Manufacturers Mixed on Prospect of a Donald Trump Presidency

09 November 2016 - 5:22PM

Dow Jones News

By Andrew Tangel and Bob Tita

Caterpillar Inc., the world's largest maker of heavy machinery,

is optimistic President-elect Donald Trump will increase spending

on U.S. infrastructure and reduce corporate tax and regulatory

burdens.

"We've got a lot to do at home on building our own

infrastructure in this country, and we are excited about some of

the things that he has said in this regard," said Kathryn Dickey

Karol, Caterpillar's vice president for global government and

corporate affairs.

Stocks for major U.S. manufacturers were mixed in morning

trading on Wall Street as investors weighed the prospect of Mr.

Trump's presidency following Tuesday's election. Caterpillar was up

more than 8% to $91.87 at the market open as investors gauged

potential for elevated U.S. spending on infrastructure construction

in a Trump administration.

But other companies in the sector were lower in trading on

uncertainty regarding Trump's pledge to renegotiate trade deals and

campaign promises to discourage companies from moving plants

overseas. Auto makers Ford Motor Co. and General Motors are trading

lower along with General Electric, United Technologies.

Ms. Karol said Peoria, Ill.-based Caterpillar would continue to

push for adoption of the Trans-Pacific Partnership during the

remaining days of the Obama administration. While Mr. Trump was

critical of that trade deal and others, Ms. Karol said the company

would continue advocating for lowering trade barriers to expand its

sales overseas.

"Caterpillar has always positioned ourselves to support strong

trade deals to bring back American competitiveness, level that

playing field and provide for growth," she said.

Reaction to the election from industrial companies is likely to

be generally muted Wednesday as executives digest the ramifications

of the election. Many companies are likely to welcome Trump's

promises to lower taxes and reduce business regulations as well as

a continuation of business friendly Republican majorities in

Congress.

But Trump's nationalistic rhetoric during the campaign will

likely unnerve foreign customers of U.S. companies and could

undermine overseas growth strategies.

Ms. Karol declined to speculate whether Mr. Trump's trade

policies would spark an international backlash and affect

Caterpillar's business over the next four years. The company has a

sprawling network of overseas facilities in countries including

China and Mexico.

"Worried, not worried -- I think we see opportunity to advocate

on the benefits of trade with this new administration and

Congress," she said. "We're going to be very vocal about that."

Ron DeFeo, chief executive of Pennsylvania-based Kennametal

Inc., which makes drilling and cutting heads for oil wells and

metal-forming machinery, predicted that U.S. businesses will warm

up to Mr. Trump if he is able to generate stronger U.S. economic

growth in the coming years.

"I don't think you can begin to address the global problems when

your domestic economy is stuck in neutral," he said.

He predicted that Mr. Trump with show a more measured approach

to trade policy as president than he showed during the campaign as

a candidate.

"A little stiffer hand goes a long way to true-up the [trade]

deals that exist, but overreach will scare people," he said.

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Bob Tita at

robert.tita@wsj.com

(END) Dow Jones Newswires

November 09, 2016 11:07 ET (16:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

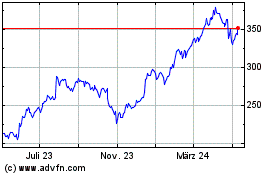

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

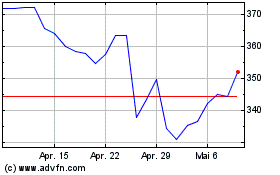

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024