UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

COMPASS DIVERSIFIED HOLDINGS

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-34927 | | 57-6218917 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

COMPASS GROUP DIVERSIFIED

HOLDINGS LLC

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-34926 | | 20-3812051 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

Sixty One Wilton Road

Second Floor

Westport, CT 06880

(Address of principal executive offices, including zip code)

Carrie Ryan, (203) 221-1703

(Name and telephone number, including area code, of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

|

| |

x | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

| |

This Form SD of Compass Group Diversified Holdings LLC and Compass Diversified Holdings (NYSE: CODI) (collectively, “CODI” or the “Company”) is filed pursuant to Rule 13p-1 under the Securities Exchange Act of 1934, as amended, for the reporting period from January 1, 2014 through December 31, 2014.

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Conflict Minerals Disclosure

Reasonable Country of Origin Inquiry

The Company conducted an analysis of its subsidiaries’ products and found that small quantities of conflict minerals (cassiterite, columbite-tantalite, gold, wolframite or their derivatives, which are limited to tin, tantalum, and tungsten) are contained in some of its subsidiaries’ products (the "Covered Products"). Therefore, for the reporting period from January 1, 2014 to December 31, 2014, the Company conducted a good faith reasonable country of origin inquiry (“RCOI”) which was reasonably designed to determine whether any of the necessary conflict minerals contained in its subsidiaries’ products originated in a Covered Country or came from recycled or scrap sources. “Necessary conflict minerals” are conflict minerals that are necessary to the functionality or production of products that the Company’s subsidiaries manufacture or that the Company’s subsidiaries contract with others to manufacture for us. A “Covered Country” is the Democratic Republic of the Congo or an adjoining country.

To conduct our RCOI, the Company engaged with its subsidiaries’ suppliers of necessary conflict minerals and made inquiries to those suppliers about the source of those necessary conflict minerals and about the smelters or refiners used to process those conflict minerals. In the Company’s supplier engagement, it used Conflict Minerals Reporting Template (“CMRT”) developed by the Conflict-Free Sourcing Initiative to request information from its subsidiaries’ suppliers about their supply chain and to gather information about the country of origin of our necessary conflict minerals. The Company and its subsidiaries do not have direct relationships with smelters or refiners in their supply chains, therefore it asked its subsidiaries’ suppliers to engage with their own respective suppliers to gather the requested information.

Conclusions

The Company has determined in good faith that during 2014 that certain of the Company’s subsidiaries have manufactured and/or contracted to manufacture products as to which conflict minerals are necessary to the functionality or production of their products. However, due to a lack of information from its suppliers for each of the products that contain conflict minerals which are necessary to the functionality of production of its products, the Company does not have sufficient information to conclusively determine the countries of origin of the Conflict Minerals contained in the Covered Products or whether the Conflict Minerals in the Covered Products are from recycled or scrap sources.

Based on our RCOI, we do not have sufficient information to determine whether our products manufactured or contracted for manufacture during the reporting period contain necessary conflict minerals that originated, or may have originated, in the Covered Countries. Accordingly, and out of an abundance of caution, we performed due diligence in an effort to determine the source and chain of custody of these necessary conflict minerals.

A copy of the Company’s Conflict Minerals Report is filed as Exhibit 1.01 to this Form SD, and is publicly available at: www.compassdiversifiedholdings.com. The content of any website referred to in this Form SD is not incorporated by reference in this Form SD.

Item 1.02 Exhibit

As required by Item 1.01, the Company is hereby filing its Conflict Minerals Report for the calendar year ended December 31, 2014 as Exhibit 1.01 to this Form SD.

Section 2 - Exhibits

Item 2.01 Exhibits

Exhibit 1.01 - Conflict Minerals Report as required by items 1.01 and 1.02 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

|

| | | |

Date: May 29, 2015 | COMPASS DIVERSIFIED HOLDINGS |

| | |

| By: | | /s/ Ryan J. Faulkingham |

| | |

| | | Ryan J. Faulkingham |

| | | Regular Trustee |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

|

| | | |

Date: May 29, 2015 | COMPASS GROUP DIVERSIFIED HOLDINGS LLC |

| | |

| By: | | /s/ Ryan J. Faulkingham |

| | |

| | | Ryan J. Faulkingham |

| | | Chief Financial Officer |

INDEX TO EXHIBITS

|

| | |

Exhibit Number | | Description of Exhibit |

| | |

1.01 | | Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form. |

Exhibit 1.01

Conflict Minerals Report

For The Year Ended December 31, 2014

This report for the reporting period from January 1, 2014 to December 31, 2014 is presented to comply with Rule 13p-1 promulgated under the Securities Exchange Act of 1934, as amended. Rule 13p-1 imposes certain reporting obligations on reporting companies whose manufactured or contract to be manufactured products contain conflict minerals which are necessary to the functionality or production of their products. “Conflict minerals” are defined as cassiterite, columbite-tantalite, gold, wolframite, and their derivatives, which are limited to tin, tantalum, and tungsten (“3TG”) for the purposes of this assessment. Please refer to Rule 13p-1, Form SD and the 1934 Act Release No. 34-67716 for definitions to the terms used in this Report, unless otherwise defined herein.

Company Overview

Compass Group Diversified Holdings LLC and Compass Diversified Holdings (collectively, “CODI” or the “Company”) were formed to acquire and manage a group of small to middle market businesses and the Company was a controlling owner of nine businesses, or operating subsidiaries, at December 31, 2014. The subsidiaries are as follows: CamelBak Products LLC. (“CamelBak”), The Ergo Baby Carrier, Inc. ("Ergobaby”), Liberty Safe and Security Products, Inc. (“Liberty Safe” or “Liberty”), Compass AC Holdings, Inc. (“ACI” or “Advanced Circuits”), American Furniture Manufacturing, Inc. (“AFM” or “American Furniture”), AMT Acquisition Corporation (“Arnold” or “Arnold Magnetics”), Clean Earth Holdings Inc. ("Clean Earth"), Candle Lamp Company, LLC ("SternoCandleLamp"), and Tridien Medical, Inc. (“Tridien”).

The Company’s subsidiaries are engaged in the following lines of business:

|

| |

| The design and manufacture of personal hydration products for outdoor, recreation and military use (CamelBak, www.camelbak.com); |

| |

| The design and marketing of wearable baby carriers, strollers and related products (Ergobaby, www.ergobaby.com ); |

| |

| The design and manufacture of premium home and gun safes (Liberty Safe, www.libertysafe.com); |

| |

| The manufacture of quick-turn, prototype and production rigid printed circuit boards (Advanced Circuits, www.advancedcircuits.com); |

| |

| The design and manufacture of promotionally priced upholstered furniture (American Furniture, www.americanfurn.net); |

| |

| The manufacture of engineered magnetic solutions for a wide range of specialty applications and end-markets (Arnold Magnetics, www.arnoldmagnetics.com); |

| |

| The treatment, analysis and recycling of a variety of contaminated materials including soil, dredged materials, hazardous waste and drill cuttings (Clean Earth, www.cleanearth.com); |

| |

| The manufacturer of portable food warming fuel and creative table lighting solutions for the food service industry (SternoCandleLamp, www.sternocandlelamp.com); |

| |

| The design and manufacture of medical therapeutic support surfaces and other wound treatment devices (Anodyne Medical Device, also doing business and known as Tridien, www.tridien.com); |

The content of any website referred to in this report is not incorporated by reference in this report.

Description of the Company's Products Covered by this Report

This report relates to products: (i) for which 3TG are necessary to the functionality or production of that product; (ii) that were manufactured or contracted to be manufactured by the Company; and (iii) for which the manufacture was completed during calendar year 2014. The Company determined that component products at three (3) of its subsidiaries contain or may contain 3TG which are necessary to the functionality or production of their products.

The Company acquired Clean Earth and SternoCandleLamp during the year ended December 31, 2014. The Company has not included either Clean Earth or SternoCandleLamp in our reporting on Form SD and the Conflict Mineral report for the year ended December 31, 2014 as we completed the acquisition during the latter half of the year. These companies acquired during calendar year 2014 will be included as required in our conflicts minerals report for calendar year 2016.

The Company's investment in FOX Factory Holding Corp. ("Fox") fell below 50% on July 10, 2014 and Fox was deconsolidated from the Company's financial statements at that time. As a result, the Company is reporting on Fox in this Conflict Minerals Report through July 10, 2014 only.

Due Diligence Design

With respect to the period covered, the design of the due diligence process conforms in all material respects with the internationally recognized due diligence framework set forth in the Organisation for Economic Co-operation and Development Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High Risk Areas, as further set out in the specific guidance for downstream companies contained in the Supplement on Tin, Tantalum, and Tungsten and the Supplement for Gold (hereinafter, collectively, the “OECD Guidance”).

Due Diligence Measures Performed

The Company undertook due diligence at each of its subsidiaries that have component products that contain or may contain conflict minerals to determine the source and chain of custody for the necessary conflict minerals contained in the products manufactured by or contracted for manufacture by the Company’s subsidiaries. Summarized below are the components of the conflict minerals due diligence program the Company undertook as they relate to the five-step framework set forth in the OECD Guidance:

1. Establish strong company management systems

Our operations are reported in nine business segments, therefore, we established a single point of contact to assist in developing and implementing a 3TG program. Each segment had its own designated specific personnel to coordinate the conflict mineral diligence, oversee the implementation and execution of a program and coordinate directly with its affected suppliers. The affected segments used the Conflict Minerals Reporting Template (“CMRT”) developed by the Conflict-Free Sourcing Initiative ("CFSI")as a reporting mechanism to request that suppliers provide information about the source and chain of custody of the necessary 3TG contained in products supplied to each of the affected segments.

2. Identifying and assessing risk in the supply chain

The Company took steps to identify and assess risk in each of its subsidiaries’ respective supply chains. The Company aimed to identify, to the best of its ability, the smelters/refiners that processed any 3TG in its subsidiaries’ products by using the CMRT. We sent the CMRT to each of the suppliers that directly supply us with components that contain 3TG in order to collect product-level information on the country of origin, source and chain of custody of those 3TG, as well as information on all smelters or refiners in their supply chain. To identify risks related to necessary 3TG in its products, the Company took the following actions:

| |

• | requested CMRT's from suppliers that supplied us material used in the production of products thought to contain conflict minerals; |

| |

• | worked with suppliers to obtain more complete information; |

| |

• | followed up with suppliers that did not respond; |

| |

• | sought information regarding the smelters or refiners or smelters that processed the conflict minerals in the suppliers’ products; and |

| |

• | analyzed the supplier’s responses. |

3. Design and implement a strategy to respond to identified risks

Results of the Company’s supply chain risk assessment were reported to the senior management of the Company. The Company adopted a risk management plan of attempting to disengage with a supplier where the Company deems risk mitigation not feasible or unacceptable, and where, in the Company’s opinion, such disengagement would not likely harm the supply chain for a particular product.

4. Carry out an independent third party audit of smelter's/ refiner’s due diligence practices

As an owner of downstream companies, the Company relies on audits by independent third parties, including audits of smelters and refiners reported by the CFSP. The Company also supports the certification processes of the London Bullion Market Association, The Responsible Jewellery Council, and the Tungsten Industry - Conflict Minerals Council.

Results of Review

As an owner of downstream companies, the Company can only provide reasonable, not absolute, assurance regarding the source and chain of custody of the 3TG used in its subsidiaries’ products. The Company relies on the information collected and provided by its subsidiaries’ direct suppliers and independent third party audit programs.

Smelters/Refiners

The Company requested smelter information from each of its subsidiaries’ suppliers. Table 1 lists smelters that processed necessary 3TG in its subsidiaries’ product lines, but is not a complete listing of all such smelters. Table 1 was compiled based on subsidiary suppliers’ responses to the CMRT where a supplier named a smelter. Subsidiary suppliers did not name more than one smelter in their responses, allowing the Company to determine that the particular smelter named in the response processed the necessary conflict minerals in its subsidiaries’ products. There was not sufficient information provided by suppliers to identify the rest of the smelters used in the Company’s subsidiaries’ supply chain.

Country of Origin

The Company asked each of its subsidiaries’ suppliers to disclose whether the necessary 3TG in the products they sold to the subsidiary came from the Democratic Republic of the Congo or an adjoining country. However, because its subsidiaries’ suppliers did not disclose the country of origin of those necessary 3TG, the Company was also unable to determine the country of origin of its necessary conflict minerals.

Efforts to determine mine or location

The Company has determined that the most reasonable effort it can make to determine the mines or locations of origin of its necessary 3TG is to seek information from its direct suppliers about the smelters and refiners and the countries of origin of the necessary 3TG in its products and urge that its suppliers do the same with their direct suppliers. The Company must rely on its direct and indirect suppliers to provide the information about the mine or location of origin of the necessary 3TG in its products. As a result of the lack of information obtained from the Company’s subsidiaries’ suppliers, the Company was unable to determine the mine or location of the necessary conflict minerals in its subsidiaries’ product lines.

Risk Mitigation / Future Due Diligence Measures

The Company intends to take steps to improve its due diligence and mitigate the risk that the Company’s necessary 3TG benefit or finance armed groups, including:

| |

• | Evaluating current suppliers based on their responsiveness to this first data collection effort. Those suppliers who provide products with risk of 3TG content that requires reporting and whose response was limited or non-existent for calendar year 2014 will be submitted to the executive management of the applicable subsidiary for review. |

| |

• | Reaching out to suppliers earlier in the process and asking them to complete the CMRT. |

| |

• | Improving, to the extent possible, the percentage of supplier provided responses to the request to complete the CMRT. |

Independent Private Sector Audit

An Independent Private Sector Audit of this report was not required for the year ended December 31, 2014.

Forward-Looking Statements

This report may contain certain forward-looking statements, including those made under the “Risk Mitigation / Future Due Diligence Measures” section. Words such as “believes,” “expects,” “projects,” and “future” or similar expressions, are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements are subject to a variety of uncertainties, unknown risks and other factors concerning the Company’s operations and business environment, which are difficult to predict and are beyond the control of the Company. Factors that could adversely affect our future performance include (1) those described under the heading “Risk Factors” in Item 1A of Part I of our Annual Report on Form 10-K for the year ended December 31, 2014, (2) the outcome of the current legal challenge to Rule 13p-1, (3) the responsible sourcing of 3TG in our supply chain by our direct and indirect suppliers and (4) the effectiveness of traceability systems used by our direct and indirect suppliers to determine the source and chain of custody of 3TG contained in our supply chain. Except as required by law, CODI undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise

Table 1 - Partial List of Smelters that have processed necessary 3TG of the Company’s subsidiaries

|

| | | | |

Metal | | Smelter Reference List | | Smelter Facility Location: Country |

Tungsten | | HC Starck GmBH | | GERMANY |

Gold | | Royal Canadian Mint | | CANADA |

Gold | | Metalor USA Refining Corporation | | UNITED STATES |

Gold | | Umicore SA Business Unit Precious Metals Refining | | BELGIUM |

Gold | | United Precious Metal Refining, Inc. | | UNITED STATES |

Gold | | Ohio Precious Metals, LLC | | UNITED STATES |

Tin | | PT Bukit Timah | | INDONESIA |

Tin | | Thaisarco | | THAILAND |

Tin | | Metallo Chimique | | BELGIUM |

Tin | | EM Vinto | | BOLIVIA |

Tin | | Mineração Taboca S.A. | | BRAZIL |

Tin | | Cooper Santa | | BRAZIL |

Tin | | PT Koba Tin | | INDONESIA |

Tin | | PT Timah | | INDONESIA |

Tin | | Malaysia Smelting Corporation | | MALAYSIA |

Tin | | Minsur | | PERU |

Tin | | Yunnan Tin Company Limited | | CHINA |

Tantalum | | LMS Brasil S.A. | | BRAZIL |

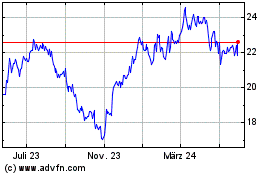

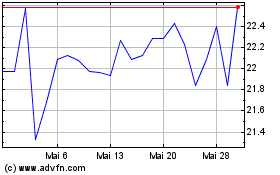

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024