Current Report Filing (8-k)

06 Juni 2022 - 10:15PM

Edgar (US Regulatory)

0001345126false00013451262022-06-042022-06-040001345126codi:SharesRepresentingBeneficialInterestsInCompassDiversifiedHoldingsMember2022-06-042022-06-040001345126codi:SeriesAPreferredSharesRepresentingSeriesATrustPreferredInterestInCompassDiversifiedHoldingsMember2022-06-042022-06-040001345126codi:SeriesBPreferredSharesRepresentingSeriesBTrustPreferredInterestInCompassDiversifiedHoldingsMember2022-06-042022-06-040001345126codi:SeriesCPreferredSharesRepresentingSeriesCTrustPreferredInterestInCompassDiversifiedHoldingsMemberDomain2022-06-042022-06-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 4, 2022

COMPASS DIVERSIFIED HOLDINGS

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34927 | | 57-6218917 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

COMPASS GROUP DIVERSIFIED HOLDINGS LLC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34926 | | 20-3812051 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

301 Riverside Avenue, Second Floor, Westport, CT 06880

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (203) 221-1703

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Shares representing beneficial interests in Compass Diversified Holdings | | CODI | | New York Stock Exchange |

| Series A Preferred Shares representing beneficial interests in Compass Diversified Holdings | | CODI PR A | | New York Stock Exchange |

| Series B Preferred Shares representing beneficial interests in Compass Diversified Holdings | | CODI PR B | | New York Stock Exchange |

| Series C Preferred Shares representing beneficial interests in Compass Diversified Holdings | | CODI PR C | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Section 7 Regulation FD

Item 7.01 Regulation FD Disclosure

On June 6, 2022, Compass Diversified Holdings (“Compass Diversified”) issued a Press Release announcing the execution of a definitive agreement for the acquisition of PrimaLoft Technologies Holdings, Inc. (“PrimaLoft”), which such agreement is further described in Item 8.01 to this Current Report on Form 8-K. A copy of the Press Release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

As announced in the Press Release, Compass Diversified will hold a conference call and webcast at 5:00 p.m., Eastern Time on June 6, 2022 to discuss the transaction. A live webcast of the conference call along with the investor presentation will be available to the public through links on the Investor Relations section of Compass Diversified’s web site (compassdiversified.com). A copy of the investor presentation, which will be discussed during the conference call, is attached to this report as Exhibit 99.2 to this Current Report on Form 8-K.

The information under this Item 7.01 and Exhibit 99.1 and Exhibit 99.2 attached hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information or exhibits be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings, except as shall be expressly set forth by specific reference in such a filing. The furnishing of Exhibit 99.1 and Exhibit 99.2 attached hereto is not intended to constitute a determination by Compass Diversified that the information is material or that the dissemination of the information is required by Regulation FD.

Section 8 Other Events

Item 8.01 Other Events

Compass Diversified and Compass Group Diversified Holdings LLC (the “Company” and, together with Compass Diversified, collectively “CODI,” “us” or “we”) acquires and manages small to middle market businesses in the ordinary course of its business. The following description relates to the recent execution of a definitive agreement for the acquisition of one such business.

PrimaLoft

On June 4, 2022, a newly formed indirect subsidiary of the Company, Relentless Intermediate, Inc. (“Buyer”), entered into Stock Purchase Agreement (the “Purchase Agreement”) with VP PrimaLoft Holdings, LLC (“Seller”), pursuant to which Buyer will acquire all of the issued and outstanding equity of PrimaLoft, other than the Rollover Shares (as defined below). Buyer will acquire PrimaLoft and its subsidiaries for an enterprise value of $530 million in cash, subject to certain adjustments based on matters such as the working capital, indebtedness, unpaid expenses and cash balances at the time of the closing. The Company expects to fund the purchase price with an approximately $495 million draw on its revolving credit facility.

Prior to closing certain equity holders of the Seller will have a portion of their equity in Seller redeemed in exchange for equity of PrimaLoft in order to facilitate a rollover of such PrimaLoft equity (the “Rollover Shares”) into Relentless Topco, Inc., the parent of Buyer (“TopCo”). Following such rollover, TopCo will contribute the Rollover Shares to Buyer. Certain other members of PrimaLoft management will contribute cash in exchange for equity in Topco. Upon consummation of the transaction contemplated by the Purchase Agreement, CODI will directly own approximately 91% of TopCo, which will in turn own all of issued and outstanding equity interests of PrimaLoft.

Buyer will obtain a buy-side representation and warranty insurance policy and, other than in the case of fraud, such policy will be Buyer’s sole remedy with respect to breaches of representations and warranties made to Buyer.

The Purchase Agreement contains customary representations, warranties and covenants. Each party’s obligation to consummate the Purchase Agreement is subject to certain conditions, including, but not limited to (i) subject to certain exceptions, the accuracy of the representations and warranties of the other party, (ii) performance in all material respects by the other party of its covenants and agreements, (iii) the absence of any action or order issued by any governmental entity preventing consummation of the transaction and (iv) the expiration or termination of all applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. Buyer’s obligation to consummate the Purchase Agreement is also subject to (i) there being no material adverse effect occurring prior to closing and (ii) certain employees of PrimaLoft complying with their respective restrictive covenant agreements. The transaction is expected to close in July 2022, but there can be no assurances that all of the conditions to closing will be satisfied.

The Company has delivered to the Seller a fully executed limited guaranty in favor of the Seller as of the date hereof with respect to certain of Buyer’s obligations under the Purchase Agreement.

The foregoing brief description of the Purchase Agreement is not meant to be exhaustive and is qualified in its entirety by the Purchase Agreement itself, which is attached hereto as Exhibit 99.3 to this Current Report on Form 8-K.

Section 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 99.3 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: June 6, 2022 | COMPASS DIVERSIFIED HOLDINGS |

| | |

| By: | | /s/ Ryan J. Faulkingham |

| | |

| | | Ryan J. Faulkingham |

| | | Regular Trustee |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: June 6, 2022 | COMPASS GROUP DIVERSIFIED HOLDINGS LLC |

| | |

| By: | | /s/ Ryan J. Faulkingham |

| | |

| | | Ryan J. Faulkingham |

| | | Chief Financial Officer |

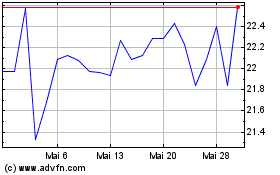

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

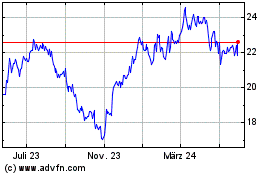

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024