Class A: GARTX Class C: GCRTX

Institutional: GJRTX Class IR: GSRTX Class R: GRRTX

Before you invest, you may want to review the Goldman Sachs Absolute Return Tracker Fund’s (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can

find the Fund’s Prospectus and other information about the Fund, including the Statement of Additional Information (“SAI”) and most recent annual reports to shareholders, online at

www.goldmansachsfunds.com/summaries

. You can

also get this information at no cost by calling 800-621-2550 for Institutional shareholders, 800-526-7384 for all other shareholders or by sending an e-mail request to gs-funds-document-requests@gs.com. The Fund’s Prospectus and SAI, both dated

April 2, 2012, as amended to date, are incorporated by reference into this Summary Prospectus.

The Goldman Sachs Absolute Return Tracker Fund (the “Fund”) seeks to deliver

long-term total return consistent with investment results that approximate the return and risk patterns of a diversified universe of hedge funds.

|

|

|

|

|

FEES AND EXPENSES OF THE FUND

|

|

|

This table describes the fees and expenses that you may pay if you buy and hold shares

of the Fund. You may qualify for sales charge discounts on purchases of Class A Shares if you and your family invest, or agree to invest in the future, at least $50,000 in Goldman Sachs Funds. More information about these and other discounts is

available from your financial professional and in “Shareholder Guide—Common Questions Applicable to the Purchase of Class A Shares” beginning on page 87 of the Prospectus and “Other Information Regarding Maximum Sales

Charge, Purchases, Redemptions, Exchanges and Dividends” beginning on page B-107 of the Fund’s SAI.

SHAREHOLDER

FEES

(fees paid directly from your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A

|

|

|

Class C

|

|

|

Institutional

|

|

|

Class IR

|

|

Class R

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price)

|

|

|

5.5

|

%

|

|

|

None

|

|

|

|

None

|

|

|

None

|

|

None

|

|

Maximum Deferred Sales Charge (Load)

(as a percentage of the lower of original

purchase price or sale proceeds)

1

|

|

|

None

|

|

|

|

1.0

|

%

|

|

|

None

|

|

|

None

|

|

None

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of

your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A

|

|

|

Class C

|

|

|

Institutional

|

|

|

Class IR

|

|

|

Class R

|

|

|

Management Fees

|

|

|

1.10

|

%

|

|

|

1.10

|

%

|

|

|

1.10

|

%

|

|

|

1.10

|

%

|

|

|

1.10

|

%

|

|

Distribution and Service (12b-1) Fees

|

|

|

0.25

|

%

|

|

|

1.00

|

%

|

|

|

None

|

|

|

|

None

|

|

|

|

0.50

|

%

|

|

Other Expenses

|

|

|

0.24

|

%

|

|

|

0.24

|

%

|

|

|

0.09

|

%

|

|

|

0.24

|

%

|

|

|

0.24

|

%

|

|

Acquired Fund Fees and Expenses

|

|

|

0.02

|

%

|

|

|

0.02

|

%

|

|

|

0.02

|

%

|

|

|

0.02

|

%

|

|

|

0.02

|

%

|

|

Total Annual Fund Operating Expenses

2

|

|

|

1.61

|

%

|

|

|

2.36

|

%

|

|

|

1.21

|

%

|

|

|

1.36

|

%

|

|

|

1.86

|

%

|

|

Expense Limitation

3

|

|

|

(0.03

|

)%

|

|

|

(0.03

|

)%

|

|

|

(0.03

|

)%

|

|

|

(0.03

|

)%

|

|

|

(0.03

|

)%

|

|

Total Annual Fund Operating Expenses After Expense Limitation

2

|

|

|

1.58

|

%

|

|

|

2.33

|

%

|

|

|

1.18

|

%

|

|

|

1.33

|

%

|

|

|

1.83

|

%

|

|

1

|

A contingent deferred sales charge (“CDSC”) of 1% is imposed on Class C Shares redeemed within 12 months of purchase.

|

|

2

|

The Total Annual Fund Operating Expenses do not correlate to the ratios of net and total expenses to average net assets provided in the Financial

Highlights, which reflect the operating expenses of the Fund and do not include Acquired Fund Fees and Expenses.

|

|

3

|

The Investment Adviser has agreed to reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and

expenses, taxes, dividend and interest expenses on short sales, interest, brokerage fees, litigation, indemnification, shareholder meeting and other extraordinary expenses) to 0.014% of the Fund’s average daily net assets through at least April

2, 2013, and prior to such date the Investment Adviser may not terminate the arrangement without the approval of the Board of Trustees. The Fund’s “Other Expenses” may be further reduced by any custody and transfer agency fee credits

received by the Fund.

|

2 SUMMARY PROSPECTUS — GOLDMAN SACHS ABSOLUTE RETURN TRACKER FUND

This Example is intended to help you compare the cost of investing in the Fund with the

cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in Class A, Class C, Institutional, Class IR and/or

Class R Shares of the Fund for the time periods indicated and then redeem all of your Class A, Class C, Institutional, Class IR and/or Class R Shares at the end of those periods. The Example also assumes that your investment has a 5% return

each year and that the Fund’s operating expenses remain the same (except that the Example incorporates the expense limitation arrangements for only the first year). Although your actual costs may be higher or lower, based on these assumptions

your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

Class A Shares

|

|

$

|

702

|

|

|

$

|

1,027

|

|

|

$

|

1,375

|

|

|

$

|

2,354

|

|

|

Class C Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— Assuming complete redemption at end of period

|

|

$

|

336

|

|

|

$

|

734

|

|

|

$

|

1,258

|

|

|

$

|

2,694

|

|

|

— Assuming no redemption

|

|

$

|

236

|

|

|

$

|

734

|

|

|

$

|

1,258

|

|

|

$

|

2,694

|

|

|

Institutional Shares

|

|

$

|

120

|

|

|

$

|

381

|

|

|

$

|

662

|

|

|

$

|

1,463

|

|

|

Class IR Shares

|

|

$

|

135

|

|

|

$

|

428

|

|

|

$

|

742

|

|

|

$

|

1,632

|

|

|

Class R Shares

|

|

$

|

186

|

|

|

$

|

582

|

|

|

$

|

1,003

|

|

|

$

|

2,177

|

|

The Fund pays transaction costs when it buys and sells securities or instruments

(

i.e.

, “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in

higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover rate for

the fiscal year ended December 31, 2011 was 105% of the average value of its portfolio.

The Fund’s Investment Adviser believes that hedge funds derive a large portion of

their returns from exposure to sources of market risk, such as equity, fixed income and commodity asset classes, rather than manager skill. (The component of hedge fund return that is attributable to market risk exposure, rather than manager skill,

is referred to as the “beta” component.) The Investment Adviser selects the Fund’s investments using a quantitative algorithm (or methodology) that seeks to identify the beta component of hedge fund returns and gain exposure to these

sources of market risk and their related returns. The Fund will invest in securities and other financial instruments (as set forth below) that provide short or long exposure to market factors that represent these sources of market risk and return

(the “Component Market Factors”). The Component Market Factors include but are not limited to:

|

n

|

|

U.S. and non-U.S. equity indices;

|

|

n

|

|

volatility indices; and

|

|

n

|

|

emerging markets exchange-traded funds (“ETFs”).

|

The Fund’s portfolio of investments may include, among other instruments, equities, futures, swaps, structured notes, ETFs, stocks and forward contracts, as well as U.S. Government securities

(including agency debentures) and other high quality debt securities. The Fund may also invest in cash equivalents. As a result of the Fund’s use of derivatives, the Fund may also hold significant amounts of U.S. Treasury or short-term

investments, including money market funds and repurchase agreements and may from time to time hold foreign currencies. The Fund generally invests in instruments that are directly linked to one or more Component Market Factors. For example, the Fund

may invest in an index futures contract where the index is a Component Market Factor. From time to time, however, the Fund may invest a portion of its assets in instruments that are not directly linked to a Component Market Factor, if the Investment

Adviser believes that those instruments will nonetheless assist the Fund in attempting to track the investment returns of a Component Market Factor. This may occur for a number of reasons. For example, regulatory constraints, such as limitations

with respect to the Fund’s investments in illiquid securities, or certain tax related concerns, may prevent the Fund from investing in instruments that are directly linked to a Component Market Factor.

The algorithm takes into account the historical returns, risks and correlations of the Component Market Factors in seeking to approximate patterns of

returns of hedge funds as a broad asset class. The algorithm operates in accordance with a set of pre-determined rules, and determines the composition of the Fund and the weight to be given to each Component Market Factor within the Fund’s

portfolio.

The weighting of a Component Market Factor within the Fund may be positive or negative. A negative weighting will result from an

investment in an instrument that provides a short exposure to a Component Market Factor. As a result of the Fund’s potential exposure to negative weightings in different Component Market Factors, the Fund’s net asset value

(“NAV”) per share may decline during certain periods, even if the value of any or all of the Component Market Factors increases during that time. The Fund does not invest in hedge funds.

|

|

|

|

|

PRINCIPAL RISKS OF THE FUND

|

|

|

Loss of money is a risk of investing in the Fund. An investment in the Fund is not a

bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its

investment objective.

Absence of Regulation.

The Fund engages in over-the-counter (“OTC”) transactions. In general,

there is less governmental regulation and supervision of transactions in the OTC markets than of transactions entered into on organized exchanges.

3 SUMMARY PROSPECTUS — GOLDMAN SACHS ABSOLUTE RETURN TRACKER FUND

Commodity Sector Risk.

Exposure to the commodities markets may subject the Fund to greater

volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a

particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. The prices of energy, industrial metals, precious metals, agriculture and

livestock sector commodities may fluctuate widely due to factors such as changes in value, supply and demand and governmental regulatory policies. The commodity-linked securities in which the Fund invests may be issued by companies in the financial

services sector, and events affecting the financial services sector may cause the Fund’s share value to fluctuate.

Derivatives Risk.

Loss may result from the Fund’s investments in options, futures, swaps, options on swaps, structured securities and

other derivative instruments. These instruments may be leveraged so that small changes may produce disproportionate losses to the Fund. Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will

not fulfill its contractual obligation.

Foreign Risk.

Foreign securities may be subject to risk of loss because of more or less

foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. Loss may also result from, among others, a slow U.S. economy, regional or global conflicts, the

imposition of exchange controls, confiscations and other government restrictions, or from problems in registration, settlement or custody. Foreign risk also involves the risk of negative foreign currency rate fluctuations. To the extent that the

Fund also invests in securities of issuers located in emerging markets, these risks will be more pronounced, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to

foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time.

Investment

Style Risk.

Different investment styles (e.

g.

, “growth”, “value” or “quantitative”) tend to shift in and out of favor depending upon market and economic conditions and investor sentiment. The Fund employs

a “quantitative” style, and may outperform or underperform other funds that invest in similar asset classes but employ different investment styles.

Liquidity Risk.

The Fund may make investments that may be illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may

be more difficult to value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests,

or other reasons. To meet redemption requests, the Fund may be forced to sell securities at an unfavorable time and/or under unfavorable conditions.

Management Risk.

A strategy used by the Investment Adviser may fail to produce the intended results. The Investment Adviser attempts to execute a complex strategy for the Fund using a

proprietary quantitative model. Investments selected using this model may perform differently than expected as a result of the Component Market Factors used in the models, the weight placed on each Component Market Factor, changes from the Component

Market Factors’ historical trends, and technical issues in the construction and implementation of the models (including, for example, data problems and/or software issues). There is no guarantee that the Investment Adviser’s use of the

quantitative model will result in effective investment decisions for the Fund. Additionally, commonality of holdings across quantitative money managers may amplify losses.

Short Selling Risk.

Short selling occurs when the Fund borrows a security from a lender, sells the security to a third party, reacquires the same security and returns it to the lender to

close the transaction. The Fund profits if the price of the borrowed security declines in value from the time the Fund sells it to the time the Fund reacquires it. Conversely, if the borrowed security has appreciated in value during this period, the

Fund will suffer a loss. The potential loss on a short sale is unlimited because the price of the borrowed security may rise indefinitely. Short selling also involves the risks of: increased leverage, and its accompanying potential for losses; the

potential inability to reacquire a security in a timely manner, or at an acceptable price; the possibility of the lender terminating the loan at any time, forcing the Fund to close the transaction under unfavorable circumstances; the additional

costs that may be incurred; and the potential loss of investment flexibility caused by the Fund’s obligations to provide collateral to the lender and set aside assets to cover the open position.

Tax Risk.

The tax treatment of the Fund’s commodity-linked investments may be adversely affected by future legislation, Treasury

Regulations, and/or guidance issued by the Internal Revenue Service (the “IRS”) that could affect whether income from such investments is “qualifying income” under Subchapter M of the Internal Revenue Code of 1986, as amended

(the “Code”), or otherwise affect the character, timing and/or amount of the Fund’s taxable income for any gains and distributions made by the Fund.

U.S. Government Securities Risk.

The U.S. government may not provide financial support to U.S. government agencies, instrumentalities or sponsored enterprises if it is not obligated to do so

by law. U.S. Government Securities issued by the Federal National Mortgage Association (“Fannie Mae”), Federal Home Loan Mortgage Corporation (“Freddie Mac”) and the Federal Home Loan Banks chartered or sponsored by Acts of

Congress are not backed by the full faith and credit of the United States. It is possible that these issuers will not have the funds to meet their payment obligations in the future.

The bar chart and table on the following page provide an indication of the risks of

investing in the Fund by showing: (a) changes in the performance of the Fund’s Institutional Shares from year to year; and (b) how the average annual total returns of the Fund’s Class A, Class C, Institutional, Class IR and

Class R Shares compare to those of broad-based securities market indices.

4 SUMMARY PROSPECTUS — GOLDMAN SACHS ABSOLUTE RETURN TRACKER FUND

The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund

will perform in the future. Updated performance information is available at no cost at

www.goldmansachsfunds.com/performance

or by calling 800-621-2550 for Institutional shareholders and 800-526-7384 for all other shareholders.

Performance reflects expense limitations in effect.

AVERAGE ANNUAL TOTAL RETURN

|

|

|

|

|

|

|

|

|

|

|

For the period ended

December 31, 2011

|

|

1 Year

|

|

|

Since

Inception

|

|

|

Class A Shares (Inception 5/30/08)

|

|

|

|

|

|

|

|

|

|

Returns Before Taxes

|

|

|

-9.07%

|

|

|

|

-4.49%

|

|

|

Returns After Taxes on Distributions

|

|

|

-9.27%

|

|

|

|

-4.61%

|

|

|

Returns After Taxes on Distributions and Sale of Fund Shares

|

|

|

-5.70%

|

|

|

|

-3.82%

|

|

|

Class C Shares (Inception 5/30/08)

|

|

|

|

|

|

|

|

|

|

Returns Before Taxes

|

|

|

-5.45%

|

|

|

|

-3.70%

|

|

|

Institutional Shares (Inception 5/30/08)

|

|

|

|

|

|

|

|

|

|

Returns Before Taxes

|

|

|

-3.51%

|

|

|

|

-2.60%

|

|

|

Class IR Shares (Inception 5/30/08)

|

|

|

|

|

|

|

|

|

|

Returns Before Taxes

|

|

|

-3.63%

|

|

|

|

-2.73%

|

|

|

Class R Shares (Inception 5/30/08)

|

|

|

|

|

|

|

|

|

|

Returns

|

|

|

-4.00%

|

|

|

|

-3.21%

|

|

|

HFRX™ Global Hedge Fund Index (reflects no deduction for fees, expenses or taxes)*

|

|

|

-8.87%

|

|

|

|

-4.87%

|

|

|

Goldman Sachs Absolute Return Tracker Index (reflects no deduction for fees, expenses or

taxes)**

|

|

|

-2.43%

|

|

|

|

-1.19%

|

|

|

*

|

The HFRX Global Hedge Fund Index is a trademark of Hedge Fund Research, Inc. (“HFR”). HFR has not participated in the formation of the Fund. HFR does not

endorse or approve the Fund or make any recommendation with respect to investing in the Fund.

|

|

**

|

Effective April 2, 2012, the Fund’s sole benchmark is the HFRX Global Hedge Fund Index. The Investment Adviser believes that the HFRX Global Hedge Fund Index

will be a more appropriate benchmark against which to measure the performance of the Fund given the Fund’s change from a passive strategy to an actively managed strategy. The Goldman Sachs Absolute Return Tracker Index is no longer a benchmark

index for the Fund.

|

The after-tax returns are for Class A Shares only. The after-tax returns for Class C, Institutional and

Class IR Shares, and returns for Class R Shares (which are offered exclusively to retirement plans), will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact

of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred

arrangements such as 401(k) plans or individual retirement accounts.

Goldman Sachs Asset Management, L.P. is the investment adviser for the Fund (the

“Investment Adviser” or “GSAM”).

Portfolio Managers:

Don Mulvihill, Managing Director, has managed the Fund

since 2012; and Matthew Hoehn, Vice President, has managed the Fund since 2009.

|

|

|

|

|

BUYING AND SELLING FUND SHARES

|

|

|

The minimum initial investment for Class A and Class C Shares is, generally,

$1,000. The minimum initial investment for Institutional Shares is, generally, $1,000,000 for individual or certain institutional investors, alone or in combination with other assets under the management of the Investment Adviser and its affiliates.

There is no minimum for initial purchases of Class IR and Class R Shares. Those share classes with a minimum initial investment requirement do not impose it on certain employee benefit plans, and Institutional Shares do not impose it on certain

investment advisers investing on behalf of other accounts.

The minimum subsequent investment for Class A and Class C shareholders is $50,

except for certain employee benefit plans, for which there is no minimum. There is no minimum subsequent investment for Institutional, Class IR or Class R shareholders.

You may purchase and redeem (sell) shares of the Fund on any business day through certain brokers, investment advisers and other financial institutions (“Authorized Institutions”).

The Fund’s distributions are taxable, and will be taxed as ordinary income or

capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Investments through tax-deferred arrangements may become taxable upon withdrawal.

|

|

|

|

|

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

|

|

|

If you purchase the Fund through an Authorized Institution, the Fund and its related

companies may pay the Authorized Institution for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Authorized Institution and your salesperson to recommend the Fund over another

investment. Ask your salesperson or visit your Authorized Institution’s website for more information.

SELSATM112V3

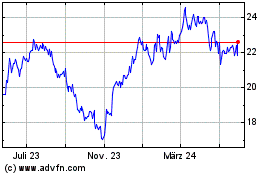

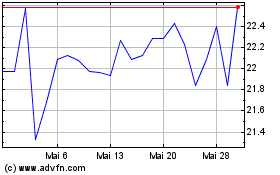

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024