As

filed with the Securities and Exchange Commission on April 30, 2021

Securities

Act Registration No. 333-252797

Investment Company Registration No. 811-22762

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

FORM

N-2

(Check appropriate box or

boxes)

☒ REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

☐

Pre-Effective Amendment No.

☒ Post-Effective Amendment No. 1

and/or

☒ REGISTRATION

STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

☒

Amendment No. 6

FLAHERTY & CRUMRINE DYNAMIC

PREFERRED AND INCOME FUND

INCORPORATED

(Exact Name of Registrant as Specified in Charter)

|

|

301 E. Colorado Boulevard, Suite 800

Pasadena, California 91101

(Address of Principal Executive Offices)

626-795-7300

(Registrant’s Telephone Number, including Area Code)

|

R.

Eric Chadwick

Flaherty & Crumrine Incorporated

301 E. Colorado Boulevard, Suite 800

Pasadena, California 91101

(Name and Address of Agent for Service)

|

|

With

Copies to:

|

|

P.

Jay Spinola, Esq.

|

|

Willkie

Farr & Gallagher LLP

|

|

787

Seventh Avenue

|

|

New

York, New York 10019

|

|

Approximate

Date of Commencement of Proposed Public Offering: From time to time after the effective date of this Registration Statement.

|

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, check

the following box: ☐

If

any of the securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415

under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment

plan, check the following box: ☒

If

this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto, check the following

box: ☒

If

this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ☐

It

is proposed that this filing will become effective (check appropriate box):

☐ when

declared effective pursuant to Section 8(c) of the Securities Act.

If

appropriate, check the following box:

☐ This

post-effective amendment designates a new effective date for a previously filed registration statement.

☐ This

Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is .

☒ This

Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration

statement number of the earlier effective registration statement for the same offering is 333-252797.

Check

each box that appropriately characterizes the Registrant:

☒ Registered closed-end fund.

☐ Business

development company.

☐ Interval

fund.

☒ A.2

Qualified.

☐ Well-Known

Seasoned Issuer (as defined by Rule 405 under the Securities Act).

☐ Emerging

Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”).

☐ New

registrant.

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 (File Nos. 333-252797 and 811-22762) of Flaherty &

Crumrine Dynamic Preferred and Income Fund Incorporated (the “Registration Statement”) is being filed pursuant to Rule 462(d)

under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purpose of filing exhibits to the Registration

Statement. Accordingly, this Post-Effective Amendment No. 1 consists only of a facing page, this explanatory note and Part C of the Registration

Statement on Form N-2 setting forth the exhibits to the Registration Statement. This Post-Effective Amendment No. 1 does not modify any

other part of the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No. 1 shall

become effective immediately upon filing with the Securities and Exchange Commission. The contents of the Registration Statement are hereby

incorporated by reference.

PART

C

OTHER INFORMATION

Item

25. Financial Statements and Exhibits

1.

Financial Statements

Included

in Part A: Financial highlights for the fiscal years ended November 30, 2020, 2019, 2018, 2017, 2016 and 2015, 2014 and 2013.

Incorporated

into Parts A and B by reference:

The

audited financial statements included in the Fund’s annual

report for the fiscal year ended November 30, 2020, together with the report of KPMG LLP, on Form N-CSR, filed

January 29, 2021 (File No. 811-22762).

The

financial highlights included in the Fund’s annual

report for the fiscal year ended November 30, 2015 on Form N-CSR, filed on January 29, 2016 (File No. 811-22762).

2.

Exhibits

Item

26. Marketing Arrangements

The information contained under the heading “Plan of Distribution” on page 63

of the prospectus is incorporated by reference, and any information concerning any underwriters will be contained in the accompanying

prospectus supplement, if any.

Item

27. Other Expenses of Issuance and Distribution

The

following table sets forth the expenses to be incurred in connection with the offer described in this Registration Statement:

|

Registration and Filing Fees

|

|

$

|

|

21,820

|

|

|

FINRA Fees

|

|

|

|

30,500

|

|

|

New York Stock Exchange Fees

|

|

|

|

21,429

|

|

|

Costs of Printing and Engraving

|

|

|

|

5,000

|

|

|

Accounting Fees and Expenses

|

|

|

|

37,500

|

|

|

Legal Fees and Expenses

|

|

|

|

150,357

|

|

|

Total

|

|

$

|

|

266,606

|

|

Item

28. Persons Controlled by or under Common Control with Registrant

None.

Item

29. Number of Holders of Securities

Set

forth below is the number of record holders as of March 31, 2021, of each class of securities of the

Registrant:

|

Title

of Class

|

|

|

Number

of Record Holders

|

|

Shares

of Common Stock, par value $0.01 per share

|

|

|

7

|

Item

30. Indemnification

It

is the Registrant’s obligation to indemnify its directors and officers to the maximum extent permitted by Maryland law as

set forth in Article VIII of Registrant’s Articles of Amendment and Restatement and Article V of the Registrant’s

Bylaws. The liability of the Registrant’s directors and officers is limited as provided in Article VIII of Registrant’s

Articles of Amendment and Restatement. The liability of Flaherty & Crumrine Incorporated, the Registrant’s investment

adviser (the “Adviser”), for any loss suffered by the Registrant or its shareholders is set forth in Section 5 of

the Investment Advisory Agreement.

Item

31. Business and other Connections of Investment Adviser

This information, with respect to the

Adviser, is set forth under the caption “Management of the Fund” in the Prospectus and in the Statement of Additional

Information, constituting Parts A and B, respectively, of this Registration Statement.

The

Adviser, a corporation organized under the laws of the State of California, acts as investment adviser to the Fund. The Fund is

fulfilling the requirement of this Item 31 to provide a list of the officers and directors of the Adviser, together with

information as to any other business, profession, vocation or employment of a substantial nature engaged in by the Adviser or

those officers and directors during the past two years, by incorporating by reference the information contained in the Form ADV

of the Adviser filed with the SEC pursuant to the 1940 Act (SEC File No. 801-19384).

Item

32. Location of Accounts and Records

The

majority of the accounts, books and other documents required to be maintained by Section 31(a) of the 1940 Act and the rules thereunder

will be maintained as follows: journals, ledgers, securities records and other original records will be maintained principally

at the offices of the Fund’s Administrator and Custodian. All other records so required to be maintained will be maintained

at the offices of Flaherty & Crumrine Incorporated, 301 E. Colorado Boulevard, Suite 800, Pasadena, California 91101.

Item

33. Management Services

Not applicable.

Item

34. Undertakings

(1) Not applicable.

(2)

Not applicable.

(3) Registrant

undertakes:

|

|

(a)

|

to

file, during any period in which offers or sales are being made, a post-effective amendment

to this Registration Statement:

(1) to

include any prospectus required by Section 10(a)(3) of the Securities Act;

(2) to

reflect in the prospectus any facts or events after the effective date of the Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information

set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation

from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with

the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change

in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective

registration statement; and

|

|

|

|

(3) to

include any material information with respect to the plan of distribution not previously disclosed

in the Registration Statement or any material change to such information in the Registration

Statement.

(4) if

(i) it determines to conduct one or more offerings of the Fund’s common shares (including rights to purchase

its common shares) at a price below its net asset value per common share at the date the offering is

commenced, and (ii) such offering or offerings will result in greater than a 15% dilution to the Fund’s net

asset value per common share.

|

|

|

(b)

|

that for the purpose

of determining any liability under the Securities Act, each post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof;

|

|

|

(c)

|

to remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the

offering;

|

|

|

(d)

|

that, for the purpose

of determining liability under the Securities Act to any purchaser:

|

(1) if

the Registrant is relying on Rule 430B:

(A) Each

prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance

on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (x), or (xi) for the purpose of providing the information

required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale

of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and

any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

or

(2) if

the Registrant is relying on Rule 430C: each prospectus filed pursuant to Rule 424(b) under the Securities Act as part of a registration

statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in

reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first

used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of

the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement

or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such

first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such date of first use.

|

|

(e)

|

that for the purpose

of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of securities:

|

The

undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or

sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser

and will be considered to offer or sell such securities to the purchaser:

|

|

(1)

|

any preliminary

prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424

under the Securities Act;

|

|

|

(2)

|

free writing prospectus

relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned

Registrant;

|

|

|

(3)

|

the portion of any

other free writing prospectus or advertisement pursuant to Rule 482 under the Securities Act relating to the offering containing

material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant;

and

|

|

|

(4)

|

any other communication

that is an offer in the offering made by the undersigned Registrant to the purchaser

|

(4) Registrant

undertakes:

|

|

(a)

|

that, for the purpose

of determining any liability under the Securities Act the information omitted from the form of prospectus filed as part of

the Registration Statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant under

Rule 424(b)(1) under the Securities Act will be deemed to be a part of the Registration Statement as of the time it was declared

effective.

|

|

|

(b)

|

that, for the purpose

of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus will

be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of the securities

at that time will be deemed to be the initial bona fide offering thereof.

|

(5) The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each

filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange

Act of 1934 that is incorporated by reference into the registration statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(6) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion

of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant

of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered,

the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and

will be governed by the final adjudication of such issue.

(7)

Registrant undertakes to send by first-class mail or other means designed to ensure equally prompt delivery, within two business

days of receipt of a written or oral request, any prospectus or Statement of Additional Information.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, Registrant

has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city

of Pasadena, State of California, on the 30th day of April, 2021.

|

|

FLAHERTY

& CRUMRINE DYNAMIC

|

|

|

PREFERRED

AND INCOME FUND

|

|

|

INCORPORATED

|

|

|

|

|

|

|

By:

|

/s/

R. Eric Chadwick

|

|

|

|

Name: R. Eric Chadwick

|

|

|

|

Title: Chief Executive Officer

|

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following

persons in the capacities and on April 30, 2021.

|

Signatures

|

|

Title

|

|

|

|

|

/s/

R. Eric Chadwick

|

|

Director

and Chief Executive Officer

|

|

R. Eric Chadwick

|

|

(Principal

Executive Officer)

|

|

|

|

|

|

Chief

Financial Officer, Vice President and

|

|

/s/

Bradford S. Stone

|

|

Treasurer

(Principal Financial and

|

|

Bradford S. Stone

|

|

Accounting

Officer)

|

|

|

|

*David

Gale

|

|

Director

|

|

David Gale

|

|

|

|

|

|

*Morgan

Gust

|

|

Director

|

|

Morgan Gust

|

|

|

|

|

|

*Karen

Hogan

|

|

Director

|

|

Karen H. Hogan

|

|

|

|

|

|

*By:

|

/s/

Chad Conwell

|

|

|

|

Chad Conwell, as

Agent

|

|

SCHEDULE

OF EXHIBITS

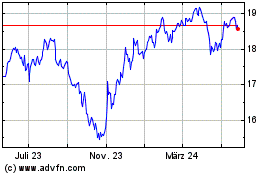

Flaherty and Crumrine Dy... (NYSE:DFP)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

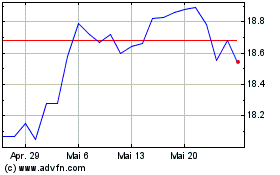

Flaherty and Crumrine Dy... (NYSE:DFP)

Historical Stock Chart

Von Nov 2023 bis Nov 2024