0001779020false00017790202024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 09, 2024 |

DANIMER SCIENTIFIC, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39280 |

84-1924518 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

140 Industrial Boulevard |

|

Bainbridge, Georgia |

|

39817 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 229 243-7075 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common stock, $0.0001 par value per share |

|

DNMR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On May 9, 2024, Danimer Scientific, Inc. (the “Company”) adopted and established the Danimer Scientific Executive Severance and Retention Plan (the “S&R Plan”), which provides for the payment of severance compensation and other benefits to certain Eligible Executives in connection with certain terminations of employment. Eligible Executives means members of the Company’s Senior Leadership Team, including Named Executive Officers other than the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), and other executives designated by the Board of Directors as eligible to participate in the S&R Plan. Each of the CEO and CFO retain separate individual employment agreements as previously disclosed. Capitalized terms used but not defined in this description have the meanings provided in the S&R Plan. The S&R Plan is intended, in part, to replace individual employment agreements for certain Eligible Executives whose employment agreements expired as of December 31, 2023 and to provide consistent benefits to all Eligible Executives. The S&R Plan was approved by the Compensation Committee of the Company’s Board of Directors.

The S&R Plan provides that an Eligible Executive who (i) is Involuntarily Terminated by the Company for other than Cause, Disability or death, or (ii) resigns from employment with the Company for Good Reason will be entitled to the following Severance Benefits:

•Twelve (12) months of continuation of Eligible Executive’s Base Salary payable in accordance with the Company’s regular payroll practices and subject to applicable federal and state withholding taxes or other withholdings required by law; and

•If the Eligible Executive elects to continue medical, dental and/or vision benefits under the Company’s group health plan(s) pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), the Company will pay a portion of the the COBRA premium such that the Eligible Executive pays the same amount that an active employee would pay for the benefits continued until the first to occur: (A) the end of the twelve (12) month period following the date the Eligible Executive’s termination of employment becomes effective, (B) the date the Eligible Executive is no longer eligible for COBRA coverage for the applicable benefit or (C) the date the Eligible Executive becomes eligible for employee coverage under another employer’s group health plan(s) without regard to whether the Eligible Executive actually enrolls in such coverage, in which case the Eligible Executive may remain enrolled in COBRA coverage under the Company’s group health plan(s) for the applicable COBRA continuation period at his or her sole expense.

Alternatively, the S&R Plan provides that if an Eligible Executive (i) is Involuntarily Terminated for other than Cause, Disability or death by the Company within three (3) months prior to or within twelve (12) months following a Change in Control or (ii) resigns from employment with the Company for Good Reason within twelve (12) months following a Change in Control, he will be entitled to the following Change In Control Severance Benefits:

•Twenty four (24) months of continuation of Eligible Executive’s Base Salary payable in accordance with the Company’s regular payroll practices and subject to applicable federal and state withholding taxes or other withholdings required by law; and

•If the Eligible Executive elects to continue medical, dental and/or vision benefits under the Company’s group health plan(s) pursuant to COBRA, the Company will pay a portion of the the COBRA premium such that the Eligible Executive pays the same amount that an active employee would pay for the benefits continued until the first to occur: (A) the end of the twelve (12) month period following the date the Eligible Executive’s termination of employment becomes effective, (B) the date the Eligible Executive is no longer eligible for COBRA coverage for the applicable benefit or (C) the date the Eligible Executive becomes eligible for employee coverage under another employer’s group health plan(s) without regard to whether the Eligible Executive actually enrolls in such coverage, in which case the Eligible Executive may remain enrolled in COBRA coverage under the Company’s group health plan for the applicable COBRA continuation period at his sole expense

In order to qualify as an Eligible Executive, participants must sign a Participation Agreement as provided in the S&R Plan. Payment of any Severance Benefits or Change in Control Severance Benefits under the S&R Plan is expressly conditioned upon the Eligible Executive signing, returning to the Company and not revoking a release of all claims against the Company, successor and/or related parties in a form prepared by the Company in its reasonable discretion. Payments and benefits under the S&R Plan are subject to recovery under any clawback, recovery or recoupment policy which the Company may adopt from time to time.

The S&R Plan provides that in the event that a payment of a Severance Benefits or Change in Control Severance Benefits would constitute an “excess parachute payment” or a “parachute payment” as defined in Code Section 280G or Code Section 4960, as applicable, and would result in imposition on the Eligible Executive of an excise tax under Code Section 4960 or Code Section 4999, as applicable, then such Severance Benefits or Change in Control Benefits will be reduced (but not below zero) so that the sum of such Severance Benefits or Change in Control Severance Benefits will be $1.00 less than the amount that would subject the Eligible Executive to any such excise tax.

The foregoing description of the S&R Plan does not purport to be complete and is subject to and qualified in its entirety by the terms and conditions of the S&R Plan, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Danimer Scientific, Inc |

|

|

|

|

Date: |

May 10, 2024 |

By: |

/s/ Stephen A. Martin |

|

|

|

Stephen A. Martin

Chief Legal Officer and Corporate Secretary |

Exhibit 10.1

Danimer Scientific

Executive Severance and Retention Plan

Effective May 9, 2024

ARTICLE 1

NAME, PURPOSE AND EFFECTIVE DATE

1.01.Name and Purpose of Plan. The name of this plan is the Danimer Scientific Executive Severance and Retention Plan (“Plan”). The purpose of the Plan is to assist in retaining certain senior level Eligible Executives of Danimer Scientific, Inc. (the “Company”) and to provide for severance pay and benefits to Eligible Executives upon separation from employment with the Company under the circumstances described in the Plan, including separation from employment in proximity to a change in control of the Company. This Plan supersedes any and all prior severance pay plans and practices, whether formal or informal, written or unwritten, of the Company and any affiliates with respect to Eligible Executives.

1.02.Effective Date. The effective date of the Plan is May 9, 2024. The compensation and benefits payable under the Plan are payable upon certain separations from employment that occur after the effective date of this Plan.

1.03. Coordination with Employment Contracts Govern. To the extent that an Eligible Executive is a party to an employment or other contract or agreement that provides for any severance payments upon such Eligible Executive’s separation from employment with the Company or any of its subsidiaries, then that contract or agreement governs, and not this Plan. Provided, however, to the extent this Plan provides for payments and/or benefits that are greater than those provided by any such contract or agreement, then this Plan shall provide only such greater payments and/or benefits to the Eligible Executive.

1.03.ERISA Status. This Plan is intended to be (i) an Eligible Executive welfare benefit plan within the meaning of Section 3(1) of the Eligible Executive Retirement Income Security Act of 1974 (“ERISA”) and (ii) an unfunded plan that is maintained primarily to provide severance compensation and benefits to a select group of “management or highly compensated Eligible Executives” within the meaning of Sections 201(2), 301(a)(3), and 401(a)(1) of ERISA and, therefore, to be exempt from the provisions of Parts 2, 3, and 4 of Title I of ERISA.

ARTICLE 2

DEFINITIONS

The following words and phrases have the following meanings unless a different meaning is plainly required by the context:

2.01. “Base Salary” means the annual base rate of compensation payable to an Eligible Executive at the time of the Eligible Executive’s Termination Date without reduction for any pre-tax deferrals under any tax-qualified plan, non-qualified deferred compensation plan, qualified transportation fringe benefit plan under Code Section 132(f), or cafeteria plan under Code Section 125 maintained by the Company, but excluding the following: incentive or other bonus plan payments, accrued vacation, commissions, sick leave, holidays, jury duty, bereavement, other paid leaves of absence, short-term disability payments, recruiting/job referral bonuses, severance, hiring bonuses, long-term disability payments, or payments from a nonqualified deferred compensation plan maintained by the Company.

2.02. “Board of Directors” means the Board of Directors of the Company.

2.03. “Cause” means termination by the Company of an Eligible Executive’s employment based upon the Eligible Executive’s: (a) commission of any act of fraud or embezzlement against the Company or any of its affiliates; (b) conduct that is grossly negligent or willful and deliberate on the Eligible Executive’s part and that is (or would reasonably be expected to be) materially detrimental to the Company or any of its affiliates; (c) conviction of or entry of a plea of guilty or no contest to, a felony or crime of moral turpitude; (d) failure to adhere in any material respect to the written policies and procedures established from time to time by the Company, including, but not limited to, any code of business conduct and ethics, and which failure is (or would reasonably be expected to be) materially detrimental to the Company or any of its affiliates; (e) violation of the Company’s policies prohibiting substance abuse; (f) violation of the Company’s polices prohibiting unlawful employment discrimination, retaliation or harassment, including sexual harassment, which includes but is not limited to engaging in or aiding and abetting any act of employment discrimination, retaliation or harassment including sexual harassment; (g) violation of any contractual, statutory or fiduciary duty owned by the Eligible Executive to the Company or any of its affiliates; (h) failure to cooperate in good faith with a governmental or internal investigation of the Company, its affiliates, or the Company’s or any affiliate’s directors, officers or Eligible Executives, if the Company has reasonably requested the Eligible Executive’s cooperation; (i) willful and continued failure or refusal to perform his or her duties (other than any such failure resulting from the Eligible Executive’s Disability); (j) willful and continued failure or refusal to comply with any valid and legal directive of the Board of Directors or the person to whom the Eligible Executive reports; (k) breach of any material policy, obligation or restrictive covenant applicable to the Eligible Executive (e.g.¸ violating any noncompete, nonsolicitation, confidentiality, arbitration and/or assignment obligation that is applicable to the Eligible Executive) and/or (l) any failure to comply in any material respect with the Foreign Corrupt Practices Act, the Securities Act of 1933, the Securities Exchange Act of 1934, the Sarbanes-Oxley Act of 2002, the Dodds-Frank Wall Street Reform and Consumer Protection Act of 2010, or any rules or regulations thereunder, or any similar applicable statute, regulation or legal requirement. A termination is for Cause only if the Eligible Executive receives written notice from the Company of such termination for Cause, specifying the particulars of his or her conduct forming the basis for such termination.

2.04. “Change in Control” means, after the Effective Date:

(a)the date any entity or person shall have become the beneficial owner of, or shall have obtained voting control over, more than fifty percent (50%) of the total voting power of the Company’s then outstanding voting stock;

(b)except as may result from any refinancing or restructuring of the Company’s currently outstanding 3.250% Convertible Senior Notes due 2026, the date of the consummation of (A) a merger, consolidation or reorganization of the Company (or similar transaction involving the Company), in which the holders of the stock of the Company outstanding immediately prior to the transaction do not have voting control over more than fifty percent (50%) of the voting securities of the surviving Company immediately after such transaction, or (B) the sale or disposition of all or substantially all of the assets of the Company; or

(c)the date there shall have been a change in the majority of the Board of Directors within a 12-month period unless the nomination for election by the Company’s shareholders of each new director was approved by the vote of two-thirds of the members of the Board (or a committee of the Board) then still in office who were in office at the beginning of the 12-month period; provided, however, that notwithstanding any of the foregoing, any business combination with the Company pursuant to an acquisition agreement (including without limitation any merger agreement or purchase agreement) executed at any time prior to the Effective Date shall not be deemed a Change in Control.

2.05. “Code” means the Internal Revenue Code of 1986 as amended.

2.06. “Disability” means:

(a)the Eligible Executive is determined to be totally and permanently disabled under any group long term disability plan sponsored by the Company in which the Eligible Executive participates; or

(b)the inability of the Eligible Executive, due to any medically determinable physical or mental impairment, to perform the essential functions of his or her job, with or without reasonable accommodation, for 120 days during any one calendar year irrespective of whether such days are consecutive.

In the event of any dispute under this Section 2.06, the Eligible Executive shall submit to a physical examination by a licensed physician mutually satisfactory to the Company and the Eligible Executive, the cost of such examination to be paid by the Company, and the determination of such physician shall be determinative.

2.07. “Eligible Executive” means the members of the Company’s Senior Leadership Team (as defined below) and any other executives designated by the Board of Directors as eligible to participate in this Plan, in each case who have delivered to the Company, within thirty (30) days of being presented therewith or such other timeframe as may be specified by the Board of Directors

on a uniform basis, a signed Participation Agreement in substantially the form attached hereto as Appendix A that has been countersigned by the Company. Provided, that Eligible Executive does not include the Company’s CEO or CFO for so long as such executive retains a separate employment agreement with the Company.

2.08. “Good Reason” means the occurrence of any of the following events, except for the occurrence of such an event in connection with the termination of the Eligible Executive by the Company for Cause, for Disability, or for death:

(a)A material diminution of Eligible Executive’s authority, duties or responsibilities (other than temporarily while Eligible Executive is physically or mentally incapacitated or as required by applicable law) in conjunction with a reduction by the Company in the Eligible Executive’s Base Salary as in effect immediately before such material diminution of authority, duties or responsibilities; provided, however, that a programmatic reduction in Base Salaries that is applied on a consistent percentage basis to all Eligible Executives, the Chief Executive Officer and Chief Financial Officer shall not constitute “Good Reason”;

(b)A reduction by the Company in the Eligible Executive’s Base Salary as in effect immediately before such reduction; provided, however, that a programmatic reduction in Base Salaries that is applied on a consistent percentage basis to all Eligible Executives, the Chief Executive Officer and Chief Financial Officer shall not constitute “Good Reason”;

(c)The Company’s relocation of the Eligible Executive’s principal place of employment by more than fifty (50) miles, or revocation of any remote or hybrid working arrangement with the Eligible Executive, without the Eligible Executive’s consent, excluding typical travel required in the performance of the Eligible Executive’s job duties, recognizing that such travel may be extensive; or

(d)The failure by the Company to obtain, as specified in Section 6.01 of this Plan, an assumption of the obligations of the Company to perform this Agreement by any successor to the Company.

However, Good Reason for an Eligible Executive’s termination of employment shall not be deemed to have occurred unless within thirty (30) days of the occurrence of the event or events that the Eligible Executive claims constitutes Good Reason, the Eligible Executive has given written notice to the Company of such event or events and the Company shall not have remedied the condition(s) within thirty (30) days of the receipt of the notice. The notice must identify the Eligible Executive and set forth in reasonable detail the facts and circumstances that Eligible Executive claims constitutes Good Reason.

2.09. “Involuntary Termination” means the termination of employment of an Eligible Executive initiated by the Company for other than Cause or Disability. For avoidance of doubt, an Eligible Executive shall not have an Involuntary Termination if he or she (i) voluntarily resigns; (ii) voluntarily retires; or (iii) has a termination of employment for Cause, because of Disability or because of death.

2.10. “Senior Leadership Team” means the following senior executives that report directly to the Chief Executive Officer on a permanent basis: Chief Human Resources Officer, Chief Legal Officer, Chief Marketing and Sustainability Officer; Chief Operating Officer, and Chief Science and Technology Officer.

2.11. “Termination Date” means the Eligible Executive’s last date of employment with the Company.

ARTICLE 3

ELIGIBILITY AND BENEFITS

3.01. Eligibility. All Eligible Executives are eligible to participate in the Plan.

3.02. Sole Source of Severance or Change in Control Benefits. Except as provided in Section 1.03, all Eligible Executives shall be ineligible for any other severance or change in control plan or program maintained by the Company without regard to the eligibility provisions of such other severance or change in control plan or program. Provided, however, for avoidance of doubt, that any severance or change in control provisions contained in the Company’s 2020 Long-Term Incentive Plan (or any successor or replacement thereto) (the “LTIP Plan”) or in any equity award any Eligible Executive may have been granted by the Company ("Award") shall remain in full effect and any acceleration of vesting or other benefits upon severance or Change in Control shall be subject to the terms and conditions of such LTIP Plan or Award. Any other benefits payable to the Eligible Executive upon termination of employment (e.g., pay for accrued unused vacation or other fringe benefits) shall be determined under the applicable Company policy or applicable written agreement between the Eligible Executive and the Company.

3.03. Severance Benefits. An Eligible Executive who, other than in conjunction with or following a Change in Control as described in Section 3.04, (i) is Involuntarily Terminated by the Company for other than Cause, Disability or death or (ii) who resigns from employment with the Company for Good Reason will be entitled to the following severance payments (“Severance Benefits”):

(a) Twelve (12) months of continuation of Eligible Executive’s Base Salary payable in accordance with the Company’s regular payroll practices and subject to applicable federal and state withholding taxes or other withholdings required by law; and

(b) If the Eligible Executive elects to continue medical, dental and/or vision benefits under the Company’s group health plan(s) pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), the Company will pay a portion of the the COBRA premium such that the Eligible Executive pays the same amount that an active employee would pay for the benefits continued until the first to occur: (A) the end of the twelve (12) month period following the date the Eligible Executive’s termination of employment becomes effective, (B) the date the Eligible Executive is no longer eligible for COBRA coverage for the applicable benefit or (C) the date the Eligible Executive becomes eligible for employee coverage under another employer’s

group health plan(s) without regard to whether the Eligible Executive actually enrolls in such coverage, in which case the Eligible Executive may remain enrolled in COBRA coverage under the Company’s group health plan(s) for the applicable COBRA continuation period at his or her sole expense.

3.04. Change in Control Severance Benefits. An Eligible Executive (i) who is Involuntarily Terminated for other than Cause, Disability or death by the Company within three (3) months prior to or within twelve (12) months following a Change in Control or (ii) who resigns from employment with the Company for Good Reason within twelve (12) months following a Change in Control will be entitled to the following severance benefits (“Change in Control Severance Benefits”):

(a) Twenty four (24) months of continuation of Eligible Executive’s Base Salary payable in accordance with the Company’s regular payroll practices and subject to applicable federal and state withholding taxes or other withholdings required by law; and

(b) If the Eligible Executive elects to continue medical, dental and/or vision benefits under the Company’s group health plan(s) pursuant to COBRA, the Company will pay a portion of the the COBRA premium such that the Eligible Executive pays the same amount that an active employee would pay for the benefits continued until the first to occur: (A) the end of the twelve (12) month period following the date the Eligible Executive’s termination of employment becomes effective, (B) the date the Eligible Executive is no longer eligible for COBRA coverage for the applicable benefit or (C) the date the Eligible Executive becomes eligible for employee coverage under another employer’s group health plan(s) without regard to whether the Eligible Executive actually enrolls in such coverage, in which case the Eligible Executive may remain enrolled in COBRA coverage under the Company’s group health plan for the applicable COBRA continuation period at his or her sole expense.

For avoidance of doubt, in the event Change in Control Severance Benefits become payable to any Eligible Executive, they shall apply in lieu of, and expressly supersede, Severance Benefits under this Plan.

3.05. COBRA. Any obligation by the Company under this Plan to pay premiums for COBRA coverage shall apply with respect to the tier of coverage and plan type that the Eligible Executive had in place as of his or her Termination Date (e.g., single, single + 1, family, etc.). If during the period of the Eligible Executive’s COBRA continuation the Eligible Executive increases the tier of coverage to a higher tier of coverage (e.g., going from single to family coverage), the Company shall not increase its premium subsidy above the premium required for the tier of coverage in place as of the Eligible Executive’s Termination Date. If during the period of the Eligible Executive’s COBRA continuation the Eligible Executive decreases the tier of coverage to a lower tier of coverage (e.g., going from family to single coverage), the Company shall decrease its premium subsidy to the subsidy applicable to the lower tier of coverage and shall not thereafter increase the subsidy for any later increases in the tier of coverage. Notwithstanding the foregoing, the

Company’s obligation to pay the premium for an Eligible Executive’s COBRA coverage shall not apply to coverage under a medical flexible spending account.

3.06. Release Required. Payment of any Severance Benefits or Change in Control Severance Benefits under this Plan is expressly conditioned upon the Eligible Executive signing, returning to the Company and not revoking a release of all claims against the Company, successor and/or related parties (“Release”) in the form prepared by the Company in its reasonable discretion. The Release shall release the Company and its predecessors, successors and affiliates, and their directors, officers, Eligible Executives, agents and other related parties from all liabilities in connection with the Eligible Executive’s relationship with the Company and/or the Company’s successor. The Release may also include reasonable noncompete obligations, other reasonable restrictive covenants, confidentiality provisions, nondisparagement provisions and other reasonable obligations. Where the period of time during which an Eligible Executive may considered whether to sign and revoke the Release spans two separate tax years, Severance Benefits or Change in Control Severance Benefits will not become payable until the second taxable year, subject to all terms and conditions of this Plan.

3.07. Timing of Payments. Any Base Salary payments under this Plan will begin on the first payroll date after the Release becomes irrevocable. Any COBRA subsidy payments under this Plan will begin on the first payroll date corresponding with the COBRA premium due date after the Eligible Executive elects COBRA coverage and after the Release becomes irrevocable.

3.08 Recoupment Policy. The payments and benefits under this Plan shall be subject to recovery under any clawback, recovery or recoupment policy which the Company may adopt from time to time, including without limitation the Company’s existing recoupment policy and any policy which the Company may be required to adopt under Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law and the rules and regulations of the Securities and Exchange Commission thereunder or the requirements of any national securities exchange on which the Company’s common stock is listed.

3.09. Code Section 409A. Although the Company does not guarantee the tax treatment of any payments under the Plan, the intent of the Company is that the payments and benefits under the Plan be exempt from, or comply with, Code Section 409A and all Treasury Regulations and guidance promulgated thereunder (“Code Section 409A”) and to the maximum extent permitted the Plan shall be limited, construed and interpreted in accordance with such intent. To this end, Base Salary continuation payments under the Plan are intended to be exempt for Code Section 409A pursuant to either the separation pay exemption under Treasury Regulation Section 1.409A-1(b)(9)(ii) or as short term deferrals under Treasury Regulation Section 1.409A-1(b)(4) and, for purposes of such exemptions, each payment under the Plan shall be considered a separate payment. If an Eligible Executive is deemed on his or her termination date to be a “specified employee” within the meaning of Code Section 409A(a)(2)(B), then with regard to any payment or provision of any benefits that is considered “nonqualified deferred compensation” under Code Section 409A payable on account of “separation from service” and which becomes payable under the terms of the Plan within six (6) months following such separation from service, then, to the extent required by Code Section 409A, such payment or benefit shall not be made or provided until the date which is the earlier of (i) the day after the expiration of the six-month period measured from the date of

such “separation from service” of the Eligible Executive, and (ii) the date of the Eligible Executive’s death. Upon expiration of the six-month delay period, all payments and benefits delayed pursuant to this provision (which would otherwise have been paid in a single sum or installments in the absence of such delay) shall be paid or reimbursed to the Eligible Executive in a lump sum without interest, and all remaining payments and benefits due under this Plan shall be paid or provided in accordance with the normal payment dates specified for them herein. In no event whatsoever will the Company or its affiliates or their respective officers, directors or Eligible Executives or agents be liable for any additional tax, interest or penalties that may be imposed on an Eligible Executive by Code Section 409A or damages for failure to comply with Code Section 409A.

3.10. Additional Limitation. Notwithstanding anything else in this Plan, in the event that the payment of a Severance Benefits or Change in Control Severance Benefits would constitute an “excess parachute payment” or a “parachute payment” as defined in Code Section 280G or Code Section 4960, as applicable, and would, but for this Section 3.10, result in imposition on the Eligible Executive of an excise tax under Code Section 4960 or Code Section 4999, as applicable, then such Severance Benefits or Change in Control Benefits shall be reduced (but not below zero) so that the sum of such Severance Benefits or Change in Control Severance Benefits shall be $1.00 less than the amount that would subject the Eligible Executive to any such excise tax.

ARTICLE 4

ADMINISTRATION

4.01. General. The Plan will be administered by the Board of Directors of the Company, provided that the Board of Directors may delegate administration to one of its committees.

4.02. Powers. The Company will have full power, discretion and authority to interpret, construe and administer the Plan and any part hereof, and such interpretation and construction hereof, and any actions hereunder, will be binding on all persons for all purposes. The Company, in fulfilling its responsibilities may (by way of illustration and not of limitation) do any or all of the following:

(a)determine which executives shall be Eligible Executives;

(b)allocate among its officers or Eligible Executives, and/or delegate to one or more other persons selected by it, responsibility for fulfilling some or all of its responsibilities under the Plan;

(c)designate one or more of its officers or Eligible Executives to sign on its behalf directions, notices and other communications to any entity or other person;

(d)establish rules and regulations with regard to its conduct and the fulfillment of its responsibilities under the Plan;

(e)designate other persons to render advice with respect to any responsibility or authority pursuant to the Plan being carried out by it or any of its delegates under the Plan; and

(f)employ legal counsel, consultants and agents as it may deem desirable in the administration of the Plan and rely on the opinion of such counsel.

ARTICLE 5

CLAIM FOR BENEFITS UNDER THIS PLAN

5.01. Claims for Benefits under this Plan. If an Eligible Executive believes that he or she should have been eligible to participate in the Plan or disputes the amount of benefits he or she receives under the Plan, he or she may submit a claim for benefits in writing to the Company within sixty (60) days after his or her termination of employment. If such claim for benefits is wholly or partially denied, the Company will within a reasonable period of time, but no later than ninety (90) days after receipt of the written claim, notify the claimant of the denial of the claim. If an extension of time for processing the claim is required, the Company may take up to an additional ninety (90) days, provided that the Company sends the claimant written notice of the extension before the expiration of the original ninety (90) day period. The notice provided to the claimant will describe why an extension is required and when a decision is expected to be made. If a claim is wholly or partially denied, the denial notice: (1) will be in writing, (2) will be written in a manner calculated to be understood by the individual, and (3) will contain (a) the reasons for the denial, including specific reference to those plan provisions on which the denial is based; (b) a description of any additional information necessary to complete the claim and an explanation of why such information is necessary; (c) an explanation of the steps to be taken to appeal the adverse determination; and (d) a statement of the claimant’s right to bring a civil action under section 502(a) of ERISA following an adverse decision after appeal. The Company will have full discretion consistent with their fiduciary obligations under ERISA to deny or grant a claim in whole or in part. If notice of denial of a claim is not furnished in accordance with this section, the claim will be deemed denied and the claimant will be permitted to exercise his rights to review pursuant to Sections 5.02 and 5.03.

5.02. Right to Request Review of Benefit Denial. Within sixty (60) days of the claimant’s receipt of the written notice of denial of a claim, the claimant may file a written request for a review of the denial of the claimant’s claim for benefits. In connection with the claimant’s appeal of the denial of his or her benefit, the claimant may submit comments, records, documents, or other information supporting the appeal, regardless of whether such information was considered in the prior benefits decision. Upon request and free of charge, the claimant will be provided reasonable access to and copies of all documents, records and other information relevant to the claim.

5.03. Disposition of Claim. The Company will deliver to the claimant a written decision on the claim promptly, but not later than sixty (60) days after the receipt of the claimant’s written request for review, except that if there are special circumstances which require an extension of time for processing, the sixty (60) day period will be extended to one hundred and twenty (120) days; provided that the appeal reviewer sends written notice of the extension before the expiration of the

original sixty (60) day period. If the appeal is wholly or partially denied, the denial notice will: (1) be written in a manner calculated to be understood by the individual, (2) contain references to the specific plan provision(s) upon which the decision was based; (3) contain a statement that, upon request and free of charge, the claimant will be provided reasonable access to and copies of all documents, records and other information relevant to the claim for benefits; and (4) contain a statement of the claimant’s right to bring a civil action under section 502(a) of ERISA.

5.04. Exhaustion. A claimant must exhaust the Plan’s claims procedures prior to bringing any claim for benefits under the Plan in a court of competent jurisdiction. No lawsuit shall be brought against the Plan or the Company after one hundred and eighty (180) days from receipt of the final decision on a claim appeal.

ARTICLE 6

MISCELLANEOUS

6.01. Successors.

(a)Any successor (whether direct or indirect and whether by purchase, lease, merger, consolidation, liquidation or otherwise) to all or substantially all of the Company’s business and/or assets, or all or substantially all of the business and/or assets of a business segment of the Company, will be obligated under this Plan in the same manner and to the same extent as the Company would be required to comply with the terms of the Plan in the absence of a succession. The Company will require any such successor to expressly assume and agree to all terms and conditions of this Plan in the same manner and to the same extent that the Company would be required to comply with the terms of the Plan if no such succession had taken place. As used in this Plan, “Company” shall mean the Company and any successor described in this Section 6.01.

(b)This Plan and all rights of the Eligible Executive hereunder will inure to the benefit of, and be enforceable by, the Eligible Executive’s personal or legal representatives, executors, administrators, successors, heirs, distributees, devisees and legatees.

6.02. Creditor Status of Eligible Executive. In the event that any Eligible Executive acquires a right to receive payments from the Company under the Plan, such right will be no greater than the right of any unsecured general creditor of the Company.

6.03 Non-Alienation of Benefits. Benefits payable under this Plan shall not be subject to any kind of anticipation, alienation, sale, transfer, assignment, pledge, encumbrance, charge, garnishment, execution or levy of any kind, either voluntary or involuntary, before actually being received by the Eligible Executive, and any such attempt to dispose of any right to benefits payable under this Plan shall be void.

6.04. Facility of Payment. If it is found that (a) an Eligible Executive entitled to receive any payment under the Plan is physically or mentally incompetent to receive such payment and to give

a valid release therefor, and (b) another person or an institution is then maintaining or has custody of such Eligible Executive, and no guardian, committee, or other representative of the estate of such person has been duly appointed by a court of competent jurisdiction, the Severance Payment or Change in Control Severance Benefits may be paid to such other person or institution referred to in (b) above, and the release will be a valid and complete discharge for the payment.

6.05. Notices. All notices and other communications under this Plan shall be in writing and delivered by hand, by a nationally recognized delivery service that promises overnight delivery, or by first-class registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

If to the Eligible Executive, at his or her most recent home address on file with the Company.

If to the Company:

Danimer Scientific, Inc.

Attention: Chief Executive Officer

140 Industrial Boulevard

Bainbridge, Georgia 39817

With a copy to:

Danimer Scientific, Inc.

Attention: Chief Legal Officer

140 Industrial Boulevard

Bainbridge, Georgia 39817

or to such other address as either party shall have furnished to the other in writing. Notice and communications shall be effective the day of receipt if delivered by hand or electronically, the second business day after deposit with an overnight delivery service if so deposited, or the fifth business day after mailing in the case of first class registered or certified mail.

6.06. Headings. The headings of the Plan are inserted for convenience and reference only and shall have no effect upon the meaning of the provisions hereof.

6.07. Choice of Law. The Plan shall be construed, regulated and administered under the laws of Georgia (excluding the choice-of-law rules thereto), except that if any such laws are superseded by any applicable Federal law or statute, such Federal law or statute shall apply.

6.08. Amendment and Termination. The Company reserves the right to amend, modify or terminate the Plan at any time. Provided, however, that any such amendment, modification or termination that adversely affects the rights of an Eligible Executive to receive Severance Benefits or Change in Control Severance Benefits may not be made without the written consent of such Eligible Executive. Notwithstanding the foregoing, the Company may amend the Plan as necessary to comply with Code Section 409A without obtaining consent of an Eligible Executive.

6.09. Whole Agreement. This Plan contains all the legally binding understandings and agreements between the Eligible Executive and the Company pertaining to the subject matter thereof and supersedes all such agreements, whether oral or in writing, previously entered into between the parties.

6.10. No Contract of Employment. Nothing in this Plan shall be construed as giving any Eligible Executive any right to be retained in the employ of the Company or any of its subsidiaries.

6.11. Withholding Taxes. All payments made under this Plan will be subject to reduction to reflect taxes required to be withheld by law.

6.12. No Assignment. The rights of an Eligible Executive to payments or benefits under this Plan shall not be made subject to option or assignment, either by voluntary or involuntary assignment or by operation of law, including (without limitation) bankruptcy, garnishment, attachment or other creditor’s process, and any action in violation of this Section 6.12 shall be void.

WHEREAS, Danimer Scientific hereby adopts this Executive Severance and Retention Plan this 9th day of May, 2024.

By: /s/ Stephen E. Croskrey

Stephen E. Croskrey

Chief Executive Officer

APPENDIX A

DANIMER SCIENTIFIC

EXECUTIVE SEVERANCE AND RETENTION PLAN

PARTICIPATION AGREEMENT

This PARTICIPATION AGREEMENT ("Participation Agreement") is entered into as of _______________, 20_____, between Danimer Scientific, Inc. (the "Company") and ______________________________ (the "Eligible Executive") (jointly the "Parties") pursuant to which the Eligible Executive accepts participation in the Danimer Scientific Executive Severance and Retention (the "Plan") subject to the terms and conditions of this Participation Agreement and the Plan as amended from time to time.

In exchange for Eligible Executive's continued employment, participation in the Plan and other good and valuable consideration, Eligible Executive agrees to comply with all terms and conditions of the Plan and the following:

1.Confidentiality; Noncompetition and Nonsolicitation. For purposes of this Section 1, all references to the Company shall be deemed to include the Company and its Subsidiaries, whether now existing or hereafter established or acquired.

(a)Confidentiality. Eligible Executive acknowledges that as a result of his or her employment with the Company, Eligible Executive has and will continue to have knowledge of, and access to, proprietary and confidential information of the Company including, without limitation, research and development plans and results, software, databases, technology, inventions, trade secrets, technical information, know-how, plans, specifications, methods of operations, product and service information, product and service availability, pricing information (including pricing strategies), financial, business and marketing information and plans, and the identity of customers, clients and suppliers (collectively, the "Confidential Information"), and that the Confidential Information, even though it may be contributed, developed or acquired by the Eligible Executive, constitutes valuable, special and unique assets of the Company developed at great expense which are the exclusive property of the Company. Accordingly, Eligible Executive shall not, at any time, either during or subsequent to the Term of this Agreement, use, reveal, report, publish, transfer or otherwise disclose to any person, corporation, or other entity, any of the Confidential Information without the prior written consent of the Company, except to responsible officers and Eligible Executives of the Company and other responsible persons who are in a contractual or fiduciary relationship with the Company and who have a need for such Confidential Information for purposes in the best interests of the Company, and except for such Confidential Information which is or becomes of general public knowledge from authorized sources other than by or through Eligible Executive. Eligible Executive acknowledges that the Company would not enter into this Agreement without the assurance that all the Confidential Information will be used for the exclusive benefit of the Company.

(b)Noncompetition. Eligible Executive covenants and agrees that, during Eligible Executive's employment with and service as an Eligible Executive to the Company and any of its Business Affiliates, and for a period of twelve (12) months following any termination of such employment, except if such termination is being paid in accordance with Section 3.04 (Change in Control Severance Benefit) in which case the period shall be twenty-four (24) months (the "Noncompete Period"), Eligible Executive shall not for Eligible Executive's own behalf or on behalf of any Person (other than the Company or any of its Business Affiliates), directly or indirectly (either individually or as an agent, advisor, partner, joint venturer, trustee, shareholder, officer, manager, investor, director, consultant, Eligible Executive or in any other capacity):

(i)engage in any Competitive Activity within the Prohibited Territory; or

(ii) assist others in engaging in any Competitive Activity within the Prohibited Territory; provided, however, that nothing in this Section 1(b) shall restrict Eligible Executive from the passive ownership of two percent (2%) or less of the publicly traded securities of any entity.

(c) Nonsolicitation. Eligible Executive covenants and agrees that unless specifically authorized by the Company in writing, during the Noncompete Period and within the Prohibited Territory, Eligible Executive shall not:

(i)solicit, encourage, support or cause any employee or consultant of the Company or any Business Affiliate thereof to leave the employment of the Company or any Business Affiliate thereof;

(ii)solicit, encourage, support or cause any supplier of goods, services or property (including intangible or other intellectual property) to the Company or any Business Affiliate thereof, or any licensor or licensee of the Company or any Business Affiliate thereof, to not do business with, to discontinue doing business with, or to materially reduce all or any part of such supplier's or licensor's or licensee's business with the Company or any Business Affiliate thereof;

(iii)solicit any Customer for the purposes of offering or providing any product or service of the type provided or conducted by the Company or any Business Affiliate thereof during the Noncompete Period (including, for the avoidance of doubt, offering or providing traditional plastic resins that compete with the Company’s biodegradable plastic resins); or

(iv)solicit or encourage any Customer to terminate, curtail or otherwise limit its business relationship with the Company or any Business Affiliate thereof.

(d)Cooperation. Eligible Executive covenants and agrees that following his or her Termination Date, Eligible Employee will fully and reasonably cooperate with the Company with respect to business issues, claims, administrative charges, governmental investigations

and/or litigation related the Company or its business interests. Such cooperation may include, but is not limited to, responding to questions, providing information, attending meetings, depositions, administrative proceedings, and court proceedings, and assisting the Company, its counsel and any of its expert witnesses. Eligible Executive agrees not to communicate with any adverse party, any such party’s legal counsel, or others adverse to the Company with respect to any pending or threatened claim, charge, or litigation except through legal counsel designated by the Company. Should Eligible Executive receive notice of a subpoena or other attempt to communicate with or obtain information from Eligible Executive in any way related to the Company or its business interests, Eligible Executive agrees to notify the Company, to provide a copy of any such subpoena or request within two (2) calendar days of receipt of same, and not to provide any such information except through counsel designed by the Company unless compelled to do so by court order and after the Company has had an opportunity to raise and resolve any objections. Upon receipt of proper substantiation in the form specified by the Company, the Company will reimburse Eligible Executive for reasonable costs and expenses associated with Eligible Executive’s cooperation and will compensate Eligible Executive at an hourly rate equivalent of the Eligible Executive’s Base Salary for time spent providing the cooperation specified in this Section 1(d).

(e)Remedies. The restrictions set forth in this Section 1 are considered by the Parties to be fair and reasonable. Eligible Executive acknowledges that the restrictions contained in this Section 1 will not prevent him or her from earning a livelihood. Eligible Executive further acknowledges that the Company would be irreparably harmed and that monetary damages would not provide an adequate remedy in the event of a breach of the provisions of this Section 1. Accordingly, Eligible Executive agrees that, in addition to any other remedies available to the Company, the Company shall be entitled to injunctive and other equitable relief to secure the enforcement of these provisions. In connection with seeking any such equitable remedy, including, but not limited to, an injunction or specific performance, the Company shall not be required to post a bond as a condition to obtaining such remedy. In any such litigation, the prevailing party shall be entitled to receive an award of reasonable attorneys' fees and costs. If any provisions of this Section 1 relating to the time period, scope of activities or geographic area of restrictions is declared by a court of competent jurisdiction to exceed the maximum permissible time period, scope of activities or geographic area, the maximum time period, scope of activities or geographic area, as the case may be, shall be reduced to the maximum which such court deems enforceable. If any provisions of this Section 1 other than those described in the preceding sentence are adjudicated to be invalid or unenforceable, the invalid or unenforceable provisions shall be deemed amended (with respect only to the jurisdiction in which such adjudication is made) in such manner as to render them enforceable and to effectuate as nearly as possible the original intentions and agreement of the parties. Nothing herein shall be construed as prohibiting a Party from pursuing other remedies available to it for such breach or threatened breach. Eligible Executive also agrees that the Company may disclose this Agreement to any Person that, at any time during Eligible Executive's employment with the Company or during the period the restrictive covenants set forth herein are in effect, employs or considers employing Eligible Executive.

2. Corporate Opportunities. During Eligible Executive's employment with the Company, Eligible Executive shall bring all investment or business opportunities to the Company

of which the Eligible Executive is aware and which Eligible Executive believes are, or would reasonably be, within the scope and objectives of the business of the Company and its Business Affiliates. If Eligible Executive is engaged in or associated with the planning or implementing of any project, program or venture involving the Company or its Business Affiliates and any third parties, all rights in such project, program or venture shall belong exclusively to the Company (or the third party, to the extent provided in any agreement between the Company and the third party). Except as formally approved in advance and in writing by the Company, Eligible Executive shall not be entitled to any interest in such project, program or venture or to any commission, finder's fee or other compensation in connection therewith other than the salary or other compensation to be paid to Eligible Executive as provided in this Agreement.

3.Nondisparagement. During Eligible Executive's employment with the Company, and at all times thereafter, (i) Eligible Executive will not make any public statement that is disparaging about the Company, any of its Business Affiliates, any of its or their respective officers or directors, including, but not limited to, any statement that disparages the products, services, finances, financial condition, capabilities or other aspects of the business of the Company or any of its Business Affiliates and (ii) the Company will not make any public statement that is disparaging about Eligible Executive. The immediately preceding sentence shall not apply to or limit any statement made in any judicial proceeding relating to any dispute under this Agreement.

4.Receipt and Compliance. Eligible Executive has received a copy of, read, understood and agrees to comply with the terms of the Plan including this Participation Agreement inclusive of Schedule 1 attached hereto.

5.Severability. If any provision of this Participation Agreement is deemed invalid or unenforceable, the validity of the other provisions of this Participation Agreement shall not be impaired. If any provision of this Participation Agreement shall be deemed invalid as to its scope, then notwithstanding such invalidity, that provision shall be deemed valid to the fullest extent permitted by law, and the Parties agree that, if any court makes such a determination, it shall have the power to reduce the duration, scope or area of such provisions and to delete specific words and phrases by "blue penciling" and, in its reduced or blue-penciled form, such provisions shall then be enforceable as allowed by law.

6.Survival. The Parties acknowledge and agree that the provisions of this Participation Agreement which by their terms extend beyond termination of the Eligible Executive’s employment for any reason shall survive in accordance with the terms thereof, including Sections 1 and 3, after termination of the Eligible Executive’s employment for any reason and/or after any amendment to, or termination of, the Plan.

IN WITNESS WHEREOF, the Company and the Eligible Executive have executed this Participation Agreement as of the date first written above.

ELIGIBLE EXECUTIVE

(signature)

DANIMER SCIENTIFIC, INC.

By:

(print name)

Its:

SCHEDULE 1

DEFINITIONS

Capitalized terms in the Participation Agreement that are not defined in Article 2 of the Plan shall have the following meanings:

(a)"Affiliate" means, with respect to any specified Person, any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with such specified Person.

(b)"Business Affiliate" means the Company or any Subsidiary or Affiliate of the Company; provided that notwithstanding the foregoing, companies which are deemed to be Affiliates solely due to the control of such entity by a shareholder of the Company (including portfolio companies in which a shareholder of the Company holds an investment) shall not be deemed to be Affiliates of the Company.

(c)"Competitive Activity" means services of the type conducted, authorized, offered or provided by the Eligible Executive to the Company within two (2) years prior to his or her Termination Date with regard to, as applicable, the design, development, manufacturing, production, marketing, distribution and/or sale or provision of, or the provision of consulting services related to, products or services that are substantially similar to, identical to, or are otherwise competitive with those offered or under development by the Company during the twelve (12) month period prior to the termination date of Eligible Executive's employment hereunder, including, without limitation, the design, development, manufacturing, production, marketing, distribution and/or sale or provision of, or the provision of consulting services related to, (i) PHA, poly(3-hydroypropionate) (“p3HP”), polylactic acid (“PLA”), Levan or other products that are compostable and/or biodegradable substitutes for non-biodegradable plastics and (ii) the reactive extrusion of PHA, poly(3-hydroypropionate) (“p3HP”), polylactic acid (“PLA”), Levan or other products that are compostable and/or biodegradable substitutes for non-biodegradable plastics.

(d)"Customer" means any Person that is now, or during the Noncompete Period becomes, a customer of the Company or any Business Affiliate with whom Eligible Executive had a business relationship.

(e)“Levan” means levan polysaccharide.

(f)"Person" means an individual (including Eligible Executive), a partnership, a corporation, a limited liability company, an association, a joint stock company, a trust, a joint venture, an unincorporated organization or a governmental entity or any department, agency or political subdivision thereof.

(g)“PHA” means polyhydroxyalkanoate.

(h)"Prohibited Territory" means North America, South America, Europe, Asia, Australia and the country of South Africa.

(i)"Subsidiary" means, with respect to any specified Person, any other Person of which (or in which) such specified Person will, at the time, directly or indirectly through one or more subsidiaries, (a) own at least 50% of the outstanding capital stock or equity interests having ordinary voting power to elect a majority of the board of directors or other similar governing body,

(b) hold at least 50% of the interests in the capital or profits, (c) hold at least 50% of the beneficial interest (in the case of any such Person that is a trust or estate), or (d) be a general partner (in the case of a partnership) or a managing member (in the case of a limited liability company).

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

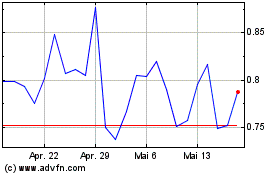

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Danimer Scientific (NYSE:DNMR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024