FALSE00008974292/32023Q300008974292023-01-292023-10-2800008974292023-11-21xbrli:shares00008974292023-07-302023-10-28iso4217:USDxbrli:pure00008974292022-07-312022-10-2900008974292022-01-302022-10-29iso4217:USDxbrli:shares00008974292023-10-2800008974292023-01-2800008974292022-10-290000897429us-gaap:CommonStockMember2023-07-290000897429us-gaap:AdditionalPaidInCapitalMember2023-07-290000897429us-gaap:TreasuryStockCommonMember2023-07-290000897429us-gaap:RetainedEarningsMember2023-07-290000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-2900008974292023-07-290000897429us-gaap:RetainedEarningsMember2023-07-302023-10-280000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-302023-10-280000897429us-gaap:CommonStockMember2023-07-302023-10-280000897429us-gaap:AdditionalPaidInCapitalMember2023-07-302023-10-280000897429us-gaap:CommonStockMember2023-10-280000897429us-gaap:AdditionalPaidInCapitalMember2023-10-280000897429us-gaap:TreasuryStockCommonMember2023-10-280000897429us-gaap:RetainedEarningsMember2023-10-280000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-280000897429us-gaap:CommonStockMember2022-07-300000897429us-gaap:AdditionalPaidInCapitalMember2022-07-300000897429us-gaap:TreasuryStockCommonMember2022-07-300000897429us-gaap:RetainedEarningsMember2022-07-300000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-3000008974292022-07-300000897429us-gaap:RetainedEarningsMember2022-07-312022-10-290000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-312022-10-290000897429us-gaap:CommonStockMember2022-07-312022-10-290000897429us-gaap:AdditionalPaidInCapitalMember2022-07-312022-10-290000897429us-gaap:CommonStockMember2022-10-290000897429us-gaap:AdditionalPaidInCapitalMember2022-10-290000897429us-gaap:TreasuryStockCommonMember2022-10-290000897429us-gaap:RetainedEarningsMember2022-10-290000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-290000897429us-gaap:CommonStockMember2023-01-280000897429us-gaap:AdditionalPaidInCapitalMember2023-01-280000897429us-gaap:TreasuryStockCommonMember2023-01-280000897429us-gaap:RetainedEarningsMember2023-01-280000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-280000897429us-gaap:RetainedEarningsMember2023-01-292023-10-280000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-292023-10-280000897429us-gaap:CommonStockMember2023-01-292023-10-280000897429us-gaap:AdditionalPaidInCapitalMember2023-01-292023-10-280000897429us-gaap:TreasuryStockCommonMember2023-01-292023-10-280000897429us-gaap:CommonStockMember2022-01-290000897429us-gaap:AdditionalPaidInCapitalMember2022-01-290000897429us-gaap:TreasuryStockCommonMember2022-01-290000897429us-gaap:RetainedEarningsMember2022-01-290000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-2900008974292022-01-290000897429us-gaap:RetainedEarningsMember2022-01-302022-10-290000897429us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-302022-10-290000897429us-gaap:CommonStockMember2022-01-302022-10-290000897429us-gaap:AdditionalPaidInCapitalMember2022-01-302022-10-290000897429chs:MergerAgreementMember2023-09-272023-09-270000897429chs:MergerAgreementMember2023-09-270000897429chs:ChicosBrandMember2023-07-302023-10-280000897429chs:ChicosBrandMember2022-07-312022-10-290000897429chs:ChicosBrandMember2023-01-292023-10-280000897429chs:ChicosBrandMember2022-01-302022-10-290000897429chs:WhiteHouseBlackMarketMember2023-07-302023-10-280000897429chs:WhiteHouseBlackMarketMember2022-07-312022-10-290000897429chs:WhiteHouseBlackMarketMember2023-01-292023-10-280000897429chs:WhiteHouseBlackMarketMember2022-01-302022-10-290000897429chs:SomaMember2023-07-302023-10-280000897429chs:SomaMember2022-07-312022-10-290000897429chs:SomaMember2023-01-292023-10-280000897429chs:SomaMember2022-01-302022-10-290000897429chs:CustomerRewardsProgramMember2023-10-280000897429chs:CustomerRewardsProgramMember2023-01-280000897429chs:CustomerRewardsProgramMember2022-10-290000897429chs:CustomerRewardsProgramMember2023-07-290000897429chs:CustomerRewardsProgramMember2022-07-300000897429chs:CustomerRewardsProgramMember2022-01-290000897429chs:CustomerRewardsProgramMember2023-07-302023-10-280000897429chs:CustomerRewardsProgramMember2022-07-312022-10-290000897429chs:CustomerRewardsProgramMember2023-01-292023-10-280000897429chs:CustomerRewardsProgramMember2022-01-302022-10-290000897429us-gaap:RestrictedStockMember2023-01-292023-10-280000897429us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:RestrictedStockMember2023-01-292023-10-280000897429us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockMember2023-01-292023-10-280000897429us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:RestrictedStockMember2023-01-292023-10-280000897429us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RestrictedStockMember2023-01-292023-10-280000897429us-gaap:RestrictedStockMember2023-01-280000897429us-gaap:RestrictedStockMember2023-10-280000897429us-gaap:RestrictedStockUnitsRSUMember2023-01-292023-10-280000897429us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-292023-10-280000897429us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-292023-10-280000897429us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-292023-10-280000897429us-gaap:RestrictedStockUnitsRSUMember2022-03-012022-03-310000897429us-gaap:RestrictedStockUnitsRSUMember2023-01-280000897429us-gaap:RestrictedStockUnitsRSUMember2023-10-280000897429chs:PerformanceBasedRestrictedStockUnitsMember2023-01-292023-10-280000897429chs:PerformanceBasedRestrictedStockUnitsMember2023-01-280000897429chs:PerformanceBasedRestrictedStockUnitsMember2023-10-280000897429chs:CARESActCOVID19Member2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMember2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-10-280000897429us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-10-280000897429us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-10-280000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-10-280000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-10-280000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-10-280000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2023-10-280000897429us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel3Member2023-10-280000897429us-gaap:FairValueMeasurementsRecurringMember2023-01-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-01-280000897429us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-01-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-01-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-01-280000897429us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-01-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-01-280000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-01-280000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-01-280000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-01-280000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-01-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2023-01-280000897429us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-01-280000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel3Member2023-01-280000897429us-gaap:FairValueMeasurementsRecurringMember2022-10-290000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-10-290000897429us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-10-290000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-10-290000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-10-290000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-10-290000897429us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-10-290000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-10-290000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-10-290000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-10-290000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-10-290000897429us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-10-290000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2022-10-290000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2022-10-290000897429us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2022-10-290000897429us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel3Member2022-10-290000897429us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-02-020000897429us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-02-020000897429us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-02-020000897429us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-02-020000897429us-gaap:RevolvingCreditFacilityMemberchs:FirstInLastOutLoanMember2022-02-020000897429us-gaap:RevolvingCreditFacilityMemberchs:FirstInLastOutLoanMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-02-020000897429us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberchs:FirstInLastOutLoanMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-02-020000897429us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberchs:FirstInLastOutLoanMember2022-02-020000897429us-gaap:RevolvingCreditFacilityMemberchs:FirstInLastOutLoanMember2022-02-022022-02-020000897429us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-10-280000897429chs:PriorShareRepurchaseProgramMember2015-11-300000897429chs:PriorShareRepurchaseProgramMember2023-01-292023-10-280000897429chs:NewShareRepurchaseProgramMember2023-06-300000897429chs:PriorShareRepurchaseProgramMember2023-06-300000897429chs:NewShareRepurchaseProgramMember2023-10-28chs:supplier0000897429chs:ThirdPartyFinancialInstitutionMemberus-gaap:SupplierConcentrationRiskMemberchs:TradePayablesMember2023-10-282023-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | |

☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended October 28, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-16435

| | |

|

| Chico’s FAS, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Florida | | 59-2389435 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

11215 Metro Parkway, Fort Myers, Florida 33966

(Address of principal executive offices) (Zip Code)

239-277-6200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, Par Value $0.01 Per Share | CHS | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☑ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

At November 21, 2023, the registrant had 123,457,364 shares of Common Stock, $0.01 par value per share, outstanding.

CHICO’S FAS, INC. AND SUBSIDIARIES

QUARTERLY REPORT ON FORM 10-Q

FOR THE

FISCAL THIRTEEN AND THIRTY-NINE WEEKS ENDED OCTOBER 28, 2023

TABLE OF CONTENTS

PART I – FINANCIAL INFORMATION

| | | | | |

| ITEM 1. | FINANCIAL STATEMENTS |

The accompanying notes are an integral part of these condensed consolidated statements.

3

CHICO’S FAS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Thirty-Nine Weeks Ended |

| | October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| | | | | | | | | | | |

| | Amount | | % of

Sales | | Amount | | % of

Sales | | Amount | | % of

Sales | | Amount | | % of

Sales |

| Net Sales | $ | 505,126 | | | 100.0 | % | | $ | 518,332 | | | 100.0 | % | | $ | 1,584,995 | | | 100.0 | % | | $ | 1,617,967 | | | 100.0 | % |

| Cost of goods sold | 308,677 | | | 61.1 | | | 310,892 | | | 60.0 | | | 946,637 | | | 59.7 | | | 962,448 | | | 59.5 | |

| Gross Profit | 196,449 | | | 38.9 | | | 207,440 | | | 40.0 | | | 638,358 | | | 40.3 | | | 655,519 | | | 40.5 | |

| Selling, general, and administrative expenses | 178,643 | | | 35.4 | | | 175,841 | | | 33.9 | | | 520,672 | | | 32.8 | | | 520,296 | | | 32.1 | |

| Merger-related costs | 7,277 | | | 1.4 | | | — | | | 0.0 | | | 7,277 | | | 0.5 | | | — | | | 0.0 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Income from Operations | 10,529 | | | 2.1 | | | 31,599 | | | 6.1 | | | 110,409 | | | 7.0 | | | 135,223 | | | 8.4 | |

| Interest expense, net | (389) | | | (0.1) | | | (1,080) | | | (0.2) | | | (1,439) | | | (0.1) | | | (3,111) | | | (0.2) | |

| Income before Income Taxes | 10,140 | | | 2.0 | | | 30,519 | | | 5.9 | | | 108,970 | | | 6.9 | | | 132,112 | | | 8.2 | |

| Income tax provision | 5,100 | | | 1.0 | | | 5,900 | | | 1.2 | | | 4,700 | | | 0.3 | | | 30,600 | | | 1.9 | |

| Net Income | $ | 5,040 | | | 1.0 | % | | $ | 24,619 | | | 4.7 | % | | $ | 104,270 | | | 6.6 | % | | $ | 101,512 | | | 6.3 | % |

| Per Share Data: | | | | | | | | | | | | | | | |

| Net income per common share – basic | $ | 0.04 | | | | | $ | 0.20 | | | | | $ | 0.87 | | | | | $ | 0.84 | | | |

| Net income per common and common equivalent share – diluted | $ | 0.04 | | | | | $ | 0.20 | | | | | $ | 0.85 | | | | | $ | 0.82 | | | |

| Weighted average common shares outstanding – basic | 119,457 | | | | | 120,333 | | | | | 119,424 | | | | | 119,776 | | | |

| Weighted average common and common equivalent shares outstanding – diluted | 122,735 | | | | | 124,887 | | | | | 122,500 | | | | | 124,016 | | | |

The accompanying notes are an integral part of these condensed consolidated statements.

4

CHICO’S FAS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Thirty-Nine Weeks Ended |

| | October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Net income | $ | 5,040 | | | $ | 24,619 | | | $ | 104,270 | | | $ | 101,512 | |

| Other comprehensive income: | | | | | | | |

| Unrealized gains (losses) on marketable securities, net of taxes | 35 | | | (233) | | | 72 | | | (228) | |

| | | | | | | |

| Comprehensive income | $ | 5,075 | | | $ | 24,386 | | | $ | 104,342 | | | $ | 101,284 | |

The accompanying notes are an integral part of these condensed consolidated statements.

5

CHICO’S FAS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | |

| October 28, 2023 | | January 28, 2023 | | October 29, 2022 |

| ASSETS | (Unaudited) | | (Audited) | | (Unaudited) |

| | | | | |

| Current Assets: | | | | | |

| Cash and cash equivalents | $ | 101,944 | | | $ | 153,377 | | | $ | 117,726 | |

| Marketable securities, at fair value | 24,702 | | | 24,677 | | | 23,017 | |

| Inventories | 342,721 | | | 276,840 | | | 304,127 | |

| Prepaid expenses and other current assets | 51,086 | | | 48,604 | | | 47,208 | |

| Income tax receivable | 9,181 | | | 11,865 | | | 15,430 | |

| | | | | |

| Total Current Assets | 529,634 | | | 515,363 | | | 507,508 | |

| Property and Equipment, net | 200,980 | | | 192,165 | | | 183,153 | |

| Right of Use Assets | 466,888 | | | 435,321 | | | 432,018 | |

| Other Assets: | | | | | |

| Goodwill | 16,360 | | | 16,360 | | | 16,360 | |

| Other intangible assets, net | 5,000 | | | 5,000 | | | 5,000 | |

| Other assets, net | 45,853 | | | 23,632 | | | 18,890 | |

| Total Other Assets | 67,213 | | | 44,992 | | | 40,250 | |

| $ | 1,264,715 | | | $ | 1,187,841 | | | $ | 1,162,929 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | |

| Current Liabilities: | | | | | |

| Accounts payable | $ | 153,401 | | | $ | 156,262 | | | $ | 107,400 | |

| Current lease liabilities | 150,053 | | | 153,202 | | | 157,687 | |

| | | | | |

| Other current and deferred liabilities | 138,887 | | | 141,698 | | | 155,133 | |

| | | | | |

| Total Current Liabilities | 442,341 | | | 451,162 | | | 420,220 | |

| Noncurrent Liabilities: | | | | | |

| Long-term debt | 24,000 | | | 49,000 | | | 69,000 | |

| Long-term lease liabilities | 373,823 | | | 349,409 | | | 346,560 | |

| Other noncurrent and deferred liabilities | 1,956 | | | 2,637 | | | 2,612 | |

| | | | | |

| Total Noncurrent Liabilities | 399,779 | | | 401,046 | | | 418,172 | |

| Commitments and Contingencies (see Note 12) | | | | | |

| Shareholders’ Equity: | | | | | |

Preferred stock, $0.01 par value; 2,500 shares authorized; no shares issued and outstanding | — | | | — | | | — | |

Common stock, $0.01 par value; 400,000 shares authorized; 167,994 and 166,320 and 166,326 shares issued respectively; and 123,447 and 125,023 and 125,029 shares outstanding, respectively | 1,234 | | | 1,250 | | | 1,250 | |

| Additional paid-in capital | 516,323 | | | 513,914 | | | 510,374 | |

Treasury stock, at cost, 44,547 and 41,297 and 41,297 shares, respectively | (514,168) | | | (494,395) | | | (494,395) | |

| Retained earnings | 419,292 | | | 315,022 | | | 307,536 | |

| Accumulated other comprehensive loss | (86) | | | (158) | | | (228) | |

| Total Shareholders’ Equity | 422,595 | | | 335,633 | | | 324,537 | |

| $ | 1,264,715 | | | $ | 1,187,841 | | | $ | 1,162,929 | |

The accompanying notes are an integral part of these condensed consolidated statements.

6

CHICO’S FAS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended |

| | Common Stock | | Additional Paid-in Capital | | Treasury Stock | | Retained Earnings | | Accumulated Other Comprehensive Gain (Loss) | | |

| Shares | | Par Value | | | Shares | | Amount | | | | Total |

| BALANCE, July 29, 2023 | 123,524 | | | $ | 1,235 | | | $ | 514,059 | | | 44,547 | | | $ | (514,168) | | | $ | 414,252 | | | $ | (121) | | | $ | 415,257 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | — | | | 5,040 | | | — | | | 5,040 | |

| Unrealized gains on marketable securities, net of taxes | — | | | — | | | — | | | — | | | — | | | — | | | 35 | | | 35 | |

| | | | | | | | | | | | | | | |

| Issuance of common stock | 44 | | | — | | | 111 | | | — | | | — | | | — | | | — | | | 111 | |

| | | | | | | | | | | | | | | |

| Repurchase of common stock and tax withholdings related to share-based awards | (121) | | | (1) | | | (677) | | | — | | | — | | | — | | | — | | | (678) | |

| Share-based compensation | — | | | — | | | 2,830 | | | — | | | — | | | — | | | — | | | 2,830 | |

| BALANCE, October 28, 2023 | 123,447 | | | $ | 1,234 | | | $ | 516,323 | | | 44,547 | | | $ | (514,168) | | | $ | 419,292 | | | $ | (86) | | | $ | 422,595 | |

| | | | | | | | | | | | | | | |

| BALANCE, July 30, 2022 | 125,184 | | | $ | 1,252 | | | $ | 508,105 | | | 41,297 | | | $ | (494,395) | | | $ | 282,910 | | | $ | 5 | | | $ | 297,877 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | — | | | 24,619 | | | — | | | 24,619 | |

| Unrealized losses on marketable securities, net of taxes | — | | | — | | | — | | | — | | | — | | | — | | | (233) | | | (233) | |

| | | | | | | | | | | | | | | |

| Issuance of common stock | 3 | | | — | | | 83 | | | — | | | — | | | — | | | — | | | 83 | |

| Dividends on common stock | — | | | — | | | — | | | — | | | — | | | 7 | | | — | | | 7 | |

| Repurchase of common stock and tax withholdings related to share-based awards | (158) | | | (2) | | | (978) | | | — | | | — | | | — | | | — | | | (980) | |

| Share-based compensation | — | | | — | | | 3,164 | | | — | | | — | | | — | | | — | | | 3,164 | |

| BALANCE, October 29, 2022 | 125,029 | | | $ | 1,250 | | | $ | 510,374 | | | 41,297 | | | $ | (494,395) | | | $ | 307,536 | | | $ | (228) | | | $ | 324,537 | |

The accompanying notes are an integral part of these condensed consolidated statements.

7

CHICO’S FAS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(Unaudited)

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Thirty-Nine Weeks Ended |

| Common Stock | | Additional Paid-in Capital | | Treasury Stock | | Retained Earnings | | Accumulated Other Comprehensive Gain (Loss) | | |

| | Shares | | Par Value | | | Shares | | Amount | | | | Total |

| BALANCE, January 28, 2023 | 125,023 | | | $ | 1,250 | | | $ | 513,914 | | | 41,297 | | | $ | (494,395) | | | $ | 315,022 | | | $ | (158) | | | $ | 335,633 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | — | | | 104,270 | | | — | | | 104,270 | |

| Unrealized gains on marketable securities, net of taxes | — | | | — | | | — | | | — | | | — | | | — | | | 72 | | | 72 | |

| | | | | | | | | | | | | | | |

| Issuance of common stock | 2,830 | | | 28 | | | 301 | | | — | | | — | | | — | | | — | | | 329 | |

| | | | | | | | | | | | | | | |

| Repurchase of common stock and tax withholdings related to share-based awards | (4,406) | | | (44) | | | (7,028) | | | 3,250 | | | (19,773) | | | — | | | — | | | (26,845) | |

| Share-based compensation | — | | | — | | | 9,136 | | | — | | | — | | | — | | | — | | | 9,136 | |

| BALANCE, October 28, 2023 | 123,447 | | | $ | 1,234 | | | $ | 516,323 | | | 44,547 | | | $ | (514,168) | | | $ | 419,292 | | | $ | (86) | | | $ | 422,595 | |

| | | | | | | | | | | | | | | |

| BALANCE, January 29, 2022 | 122,526 | | | $ | 1,225 | | | $ | 508,654 | | | 41,297 | | | $ | (494,395) | | | $ | 206,020 | | | $ | — | | | $ | 221,504 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | — | | | 101,512 | | | — | | | 101,512 | |

| Unrealized losses on marketable securities, net of taxes | — | | | — | | | — | | | — | | | — | | | — | | | (228) | | | (228) | |

| | | | | | | | | | | | | | | |

| Issuance of common stock | 4,258 | | | 43 | | | 196 | | | — | | | — | | | — | | | — | | | 239 | |

| Dividends on common stock | — | | | — | | | — | | | — | | | — | | | 4 | | | — | | | 4 | |

| Repurchase of common stock and tax withholdings related to share-based awards | (1,755) | | | (18) | | | (8,797) | | | — | | | — | | | — | | | — | | | (8,815) | |

| Share-based compensation | — | | | — | | | 10,321 | | | — | | | — | | | — | | | — | | | 10,321 | |

| BALANCE, October 29, 2022 | 125,029 | | | $ | 1,250 | | | $ | 510,374 | | | 41,297 | | | $ | (494,395) | | | $ | 307,536 | | | $ | (228) | | | $ | 324,537 | |

The accompanying notes are an integral part of these condensed consolidated statements.

8

CHICO’S FAS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

| | | | | | | | | | | |

| | Thirty-Nine Weeks Ended |

| | October 28, 2023 | | October 29, 2022 |

| Cash Flows from Operating Activities: | | | |

| Net income | $ | 104,270 | | | $ | 101,512 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| | | |

| Inventory write-offs | — | | | 826 | |

| Depreciation and amortization | 31,283 | | | 33,350 | |

| Non-cash lease expense | 135,679 | | | 137,184 | |

| | | |

| | | |

| Loss on disposal and impairment of property and equipment, net | 83 | | | 1,804 | |

| Deferred tax benefit | (15,825) | | | (381) | |

| Share-based compensation expense | 9,136 | | | 10,321 | |

| | | |

| | | |

| Changes in assets and liabilities: | | | |

| Inventories | (65,881) | | | 18,436 | |

| Prepaid expenses and other assets | (10,480) | | | (2,591) | |

| Income tax receivable | 2,684 | | | (1,732) | |

| Accounts payable | (2,778) | | | (73,120) | |

| Accrued and other liabilities | (6,924) | | | 13,583 | |

| Lease liability | (145,729) | | | (155,561) | |

| Net cash provided by operating activities | 35,518 | | | 83,631 | |

| Cash Flows from Investing Activities: | | | |

| Purchases of marketable securities | (13,913) | | | (26,376) | |

| Proceeds from sale of marketable securities | 13,938 | | | 3,083 | |

| Purchases of property and equipment | (35,460) | | | (21,207) | |

| Proceeds from sale of assets | — | | | 2,772 | |

| Net cash used in investing activities | (35,435) | | | (41,728) | |

| Cash Flows from Financing Activities: | | | |

| | | |

| Payments on borrowings | (25,000) | | | (30,000) | |

| Payments of debt issuance costs | — | | | (706) | |

| Proceeds from issuance of common stock | 329 | | | 239 | |

| | | |

| Repurchase of treasury stock under repurchase program | (19,805) | | | — | |

| Payments of tax withholdings related to share-based awards | (7,040) | | | (8,815) | |

| Net cash used in financing activities | (51,516) | | | (39,282) | |

| | | |

| Net (decrease) increase in cash and cash equivalents | (51,433) | | | 2,621 | |

Cash and Cash Equivalents, Beginning of period | 153,377 | | | 115,105 | |

Cash and Cash Equivalents, End of period | $ | 101,944 | | | $ | 117,726 | |

| | | |

| Supplemental Disclosures of Cash Flow Information: | | | |

| Cash paid for interest | $ | 2,409 | | | $ | 3,686 | |

| Cash paid for income taxes, net | $ | (14,230) | | | $ | (26,426) | |

The accompanying notes are an integral part of these condensed consolidated statements.

9

CHICO’S FAS, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share amounts and where otherwise indicated)

(Unaudited)

1. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited condensed consolidated financial statements of Chico’s FAS, Inc., a Florida corporation, and its wholly owned subsidiaries (“Company”) have been prepared in accordance with the instructions to Form 10-Q and do not include all of the information and notes required by accounting principles generally accepted in the U.S. for complete financial statements. In the opinion of management, such interim financial statements reflect all normal, recurring adjustments considered necessary to present fairly the condensed consolidated financial position, the results of operations, and cash flows for the interim periods presented. All significant intercompany balances and transactions have been eliminated in consolidation. The fiscal year ended January 28, 2023 balance sheet data was derived from audited consolidated financial statements. For further information, refer to the consolidated financial statements and notes thereto for the fiscal year ended January 28, 2023, included in the Company’s Annual Report on Form 10-K for the fiscal year ended January 28, 2023, filed with the Securities and Exchange Commission (“SEC”) on March 14, 2023 (“2022 Annual Report on Form 10-K”).

As used in this report, all references to “we,” “us,” “our,” “Company,” and “Chico’s FAS,” refer to Chico’s FAS, Inc. and all of its wholly owned subsidiaries.

Our fiscal years end on the Saturday closest to January 31 and are designated by the calendar year in which the fiscal year commences. Operating results for the thirteen and thirty-nine weeks ended October 28, 2023 are not necessarily indicative of the results that may be expected for the entire year.

Adoption of New Accounting Pronouncements

In September 2022, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update (“ASU”) 2022-04, entitled “Supplier Finance Programs: Disclosure of Supplier Finance Program Obligations,” to improve the disclosures of supplier finance programs. Specifically, the ASU requires disclosure of key terms of the supplier finance programs and a roll-forward of the related obligations. The amendments in this ASU do not affect the recognition, measurement, or financial statement presentation of obligations covered by supplier finance programs. The ASU is effective for the fiscal years, and the interim periods within those years, beginning after December 15, 2022, except for the amendment on roll-forward information, which is effective for fiscal years beginning after December 15, 2023. Early adoption is permitted. The Company entered into a supplier financing agreement administered by a third-party platform in the fourth quarter of 2022. Payments to suppliers through this program began in the third quarter of fiscal 2023. Refer to Note 11 for additional information regarding the Company’s payment obligations to participating suppliers.

Entry into Merger Agreement

On September 27, 2023, the Company entered into an Agreement and Plan of Merger (“Merger Agreement”) with Daphne Parent LLC, a Delaware limited liability company (“Parent”), and Daphne Merger Sub, Inc., a Florida corporation and wholly owned subsidiary of Parent (“Merger Sub” and together with Parent, “Buyer Parties”), providing for the merger of Merger Sub with and into the Company, with the Company continuing as the surviving corporation and becoming a wholly owned subsidiary of Parent (“Merger”).

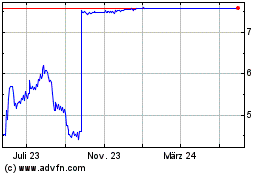

Upon the consummation of the Merger, each share of the Company’s common stock outstanding as of immediately prior to the effective time of the Merger (other than shares of the Company’s common stock that are (i) held by the Company or any subsidiary of the Company, (ii) owned by the Buyer Parties, or (iii) owned by any direct or indirect wholly owned subsidiary of the Buyer Parties as of immediately prior to the effective time (“Owned Company Shares”)) will be cancelled and extinguished and automatically converted into the right to receive cash in an amount equal to $7.60 per share, without interest thereon. Each Owned Company Share will be cancelled and extinguished without any conversion thereof or consideration paid therefor.

Consummation of the Merger is subject to certain conditions set forth in the Merger Agreement, including, but not limited to, the following: (i) the affirmative vote of the holders of a majority of all of the outstanding shares of the Company’s common stock to adopt the Merger Agreement; (ii) the absence of any law or order restraining, enjoining, or otherwise prohibiting the Merger; and (iii) the absence of a Company Material Adverse Effect (as defined in the Merger Agreement,

which is filed as Exhibit 2.1 to this Quarterly Report on Form 10-Q). The Go-Shop Period has ended, and the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, has expired. In addition, the Company filed its Definitive Merger Proxy Statement on Schedule 14A with the Securities and Exchange Commission on November 29, 2023. The transaction is not subject to a financing condition. The Merger Agreement includes customary representations, warranties, and covenants of the parties, including termination provisions for both the Company and the Buyer Parties. Under the Merger Agreement, the Company may be required to pay the Buyer Parties a termination fee of up to $29,956,324 if the Merger Agreement is terminated under certain specified circumstances. The Merger Agreement also places certain restrictions on the conduct of the Company’s business prior to the completion of the Merger, which could delay or prevent the Company from undertaking business opportunities that may arise or any other action it would otherwise take with respect to the operations of the Company absent these restrictions.

Parent and the Company expect to close the Merger by the end of the first calendar quarter of 2024.

2. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

The Company currently has no material recent accounting pronouncements yet to be adopted.

3. REVENUE RECOGNITION

Disaggregated Revenue

The table below disaggregates our operating segment revenue by brand, which we believe provides a meaningful depiction of the nature of our revenue. Amounts shown include licensing and wholesale revenue, which is not a significant component of total revenue, and is aggregated within the respective brands.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Thirty-Nine Weeks Ended |

| | October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Chico’s | $ | 252,221 | | | 49.9 | % | | $ | 255,341 | | | 49.3 | % | | $ | 800,088 | | | 50.5 | % | | $ | 801,584 | | | 49.5 | % |

| WHBM | 147,498 | | | 29.2 | | | 157,451 | | | 30.4 | | | 451,016 | | | 28.4 | | | 485,061 | | | 30.0 | |

| Soma | 105,407 | | | 20.9 | | | 105,540 | | | 20.3 | | | 333,891 | | | 21.1 | | | 331,322 | | | 20.5 | |

| | | | | | | | | | | | | | | |

| Total Net Sales | $ | 505,126 | | | 100.0 | % | | $ | 518,332 | | | 100.0 | % | | $ | 1,584,995 | | | 100.0 | % | | $ | 1,617,967 | | | 100.0 | % |

Contract Liability

Contract liabilities in the unaudited condensed consolidated balance sheets are comprised of obligations associated with our gift card and customer rewards programs. As of October 28, 2023, January 28, 2023, and October 29, 2022, contract liabilities primarily consisted of gift cards of $29.2 million, $42.6 million, and $31.9 million, respectively.

For the thirteen and thirty-nine weeks ended October 28, 2023, the Company recognized $6.2 million and $25.3 million, respectively, of revenue that was previously included in the gift card contract liability as of January 28, 2023. For the thirteen and thirty-nine weeks ended October 29, 2022, the Company recognized $7.0 million and $27.0 million, respectively, of revenue that was previously included in the gift card contract liability as of January 29, 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | Thirty-Nine Weeks Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| | | | | |

| | | | | |

| Beginning gift card liability | $ | 30,905 | | | $ | 33,707 | | | $ | 42,649 | | | $ | 43,536 | |

| Issuances | 7,602 | | | 7,878 | | | 26,585 | | | 28,218 | |

| Redemptions | (9,174) | | | (9,869) | | | (35,893) | | | (37,739) | |

| Breakage adjustment | (162) | | | 176 | | | (4,170) | | | (2,123) | |

| Ending gift card liability | $ | 29,171 | | | $ | 31,892 | | | $ | 29,171 | | | $ | 31,892 | |

| | | | | | | |

The Company maintains customer rewards programs in which customers earn points toward rewards for qualifying purchases and other marketing activities. Upon reaching specified point values, customers are issued a reward, which they may redeem on merchandise purchases at the Company’s stores or on its website. Generally, rewards earned must be redeemed within 60 days from the date of issuance. The Company defers a portion of the merchandise sales based on the estimated standalone selling price of the points earned. This deferred revenue is recognized as the rewards are redeemed or expire. While historically this points-based program was specific to Soma®, during the second quarter of fiscal year 2022, Chico’s FAS extended its points-based rewards program to Chico’s® and White House Black Market® (“WHBM”). As of October 28, 2023, January 28, 2023, and October 29, 2022, the rewards deferred revenue balance was $9.9 million, $7.4 million, and $4.5 million, respectively.

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | Thirty-Nine Weeks Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| | | | | | | |

| | | | | | | |

| Beginning balance rewards deferred revenue | $ | 9,233 | | | $ | 3,236 | | | $ | 7,441 | | | $ | 626 | |

| Net reduction in revenue | 653 | | | 1,288 | | | 2,445 | | | 3,898 | |

| Ending balance rewards deferred revenue | $ | 9,886 | | | $ | 4,524 | | | $ | 9,886 | | | $ | 4,524 | |

Performance Obligation

For the thirteen and thirty-nine weeks ended October 28, 2023 and October 29, 2022, revenue recognized from performance obligations related to prior periods was not material. Revenue to be recognized in future periods related to performance obligations is not expected to be material.

4. LEASES

The Company leases retail stores, a limited amount of office space, and certain equipment under operating leases expiring in various years through the fiscal year ending 2033. All of our leases have been classified as operating leases and are recognized and measured as such.

Certain operating leases provide for renewal options that are at a pre-determined period and rental value. Furthermore, certain leases provide that we may cancel the lease if our retail sales at that location fall below an established level. In the normal course of business, operating leases are typically renewed or replaced by other leases.

Escalation of operating lease payments of certain leases depend on an existing index or rate, such as the consumer price index or the market interest rate. These are considered variable lease payments and are included in lease payments when the escalation is known.

Operating lease expense was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | Thirty-Nine Weeks Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

Operating lease cost (1) | $ | 58,132 | | | $ | 55,608 | | | $ | 169,916 | | | $ | 163,271 | |

(1) For the thirteen and thirty-nine weeks ended October 28, 2023, includes $14.3 million and $41.1 million, respectively, in variable lease costs. For the thirteen and thirty-nine weeks ended October 29, 2022, includes $9.7 million and $28.5 million, respectively, in variable lease costs.

Supplemental balance sheet information related to operating leases was as follows:

| | | | | | | | | | | | | | | | | |

| October 28, 2023 | | January 28, 2023 | | October 29, 2022 |

| Right of use assets | $ | 466,888 | | | $ | 435,321 | | | $ | 432,018 | |

| | | | | |

| Current lease liabilities | $ | 150,053 | | | $ | 153,202 | | | $ | 157,687 | |

| Long-term lease liabilities | 373,823 | | | 349,409 | | | 346,560 | |

| Total operating lease liabilities | $ | 523,876 | | | $ | 502,611 | | | $ | 504,247 | |

| | | | | |

| Weighted Average Remaining Lease Term (years) | 4.4 | | 4.2 | | 4.1 |

| | | | | |

Weighted Average Discount Rate (1) | 5.9 | % | | 5.3 | % | | 5.0 | % |

(1) The incremental borrowing rate used by the Company is based on the rate at which the Company could borrow funds using its credit rating for a collateralized loan of similar term to the lease. The weighted average discount rate represents a weighted average of the incremental borrowing rate for each lease, weighted based on the remaining fixed lease obligations.

Supplemental cash flow information related to operating leases was as follows:

| | | | | | | | | | | |

| Thirty-Nine Weeks Ended |

| October 28, 2023 | | October 29, 2022 |

| Cash paid for amounts included in the measurement of lease liabilities: | | | |

| Operating cash outflows | $ | 145,729 | | | $ | 155,561 | |

| Right of use assets obtained in exchange for lease obligations, non-cash | 145,342 | | | 88,484 | |

Maturities of operating lease liabilities as of October 28, 2023 were as follows:

| | | | | |

| Fiscal Year Ending: | |

| February 3, 2024 | $ | 48,986 | |

| February 1, 2025 | 171,076 | |

| January 31, 2026 | 129,459 | |

| January 30, 2027 | 95,434 | |

| January 29, 2028 | 66,278 | |

| Thereafter | 92,906 | |

| Total future minimum lease payments | $ | 604,139 | |

| Less imputed interest | (80,263) | |

| Total | $ | 523,876 | |

5. SHARE-BASED COMPENSATION

For the thirty-nine weeks ended October 28, 2023 and October 29, 2022, share-based compensation expense was $9.1 million and $10.3 million, respectively. As of October 28, 2023, approximately 10.4 million shares remain available for future grants of equity awards under our 2020 Omnibus Stock and Incentive Plan.

Restricted Stock Awards

Restricted stock awards vest in equal annual installments over a three-year period from the date of grant, except for a (i) restricted stock award granted to our then Chief Executive Officer in fiscal 2019, which vests over a four-year period from the date of grant, and (ii) restricted stock awards granted in March 2021, which vest 50% one year from the date of grant, 30% two years from the date of grant, and 20% three years from the date of grant.

Restricted stock award activity for the thirty-nine weeks ended October 28, 2023 was as follows:

| | | | | | | | | | | |

| Number of

Shares | | Weighted

Average

Grant Date

Fair Value |

| Unvested, beginning of period | 4,611,801 | | | $ | 4.02 | |

| Granted | 2,146,506 | | | 5.85 | |

| Vested | (2,399,562) | | | 3.77 | |

| Forfeited | (418,664) | | | 5.02 | |

| Unvested, end of period | 3,940,081 | | | 5.06 | |

Restricted Stock Units

Restricted stock units vest 100% one year from the date of grant with certain rights to defer settlement in shares of our common stock, except for (i) restricted stock units granted in March 2021, which vest 50% one year from the date of grant, 30% two years from the date of grant, and 20% three years from the date of grant, and (ii) restricted stock units granted in March 2022, which vest in equal annual installments over a three-year period from the date of grant.

Restricted stock unit activity for the thirty-nine weeks ended October 28, 2023 was as follows:

| | | | | | | | | | | |

| Number of

Shares | | Weighted

Average

Grant Date

Fair Value |

| Unvested, beginning of period | 406,218 | | | $ | 2.46 | |

| Granted | 27,462 | | | 5.28 | |

| Vested | (274,573) | | | 2.17 | |

| | | |

| Unvested, end of period | 159,107 | | | 3.46 | |

Performance-based Restricted Stock Units

During the thirty-nine weeks ended October 28, 2023, we granted performance-based restricted stock units (“PSUs”), contingent upon the achievement of Company-specific performance goals during the three fiscal years 2023 through 2025. Any units earned as a result of the achievement of the performance goals of the PSUs will vest three years from the date of grant and will be settled in shares of our common stock.

PSU activity for the thirty-nine weeks ended October 28, 2023 was as follows:

| | | | | | | | | | | |

| Number of Units/

Shares | | Weighted

Average

Grant Date

Fair Value |

| Unvested, beginning of period | 2,696,449 | | | $ | 3.48 | |

| Granted | 1,239,354 | | | 5.70 | |

| Vested | (753,078) | | | 3.17 | |

| Forfeited | (193,703) | | | 5.45 | |

| Unvested, end of period | 2,989,022 | | | 4.35 | |

6. INCOME TAXES

The provision for income taxes is based on a current estimate of the annual effective tax rate and is adjusted as necessary for quarterly events. Our effective income tax rate may fluctuate from quarter to quarter as a result of a variety of factors, including changes in our assessment of certain tax contingencies, valuation allowances, changes in tax law, outcomes of administrative audits, the impact of discrete items, and the mix of earnings across jurisdictions.

For the thirteen weeks ended October 28, 2023 and October 29, 2022, the Company’s effective tax rate was 50.3% and 19.3%, respectively. The effective tax rate of 50.3% for the thirteen weeks ended October 28, 2023 primarily reflects the impact of certain incurred and anticipated nondeductible Merger-related costs, and the Company’s projected annual pre-tax income, partially offset by a fiscal 2022 provision-to-return benefit related to federal tax credits. The 19.3% effective tax rate for the thirteen weeks ended October 29, 2022 primarily reflects the impact of a fiscal 2021 provision-to-return benefit due to the reversal of a valuation allowance related to temporary differences.

For the thirty-nine weeks ended October 28, 2023 and October 29, 2022, the Company’s effective tax rate was 4.3% and 23.2%, respectively. The effective tax rate of 4.3% for the thirty-nine weeks ended October 28, 2023 primarily reflects the non-cash benefit for the partial reversal of the valuation allowance on deferred tax assets, favorable share-based compensation benefit, and a fiscal 2022 provision-to-return benefit related to federal credits, offset by the impact of certain incurred and anticipated nondeductible Merger-related costs and the Company’s projected annual pre-tax income. The 23.2% effective tax rate for the thirty-nine weeks ended October 29, 2022 primarily reflects a provision to return benefit due to the reversal of a valuation allowance related to 2021 temporary differences and favorable share-based compensation benefit.

As of October 28, 2023, our unaudited condensed consolidated balance sheet reflected a $7.9 million income tax receivable related to the recovery of federal income taxes paid in prior years and other tax law changes as a result of the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act.

7. INCOME PER SHARE

In accordance with relevant accounting guidance, unvested share-based payment awards that include non-forfeitable rights to dividends, whether paid or unpaid, are considered participating securities. As a result, such awards are required to be included in the calculation of income per common share pursuant to the “two-class” method. For the Company, participating securities are comprised entirely of unvested restricted stock awards granted prior to fiscal 2020.

Net income per share is determined using the two-class method when it is more dilutive than the treasury stock method. Basic net income per share is computed by dividing net income available to common shareholders by the weighted-average number of common shares outstanding during the period, including participating securities. Diluted net income per share reflects the dilutive effect of potential common shares from non-participating securities, such as restricted stock awards granted after fiscal 2019, stock options, PSUs, and restricted stock units.

The following table sets forth the computation of net income per basic and diluted share shown on the face of the accompanying condensed consolidated statements of income:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended | | Thirty-Nine Weeks Ended |

| | October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| | | | | |

| Numerator: | | | | | | | |

| Net income | $ | 5,040 | | | $ | 24,619 | | | $ | 104,270 | | | $ | 101,512 | |

| Net income allocated to participating securities | (2) | | | (47) | | | (113) | | | (370) | |

| Net income available to common shareholders | $ | 5,038 | | | $ | 24,572 | | | $ | 104,157 | | | $ | 101,142 | |

| Denominator: | | | | | | | |

| Weighted average common shares outstanding – basic | 119,457 | | | 120,333 | | | 119,424 | | | 119,776 | |

| Dilutive effect of non-participating securities | 3,278 | | | 4,554 | | | 3,076 | | | 4,239 | |

| Weighted average common and common equivalent shares outstanding – diluted | 122,735 | | | 124,887 | | | 122,500 | | | 124,016 | |

| Net income per common share: | | | | | | | |

| Basic | $ | 0.04 | | | $ | 0.20 | | | $ | 0.87 | | | $ | 0.84 | |

| Diluted | $ | 0.04 | | | $ | 0.20 | | | $ | 0.85 | | | $ | 0.82 | |

For the thirteen weeks ended October 28, 2023 and October 29, 2022, 0.0 million and 0.1 million potential shares of common stock, respectively, were excluded from the income per diluted common share calculation relating to non-participating securities, due to the antidilutive effect of including these shares.

For the thirty-nine weeks ended October 28, 2023 and October 29, 2022, 0.1 million and 0.1 million potential shares of common stock, respectively, were excluded from the income per diluted common share calculation relating to non-participating securities, due to the antidilutive effect of including these shares.

8. FAIR VALUE MEASUREMENTS

Our financial instruments generally consist of cash, money market accounts, marketable securities, assets held in our non-qualified deferred compensation plan, accounts receivable and payable, and debt. Cash, accounts receivable, and accounts payable are carried at cost, less reserves for credit losses, as applicable, which approximates their fair value due to the short-term nature of the instruments.

Marketable securities are classified as available-for-sale, and as of October 28, 2023, consisted of U.S. government agencies, corporate bonds, and commercial paper, with $22.2 million of securities with maturity dates within one year or less, and $2.5 million with maturity dates over one year.

We consider all marketable securities available-for-sale, including those with maturity dates beyond 12 months, and therefore classify these securities within current assets on the unaudited condensed consolidated balance sheets, as applicable, as they were available to support current operational liquidity needs. Marketable securities are carried at fair value, with the unrealized holding gains and losses, net of income taxes, reflected in accumulated other comprehensive gain (loss) until realized, and any credit risk-related losses recognized in net income during the period incurred. For the purposes of computing realized and unrealized gains and losses, cost is determined on a specific identification basis.

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in the principal or most advantageous market in an orderly transaction between market participants on the measurement date. Entities are required to use a three-level hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability on the measurement date. The three levels are defined as follows:

| | | | | | | | | | | |

| Level 1 | — | Unadjusted quoted prices in active markets for identical assets or liabilities |

| | | |

| Level 2 | — | Unadjusted quoted prices in active markets for similar assets or liabilities; or unadjusted quoted prices for identical or similar assets or liabilities in markets that are not active; or inputs other than quoted prices that are observable for the asset or liability |

| | | |

| Level 3 | — | Unobservable inputs for the asset or liability |

Assets Measured on a Recurring Basis

We measure certain financial assets at fair value on a recurring basis, including our marketable securities, as applicable, which are classified as available-for-sale securities, certain cash equivalents, specifically our money market accounts and assets held in our non-qualified deferred compensation plan, as applicable. The money market accounts are valued based on quoted market prices in active markets. Our marketable securities are generally valued based on other observable inputs for those securities (including market corroborated pricing or other models that utilize observable inputs, such as interest rates and yield curves) based on information provided by independent third-party pricing entities, except for U.S. government securities, which are valued based on quoted market prices in active markets. The investments in our non-qualified deferred compensation plan are valued using quoted market prices and are included in other assets on our unaudited condensed consolidated balance sheets.

Assets Measured on a Nonrecurring Basis

From time to time, we measure certain assets at fair value on a nonrecurring basis when carrying value exceeds fair value. This measurement includes the evaluation of long-lived assets, goodwill, and other intangible assets for impairment using Company-specific assumptions that would fall within Level 3 of the fair-value hierarchy. Assets that are measured at fair value on a nonrecurring basis are remeasured when carrying value exceeds fair value. Carrying value after impairment approximates fair value.

We assess the carrying amount of long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company uses market participant rents and a market participant discount rate to calculate the fair value of right of use assets. The Company uses discounted future cash flows of the asset or asset group using a discount rate that approximates the cost of capital of a market participant to quantify fair value for other long-lived assets within the asset group, which are primarily leasehold improvements. The asset group is defined as the lowest level for which identifiable cash flows are available and is largely independent of the cash flows of other groups of assets, which for our retail stores, is primarily at the store level.

To assess the fair value of goodwill, we have historically utilized both an income approach and a market approach. Inputs used to calculate the fair value based on the income approach primarily include estimated future cash flows, discounted at a rate that approximates the cost of capital of a market participant. Inputs used to calculate the fair value based on the market approach include identifying sales and EBITDA multiples based on guidelines for similar publicly traded companies and recent transactions.

To assess the fair value of trademarks, we utilize a relief from royalty approach. Inputs used to calculate the fair value of the trademarks primarily include future sales projections, discounted at a rate that approximates the cost of capital of a market participant, and an estimated royalty rate.

As of October 28, 2023, January 28, 2023, and October 29, 2022, our revolving loan and letter of credit facility approximates fair value, as this instrument has a variable interest rate that approximates current market rates (Level 2 criteria).

Fair value calculations contain significant judgments and estimates, which may differ from actual results due to, among other things, economic conditions, changes to the business model, or changes in operating performance.

We conduct reviews on a quarterly basis to verify pricing, assess liquidity, and determine if significant inputs have changed that would impact the fair value hierarchy disclosure.

In accordance with the provisions of the guidance, we categorized our financial assets and liabilities, which are valued on a recurring and nonrecurring basis, based on the priority of the inputs to the valuation technique for the instruments, as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fair Value Measurements at the End of the Reporting Date Using | | |

| | Balance as of October 28, 2023 | | Quoted Prices in Active Markets for Identical Assets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | |

| Recurring fair value measurements: | | | | | | | | | |

| Current Assets | | | | | | | | | |

| Cash equivalents: | | | | | | | | | |

| Money market accounts | $ | 18,255 | | | $ | 18,255 | | | $ | — | | | $ | — | | | |

| Marketable securities: | | | | | | | | | |

| U.S. government agencies | 5,531 | | | — | | | 5,531 | | | — | | | |

| Corporate bonds | 11,767 | | | — | | | 11,767 | | | — | | | |

| Commercial paper | 7,404 | | | — | | | 7,404 | | | — | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total recurring fair value measurements | $ | 42,957 | | | $ | 18,255 | | | $ | 24,702 | | | $ | — | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | Fair Value Measurements at the End of the Reporting Date Using | | |

| Balance as of January 28, 2023 | | Quoted Prices in Active Markets for Identical Assets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | |

| Recurring fair value measurements: | | | | | | | | | |

| Current Assets | | | | | | | | | |

| Cash equivalents: | | | | | | | | | |

| Money market accounts | $ | 41,642 | | | $ | 41,642 | | | $ | — | | | $ | — | | | |

| Marketable securities: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| U.S. government agencies | 5,506 | | | — | | | 5,506 | | | — | | | |

| Corporate bonds | 12,802 | | | — | | | 12,802 | | | — | | | |

| Commercial paper | 6,369 | | | — | | | 6,369 | | | — | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total recurring fair value measurements | $ | 66,319 | | | $ | 41,642 | | | $ | 24,677 | | | $ | — | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | Fair Value Measurements at the End of the Reporting Date Using | | |

| | Balance as of October 29, 2022 | | Quoted Prices in Active Markets for Identical Assets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | |

| Recurring fair value measurements: | | | | | | | | | |

| Current Assets | | | | | | | | | |

| Cash equivalents: | | | | | | | | | |

| Money market accounts | $ | 42,596 | | | $ | 42,596 | | | $ | — | | | $ | — | | | |

| Marketable securities: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| U.S. government agencies | 3,479 | | | — | | | 3,479 | | | — | | | |

| Corporate bonds | 10,709 | | | — | | | 10,709 | | | — | | | |

| Commercial paper | 8,829 | | | — | | | 8,829 | | | — | | | |

| | | | | | | | | |

| Noncurrent Assets | | | | | | | | | |

| Deferred compensation plan | 4,776 | | | 4,776 | | | — | | | — | | | |

| Total recurring fair value measurements | $ | 70,389 | | | $ | 47,372 | | | $ | 23,017 | | | $ | — | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

9. DEBT

On February 2, 2022, the Company and certain material domestic subsidiaries entered into Amendment No. 2 (“Amendment”) to its credit agreement (as amended, “Credit Agreement”), originally entered into on August 2, 2018 and amended October 30, 2020, by and among the Company, certain material domestic subsidiaries as co-borrowers and guarantors, Wells Fargo Bank, National Association (“Wells Fargo Bank”), as Agent, letter of credit issuer, and swing line lender, and certain lenders party thereto. Our obligations under the Credit Agreement are guaranteed by the guarantors and are secured by a first-priority lien on certain assets of the Company and certain material domestic subsidiaries, including inventory, accounts receivable, cash deposits, certain insurance proceeds, real estate, fixtures, and certain intellectual property. The Credit Agreement provides for a five-year Asset-Based Lending senior secured revolving loan (“ABL”) and letter of credit facility of up to $285.0 million, maturing February 2, 2027. The interest rate applicable to Term Secured Overnight Financing Rate (“SOFR”) loans drawn under the ABL is equal to Term SOFR plus 1.60% (subject to a further decrease to Term SOFR plus 1.35% or an increase to Term SOFR plus 1.85% based upon average quarterly excess availability under the ABL). The Credit Agreement also provides for a $15.0 million first-in last-out (“FILO”) loan. The interest rate applicable to the FILO is equal to Term SOFR plus 3.60% (subject to a further decrease to Term SOFR plus 3.35% or an increase to Term SOFR plus 3.85% based on average quarterly excess availability under the FILO). However, for any ABL or FILO with a SOFR interest rate period of six months, the interest rate applicable to the ABL and FILO is increased by 30 basis points.

The Credit Agreement contains customary representations, warranties, and affirmative covenants, as well as customary negative covenants, that, among other things restrict, subject to certain exceptions, the ability of the Company and certain of its domestic subsidiaries to (i) incur liens, (ii) make investments, (iii) issue or incur additional indebtedness, (iv) undergo significant corporate changes, including mergers and acquisitions, (v) make dispositions, (vi) make restricted payments, (vii) prepay other indebtedness, and (viii) enter into certain other restrictive agreements. The Company may pay cash dividends and repurchase shares under its share buyback program, subject to certain thresholds of available borrowings, based upon the lesser of the aggregate amount of commitments under the Credit Agreement and the borrowing base, determined after giving effect to any such transaction or payment, on a pro forma basis. In addition, the Company must pay a commitment fee per annum on the unused portion of the commitments under the Credit Agreement.

As of October 28, 2023, $24.0 million in net borrowings were outstanding under the Credit Agreement. Availability under the Credit Agreement is determined based upon a monthly borrowing base calculation, which includes eligible credit card receivables, real estate, and inventory, less outstanding borrowings, letters of credit, and certain designated reserves. As of October 28, 2023, the available additional borrowing capacity under the Credit Agreement was approximately $265.1 million, inclusive of the current loan cap of $30.0 million.

As of October 28, 2023, deferred financing costs of $2.7 million were outstanding related to the Credit Agreement and are presented in other current assets in the accompanying unaudited condensed consolidated balance sheet.

10. SHARE REPURCHASES

During the thirty-nine weeks ended October 28, 2023, under our $300.0 million share repurchase program announced in November 2015 (“Prior Share Repurchase Program”), we repurchased 3.25 million shares at a total cost of approximately $19.8 million, at an average price of $6.09 per share. In June 2023, the Company authorized a new share repurchase program (“New Share Repurchase Program”) of up to $100.0 million of the Company’s common stock and cancelled the remaining $35.4 million available under the Prior Share Repurchase Program. As of October 28, 2023, the Company had $100.0 million remaining for future repurchases under the New Share Repurchase Program. However, we have no continuing obligation to repurchase shares under this authorization, and the timing, actual number, and purchase price of any shares purchased under the New Share Repurchase Program will depend on a variety of factors, including, but not limited to, the pending Merger, the market price of the Company’s common stock, general business and market conditions, other investment opportunities, and applicable legal and regulatory requirements.

11. SUPPLIER FINANCE PROGRAM

In September 2022, the FASB issued ASU 2022-04, Liabilities - Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Program Obligations, which enhances the transparency about the use of supplier finance programs for investors and other allocators of capital. The Company entered into a supplier financing agreement administered by a third-party platform in the fourth quarter of 2022. Payments to suppliers through this program began in the third quarter of fiscal 2023. Inclusion in the supplier financing program is by sole discretion of the Company, offering participating suppliers early payment of invoices through a third-party financial institution. The Company negotiates payment terms with each supplier separately, and inclusion in the financing program does not impact amounts due. One supplier is currently participating in the program with 90-day payment terms. The Company may on occasion submit debit memos to the third-party financial institution, and the financial institution agrees to work with the Company in applying these credits to future payments to suppliers. During the thirteen weeks ended October 28, 2023, no payments were made for invoices submitted through the supplier financing program. The outstanding payment obligation to the financial institution under this program was $2.2 million as of October 28, 2023, which is 1.7% of total trade payables obligations to suppliers.

12. COMMITMENTS AND CONTINGENCIES

We are not currently a party to any material legal proceedings other than claims and lawsuits arising in the normal course of our business. All such matters are subject to uncertainties, and outcomes may not be predictable. Consequently, as of October 28, 2023, the ultimate aggregate amounts of monetary liability or financial impact with respect to such matters are not estimable. However, while such matters could affect our consolidated operating results when resolved in future periods, management believes that, upon final disposition, any monetary liability or financial impact to us would not be material to our annual consolidated financial statements.

| | | | | |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A, should be read in conjunction with the unaudited condensed consolidated financial statements and notes thereto included in this Quarterly Report on Form 10-Q (“this Form 10-Q”) and in our Annual Report on Form 10-K for the fiscal year ended January 28, 2023, filed with the Securities and Exchange Commission (“SEC”) on March 14, 2023 (“2022 Annual Report on Form 10-K”).

Executive Overview

Chico’s FAS, Inc. (“Company,” “we,” “us,” or “our”) is a Florida-based fashion company founded in 1983 on Sanibel Island, Florida. The Company reinvented the fashion retail experience by creating fashion communities anchored by service, which put the customer at the center of everything we do. As one of the leading fashion retailers in North America, Chico’s FAS is a company of three unique brands – Chico’s®, White House Black Market® (“WHBM”), and Soma® – each operating in their own white space, founded by women, led by women, providing solutions that millions of women say give them confidence and joy. We sometimes refer to our Chico’s and WHBM brands collectively as our “Apparel Group.” Our distinct lifestyle brands serve the needs of fashion-savvy women with household incomes in the moderate-to-high income level. We earn revenue and generate cash through the sale of merchandise in our domestic retail stores, our various Company-operated e-commerce websites, social commerce, our call center (which takes orders for all our brands), and through unaffiliated franchise partners.

We utilize an integrated, omnichannel approach to managing our business. We want our customers to experience our brands holistically and to view the various commerce channels we operate as a single, integrated experience rather than as separate sales channels operating independently. This approach allows our customers to browse, purchase, return, or exchange our merchandise through whatever sales channel, and at whatever time, is most convenient. As a result, we track total sales and comparable sales on a combined basis.

Our growth strategy is supported by the “power of three” unique brands and the “power of three” commerce channels. Our physical stores serve as community centers for entertainment and self-discovery, where our stylists and bra experts showcase our products and share their knowledge and enthusiasm for our brands. Our digital stores serve as a first impression of our brands and an efficient platform to teach and inspire our customers about our merchandise. Our social stylists – who are a combination of store associates, social media platform hosts and hyperlocal social stylists who arrange events within their communities – are an additional connection between our physical stores and digital.

Business Highlights

The Company’s third quarter highlights include:

•Consistent profitability: For the third quarter, the Company reported net income per diluted share of $0.04.

•Solid balance sheet: The Company ended the third quarter with $126.6 million in cash and marketable securities and total liquidity of $361.7 million, with $24.0 million in long-term debt.

•Pending Merger: On September 27, 2023, the Company entered into a definitive agreement (“Merger Agreement”), which is filed as Exhibit 2.1 to this Form 10-Q, to be acquired by Sycamore Partners, a private equity firm specializing in retail, consumer, and distribution-related investments, pursuant to which the Company’s shareholders would receive $7.60 per share in cash (“Merger”). If the Merger is successful, Chico’s FAS will become a privately held company. The Merger is expected to close by the end of the first calendar quarter of 2024, subject to both the approval by the Company’s shareholders and customary closing conditions. The Go-Shop Period has ended, and the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, has expired. In addition, the Company filed its Definitive Merger Proxy Statement on Schedule 14A with the Securities and Exchange Commission on November 29, 2023. The transaction is not subject to a financing condition.

Select Financial Results

The following table depicts select financial results for the thirteen and thirty-nine weeks ended October 28, 2023 and October 29, 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended | | Thirty-Nine Weeks Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| (in millions, except per share amounts) |

| Net sales | $ | 505 | | | $ | 518 | | | $ | 1,585 | | | $ | 1,618 | |

| | | | | | | |

Income from operations (1) | 11 | | | 32 | | | 110 | | | 135 | |

Net income (2) | 5 | | | 25 | | | 104 | | | 102 | |

| Net income per common and common equivalent share – diluted | $ | 0.04 | | | $ | 0.20 | | | $ | 0.85 | | | $ | 0.82 | |

(1) Includes $7.3 million in Merger-related costs during the third quarter of 2023.

(2) Includes a $25.6 million non-cash favorable impact of the tax valuation allowance reversal during the second quarter of 2023 and $8.0 million in Merger-related costs, after taxes, during the third quarter of 2023.

Current Trends

Our financial results, we believe, demonstrate that we are successfully executing on our four strategic pillars of customer led, product obsessed, digital first, and operationally excellent.

We offer our customers the ability to shop through three powerful platforms – digital, stores, and our social stylists. Our customers have proven to be resilient, and our multi-channel customers are especially valuable to us, spending three times more than single-channel customers. We continually work to assure we are meeting our customers’ demands with the right balance and styles of inventory and accommodating their evolving shopping preferences. We are constantly innovating and introducing new fashion, trends, and fabrications to our assortments. Over the last several years, we have made meaningful investments to transform our Company into a digital-first enterprise, fast-tracking numerous innovation and technology investments across all three brands to improve service, engagement, and decision making. In addition, we are disciplined in the way we manage our inventories, costs, real estate, and cash.

Our cash position, total liquidity, and operating cash flow remain strong, providing us with flexibility to manage the business, make investments to further propel our growth, and return excess cash to shareholders, as deemed appropriate. In addition to funding strategic investments, we believe our cash flow will allow us to navigate any economic developments that may arise over the coming quarters.