Chegg, Inc. (NYSE:CHGG), the leading student-first connected

learning platform, today reported financial results for the three

months ended June 30, 2024.

“Q2 has been transformational for Chegg, completing our

restructure, outlining an exciting vision for the future, and

completing the rollout of conversational instruction capability and

automated solutions just in time for the back-to-school season,”

said Nathan Schultz, Chief Executive Officer & President of

Chegg, Inc. “We are executing our product vision to evolve Chegg

from a solutions-based study platform to one that supports students

holistically with 360 degrees of individualized academic and

functional support, which meets the needs of the modern

student.”

Second Quarter 2024

Highlights

- Total Net Revenues of $163.1 million, a decrease of 11%

year-over-year

- Subscription Services Revenues of $146.8 million, a

decrease of 11% year-over-year

- Gross Margin of 72%

- Non-GAAP Gross Margin of 75%

- Net Loss was $616.9 million

- Non-GAAP Net Income was $26.5 million

- Adjusted EBITDA was $44.1 million

- 4.4 million Subscription Services subscribers, a

decrease of 9% year-over-year

Total net revenues include revenues from Subscription Services

and Skills and Other. Subscription Services includes revenues from

our Chegg Study Pack, Chegg Study, Chegg Writing, Chegg Math, and

Busuu offerings. Skills and Other includes revenues from Chegg

Skills, Advertising, and any other revenues not included in

Subscription Services.

For more information about non-GAAP net income, non-GAAP gross

margin and adjusted EBITDA, and a reconciliation of non-GAAP net

income to net (loss) income, gross margin to non-GAAP gross margin

and adjusted EBITDA to net (loss) income, see the sections of this

press release titled, “Use of Non-GAAP Measures,” “Reconciliation

of Net (Loss) Income to EBITDA and Adjusted EBITDA,” and

“Reconciliation of GAAP to Non-GAAP Financial Measures.”

Business Outlook

Third Quarter 2024

- Total Net Revenues in the range of $133 million to $135

million

- Subscription Services Revenues in the range of $116

million to $118 million

- Gross Margin between 67% and 68%

- Adjusted EBITDA in the range of $19 million to $21

million

For more information about the use of forward-looking non-GAAP

measures, a reconciliation of forward-looking net loss to EBITDA

and adjusted EBITDA for the third quarter 2024, see the below

sections of the press release titled “Use of Non-GAAP Measures,”

and “Reconciliation of Forward-Looking Net Loss to EBITDA and

Adjusted EBITDA.”

An updated investor presentation and an investor data sheet can

be found on Chegg’s Investor Relations website https://investor.chegg.com.

Prepared Remarks – Nathan Schultz, CEO &

President, Chegg, Inc.

Thank you, Tracey. Good afternoon, everyone, and thanks for

joining Chegg’s 2nd quarter earnings call. I’m so very proud of how

Chegg shows up for students and of our teams’ endeavor to build an

unparalleled learning platform. Since assuming the CEO role 65 days

ago, I spearheaded a significant restructuring effort to create a

leaner, more efficient organization, which will allow us to move

faster, smarter, and make investments for the long term. In 2025,

our restructuring program will generate non-GAAP expense savings in

the range of $40-50 million and has allowed us to remain committed

to our goals of 30%+ adjusted EBITDA margin and at least $100

million of Free Cash Flow. Additionally, we have outlined a new

product vision to evolve Chegg from a solutions-based study

platform to one that supports the whole student with 360 degrees of

individualized academic and functional support. Our talented teams

are hard at work building the products and experiences that bring

our new vision to life. However, let’s start with Q2.

For Q2, we exceeded our guidance delivering $146.8 million in

revenue and $44.1 million in Adjusted EBITDA. We continued to

integrate AI into Chegg Study, completing several foundational

programs, and most importantly, the complete rollout of

conversational instructional capability and automated solutions—all

in time for the upcoming back-to-school season. As a result, we are

seeing positive reception, as demonstrated by an increase in

student engagement. I’d like to specifically call out two exciting

trends: first, 70% of subscribers are engaging in conversational

instruction; second, students are asking more questions. The number

of questions asked by students increased 74% year-over-year versus

Q2 2023, and in H1 ’24 alone, students asked a whopping 16.2

million questions, which is a 109% year-over-year increase.

While pleased with the product advancements we implemented in

Q2, we are only getting started. Our sights are fixed on

innovations that leverage both our key differentiators and the

generational technology shift in which we find ourselves. Speaking

of which, I would like to spend a few minutes highlighting three

key differentiators.

First, we are obsessed with studying students. With more than a

decade of insights into student needs, motivations, and behaviors,

we consistently work to evolve and align our services to the modern

student experience. We apply deep learning science from an in-house

team to create a verticalized user experience that reflects how

students learn best. For example, we provide step-by-step

solutions, jargon-free explanations, and simplified concepts to

make learning accessible. This deep understanding of students

culled from millions of learning interactions drives our product

innovation.

Second, we have been built from the bottom up to deliver

high-quality, accurate content at scale. Students care deeply about

accuracy and quality of instruction. In our study of more than

11,000 students globally, 47% of those who use Generative AI for

university study say receiving incorrect information is a top

concern. This lack of trust has led 67% of students to spend

additional time verifying the information they receive from AI

tools. This is inefficient, and we can do better. To that end,

Chegg will launch this fall a student-facing satisfaction guarantee

aligned to the quality and accuracy of our content, to better

support student success and differentiate Chegg.

Third, and finally, Chegg’s brand awareness remains high, with

75% of U.S. college students having heard of Chegg. We plan to

build on our strong foundation in Q3, launching our “Small Steps,

Big Wins” marketing campaign this back-to-school season. This will

extend our reach into channels where students are congregating,

such as TikTok, Instagram, and on campus, to increase our top of

funnel. Additionally, we will start to test services delivered on

Discord and through Chrome extensions, with the goal of making sure

Chegg is everywhere our current and future students are.

The differentiators we have built over the last decade have

positioned us for success as we execute our product roadmap and

dive headfirst into the generational technology shift ushered in by

AI. Our mission is to build from our foundation to support student

outcomes – not by delivering AI education but rather education

enhanced by AI. With that in mind, I would like to take you through

some examples of the AI architecture we have built.

First, we have created proprietary technology that allows Chegg

to deeply understand students' questions. When a question is asked,

we create a full picture: why they asked it, at what depth the

answer should be given, and most exciting, how we can use this

question to develop a series of next-best actions that creates an

individualized learning pathway, driving student engagement and

retention.

Second, our evolving architecture takes an innovative

multi-source approach, leveraging foundational and proprietary

language models, our industry-leading symbolic math engine, our

deep catalog of learning content, and our subject matter experts to

deliver the best learning solutions possible. To fully realize our

ground-breaking vision for integrating AI with our proprietary

content and computational models, we have built a sophisticated,

source-agnostic Orchestrator that intelligently selects the best

approach to assist each student. You can think of the Orchestrator

as an air-traffic controller. Using this approach, accuracy and

quality remain paramount. As such, we have also developed a

proprietary quality rubric that assesses all possible content

sources and language models. We believe this enables Chegg to take

advantage of any future innovations that foundational language

models will inevitably create while maintaining the quality that

has built our brand.

As always, we have developed our innovative approach to

servicing students with scale and cost in mind. Today, we produce

solutions at a 75% reduction per unit vs. human creation alone. The

bottom line is that we are now creating more content, of higher

quality, at lower cost. And as you know, content is the primary

driver of our acquisition flywheel.

Before I turn it over to David, I want to briefly talk about

what you can expect regarding product innovation in Q3 as well as

an exciting new partnership as we get set for our back-to-school

rush.

On the global product side, we are well underway in implementing

our iterative approach to product development. This fall, we will

be testing a variety of innovations. As an example, we have

developed a feature internally referred to as Starting Point, which

is meant to address the common issue of students simply not knowing

where to start, whether they are studying for a mid-term or writing

an important paper. This introduces a whole new way for students to

leverage Chegg on their learning journey. In addition to Starting

Point, we have developed two new applications, one that keeps

students on track and another that organizes students’ notes and

turns them into study tools. As we get more products into students’

hands through iterative development, you are beginning to see the

evolution of Chegg from a Q&A platform to one that delivers 360

degrees of support.

On the international front, we will be launching a fully

localized product experience in Mexico by the end of September. Our

end-to-end localization strategy adapts Chegg Study to meet the

cultural, linguistic, and user experience requirements of key

international markets. As our first fully localized market, Mexico

will serve as the playbook for future localization efforts. We

remain excited about the growth opportunities that international

expansion provides.

Finally, I’m excited to announce that we are expanding our Chegg

Perks program through a partnership with Max, one of the leading

global streaming services. Max delivers exclusive original series

and blockbuster movies as well as a library of beloved TV that our

U.S. subscribers will now be able to access with ads. Max joins our

other Perks partners, including Tinder, DoorDash, Calm, and others,

to enrich the value of a Chegg subscription.

In closing, we continue to execute the plan that we believe will

return our company to growth. The way back will take time and will

be accomplished through steady execution of our vision to serve the

whole student, thoughtful implementation of our unique AI strategy,

and building off our durable differentiators, which include a deep

knowledge of students, a content foundation built for quality and

scale, and a brand that students know and love.

Now, with that, I will turn it over to David…

Prepared Remarks – David Longo, CFO, Chegg,

Inc.

Thank you, Nathan,

Today, I will present our financial performance for the second

quarter of 2024 and our outlook for Q3.

Q2 was a solid quarter. We remained focused on delivering our

new AI-driven experiences to students around the world, made

progress on key metrics which we believe will support both revenue

and adjusted EBITDA growth over time, and continued to execute

prudent expense management to maintain strong profitability. We

exceeded our Q2 guidance on both revenue and adjusted EBITDA and

our balance sheet remains healthy.

Before I jump into the results of the quarter, in the

Shareholder Letter related to the restructuring, we committed to

sharing key metrics that would assist investors to understand and

model our company. Our earnings presentation on our investor

relations website includes these key metrics for Q2. These are the

metrics we review to understand the trends and health of our

business.

Moving on to our second quarter performance, we had 4.4 million

subscribers in the quarter, with 25% coming from international.

Total revenue was $163 million, down 11% year-over-year, including

Subscription Services revenue of $147 million. Subscription

Services ARPU was down 3% year-over-year, which was primarily

driven by the international promotional pricing we introduced last

year to bolster conversion and retention. Overall monthly retention

for Chegg Study and Study Pack remained strong and was up 23 basis

points year-over-year. Skills and Other revenue was $16 million, a

decrease of 4% year-over-year.

Second quarter adjusted EBITDA of $44 million represented a

margin of 27%. This is above our guidance due to the better than

anticipated revenue, as well as ongoing expense management to

preserve profitability and cash flows as we navigate the path back

to growth. As planned, the restructuring had a minimal impact on

our Q2 adjusted EBITDA, and the full financial savings will not be

realized until 2025.

We had a few notable GAAP items this quarter, specifically an

impairment charge and a large discreet item in our income tax

provision. As a result of continued industry pressure and declines

in our market capitalization, and as required by accounting rules,

we completed an impairment test on our goodwill, intangible assets

and property & equipment. The test resulted in $481.5 million

of non-cash impairment charges that were excluded from our Q2

adjusted EBITDA.

In addition, the goodwill impairment impacted our Q2 income tax

provision as we are now in three years of cumulative pretax losses

in the U.S. This triggered the necessity of a $141.6 million

non-cash valuation allowance recorded on all U.S. federal and state

deferred tax assets which is included in the Q2 income tax

provision.

Free Cash Flow was negative $3.6 million in the second quarter,

which was driven by severance payments related to our restructuring

and an increase in net working capital largely related to the

timing of accounts payable items. Capital expenditures were $17.8

million in the quarter, of which $13 million were content costs.

Content costs were down 7% year-over-year, even with an increase of

74% in the number of questions asked.

Looking at the balance sheet, we ended the quarter with cash and

investments of $605 million and a net cash balance of $4.5

million.

With respect to Q3 guidance, we expect:

- Total revenue between $133 and $135 million, with Subscription

Services revenue between $116 and $118 million;

- Gross margin to be in the range of 67 to 68 percent;

- And adjusted EBITDA between $19 and $21 million.

In closing, while these numbers are not where we want them to

be, like many companies in the ed-tech space, we are dealing with

the challenges of the changing landscape. As Nathan detailed

earlier, we are working to implement the vision to get us back to

growth, but it will take some time before we see the benefits. I am

committed to delivering our financial goals. We believe there is a

significant opportunity ahead for Chegg and I am confident in our

team and our ability to succeed.

With that, I will turn the call over to the operator for your

questions.

Conference Call and Webcast

Information

To access the call, please dial 1-877-407-4018, or outside the

U.S. +1-201-689-8471, five minutes prior to 1:30 p.m. Pacific Time

(or 4:30 p.m. Eastern Time). A live webcast of the call will also

be available at https://investor.chegg.com under the Events &

Presentations menu. An audio replay will be available beginning at

4:30 p.m. Pacific Time (or 7:30 p.m. Eastern Time) on August 5,

2024, until 8:59 p.m. Pacific Time (or 11:59 p.m. Eastern Time) on

August 12, 2024, by calling 1-844-512-2921, or outside the U.S.

+1-412-317-6671, with Conference ID 13747410. An audio archive of

the call will also be available at https://investor.chegg.com.

Use of Investor Relations Website for

Regulation FD Purposes

Chegg also uses its media center website,

https://www.chegg.com/press, as a means of disclosing material

non-public information and for complying with its disclosure

obligations under Regulation FD. Accordingly, investors should

monitor https://www.chegg.com/press, in addition to following press

releases, Securities and Exchange Commission filings and public

conference calls and webcasts.

About Chegg

Chegg provides individualized learning support to students as

they pursue their educational journeys. Available on demand 24/7

and powered by over a decade of learning insights, the Chegg

platform offers students AI-powered academic support thoughtfully

designed for education coupled with access to a vast network of

subject matter experts who ensure quality. No matter the goal,

level, or style, Chegg helps millions of students around the world

learn with confidence by helping them build essential academic,

life, and job skills to achieve success. Chegg is a publicly held

company based in Santa Clara, California and trades on the NYSE

under the symbol CHGG. For more information, visit

www.chegg.com.

Use of Non-GAAP Measures

To supplement Chegg’s financial results presented in accordance

with generally accepted accounting principles in the United States

(GAAP), this press release and the accompanying tables and the

related earnings conference call contain non-GAAP financial

measures, including adjusted EBITDA, non-GAAP cost of revenues,

non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating

expenses, non-GAAP income from operations, non-GAAP net income,

non-GAAP weighted average shares, non-GAAP net income per share,

and free cash flow. For reconciliations of these non-GAAP financial

measures to the most directly comparable GAAP financial measures,

please see the section of the accompanying tables titled,

“Reconciliation of Net (Loss) Income to EBITDA and Adjusted

EBITDA,” “Reconciliation of GAAP to Non-GAAP Financial Measures,”

“Reconciliation of Net Cash Provided by Operating Activities to

Free Cash Flow,” and “Reconciliation of Forward-Looking Net Loss to

EBITDA and Adjusted EBITDA.”

The presentation of these non-GAAP financial measures is not

intended to be considered in isolation from, as a substitute for,

or superior to, the financial information prepared and presented in

accordance with GAAP, and may be different from non-GAAP financial

measures used by other companies. Chegg defines (1) adjusted EBITDA

as earnings before interest, taxes, depreciation and amortization

or EBITDA, adjusted for share-based compensation expense, other

income, net, acquisition-related compensation costs, impairment

expense, restructuring charges, content and related assets charge

and transitional logistic charges; (2) non-GAAP cost of revenues as

cost of revenues excluding amortization of intangible assets,

share-based compensation expense, acquisition-related compensation

costs, restructuring charges, content and related assets charge,

and transitional logistic charges; (3) non-GAAP gross profit as

gross profit excluding amortization of intangible assets,

share-based compensation expense, acquisition-related compensation

costs, restructuring charges, content and related assets charge,

and transitional logistic charges; (4) non-GAAP gross margin is

defined as non-GAAP gross profit divided by net revenues; (5)

non-GAAP operating expenses as operating expenses excluding

share-based compensation expense, amortization of intangible

assets, acquisition-related compensation costs, restructuring

charges, impairment expense, impairment of lease related assets,

and loss contingency; (6) non-GAAP income from operations as loss

from operations excluding share-based compensation expense,

amortization of intangible assets, acquisition-related compensation

costs, restructuring charges, impairment expense, content and

related assets charge, impairment of lease related assets, loss

contingency, and transitional logistic charges; (7) non-GAAP net

income as net (loss) income excluding share-based compensation

expense, amortization of intangible assets, acquisition-related

compensation costs, amortization of debt issuance costs, the income

tax effect of non-GAAP adjustments, restructuring charges,

impairment expense, content and related assets charge, impairment

of lease related assets, gain on sale of strategic equity

investment, gain on early extinguishment of debt, loss contingency

and transitional logistic charges; (8) non-GAAP weighted average

shares outstanding as weighted average shares outstanding adjusted

for the effect of shares for stock plan activity and shares related

to our convertible senior notes, to the extent such shares are not

already included in our weighted average shares outstanding; (9)

non-GAAP net income per share is defined as non-GAAP net income

divided by non-GAAP weighted average shares outstanding; and (10)

free cash flow as net cash provided by operating activities

adjusted for purchases of property and equipment. To the extent

additional significant non-recurring items arise in the future,

Chegg may consider whether to exclude such items in calculating the

non-GAAP financial measures it uses.

Chegg believes that these non-GAAP financial measures, when

taken together with the corresponding GAAP financial measures,

provide meaningful supplemental information regarding Chegg’s

performance by excluding items that may not be indicative of

Chegg’s core business, operating results or future outlook. Chegg

management uses these non-GAAP financial measures in assessing

Chegg’s operating results, as well as when planning, forecasting

and analyzing future periods and believes that such measures

enhance investors’ overall understanding of our current financial

performance. These non-GAAP financial measures also facilitate

comparisons of Chegg’s performance to prior periods.

As presented in the “Reconciliation of Net (Loss) Income to

EBITDA and Adjusted EBITDA,” “Reconciliation of GAAP to Non-GAAP

Financial Measures,” “Reconciliation of Forward-Looking Net Loss to

EBITDA and Adjusted EBITDA,” and “Reconciliation of Net Cash

Provided by Operating Activities to Free Cash Flow” tables below,

each of the non-GAAP financial measures excludes or includes one or

more of the following items:

Share-based compensation expense.

Share-based compensation expense is a non-cash expense that

varies in amount from period to period and is dependent on market

forces that are often beyond Chegg's control. As a result,

management excludes this item from Chegg's internal operating

forecasts and models. Management believes that non-GAAP measures

adjusted for share-based compensation expense provide investors

with a basis to measure Chegg's core performance against the

performance of other companies without the variability created by

share-based compensation as a result of the variety of equity

awards used by other companies and the varying methodologies and

assumptions used.

Amortization of intangible assets.

Chegg amortizes intangible assets, including those that

contribute to generating revenues, that it acquires in conjunction

with acquisitions, which results in non‑cash expenses that may not

otherwise have been incurred. Chegg believes excluding the expense

associated with intangible assets from non-GAAP measures allows for

a more accurate assessment of its ongoing operations and provides

investors with a better comparison of period-over-period operating

results. No corresponding adjustments have been made related to

revenues generated from acquired intangible assets.

Acquisition-related compensation costs.

Acquisition-related compensation costs include compensation

expense resulting from the employment retention of certain key

employees established in accordance with the terms of the

acquisitions. In most cases, these acquisition-related compensation

costs are not factored into management's evaluation of potential

acquisitions or Chegg's performance after completion of

acquisitions, because they are not related to Chegg's core

operating performance. In addition, the frequency and amount of

such charges can vary significantly based on the size and timing of

acquisitions and the maturities of the businesses being acquired.

Excluding acquisition-related compensation costs from non-GAAP

measures provides investors with a basis to compare Chegg’s results

against those of other companies without the variability caused by

purchase accounting.

Amortization of debt issuance costs.

The difference between the effective interest expense and the

contractual interest expense are excluded from management's

assessment of our operating performance because management believes

that these non-cash expenses are not indicative of ongoing

operating performance. Chegg believes that the exclusion of the

non-cash interest expense provides investors with a better

comparison of period-over-period operating results.

Income tax effect of non-GAAP adjustments.

We utilize a non-GAAP effective tax rate for evaluating our

operating results, which is based on our current mid-term

projections. This non-GAAP tax rate could change for various

reasons including, but not limited to, significant changes

resulting from tax legislation, changes to our corporate structure

and other significant events. Chegg believes that the inclusion of

the income tax effect of non-GAAP adjustments provides investors

with a better comparison of period-over-period operating

results.

Restructuring charges.

Restructuring charges represent expenses incurred in conjunction

with a reduction in workforce. Chegg believes that it is

appropriate to exclude them from non-GAAP financial measures

because they are nonrecurring and the result of an event that is

not considered a core-operating activity. Chegg believes that it is

appropriate to exclude the restructuring charges from non-GAAP

financial measures because it provides investors with a better

comparison of period-over-period operating results.

Impairment expense.

Impairment expense represents the impairment of goodwill,

intangible assets, and property and equipment. Chegg believes that

it is appropriate to exclude them from non-GAAP financial measures

because they are the result of discrete events that are not

considered core-operating activities and are not indicative of our

ongoing operating performance. Chegg believes that it is

appropriate to exclude the impairment expense from non-GAAP

financial measures because it provides investors with a better

comparison of period-over-period operating results.

Impairment of lease related assets.

The impairment of lease related assets represents impairment

charge recorded on the ROU asset and leasehold improvements

associated with the closure of our offices. The impairment of lease

related assets is the result of an event that is not considered a

core-operating activity and we believe its exclusion provides

investors with a better comparison of period-over-period operating

results.

Content and related assets charge.

The content and related assets charge represents a write off of

certain content and related assets. The content and related assets

charge is excluded from non-GAAP financial measures because it is

the result of a discrete event that is not considered

core-operating activities. Chegg believes that it is appropriate to

exclude the content and related assets charge from non-GAAP

financial measures because it enables the comparison of

period-over-period operating results.

Gain on sale of strategic equity investment.

The gain on sale of strategic equity investment represents a

one-time event to record the sale of our equity investment in Sound

Ventures. We believe that it is appropriate to exclude the gain

from non-GAAP financial measures because it is the result of an

event that is not considered a core-operating activity and we

believe its exclusion provides investors with a better comparison

of period-over-period operating results.

Gain on early extinguishment of debt.

The difference between the carrying amount of early extinguished

debt and the reacquisition price is excluded from management's

assessment of our operating performance because management believes

that these non-cash gains are not indicative of ongoing operating

performance. Chegg believes that the exclusion of the gain on early

extinguishment of debt provides investors with a better comparison

of period-over-period operating results.

Loss contingency.

The loss contingency represents a one-time accrual in connection

with a demand for repayment of certain investment proceeds received

by the Company in its capacity as an investor in TAPD, Inc. (more

commonly known as “Frank”). The loss contingency is excluded from

non-GAAP financial measures because they are the result of discrete

events that are not considered core-operating activities. Chegg

believes that it is appropriate to exclude the loss contingency

from non-GAAP financial measures because it enables the comparison

of period-over-period operating results.

Transitional logistics charges.

The transitional logistics charges represent incremental

expenses incurred as we transition our print textbooks to a third

party. Chegg believes that it is appropriate to exclude them from

non-GAAP financial measures because it is the result of an event

that is not considered a core-operating activity and we believe its

exclusion provides investors with a better comparison of

period-over-period operating results.

Effect of shares for stock plan activity.

The effect of shares for stock plan activity represents the

dilutive impact of outstanding stock options, RSUs, and PSUs

calculated under the treasury stock method.

Effect of shares related to convertible senior notes.

The effect of shares related to convertible senior notes

represents the dilutive impact of our convertible senior notes, to

the extent such shares are not already included in our weighted

average shares outstanding as they were antidilutive on a GAAP

basis.

Free cash flow.

Free cash flow represents net cash provided by operating

activities adjusted for purchases of property and equipment. Chegg

considers free cash flow to be a liquidity measure that provides

useful information to management and investors about the amount of

cash generated by the business after the purchases of property and

equipment, which can then be used to, among other things, invest in

Chegg's business and make strategic acquisitions. A limitation of

the utility of free cash flow as a measure of financial performance

is that it does not represent the total increase or decrease in

Chegg's cash balance for the period.

Forward-Looking

Statements

This press release contains forward-looking statements made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, which include, without limitation,

our endeavor to build an unparalleled learning platform, our effort

to create a leaner, more efficient organization, which will move

faster, smarter, and allow us to make investments for the long

term, our prediction that our restructuring program will generate

non-GAAP expense savings in the range of $40-50 million, our goals

of 30%+ adjusted EBITDA margin and at least $100 million of Free

Cash Flow for 2025, our new product vision to evolve Chegg from a

solutions-based study platform to one that supports the whole

student with 360 degrees of individualized academic and functional

support, our ability to build the products and experiences that

bring our new vision to life, our ability to leverage both our key

differentiators and the general technology shift in which we find

ourselves, our ability to evolve and align our services to the

modern student experience, our expectation that we can do better

regarding students spending time verifying the information they

receive from AI tools, the launch of our student-facing

satisfaction guarantee, our ability to support student success and

differentiate Chegg, our plan to launch our "Small Steps, Big Wins"

marketing campaign, our expectation that our marketing program will

extend our reach into channels where students are congregating and

that it will increase our top of funnel, our goal of making sure

Chegg is everywhere our current and future students are, our

ability to execute our product roadmap, our ability to support

student outcomes by delivering education enhanced by AI, whether we

can use our proprietary technology to develop a series of next-best

actions that creates an individualized learning pathway and whether

this will drive student engagement and retention, our ability to

deliver the best learning solutions possible, our Orchestrator's

ability to select the best approach to assist each student, our

ability to take advantage of any future innovations that

foundational models will create while maintaining quality,

producing solutions at a reduced cost per unit vs. human creation

alone, our content acting as the primary driver of our acquisition

flywheel, our product innovations for Q3 including Starting Point,

one that keeps students on track and another that organizes

students' notes, the evolution of Chegg from a Q&A platform to

one that delivers 360 degrees of support, the launch of a fully

localized product in Mexico by the end of September, our ability to

meet the cultural, linguistic, and user experience requirements of

key international markets, the ability of Mexico to serve as a

playbook for future localization efforts, the growth opportunities

that international expansion provides, our partnership with Max,

our belief that we will return to growth, that the work done in Q2

will support both revenue and adjusted EBITDA growth over time, our

ability to maintain strong profitability, our Q3 guidance,

including total revenue, Subscription Services revenue, gross

margin, and adjusted EBITDA, our ability to implement our vision to

get back to growth, our ability to deliver our financial goals,

that there is a significant opportunity ahead of Chegg, and our

confidence in our team and our ability to succeed, as well as those

included in the investor presentation referenced above, those

included in the “Prepared Remarks” sections above, and all

statements about Chegg’s outlook under “Business Outlook.” The

words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“project,” “endeavor,” “will,” “should,” “future,” “transition,”

“outlook” and similar expressions, as they relate to Chegg, are

intended to identify forward-looking statements. These statements

are not guarantees of future performance, and are based on

management’s expectations as of the date of this press release and

assumptions that are inherently subject to uncertainties, risks and

changes in circumstances that are difficult to predict.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance or achievements to differ materially from any future

results, performance or achievements. Important factors that could

cause actual results to differ materially from those expressed or

implied by these forward-looking statements include the following:

the effects of AI technology on Chegg’s business and the economy

generally; Chegg’s ability to attract new learners to, and retain

existing learners on, our learning platform; Chegg's innovation and

offering of new products and services in response to technology and

market developments, including AI; Chegg’s brand and reputation;

the uncertainty surrounding the evolving educational landscape;

enrollment and student behavior, including the impact of AI;

Chegg’s ability to expand internationally; the efficacy of Chegg's

efforts to drive user traffic, including search engine

optimization, social media campaigns, and other marketing; the

success of Chegg’s new product offerings, including 360 degrees of

individualized academic and functional support; competition in all

aspects of Chegg’s business, including with respect to AI and

Chegg's expectation that such competition will increase; Chegg’s

ability to maintain its services and systems without interruption,

including as a result of technical issues, cybersecurity threats,

or cyber-attacks; third-party payment processing risks; adoption of

government regulation of education unfavorable to Chegg; the rate

of adoption of Chegg’s offerings; mobile app stores and mobile

operating systems making Chegg’s apps and mobile website available

to students and to grow Chegg’s user base and increase their

engagement; colleges and governments restricting online access or

access to Chegg’s services; Chegg’s ability to strategically take

advantage of new opportunities; competitive developments, including

pricing pressures and other services targeting students; Chegg’s

ability to build and expand its services offerings; Chegg’s ability

to integrate acquired businesses and assets; the impact of

seasonality and student behavior on the business; the outcome of

any current litigation and investigations; misuse of Chegg’s

platform and content; Chegg’s ability to effectively control

operating costs; regulatory changes, in particular concerning

privacy, marketing, and education; changes in the education market,

including as a result of AI technology and COVID-19; and general

economic, political and industry conditions, including inflation,

recession and war. All information provided in this release and in

the conference call is as of the date hereof, and Chegg undertakes

no duty to update this information except as required by law. These

and other important risk factors are described more fully in

documents filed with the Securities and Exchange Commission,

including Chegg's Annual Report on Form 10-K for the year ended

December 31, 2023 filed with the Securities and Exchange Commission

on February 20, 2024, and could cause actual results to differ

materially from expectations.

CHEGG, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except for

number of shares and par value)

(unaudited)

June 30,

2024

December 31,

2023

Assets

Current assets

Cash and cash equivalents

$

133,068

$

135,757

Short-term investments

212,396

194,257

Accounts receivable, net of allowance of

$183 and $376 at June 30, 2024 and December 31, 2023,

respectively

20,964

31,404

Prepaid expenses

30,841

20,980

Other current assets

36,279

32,437

Total current assets

433,548

414,835

Long-term investments

259,925

249,547

Property and equipment, net

179,278

183,073

Goodwill

189,769

631,995

Intangible assets, net

12,848

52,430

Right of use assets

21,508

25,130

Deferred tax assets

2,287

141,843

Other assets

15,167

28,382

Total assets

$

1,114,330

$

1,727,235

Liabilities and stockholders'

equity

Current liabilities

Accounts payable

$

14,424

$

28,184

Deferred revenue

45,023

55,336

Accrued liabilities

68,001

77,863

Current portion of convertible senior

notes, net

357,838

357,079

Total current liabilities

485,286

518,462

Long-term liabilities

Convertible senior notes, net

243,079

242,758

Long-term operating lease liabilities

15,595

18,063

Other long-term liabilities

4,870

3,334

Total long-term liabilities

263,544

264,155

Total liabilities

748,830

782,617

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.001 par value per

share, 10,000,000 shares authorized, no shares issued and

outstanding

—

—

Common stock, $0.001 par value per share:

400,000,000 shares authorized; 103,360,633 and 102,823,700 shares

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively

103

103

Additional paid-in capital

1,075,989

1,031,627

Accumulated other comprehensive loss

(39,915

)

(34,739

)

Accumulated deficit

(670,677

)

(52,373

)

Total stockholders' equity

365,500

944,618

Total liabilities and stockholders'

equity

$

1,114,330

$

1,727,235

CHEGG, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Net revenues

$

163,147

$

182,853

$

337,497

$

370,454

Cost of revenues(1)

45,411

47,412

91,908

96,562

Gross profit

117,736

135,441

245,589

273,892

Operating expenses:

Research and development(1)

43,651

52,872

88,086

99,779

Sales and marketing(1)

23,545

30,956

53,920

67,973

General and administrative(1)

54,016

70,309

109,550

129,282

Impairment expense

481,531

—

481,531

—

Total operating expenses

602,743

154,137

733,087

297,034

Loss from operations

(485,007

)

(18,696

)

(487,498

)

(23,142

)

Interest expense, net and other income,

net:

Interest expense, net

(651

)

(1,114

)

(1,301

)

(2,382

)

Other income, net

7,119

64,103

17,899

76,179

Total interest expense, net and other

income, net

6,468

62,989

16,598

73,797

(Loss) income before provision for income

taxes

(478,539

)

44,293

(470,900

)

50,655

Provision for income taxes

(138,345

)

(19,681

)

(147,404

)

(23,857

)

Net (loss) income

$

(616,884

)

$

24,612

$

(618,304

)

$

26,798

Net (loss) income per share

Basic

$

(6.01

)

$

0.21

$

(6.03

)

$

0.22

Diluted

$

(6.01

)

$

(0.11

)

$

(6.03

)

$

(0.08

)

Weighted average shares used to compute

net (loss) income per share

Basic

102,604

117,977

102,474

120,828

Diluted

102,604

132,944

102,474

137,416

(1) Includes share-based compensation

expense and restructuring charges as follows:

Share-based compensation expense:

Cost of revenues

$

466

$

560

$

979

$

1,087

Research and development

7,123

11,968

16,332

22,882

Sales and marketing

1,726

2,182

3,866

4,681

General and administrative

8,732

21,210

26,159

41,016

Total share-based compensation expense

$

18,047

$

35,920

$

47,336

$

69,666

Restructuring charges:

Cost of revenues

$

191

$

12

$

191

$

12

Research and development

2,082

1,692

2,082

1,692

Sales and marketing

906

1,228

906

1,228

General and administrative

3,549

2,772

3,549

2,772

Total restructuring charges

$

6,728

$

5,704

$

6,728

$

5,704

CHEGG, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Six Months Ended

June 30,

2024

2023

Cash flows from operating

activities

Net (loss) income

$

(618,304

)

$

26,798

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Share-based compensation expense

47,336

69,666

Depreciation and amortization expense

39,393

52,027

Deferred income taxes

141,032

20,142

Operating lease expense, net

3,141

3,009

Amortization of debt issuance costs

1,081

1,988

Loss from write-off of property and

equipment

1,657

450

Impairment expense

481,531

—

Gain on early extinguishment of debt

—

(53,777

)

Loss contingency

—

7,000

Impairment on lease related assets

2,189

—

Other non-cash items

82

(1,083

)

Change in assets and liabilities:

Accounts receivable

10,561

3,081

Prepaid expenses and other current

assets

(12,173

)

15,082

Other assets

(773

)

5,470

Accounts payable

(12,045

)

(671

)

Deferred revenue

(10,226

)

(3,634

)

Accrued liabilities

(4,057

)

(1,436

)

Other liabilities

(2,880

)

(8,205

)

Net cash provided by operating

activities

67,545

135,907

Cash flows from investing

activities

Purchases of property and equipment

(45,817

)

(33,864

)

Proceeds from disposition of textbooks

—

9,787

Purchases of investments

(123,669

)

(552,409

)

Maturities of investments

89,890

476,862

Proceeds from sale of investments

—

238,681

Proceeds from sale of strategic equity

investment

15,500

—

Purchase of strategic equity

investment

—

(9,604

)

Net cash (used in) provided by investing

activities

(64,096

)

129,453

Cash flows from financing

activities

Proceeds from common stock issued under

stock plans, net

2,190

3,081

Payment of taxes related to the net share

settlement of equity awards

(7,825

)

(11,068

)

Repurchase of common stock

—

(186,368

)

Repayment of convertible senior notes

—

(369,761

)

Proceeds from exercise of convertible

senior notes capped call

—

297

Net cash used in financing activities

(5,635

)

(563,819

)

Effect of exchange rate changes

(305

)

197

Net decrease in cash, cash equivalents and

restricted cash

(2,491

)

(298,262

)

Cash, cash equivalents and restricted

cash, beginning of period

137,976

475,854

Cash, cash equivalents and restricted

cash, end of period

$

135,485

$

177,592

Six Months Ended

June 30,

2024

2023

Supplemental cash flow data:

Cash paid during the period for:

Interest

$

224

$

517

Income taxes, net of refunds

$

2,729

$

6,171

Cash paid for amounts included in the

measurement of lease liabilities:

Operating cash flows from operating

leases

$

4,346

$

4,909

Right of use assets obtained in exchange

for lease obligations:

Operating leases

$

663

$

12,407

Non-cash investing and financing

activities:

Accrued purchases of long-lived assets

$

5,016

$

4,518

June 30,

2024

2023

Reconciliation of cash, cash equivalents

and restricted cash:

Cash and cash equivalents

$

133,068

$

175,368

Restricted cash included in other current

assets

540

60

Restricted cash included in other

assets

1,877

2,164

Total cash, cash equivalents and

restricted cash

$

135,485

$

177,592

CHEGG, INC.

RECONCILIATION OF NET (LOSS)

INCOME TO EBITDA AND ADJUSTED EBITDA

(in thousands)

(unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Net (loss) income

$

(616,884

)

$

24,612

$

(618,304

)

$

26,798

Interest expense, net

651

1,114

1,301

2,382

Provision for income taxes

138,345

19,681

147,404

23,857

Depreciation and amortization expense

19,706

26,484

39,393

52,027

EBITDA

(458,182

)

71,891

(430,206

)

105,064

Share-based compensation expense

18,047

35,920

47,336

69,666

Other income, net

(7,119

)

(64,103

)

(17,899

)

(76,179

)

Acquisition-related compensation costs

173

3,417

428

5,877

Restructuring charges

6,728

5,704

6,728

5,704

Impairment expense

481,531

—

481,531

—

Impairment of lease related assets

2,189

—

2,189

—

Content and related assets charge

729

—

729

—

Loss contingency

—

7,000

—

7,000

Transitional logistics charges

—

—

—

253

Adjusted EBITDA

$

44,096

$

59,829

$

90,836

$

117,385

CHEGG, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(in thousands, except

percentages and per share amounts)

(unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Cost of revenues

$

45,411

$

47,412

$

91,908

$

96,562

Amortization of intangible assets

(3,071

)

(3,382

)

(6,213

)

(6,721

)

Share-based compensation expense

(466

)

(560

)

(979

)

(1,087

)

Acquisition-related compensation costs

(5

)

(7

)

(11

)

(12

)

Restructuring charges

(191

)

(12

)

(191

)

(12

)

Content and related assets charge

(729

)

—

(729

)

—

Transitional logistics charges

—

—

—

(253

)

Non-GAAP cost of revenues

$

40,949

$

43,451

$

83,785

$

88,477

Gross profit

$

117,736

$

135,441

$

245,589

$

273,892

Amortization of intangible assets

3,071

3,382

6,213

6,721

Share-based compensation expense

466

560

979

1,087

Acquisition-related compensation costs

5

7

11

12

Restructuring charges

191

12

191

12

Content and related assets charge

729

—

729

—

Transitional logistics charges

—

—

—

253

Non-GAAP gross profit

$

122,198

$

139,402

$

253,712

$

281,977

Gross margin %

72

%

74

%

73

%

74

%

Non-GAAP gross margin %

75

%

76

%

75

%

76

%

Operating expenses

$

602,743

$

154,137

$

733,087

$

297,034

Share-based compensation expense

(17,581

)

(35,360

)

(46,357

)

(68,579

)

Amortization of intangible assets

(435

)

(2,977

)

(1,291

)

(5,888

)

Acquisition-related compensation costs

(168

)

(3,410

)

(417

)

(5,865

)

Restructuring charges

(6,537

)

(5,692

)

(6,537

)

(5,692

)

Impairment expense

(481,531

)

—

(481,531

)

—

Impairment of lease related assets

(2,189

)

—

(2,189

)

—

Loss contingency

—

(7,000

)

—

(7,000

)

Non-GAAP operating expenses

$

94,302

$

99,698

$

194,765

$

204,010

Loss from operations

$

(485,007

)

$

(18,696

)

$

(487,498

)

$

(23,142

)

Share-based compensation expense

18,047

35,920

47,336

69,666

Amortization of intangible assets

3,506

6,359

7,504

12,609

Acquisition-related compensation costs

173

3,417

428

5,877

Restructuring charges

6,728

5,704

6,728

5,704

Impairment expense

481,531

—

481,531

—

Impairment of lease related assets

2,189

—

2,189

—

Content and related assets charge

729

—

729

—

Transitional logistics charges

—

—

—

253

Loss contingency

—

7,000

—

7,000

Non-GAAP income from operations

$

27,896

$

39,704

$

58,947

$

77,967

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Net (loss) income

$

(616,884

)

$

24,612

$

(618,304

)

$

26,798

Share-based compensation expense

18,047

35,920

47,336

69,666

Amortization of intangible assets

3,506

6,359

7,504

12,609

Acquisition-related compensation costs

173

3,417

428

5,877

Amortization of debt issuance costs

540

931

1,081

1,988

Income tax effect of non-GAAP

adjustments

129,937

7,671

130,650

(184

)

Restructuring charges

6,728

5,704

6,728

5,704

Impairment expense

481,531

—

481,531

—

Impairment of lease related assets

2,189

—

2,189

—

Content and related assets charge

729

—

729

—

Gain on sale of strategic equity

investment

—

—

(3,783

)

—

Gain on early extinguishment of debt

—

(53,777

)

—

(53,777

)

Loss contingency

—

7,000

—

7,000

Transitional logistics charges

—

—

—

253

Non-GAAP net income

$

26,496

$

37,837

$

56,089

$

75,934

Weighted average shares used to compute

net (loss) income per share, diluted

102,604

132,944

102,474

137,416

Effect of shares for stock plan

activity

310

273

513

433

Effect of shares related to convertible

senior notes

9,234

—

9,234

—

Non-GAAP weighted average shares used to

compute non-GAAP net income per share, diluted

112,148

133,217

112,221

137,849

Net (loss) income per share, diluted

$

(6.01

)

$

(0.11

)

$

(6.03

)

$

(0.08

)

Adjustments

6.25

0.39

6.53

0.63

Non-GAAP net income per share, diluted

$

0.24

$

0.28

$

0.50

$

0.55

CHEGG, INC.

RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(in thousands)

(unaudited)

Six Months Ended

June 30,

2024

2023

Net cash provided by operating

activities

$

67,545

$

135,907

Purchases of property and equipment

(45,817

)

(33,864

)

Proceeds from disposition of textbooks

—

9,787

Free cash flow

$

21,728

$

111,830

CHEGG, INC.

RECONCILIATION OF

FORWARD-LOOKING NET LOSS TO EBITDA AND ADJUSTED EBITDA

(in thousands)

(unaudited)

Three Months Ending

September 30, 2024

Net loss

$

(16,100

)

Interest expense, net

500

Provision for income taxes

(800

)

Depreciation and amortization expense

19,700

EBITDA

3,300

Share-based compensation expense

21,500

Other income, net

(6,800

)

Acquisition-related compensation costs

200

Restructuring charges

1,800

Adjusted EBITDA

$

20,000

* Adjusted EBITDA guidance for the three months ending September

30, 2024 represent the midpoint of the range of $19 million to $21

million, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240805359231/en/

Media Contact: Tonya B. Hudson, press@chegg.com Investor

Contact: Tracey Ford, IR@chegg.com

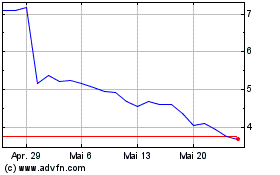

Chegg (NYSE:CHGG)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Chegg (NYSE:CHGG)

Historical Stock Chart

Von Mär 2024 bis Mär 2025