Brookfield Renewable to Issue C$400 Million of Green Bonds

16 Juli 2024 - 2:13AM

Brookfield Renewable (NYSE: BEP, BEPC; TSX: BEP.UN, BEPC)

(“Brookfield Renewable”) today announced that it has agreed to

issue C$400 million aggregate principal amount of medium-term notes

(the “Notes”), comprised of C$100 million aggregate principal

amount of Series 17 Notes (the “Series 17 Notes”), due January 10,

2054, with an effective interest rate1 of 5.417% and C$300 million

aggregate principal amount of Series 18 Notes (the “Series 18

Notes”), due October 20, 2034, which will bear interest at a rate

of 4.959% per annum.

The Series 17 Notes will be issued as a

re-opening on identical terms, other than issue date and the price

to the public, to the C$400 million principal amount of 5.318%

Series 17 Notes that were issued in January 2024. The Series 17

Notes will be issued at a price of C$98.549, plus accrued

interest.

Brookfield Renewable Partners ULC, a subsidiary

of Brookfield Renewable, will be the issuer of the Notes, which

will be fully and unconditionally guaranteed by Brookfield

Renewable and certain of its key holding subsidiaries.

The Notes will be issued pursuant to a base

shelf prospectus dated September 8, 2023 and a related prospectus

supplement and pricing supplements to be dated July 15, 2024. The

issue is expected to close on or about July 17, 2024 subject to

customary closing conditions.

The Series 18 Notes will represent Brookfield

Renewable’s fourteenth green labelled corporate securities issuance

in North America and the third issuance under Brookfield

Renewable’s 2024 Green Financing Framework (the “Green Financing

Framework”). Brookfield Renewable intends to use the net proceeds

from the sale of the Notes to fund Eligible Investments (as defined

in the Green Financing Framework), including to repay indebtedness

incurred in respect thereof. The Green Financing Framework is

available on Brookfield Renewable’s website and described in the

prospectus supplement in respect of the offering.

The Notes have been rated BBB+ by S&P Global

Ratings, BBB (high) with a stable trend by DBRS Limited and BBB+ by

Fitch Ratings.

The Notes are being offered through a syndicate

of agents led by RBC Capital Markets, Scotiabank, BMO Capital

Markets, TD Securities, CIBC Capital Markets and National Bank

Financial Markets, and including Desjardins, SMBC Nikko, Mizuho

Securities, MUFG, BNP Paribas and iA Private Wealth Inc.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy the securities in

any jurisdiction, nor shall there be any offer or sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful. The securities being offered have not been

approved or disapproved by any regulatory authority nor has any

such authority passed upon the accuracy or adequacy of the short

form base shelf prospectus or the prospectus supplement. The offer

and sale of the securities has not been and will not be registered

under the United States Securities Act of 1933, as amended (the

“U.S. Securities Act”) or any state securities laws and may not be

offered or sold in the United States or to United States persons

absent registration or an applicable exemption from the

registration requirements of the U.S. Securities Act and applicable

state securities laws.

Brookfield Renewable

Brookfield Renewable operates one of the world’s

largest publicly traded platforms for renewable power and

sustainable solutions. Our renewable power portfolio consists of

hydroelectric, wind, utility-scale solar and storage facilities in

North America, South America, Europe and Asia. Our operating

capacity totals almost 34,000 megawatts and our development

pipeline stands at approximately 157,000 megawatts. Our portfolio

of sustainable solutions assets includes our investments in

Westinghouse (a leading global nuclear services business) and a

utility and independent power producer with operations in the

Caribbean and Latin America, as well as both operating assets and a

development pipeline of carbon capture and storage capacity,

agricultural renewable natural gas and materials recycling.

Investors can access the portfolio either

through Brookfield Renewable Partners L.P. (NYSE: BEP; TSX:

BEP.UN), a Bermuda-based limited partnership, or Brookfield

Renewable Corporation (NYSE, TSX: BEPC), a Canadian

corporation.

Brookfield Renewable is the flagship listed

renewable power and transition company of Brookfield Asset

Management, a leading global alternative asset manager with over

$925 billion of assets under management.

|

Contact information: |

|

|

Media: |

Investors: |

|

Simon Maine |

Alex Jackson |

|

+44 7398 909 278 |

+1 (416) 649-8196 |

|

simon.maine@brookfield.com |

alexander.jackson@brookfield.com |

|

|

|

Cautionary Statement Regarding

Forward-looking Statements

Note: This news release contains forward-looking

statements and information within the meaning of Canadian

securities laws. Forward-looking statements may include estimates,

plans, expectations, opinions, forecasts, projections, guidance or

other statements that are not statements of fact. Forward-looking

statements can be identified by the use of words such as “will”,

“expected”, “intend”, or variations of such words and phrases.

Forward-looking statements in this news release include statements

regarding the closing, the terms and the use of proceeds of the

offering of Notes. Although Brookfield Renewable believes that such

forward-looking statements and information are based upon

reasonable assumptions and expectations, no assurance is given that

such expectations will prove to have been correct. The reader

should not place undue reliance on forward-looking statements and

information as such statements and information involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Brookfield Renewable

to differ materially from anticipated future results, performance

or achievement expressed or implied by such forward-looking

statements and information. Except as required by law, Brookfield

Renewable does not undertake any obligation to publicly update or

revise any forward-looking statements or information, whether

written or oral, whether as a result of new information, future

events or otherwise.

1) Calculated as effective yield if held to

maturity.

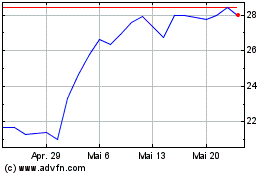

Brookfield Renewable Par... (NYSE:BEP)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

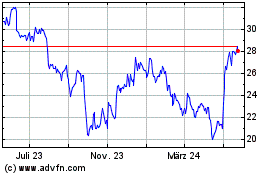

Brookfield Renewable Par... (NYSE:BEP)

Historical Stock Chart

Von Mär 2024 bis Mär 2025