GCM Grosvenor’s Infrastructure Advantage Strategy Acquires Equity Interest in Brookfield’s Shepherds Flat

24 September 2024 - 3:00PM

GCM Grosvenor (NASDAQ: GCMG), a leading global alternative asset

management firm, today announced that its Infrastructure Advantage

Strategy has acquired a 25% equity interest in Shepherds Flat (the

“Transaction”), the largest repowered wind farm in North America,

from Brookfield Asset Management (NYSE: BAM, TSX: BAM) and its

institutional partners, including its listed affiliate Brookfield

Renewable (NYSE: BEP, BEPC; TSX: BEP.UN, BEPC) (“Brookfield”).

Shepherds Flat, located in north central Oregon, is a fully

contracted 338-turbine wind farm with a nameplate capacity of 845

MW. The wind farm produces in excess of 2,000 GWh of electricity

annually, which is enough to power ~185,000 average U.S. households

and is fully supported by a long-term contract with a large-scale

utility.

"We believe Shepherds Flat presents a rare opportunity to invest

in a high-quality, hard-to-replicate, sustainable infrastructure

asset alongside an experienced owner, operator, and developer of

clean power," said GCM Grosvenor Managing Director Matt Rinklin.

"The Infrastructure Advantage Strategy is pleased to invest in

contracted renewable power generation in the Pacific Northwest

energy market. We are confident we can deliver long-term value to

our investors through this strategic acquisition."

Brookfield Renewable, a global platform for renewable power and

decarbonization solutions, acquired Shepherds Flat in 2021. A

comprehensive repowering which materially increased the wind farm’s

generation capacity was performed under Brookfield Renewable’s

ownership, enhancing the plant’s operational efficiency and

substantially extending its lifespan.

“We are excited to partner with GCM Grosvenor while maintaining

exposure to this high-quality asset that provides essential clean

energy to customers throughout the Pacific Northwest. We continue

to see opportunities to further enhance value at Shepherds Flat and

are thrilled to be working with GCM,” said Jeh Vevaina, Managing

Partner, Brookfield Asset Management.

GCM Grosvenor’s investment in Shepherds Flat was completed

through its Infrastructure Advantage Strategy, which seeks to

generate high-quality risk adjusted returns through alignment with

key stakeholders, including union labor. As part of the

transaction, the Shepherds Flat partnership has adopted a

Responsible Contractor Policy which will apply to any material

construction work at the site.

Thorndike Landing LLC acted as financial advisor and Kirkland

& Ellis LLP acted as legal advisor on the transaction for GCM

Grosvenor. BMO and Wells Fargo acted as financial advisor and King

& Spalding LLP acted as legal advisor on the transaction for

Brookfield.

About GCM Grosvenor

GCM Grosvenor (Nasdaq: GCMG) is a global alternative asset

management solutions provider with approximately $79 billion in

assets under management across private equity, infrastructure, real

estate, credit, and absolute return investment strategies. The firm

has specialized in alternatives for more than 50 years and is

dedicated to delivering value for clients by leveraging its

cross-asset class and flexible investment platform. GCM Grosvenor’s

experienced team of approximately 540 professionals serves a global

client base of institutional and individual investors. The firm is

headquartered in Chicago, with offices in New York, Toronto,

London, Frankfurt, Tokyo, Hong Kong, Seoul and Sydney. For more

information, visit: gcmgrosvenor.com.

About Brookfield Asset Management

Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) is a

leading global alternative asset manager with approximately $1

trillion of assets under management. We invest client capital for

the long-term with a focus on real assets and essential service

businesses that form the backbone of the global economy. We offer a

range of alternative investment products to investors around the

world — including public and private pension plans, endowments and

foundations, sovereign wealth funds, financial institutions,

insurance companies and private wealth investors.

Brookfield operates Brookfield Renewable Partners (NYSE: BEP,

TSX: BEP), one of the world’s largest publicly traded platforms for

renewable power and sustainable solutions. Our renewable power

portfolio totals over 34,000 megawatts and our development pipeline

stands at approximately 200,000 megawatts. Our portfolio of

sustainable solutions assets includes our investments in

Westinghouse (a leading global nuclear services business) and a

utility and independent power producer with operations in the

Caribbean and Latin America, as well as both operating assets and a

development pipeline of carbon capture and storage capacity,

agricultural renewable natural gas and materials recycling.

Media Contacts:

GCM GrosvenorTom Johnson and Abigail

RuckH/Advisors Abernathy on behalf of GCM

Grosvenortom.johnson@h-advisors.global / abigail.ruck@h-advisors.global212-371-5999

Brookfield

Simon MaineManaging Director – Communications+44 (0)7398 909 278

simon.maine@brookfield.com

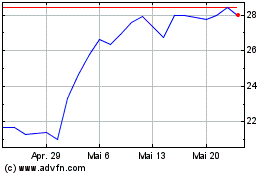

Brookfield Renewable Par... (NYSE:BEP)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

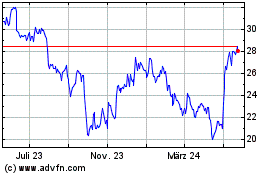

Brookfield Renewable Par... (NYSE:BEP)

Historical Stock Chart

Von Jan 2024 bis Jan 2025