Form 8-K - Current report

24 Januar 2024 - 10:17PM

Edgar (US Regulatory)

0000761648FALSE00007616482024-01-242024-01-240000761648us-gaap:SeriesBPreferredStockMember2024-01-242024-01-240000761648us-gaap:SeriesCPreferredStockMember2024-01-242024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2024

Cedar Realty Trust, Inc.

(Exact name of Registrant as specified in Its Charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-31817 | | 42-1241468 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

2529 Virginia Beach Blvd. Virginia Beach, VA | | | | 23452 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (757) 627-9088

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

7.25% Series B Cumulative Redeemable

Preferred Stock, $25.00 Liquidation Value | | CDRpB | | New York Stock Exchange |

6.50% Series C Cumulative Redeemable

Preferred Stock, $25.00 Liquidation Value | | CDRpC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On January 24, 2024, Cedar Realty Trust, Inc. (the “Company”) issued a press release announcing tax information for 2023 distributions.

A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | CEDAR REALTY TRUST, INC. |

| | | |

| Date: | January 24, 2024 | By: | /s/ M. ANDREW FRANKLIN |

| | | M. Andrew Franklin |

| | | Chief Executive Officer and President |

Exhibit 99.1 CEDAR REALTY TRUST ANNOUNCES TAX INFORMATION FOR 2023 DISTRIBUTIONS Virginia Beach, Virginia – January 24, 2024 - Cedar Realty Trust, Inc. (the “Company”) (NYSE: CDRpB) (NYSE: CDRpC) today announced the federal income tax treatment of its 2023 distributions to the holders of its preferred shares. Total Unrecaptured Distribution Ordinary Capital Gain Section Nondividend Record Date Payable Date Per Share Dividends Distribution (2) (3) 1250 Gain (1) Distribution 2/10/2023 2/20/2023 $0.453125 $0.000000 $0.022656 $0.022656 $0.430469 5/10/2023 5/22/2023 $0.453125 $0.000000 $0.022656 $0.022656 $0.430469 8/10/2023 8/21/2023 $0.453125 $0.000000 $0.022656 $0.022656 $0.430469 11/10/2023 11/20/2023 $0.453125 $0.000000 $0.022656 $0.022656 $0.430469 Totals $1.812500 $0.000000 $0.090624 $0.090624 $1.721876 Total Unrecaptured Distribution Ordinary Capital Gain Section Nondividend Record Date Payable Date Per Share Dividends Distribution (2) (3) 1250 Gain (1) Distribution 2/10/2023 2/20/2023 $0.406250 $0.000000 $0.020313 $0.020313 $0.385937 5/10/2023 5/22/2023 $0.406250 $0.000000 $0.020313 $0.020313 $0.385937 8/10/2023 8/21/2023 $0.406250 $0.000000 $0.020313 $0.020313 $0.385937 11/10/2023 11/20/2023 $0.406250 $0.000000 $0.020313 $0.020313 $0.385937 Totals $1.625000 $0.000000 $0.081252 $0.081252 $1.543748 (1) The amount reported as Unrecaptured Section 1250 Gain is a subset of, and is included in, the Capital Gain Distribution. (2) The Section 897 Capital Gain amount is equal to 100% of the total Capital Gain Distribution to Shareholders for the tax year ended December 31, 2023. (3) Pursuant to Treasury Regulation §1.1061-6(c), Cedar Realty Turst, Inc. is disclosing additional information related to the Capital Gain Distributions reported. on Form 1099-DIV, for purposes of Section 1061. Section 1061 is generally applicable to direct and indirect holders of "applicable partnership interests." "The One Year Amounts" and "Three Year Amounts" required to be disclosed are both zero with respect to the 2023 distributions, since all capital gain dividends relate to Section 1231 gains. CUSIP: 1506025063 Series B Preferred Stock Series C Preferred Stock Symbol: CDRpB Symbol: CDRpC CUSIP: 150602407 Shareholders are advised to consult their tax advisor about the specific tax treatment of 2023 dividends.

About Cedar Realty Trust Cedar Realty Trust, Inc., a wholly owned subsidiary of Wheeler Real Estate Investment Trust, Inc., is a real estate investment trust (REIT) that owns and operates income producing retail properties with a primary focus on grocery-anchored shopping centers in the Northeast. The Company's portfolio comprises 19 properties, with approximately 2.8 million square feet of gross leasable area. For additional financial and descriptive information on the Company, its operations, and its portfolio, please refer to the Company's website at www.whlr.us. Contact Information: Cedar Realty Trust, Inc. (757) 627-9088

v3.23.4

Cover

|

Jan. 24, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 24, 2024

|

| Entity Registrant Name |

Cedar Realty Trust, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-31817

|

| Entity Tax Identification Number |

42-1241468

|

| Entity Address, Address Line One |

2529 Virginia Beach Blvd

|

| Entity Address, City or Town |

Virginia Beach

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23452

|

| City Area Code |

757

|

| Local Phone Number |

627-9088

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000761648

|

| Amendment Flag |

false

|

| 7.25% Series B Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.25% Series B Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value

|

| Trading Symbol |

CDRpB

|

| Security Exchange Name |

NYSE

|

| 6.50% Series C Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.50% Series C Cumulative Redeemable Preferred Stock, $25.00 Liquidation Value

|

| Trading Symbol |

CDRpC

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesCPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

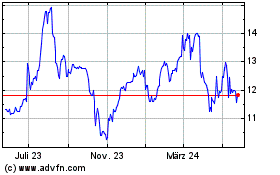

Cedar Realty (NYSE:CDR-C)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

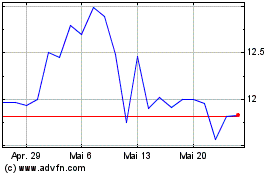

Cedar Realty (NYSE:CDR-C)

Historical Stock Chart

Von Dez 2023 bis Dez 2024