Caterpillar Revenue Continues to Skid -- 2nd Update

26 Januar 2017 - 6:15PM

Dow Jones News

By Andrew Tangel

Caterpillar Inc. trimmed its sales outlook for this year and

said revenue slid in 2016 for the fourth year in a row, evidence a

prolonged slump in mining and construction is still unfolding.

The Peoria, Ill.-based heavy-equipment giant said the recent

strengthening of the U.S. dollar could drag down sales this year,

after revenue fell 18% in 2016 to $38.5 billion.

Caterpillar's losses deepened in the fourth quarter. The company

reported a loss of $1.2 billion, or $2 a share, compared with a

year-earlier loss of $94 million, or 16 cents. Revenue fell to $9.6

billion from $11 billion a year ago.

"We continue to execute in a challenging economic environment

and are focused on improving operating margins, profitability and

shareholder returns," Caterpillar Chief Executive Jim Umpleby said.

"While we see signs of positive activity in some of our key end

markets, the overall economic environment remains challenging."

The manufacturer's troubles were compounded by

higher-than-expected restructuring costs, losses related to pension

and retirement benefits and a $595 million impairment tied to its

2011 billion acquisition of mining-equipment maker Bucyrus

International Inc.

Excluding those items, the company said it earned 83 cents per

share, flat with a year ago and above the 66 cents expected by

analysts polled by Thomson Reuters. Analysts had expected revenue

of $9.8 billion.

Caterpillar's shares fell about 1% to $97.13 in early trading

Thursday.

The dollar's strengthening since President Donald Trump's

election in November could make 2017 a tough year for manufacturers

such as Caterpillar that depend on exports. A stronger dollar makes

American products more expensive overseas, and foreign sales less

valuable.

Caterpillar said the dollar's climb is one reason it lowered its

revenue outlook for the year to a range of between $36 billion and

$39 billion.

The midpoint would be lower than the approximately $38 billion

it telegraphed in December, and potentially mark a fifth-straight

year of declining revenue for the world's largest mining and

construction equipment maker.

Caterpillar said it expects earnings per-share of about $2.30

this year, or $2.90 excluding estimated restructuring costs of

about $500 million.

Caterpillar's restructuring also weighed on its global

workforce, which it has cut recently. By the end of 2016, the

company counted 106,400 employees, down from 118,700 a year ago.

Most of the reductions were made in the U.S.

Caterpillar's scheduled call with analysts on Thursday morning

will review the company's first quarterly earnings report with Mr.

Umpleby as chief executive. He succeeded Doug Oberhelman, who is

slated to remain chairman of the of board through March.

Analysts and investors will be listening for clues as to how Mr.

Trump's presidency could affect Caterpillar's fortunes. The

president has called for increased spending on U.S. infrastructure,

as well as sweeping changes to tax and trade policies.

Joshua Jamerson contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

January 26, 2017 12:00 ET (17:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

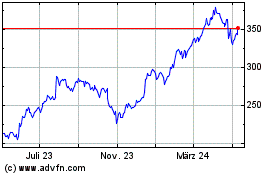

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

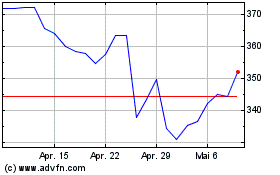

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024