Definitive Materials Filed by Investment Companies. (497)

07 November 2012 - 10:18PM

Edgar (US Regulatory)

SUPPLEMENT TO THE PROSPECTUS

OF

WELLS FARGO ADVANTAGE COREBUILDER SHARES

Series M

The prospectus is supplemented as follows:

The sections entitled "Principal Investment Strategies" are supplemented to add the following:

Effective April 1, 2013, we may invest up to 20% of the Fund's total assets in inverse floaters to seek enhanced returns.

Inverse floaters are derivative debt instruments created by depositing a municipal security in a trust. Inverse floaters pay

interest at rates that generally vary inversely with specified short-term interest rates and involve leverage. We intend to

limit leverage created by the Fund's investment in inverse floaters to an amount equal to 20% of the Fund's total assets.

The section entitled "Principal Investments" is supplemented to add the following:

■

effective April 1, 2013, up to 20% of the Fund's total assets in inverse floaters.

The section entitled "Principal Investment Risks" is supplemented to add the following:

Effective April 1, 2013, the following principal investment risk applies to the Fund:

Inverse Floater Risk.

The interest payment received on inverse floating rate securities generally will decrease when specified short-term interest

rates increase. Inverse floaters are derivative debt instruments that involve leverage, which may magnify the Fund's gains

or losses, and exhibit greater price and income volatility than bonds with similar maturities. Inverse floaters are also subject

to the risks associated with derivatives and municipal securities.

The section entitled "Principal Risk Factors" is supplemented to add the following:

■

Effective April 1, 2013, Inverse Floater Risk

The section entitled "Description of Principal Investment Risks" is supplemented to add the following:

Inverse Floater Risk.

An inverse floater is a derivative debt instrument created by depositing a municipal security in a trust. The trust then

issues two securities: a short-term floating rate security, which is referred to as a "floater," and a long-term floating

rate security, which is referred to as an "inverse floater." A floater entitles the holder to interest payments based on specified

short-term interest rates and to an option to tender the security for repayment of its principal value. An inverse floater

entitles the holder to interest payments based on a rate that varies inversely to changes in the rate payable on the floater

and to a residual interest in the underlying municipal security held in trust. The Fund, as a holder of an inverse floater,

retains the entire risk of loss on the underlying municipal security and thus could lose more than its principal investment.

An inverse floater produces less income (and may produce no income) and may decline in value when the rate payable on the

floater rises, and produces more income and may increase in value when the rate payable on the floater falls. An inverse floater

involves leverage, which may magnify the Fund's gains or losses, and exhibits greater price and income volatility than a bond

with a similar maturity. The tender of a floater, the failure of a remarketing agent to sell a floater or certain other events

may require the dissolution of the trust or the liquidation of the underlying municipal security. In that event, the Fund,

as a holder of an inverse floater, and thus a residual interest in the underlying municipal security, may lose some or all

of its investment. An inverse floater is also subject to the risks associated with derivatives and municipal securities.

|

November 7, 2012

|

CBM112/P1516S2

|

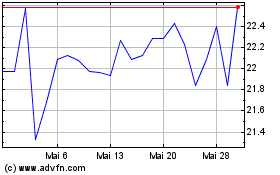

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

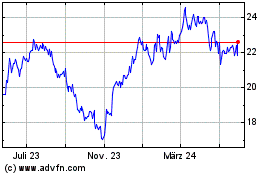

Compass Diversified (NYSE:CODI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024