Dow Industrials Surge on Strong Earnings from Caterpillar, 3M

24 Oktober 2017 - 4:37PM

Dow Jones News

By Georgi Kantchev

-- U.S. stocks open higher

-- Strong earnings support major indexes

-- Shares in Europe edge lower, while Asia stocks rise

Robust corporate earnings helped lift the Dow Jones Industrial

Average in early trading Tuesday.

The blue-chip index gained 149 points, or 0.6%, to 23423 soon

after the opening bell. The S&P 500 rose less than 0.1%, while

the Nasdaq Composite slipped less than 0.1%.

Better-than-expected earnings results from Caterpillar and 3M

among others helped support major indexes after stocks had slid a

day earlier. Strong results from U.S. companies in previous

quarters, as well as solid economic growth around the world, have

underpinned stock markets and helped push them to record highs.

"It's a busy week for markets, but risk assets continue to

perform," said Richard Benson, co-head of portfolio investments at

$18 billion fund Millennium Global Investments.

Shares of Caterpillar jumped 5.5% after the company posted

stronger-than-expected revenue and profit growth and boosted its

outlook for the year.

Meanwhile, 3M, the maker of Post-it Notes, Ace bandages and

Scotch-Brite cleaning pads, reported higher profit and revenue that

exceeded analysts' expectations, while also raising its outlook.

Shares of 3M rose 5%.

Together, the two companies contributed more than 100 points to

the Dow industrials' gain.

The Stoxx Europe 600 index fell 0.4% after lower-than-expected

economic numbers, while bourses across Asia finished mostly

higher.

Central banks are another focus for investors this week. The

European Central Bank is expected to announce changes to its

massive bond-buying program after its meeting Thursday. Economists

expect the ECB to reduce its monthly asset purchases, possibly by

half, but also to extend the program for a number of months into

2018.

Investors "need to exercise caution as markets enter a different

phase with less central bank support than has been the case over

the past decade," said David Simner, portfolio manager at Fidelity

International.

On Tuesday, IHS Markit said its composite Purchasing Managers

Index for the eurozone -- based on survey responses from

manufacturers and service providers -- fell to 55.9 in October from

56.7 in September. The index still points to solid growth, with 50

demarcating a rise from a contraction in output.

U.S. President Donald Trump is also expected to unveil his pick

for the new leader of the Federal Reserve within the next 10 days

from a roster of candidates that include current Fed Chairwoman

Janet Yellen.

A hawkish candidate might send U.S. Treasury yields higher and

boost the dollar, analysts say. The yields on the 10-year U.S.

Treasury note rose to 2.404%, according to Tradeweb, from 2.375%.

Yields rise as prices fall.

In currencies, the WSJ Dollar Index, which tracks the dollar

against a basket of 16 currencies, was up 0.2%.

Elsewhere, the Shanghai Composite Index finished up 0.2%.

Japan's Nikkei Stock Average extended its record-setting streak of

daily gains to 16 by closing up 0.5%.

-- Michael Wursthorn contributed to this article.

Write to Georgi Kantchev at georgi.kantchev@wsj.com

(END) Dow Jones Newswires

October 24, 2017 10:22 ET (14:22 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

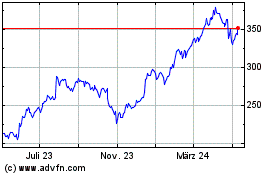

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

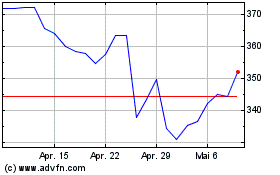

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024