Current Report Filing (8-k)

01 September 2021 - 3:05PM

Edgar (US Regulatory)

0001345126false00013451262021-09-012021-09-010001345126codi:SharesRepresentingBeneficialInterestsInCompassDiversifiedHoldingsMember2021-09-012021-09-010001345126codi:SeriesAPreferredSharesRepresentingSeriesATrustPreferredInterestInCompassDiversifiedHoldingsMember2021-09-012021-09-010001345126codi:SeriesBPreferredSharesRepresentingSeriesBTrustPreferredInterestInCompassDiversifiedHoldingsMember2021-09-012021-09-010001345126codi:SeriesCPreferredSharesRepresentingSeriesCTrustPreferredInterestInCompassDiversifiedHoldingsMemberDomain2021-09-012021-09-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 1, 2021

COMPASS DIVERSIFIED HOLDINGS

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-34927

|

|

57-6218917

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

COMPASS GROUP DIVERSIFIED HOLDINGS LLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-34926

|

|

20-3812051

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

301 Riverside Avenue, Second Floor, Westport, CT 06880

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (203) 221-1703

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Shares representing beneficial interests in Compass Diversified Holdings

|

|

CODI

|

|

New York Stock Exchange

|

|

Series A Preferred Shares representing beneficial interests in Compass Diversified Holdings

|

|

CODI PR A

|

|

New York Stock Exchange

|

|

Series B Preferred Shares representing beneficial interests in Compass Diversified Holdings

|

|

CODI PR B

|

|

New York Stock Exchange

|

|

Series C Preferred Shares representing beneficial interests in Compass Diversified Holdings

|

|

CODI PR C

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Section 7 Regulation FD

Item 7.01 Regulation FD Disclosure

On September 1, 2021, Compass Diversified Holdings (the “Trust”) and Compass Group Holdings LLC (the “Company”) (NYSE: CODI) (collectively “CODI”) issued a press release announcing that, effective September 1, 2021, it completed its planned tax reclassification and will now be treated as a corporation for U.S. federal income tax purposes (the “Reclassification”). The full text of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information contained under Item 7.01, including Exhibit 99.1, is being furnished and, as a result, such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Section 8 Other Events

Item 8.01 Other Events

Narrative description of the pro forma effects of the tax reclassification

On August 3, 2021, the shareholders of CODI approved amendments to the governing documents of CODI to allow the Board of Directors (the “Board”) to cause the Trust to elect to be treated as a corporation for United States federal income tax purposes (the “tax reclassification”). Following the shareholder vote, the Board resolved to cause the Trust to elect to be treated as a corporation for United States federal income tax purposes. Such election was effective September 1, 2021. The Trust was previously taxed as a partnership for United States income tax purposes.

If the tax reclassification had been effective December 31, 2020, the pro forma condensed consolidated balance sheet would have reflected an adjustment to reduce the deferred tax liability by $5.1 million as a result of the recording of an income tax benefit at the Trust for the year ended December 31, 2020. Stockholders’ equity would have increased by $5.1 million to reflect the effect of the income tax benefit on net income. As of December 31, 2020, pro forma consolidated total liabilities and stockholders’ equity would have been $1,373.2 million and $1,225.3, respectively. If the tax reclassification had occurred on January 1, 2020, the income tax provision recorded in the condensed consolidated pro forma statement of operations for the year ended December 31, 2020 would have decreased by $5.1 million to reflect the estimated tax benefit that would have been recorded at the Trust. Pro forma consolidated net income would have been $32.2 million for the year ended December 31, 2020. Pro forma consolidated basic and diluted loss per share would have increased $0.08 per share to ($0.26) per share for the year ended December 31, 2020.

If the tax reclassification had occurred on January 1, 2020, the income tax provision in the pro forma condensed consolidated statement of operations for the six months ended June 30, 2021 would have decreased by $14.2 million to reflect the effect of the estimated tax benefit that would have been recorded at the Trust. Pro forma consolidated net income would have been $24.9 million for the six months ended June 30, 2021. Pro forma consolidated basic and diluted loss per share would have increased $0.22 per share to ($0.07) per share for the six months ended June 30, 2021.

Section 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 1, 2021

|

COMPASS DIVERSIFIED HOLDINGS

|

|

|

|

|

|

|

By:

|

|

/s/ Ryan J. Faulkingham

|

|

|

|

|

|

|

|

|

Ryan J. Faulkingham

|

|

|

|

|

Regular Trustee

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 1, 2021

|

COMPASS GROUP DIVERSIFIED HOLDINGS LLC

|

|

|

|

|

|

|

By:

|

|

/s/ Ryan J. Faulkingham

|

|

|

|

|

|

|

|

|

Ryan J. Faulkingham

|

|

|

|

|

Chief Financial Officer

|

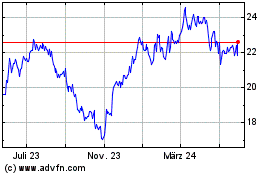

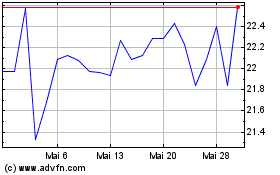

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024