclose that the Company has retained Morrow Sodali to act as a proxy solicitor for the Annual Meeting.

This Supplement SHOULD BE READ together with the Proxy Statement.

Voting Standard for and Treatment of Broker Non-Votes with Respect to the Share Increase Proposal

Effective August 1, 2023, Section 242(d)(2) was added to the Delaware General Corporation Law (the “DGCL Amendment”), which changed the voting standard to amend a Delaware corporation’s certificate of incorporation to increase the number of authorized shares of a class of stock listed on a national securities exchange immediately before and after the amendment became effective from a majority of the outstanding shares entitled to vote thereon to a majority of the votes cast for the amendment by stockholders entitled to vote thereon (i.e., votes cast “FOR” must exceed votes cast “AGAINST”). In light of the DGCL Amendment, the affirmative vote of the majority of votes cast thereon will be required for the approval of Proposal 3 (Share Increase Proposal). Stockholders may vote “FOR” or “AGAINST” Proposal 3, or stockholders may abstain from voting. If you elect to abstain on Proposal 3, the abstention will have no effect on the vote on Proposal 3, as abstentions are not votes cast.

Subsequent to making the Proxy Statement available to the Company’s stockholders on May 30, 2024, the New York Stock Exchange (the “NYSE”) determined that Proposal 3 (Share Increase Proposal) in the Proxy Statement is a discretionary or “routine” matter under NYSE rules. The “routine” designation permits brokerage firms, banks, dealers, custodians or other similar organizations acting as nominee (each, a “Broker”) to exercise discretionary voting authority with respect to such a proposal. Accordingly, if you do not instruct your Broker on how to vote your shares on Proposal 3, your Broker will be permitted to vote your shares in its discretion on Proposal 3. Due to the NYSE’s determination that Proposal 3 is a “routine” matter, the Company does not expect any “broker non-votes” in connection with Proposal 3. However, broker non-votes, if any, with respect to Proposal 3 would have no effect on the results because a broker non-vote is not a vote cast.

Accordingly, the Company is hereby revising the following information in the Proxy Statement:

1. The section of the Proxy Statement entitled “Quorum; Required Votes” on pages 2-3 is deleted and replaced as follows:

Quorum; Required Votes

The presence, virtually or by duly authorized proxy, of the holders of a majority of the outstanding shares of Common Stock entitled to vote constitutes a quorum for this Meeting.

Abstentions and “broker non-votes” are counted as present for purposes of determining whether a quorum exists. A “broker non-vote” occurs when a nominee such as a bank, broker or other agent holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner.

Under the rules of various national and regional securities exchanges, nominees have such discretion to vote absent instructions with respect to certain “routine” matters, such as Proposal 2, the ratification of independent auditors, and Proposal 3, an amendment and restatement of the Company’s Fourth Amended and Restated Certificate of Incorporation to increase the authorized number of shares

of Common Stock, but not with respect to matters that are considered “non-routine,” such as the election of directors or approval of an amendment to a long-term incentive plan to increase the number of shares reserved for equity awards made thereunder. Accordingly, without voting instructions from you, your broker will not be able to vote your shares on Proposals 1 and 4, which are non-routine matters.

Each share of Common Stock entitles the holder to one vote on each matter presented for stockholder action. The affirmative vote of a plurality of the votes cast virtually at the Meeting or represented by proxy at the Meeting is necessary for the election of each of the eleven nominees named in this Proxy Statement (Proposal 1). The affirmative vote of a majority of the shares of Common Stock present virtually at the Meeting or represented by proxy at the Meeting is necessary for each of the following: the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024 (Proposal 2); and approval of the increase in the number of shares of Common Stock reserved for issuance under the Danimer Scientific, Inc. 2020 Long-Term Incentive Plan (Proposal 4). The affirmative vote of the majority of votes cast thereon virtually at the Meeting or represented by proxy at the Meeting will be required for the approval of the amendment and restatement of the Company’s Fourth Amended and Restated Certificate of Incorporation to increase the authorized number of shares of Common Stock (Proposal 3).

Since the affirmative vote of a plurality of the votes cast virtually at the Meeting or represented by proxy at the Meeting is required for Proposal 1, abstentions and “broker non-votes” will have no effect on the outcome of such election. Since the affirmative vote of a majority of the shares of Common Stock present virtually at the Meeting or represented by proxy at the Meeting is necessary for the approval of Proposals 2 and 4, abstentions will have the same effect as a negative vote, but “broker non-votes” will have no effect on the outcome of the voting for Proposals 2 and 4. Since the affirmative vote of a majority of the shares of Common Stock cast thereon virtually at the Meeting or represented by proxy at the Meeting is necessary for the approval of Proposal 3, abstentions and “broker non-votes” will have no effect on Proposal 3, as neither abstentions nor “broker non-votes” are votes cast.

We will appoint an inspector of elections to tabulate votes at the Meeting.

2. The section of the Proxy Statement under Proposal 3 (Share Increase Proposal) entitled “Vote Required” on page 32 is deleted and replaced as follows:

Vote Required

The affirmative vote of a majority of the shares of Common Stock cast virtually at the Meeting or represented by proxy at the Meeting on the Share Increase Proposal is required to approve the Share Increase Proposal. As a result, neither abstentions nor “broker non-votes” will have an effect on the outcome of this proposal as neither abstentions nor “broker non-votes” are votes cast. Your vote is therefore extremely important.

Appointment of Proxy Solicitor

On June 6, 2024, the Company retained Morrow Sodali LLC (“Morrow Sodali”) to assist in soliciting proxies on our behalf in connection with the Annual Meeting. We have agreed to pay Morrow Sodali a fixed fee of $15,000, plus fees for soliciting stockholders by telephone, if such solicitations are undertaken, and reasonable costs and expenses, for these services. We will bear all proxy solicitation costs. If stockholders need assistance with casting or changing their vote, they should contact Morrow Sodali at 1-800-662-5200.

* * *

This Supplement is being filed with the SEC on, and first made available to stockholders on or about, June 7, 2024. No other changes have been made to the Proxy Statement or to the matters to be considered at the Annual Meeting, and this Supplement does not otherwise supplement, amend or affect the Proxy Statement. From and after the date of this Supplement, any references to the “Proxy Statement” are to the Proxy Statement as supplemented by this Supplement. This Supplement should be read in conjunction with the Proxy Statement and the other proxy materials previously made available to stockholders in connection with the Annual Meeting. If you have already voted your shares, you do not need to vote again unless you would like to change or revoke your prior vote on any proposal.

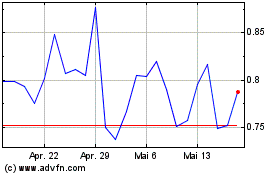

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

Von Jun 2023 bis Jun 2024