UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 13, 2015 (July 10, 2015)

COMPASS DIVERSIFIED HOLDINGS

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-34927 | | 57-6218917 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

COMPASS GROUP DIVERSIFIED

HOLDINGS LLC

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-34926 | | 20-3812051 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

Sixty One Wilton Road

Second Floor

Westport, CT 06880

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (203) 221-1703

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 8 Other Events

Item 8.01 Other Events

Compass Group Diversified Holdings LLC (the “Company”) and Compass Diversified Holdings (“Holdings” and, together with the Company, collectively “CODI,” “us” or “we”) acquires and manages small to middle market businesses in the ordinary course of its business. The following description relates to the recent acquisition of one such business.

Fresh Hemp Foods Ltd.

On June 5, 2015, 1037270 B.C. Ltd. a British Columbia corporation and a majority owned subsidiary of the Company, and 1037269 B.C. Ltd, a British Columbia corporation and a wholly owned subsidiary of 1037270 B.C. Ltd. (together, the “Buyer”), entered into a stock purchase agreement (the “Manitoba Harvest Purchase Agreement”) with Fresh Hemp Foods Ltd. (“Manitoba Harvest”), Mike Fata, as the Stockholders’ Representative and the Signing Stockholders (as such term is defined in the Manitoba Harvest Purchase Agreement), pursuant to which Buyer agreed to acquire all of the issued and outstanding capital stock of Manitoba Harvest.

On July 10, 2015, the Buyer completed the acquisition of all the issued and outstanding capital stock of Manitoba Harvest (the “Closing”) pursuant to the Manitoba Harvest Purchase Agreement (the “Transaction”) for a purchase price of C$132.5 million. Acquisition-related costs were approximately C$1.4 million. The Company funded the Transaction through drawings under its revolving credit facility. The Company's initial ownership position in Buyer is approximately 87% on a primary basis. Mike Fata, CEO of Manitoba Harvest; Clif White Road Investments LLC, an existing shareholder; and certain other management team members invested alongside CODI and own the remaining 13%.

In connection with the Closing, the Company provided a credit facility to 1037270 B.C. Ltd. (the “Borrower”), pursuant to which a revolving loan commitment and term loans were made available to the Borrower (the “Manitoba Harvest Credit Agreement”). The initial amount outstanding under these facilities at the close of the Transaction was approximately C$30 million. The loans to the Borrower are guaranteed by the Borrower's subsidiaries, including Manitoba Harvest. The Company believes that the agreed terms of the loans are fair and reasonable given the leverage and risk profile of Manitoba Harvest and its subsidiaries.

The foregoing brief description of the Manitoba Harvest Purchase Agreement is not meant to be exhaustive and is qualified in its entirety by the full text of the Manitoba Harvest Purchase Agreement, which is incorporated herein by reference to Exhibit 99.1 to CODI’s Current Report on Form 8-K filed on June 8, 2015.

On July 13, 2015, CODI issued a press release announcing the Closing. A copy of the press release is attached as Exhibit 99.1 hereto. The foregoing description of the press release is qualified in its entirety by reference to the complete text of the press release furnished as Exhibit 99.1 hereto, which is hereby incorporated by reference herein.

Section 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

a) Financial statements of the businesses acquired

To the extent required by this item, historical financial statements for the Transaction referenced in Item 8.01 above will be filed in an amendment to this Current Report on Form 8-K no later than 71 calendar days after the date of this report is due.

b) Pro forma financial information

To the extent required by this item, pro forma financial information relating to the Transaction referenced in Item 8.01 above will be filed in an amendment to this Current Report on Form 8-K no later than 71 calendar days after the date of this report is due.

d) Exhibits

The following exhibit is furnished herewith: |

| | |

Exhibit | | Description |

99.1 | | Press Release of the Company dated July 13, 2015 announcing the purchase of Fresh Hemp Foods Ltd. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

Date: July 13, 2015 | COMPASS DIVERSIFIED HOLDINGS |

| | |

| By: | | /s/ Ryan J. Faulkingham |

| | |

| | | Ryan J. Faulkingham |

| | | Regular Trustee |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

Date: July 13, 2015 | COMPASS GROUP DIVERSIFIED HOLDINGS LLC |

| | |

| By: | | /s/ Ryan J. Faulkingham |

| | |

| | | Ryan J. Faulkingham |

| | | Chief Financial Officer |

Exhibit 99.1

|

| |

Compass Diversified Holdings Ryan J. Faulkingham Chief Financial Officer 203.221.1703 ryan@compassequity.com | Investor Relations and Media Contact: The IGB Group Leon Berman / Matt Steinberg 212.477.8438 / 212.477.8261 lberman@igbir.com / msteinberg@igbir.com |

Compass Diversified Holdings Closes Acquisition of Manitoba Harvest Hemp Foods

Westport, Conn., July 13, 2015 - Compass Diversified Holdings (NYSE: CODI) (“CODI” or the “Company”), an owner of leading middle market businesses, announced the closing of the acquisition of Fresh Hemp Foods Ltd. (“Manitoba Harvest”), pursuant to an agreement it entered into on June 5, 2015.

The acquisition was completed for a purchase price of C$132.5 million and funded through drawings under its revolving credit facility. Acquisition related costs were approximately $1.4 million. CODI’s initial common equity ownership in Manitoba Harvest as a result of this transaction is approximately 87% on a primary basis. Mike Fata, CEO of Manitoba Harvest; Clif White Road Investments LLC, an existing shareholder; and certain other management team members invested alongside CODI and own the remaining 13%.

Headquartered in Winnipeg, Manitoba, Manitoba Harvest is a pioneer and global leader in branded, hemp-based foods. The company’s products are the fastest growing in the hemp food market and among the fastest growing in the natural foods industry. Manitoba Harvest’s award-winning products are currently carried in about 7,000 retail stores across the U.S. and Canada.

Additional information on the acquisition will be available on the Company’s current report on Form 8-K that will be filed with the Securities and Exchange Commission shortly.

About Compass Diversified Holdings (“CODI”)

CODI owns and manages a diverse family of established North American middle market businesses. Each of its current subsidiaries is a leader in its niche market.

CODI maintains controlling ownership interests in each of its subsidiaries in order to maximize its ability to impact long term cash flow generation and value. The Company provides both debt and equity capital for its subsidiaries, contributing to their financial and operating flexibility. CODI utilizes the cash flows generated by its subsidiaries to invest in the long-term growth of the Company and to make cash distributions to its shareholders.

Our ten majority-owned subsidiaries are engaged in the following lines of business:

| |

• | The manufacture of quick-turn, small-run and production rigid printed circuit boards (Advanced Circuits); |

| |

• | The design and manufacture of promotionally priced upholstered furniture (American Furniture Manufacturing); |

| |

• | The design and manufacture of medical therapeutic support surfaces and other wound treatment devices (Anodyne Medical Device, also doing business and known as Tridien Medical); |

| |

• | The manufacture of engineered magnetic solutions for a wide range of specialty applications and end-markets (Arnold Magnetic Technologies); |

| |

• | The design and manufacture of personal hydration products for outdoor, recreation and military use (CamelBak Products); |

| |

• | Environmental services for a variety of contaminated materials including soils, dredged material, hazardous waste and drill cuttings (Clean Earth); |

| |

• | The design and marketing of wearable baby carriers, strollers and related products (Ergobaby); |

| |

• | The design and manufacture of premium home and gun safes (Liberty Safe); |

| |

• | The manufacture and marketing of branded, hemp-based food products (Manitoba Harvest); and |

| |

• | The manufacture and marketing of portable food warming fuel and creative table lighting solutions for the foodservice industry (SternoCandleLamp). |

In addition, we own approximately 41% of the common stock of Fox Factory Holding Corp. ("FOX", Nasdaq: FOXF), a former subsidiary business that completed its initial public offering in August 2013. FOX designs and manufactures high-performance suspension products primarily for mountain bikes, side-by-side vehicles, on-road and off-road vehicles and trucks, all-terrain vehicles, snowmobiles, specialty vehicles and applications, and motorcycles.

This press release may contain certain forward-looking statements, including statements with regard to the future performance of CODI. Words such as "believes," "expects," "projects," and "future" or similar expressions, are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements, and some of these factors are enumerated in the risk factor discussion in the Form 10-K filed by CODI with the SEC for the year ended December 31, 2014 and other filings with the SEC. Except as required by law, CODI undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

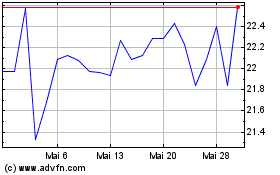

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

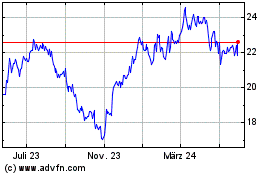

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024