Dow Industrials Surge on Strong Earnings from Caterpillar, 3M

24 Oktober 2017 - 9:56PM

Dow Jones News

By Michael Wursthorn and Georgi Kantchev

-- U.S. stocks rise as strong earnings support major indexes

-- Caterpillar, 3M boost Dow industrials

-- Shares in Europe edge lower, while Asia stocks rise

The Dow Jones Industrial Average surged Tuesday, putting the

blue-chip index on track for its best day since September.

Better-than-expected earnings results from Caterpillar and 3M,

among others, helped support major indexes after stocks had fallen

a day earlier. Strong results from U.S. companies, as well as solid

economic growth around the world, have underpinned stock markets

and helped push them to record highs over the past year.

About 24% of the companies in the S&P 500 have reported

results for the third quarter so far, with this week slated to be

one the busiest, according to FactSet. By the end of Friday, more

than half of the major index's companies will have reported results

for the most recent quarter, FactSet says.

"We continue to see a strong improvement in earnings," said

Celia Dallas, chief investment strategist at Cambridge Associates.

While valuations continue to be a concern, Ms. Dallas cautioned

that investors shouldn't limit their exposure to U.S. stocks too

much yet. "U.S. equities tend to be more defensive when you get

into periods of stress," relative to stocks elsewhere in the world,

she said.

The Dow industrials gained 167 points, or 0.7%, to 23438 in

recent trading -- above its previous closing high. The S&P 500

rose 0.1%, while the Nasdaq Composite added 0.2%.

Shares of 3M jumped 6.8% after the maker of Post-it Notes, Ace

bandages and Scotch-Brite cleaning pads reported higher profit and

revenue that exceeded analysts' expectations, while also raising

its outlook. 3M is on course for its biggest single-day percent

gain since at least 2009.

Caterpillar, meanwhile, gained about 5% after the company posted

stronger-than-expected revenue and profit growth and boosted its

outlook for the year.

Together, the two companies contributed more than 140 points to

the Dow industrials' gain.

Money managers welcomed the gains. But Eric Schoenstein,

portfolio manager of the $6 billion Jensen Quality Growth Fund,

said he has concerns around whether outsize stock jumps driven by

earnings can be sustained amid lofty valuations and a long-running

rally.

"It could be a situation where the price is getting a little bit

ahead of what the opportunity might be," Mr. Schoenstein said,

adding that his investment committee will discuss holdings such as

3M on Wednesday morning.

Central banks are another focus for investors this week. The

European Central Bank is expected to announce changes to its

massive bond-buying program after its meeting Thursday. Economists

expect the ECB to reduce its monthly asset purchases, possibly by

half, but also to extend the program for a number of months into

2018.

Investors "need to exercise caution as markets enter a different

phase with less central bank support than has been the case over

the past decade," said David Simner, portfolio manager at Fidelity

International.

U.S. President Donald Trump is also expected to unveil his pick

for the new leader of the Federal Reserve within the next 10 days

from a roster of candidates that include current Fed Chairwoman

Janet Yellen.

A hawkish candidate might send U.S. Treasury yields higher and

boost the dollar, analysts say. The yield on the 10-year U.S.

Treasury note rose to 2.410%, according to Tradeweb, from 2.375%

Monday. Yields rise as prices fall.

In currencies, the WSJ Dollar Index, which tracks the dollar

against a basket of 16 currencies, was up 0.2%.

Elsewhere, the Stoxx Europe 600 index fell 0.4%. The Shanghai

Composite Index finished up 0.2%. Japan's Nikkei Stock Average

extended its record-setting streak of daily gains to 16 by closing

up 0.5%.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com and

Georgi Kantchev at georgi.kantchev@wsj.com

(END) Dow Jones Newswires

October 24, 2017 15:41 ET (19:41 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

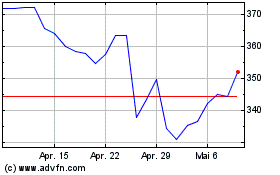

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

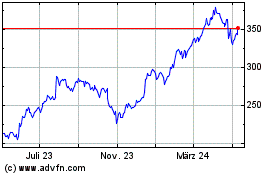

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024