BARK, Inc. (NYSE: BARK) (“BARK” or the “Company”), a leading

global omnichannel dog brand with a mission to make all dogs happy,

today announced its financial results for the fiscal second quarter

ended September 30, 2024.

Key Highlights

- Total revenue was $126.1 million, ahead of the high-end of the

Company's guidance range and a 2.5% increase, year-over-year.

- Net loss improved 49.1% to $(5.3) million, year-over-year.

- Adjusted EBITDA was $3.5 million, ahead of the high-end of the

Company's guidance range and a $2.5 million improvement,

year-over-year.

- Net cash provided by operating activities was $2.8 million and

free cash flow was $1.0 million.

"We delivered our ninth consecutive quarter of year-over-year

Adjusted EBITDA growth last quarter, driven in part by a 26%

increase in our commerce segment revenue, compared to last year,"

said Matt Meeker, Chief Executive Officer of BARK. "As I emphasized

on our last earnings call, our focus on strengthening our talent

and improving our profitability profile has enabled us to channel

our energy into driving sustainable, long-term top-line growth. I

am pleased to report, the team is tackling this objective

aggressively, already laying a strong foundation for the future.

Our recent revenue growth is an important first step and many of

the key initiatives the team has been focused on are just beginning

to be reflected in our results. Overall, we remain enthusiastic

about what lies ahead over the coming years."

Key Performance

Indicators

Three Months Ended

September 30,

Six Months Ended September

30,

2024

2023

2024

2023

Total Orders (in thousands)

3,270

3,361

6,712

6,921

Average Order Value

$

30.91

$

31.03

$

30.92

$

31.24

Direct to Consumer Gross Profit (in

thousands)(1)

$

65,504

$

67,679

$

134,774

$

137,262

Direct to Consumer Gross Margin (1)

64.8

%

64.9

%

64.9

%

63.5

%

(1) Direct to Consumer Gross Profit and

Direct to Consumer Gross Margin does not include the revenue or

cost of goods sold from BARK Air.

Fiscal Second Quarter 2025

Highlights

- Revenue was $126.1 million, ahead of the Company's

guidance range of $123.0 million to $126.0 million, and a 2.5%

increase year-over-year, primarily driven by a 25.6% year-over-year

increase in the commerce segment.

- Direct to Consumer (“DTC”) revenue was $102.6 million, a

1.6% decrease year-over-year, primarily driven by fewer total

orders in the most recent period.

- Commerce revenue was $23.5 million, a 25.6% increase

year-over-year, aided by growth in both existing and new

accounts.

- Gross profit was $76.1 million, a 0.6% increase

year-over-year.

- Gross margin was 60.4%, as compared to 61.5% in the same

period last year. The decrease was driven by a greater mix of

commerce revenue in the most recent period. Note, both segments

have a similar contribution margin.

- Advertising and marketing expenses were $18.7 million as

compared to $17.8 million in the same period last year.

- General and administrative ("G&A") expenses were

$63.1 million, as compared to $68.9 million last year. This

decrease was largely driven by a reduction in headcount and better

shipping terms.

- Net loss was $(5.3) million, as compared to $(10.3)

million in the same period in the previous year.

- Adjusted EBITDA was $3.5 million, a $2.5 million

improvement, year-over-year, and ahead of the Company's guidance

range of $1.0 million to $3.0 million.

- Net cash provided by operating activities was $2.8

million. Free cash flow, defined as net cash provided by (used in)

operating activities less capital expenditures, was $1.0

million.

Balance Sheet Highlights

- The Company’s cash and cash equivalents balance as of September

30, 2024 was $115.2 million, and reflects $0.9 million of share

repurchases at an average price of $1.67, in the quarter.

- The Company's inventory balance as of September 30, 2024 was

$88.4 million, an increase of $4.3 million compared to March 31,

2024. The increase is largely driven by the Company bringing in

additional product ahead of the holiday quarter.

Fiscal Third Quarter and Full Year 2025

Financial Outlook

Based on current market conditions as of November 7, 2024, BARK

is providing guidance for revenue and Adjusted EBITDA, which is a

Non-GAAP financial measure, as follows.

For the fiscal year 2025, the Company is reaffirming its

guidance of:

- Total revenue of $490 million to $500 million, reflecting

year-over-year growth of flat to 2.0%.

- Adjusted EBITDA of $1.0 million to $5.0 million, reflecting a

year-over-year improvement of $11.6 million to $15.6 million.

For the fiscal third quarter 2025, the Company expects:

- Total revenue of $123.0 million to $126.0 million, reflecting

year-over-year growth of (1.7)% to 0.7%

- Adjusted EBITDA of $(3.0) million to breakeven, reflecting a

year-over-year improvement of $3.4 million to $6.4 million.

We do not provide guidance for Net Loss due to the uncertainty

and potential variability of certain items, including stock-based

compensation expenses and related tax effects, which are the

reconciling items between Net Loss and Adjusted EBITDA. Because

such items cannot be calculated or predicted without unreasonable

efforts, we are unable to provide a reconciliation of Adjusted

EBITDA to Net Loss. However, such items could have a significant

impact on Net Loss.

The guidance provided above constitutes forward looking

statements and actual results may differ materially. Please refer

to the “Forward Looking Statements” section below for information

on the factors that could cause our actual results to differ

materially from these forward looking statements and “Non-GAAP

Financial Measures” for additional important information regarding

Adjusted EBITDA.

Conference Call Information

A conference call to discuss the Company's fiscal second quarter

2025 results will be held today, November 7, 2024, at 4:30 p.m. ET.

During the conference call, the Company may make comments

concerning business and financial developments, trends and other

business or financial matters. The Company's comments, as well as

other matters discussed during the conference call, may contain or

constitute information that has not been previously disclosed.

The conference call can be accessed by dialing 1-888-596-4144

for U.S. participants and 1-646-968-2525 for international

participants. The conference call passcode is 5515653. A live audio

webcast of the call will be available at https://investors.bark.co/

and will be archived for 1 year.

About BARK

BARK is the world’s most dog-centric company, devoted to making

dogs happy with the best products, services and content. BARK’s

dog-obsessed team applies its unique, data-driven understanding of

what makes each dog special to design playstyle-specific toys,

wildly satisfying treats, great food for your dog, effective and

easy to use dental care, and dog-first experiences that foster the

health and happiness of dogs everywhere. Founded in 2011, BARK

loyally serves dogs nationwide with themed toys and treats

subscriptions, BarkBox and BARK Super Chewer; custom product

collections through its retail partner network, including Target

and Amazon; its high-quality, nutritious meals made for your breed

with BARK Food; and products that meet dogs’ dental needs with BARK

Bright®. At BARK, we want to make dogs as happy as they make us

because dogs and humans are better together. Sniff around at

BARK.co for more information.

Forward Looking Statements

This press release contains forward-looking statements relating

to, among other things, the future performance of BARK that are

based on the Company’s current expectations, forecasts and

assumptions and involve risks and uncertainties. In some cases, you

can identify forward-looking statements by terminology such as

“may,” “will,” “should,” “could,” “expect,” “plan,” "anticipate,”

“believe,” “estimate,” “predict,” “intend,” “potential,”

“continue,” “ongoing” or the negative of these terms or other

comparable terminology. These statements include, but are not

limited to, statements about future operating results, including

our strategies, plans, commitments, objectives and goals. Actual

results could differ materially from those predicted or implied and

reported results should not be considered as an indication of

future performance. Other factors that could cause or contribute to

such differences include, but are not limited to, risks relating to

the uncertainty of the projected financial information with respect

to BARK; the risk that spending on pets may not increase at

projected rates; that BARK subscriptions may not increase their

spending with BARK; BARK’s ability to continue to convert social

media followers and contacts into customers; BARK’s ability to

successfully expand its product lines and channel distribution;

competition; the uncertain effects of global or macroeconomic

events or challenges.

More information about factors that could affect BARK's

operating results is included under the captions “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in the Company's quarterly report on Form

10-Q, copies of which may be obtained by visiting the Company’s

Investor Relations website at https://investors.bark.co/ or the

SEC’s website at www.sec.gov. Undue reliance should not be placed

on the forward-looking statements in this press release, which are

based on information available to the Company on the date hereof.

The Company assumes no obligation to update such statements.

Definitions of Key Performance Indicators

Total Orders

We define Total Orders as the total number of Direct to Consumer

orders shipped in a given period. These include all orders across

all of our product categories, regardless of whether they are

purchased on a subscription, auto-ship, or one-off basis. Total

Orders excludes orders from BARK Air.

Average Order Value

Average Order Value (“AOV”) is Direct to Consumer revenue for

the period divided by Total Orders for the same period. AOV

excludes Direct to Consumer revenue from BARK Air.

BARK, Inc.

CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands)

Three Months Ended

Six Months Ended

September 30,

September 30,

September 30,

September 30,

2024

2023

2024

2023

REVENUE

$

126,111

$

123,036

$

242,323

$

243,626

COST OF REVENUE

49,999

47,394

92,945

94,948

Gross profit

76,112

75,642

149,378

148,678

OPERATING EXPENSES:

General and administrative

63,143

68,931

126,567

138,352

Advertising and marketing

18,665

17,810

39,096

35,429

Total operating expenses

81,808

86,741

165,663

173,781

LOSS FROM OPERATIONS

(5,696

)

(11,099

)

(16,285

)

(25,103

)

INTEREST INCOME

1,353

1,996

2,832

4,133

INTEREST EXPENSE

(687

)

(1,366

)

(1,398

)

(2,745

)

OTHER (EXPENSE) INCOME—NET

(233

)

132

(451

)

1,715

NET LOSS BEFORE INCOME TAXES

(5,263

)

(10,337

)

(15,302

)

(22,000

)

PROVISION FOR INCOME TAXES

—

—

—

—

NET LOSS AND COMPREHENSIVE LOSS

$

(5,263

)

$

(10,337

)

$

(15,302

)

$

(22,000

)

DISAGGREGATED REVENUE

(In thousands)

Three Months Ended

Six Months Ended

September 30,

September 30,

2024

2023

2024

2023

Revenue

Direct to Consumer:

Toys & Accessories(1)

$

66,882

$

67,149

$

137,451

$

139,251

Consumables(1)

34,197

37,163

70,101

76,947

Other(2)

1,520

—

$

2,106

$

—

Total Direct to Consumer

$

102,599

$

104,312

$

209,658

$

216,198

Commerce

23,512

18,724

32,665

27,428

Revenue

$

126,111

$

123,036

$

242,323

$

243,626

(1)

The allocation between Toys &

Accessories and Consumables includes estimates and was determined

utilizing data on stand-alone selling prices that the Company

charges for similar offerings, and also reflects historical pricing

practices.

(2)

Other Direct to Consumer revenue derived

from the BARK Air.

GROSS PROFIT BY

SEGMENT

(In thousands)

Three Months Ended

September 30,

Six Months Ended

September 30,

2024

2023

2024

2023

Direct to Consumer:(1)

Revenue

$

102,599

$

104,312

$

209,658

$

216,198

Cost of revenue

37,083

36,633

75,134

78,936

Gross profit

65,516

67,679

134,524

137,262

Commerce:

Revenue

23,512

18,724

32,665

27,428

Cost of revenue

12,916

10,761

17,811

16,012

Gross profit

10,596

7,963

14,854

11,416

Consolidated:

Revenue

126,111

123,036

242,323

243,626

Cost of revenue

49,999

47,394

92,945

94,948

Gross profit

$

76,112

$

75,642

$

149,378

$

148,678

(1)

Direct to Consumer segment gross profit include revenue and cost of

revenue from BARK Air.

BARK, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share and

per share data)

September 30,

March 31,

2024

2024

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

115,243

$

125,495

Accounts receivable—net

16,901

7,696

Prepaid expenses and other current

assets

11,070

4,379

Inventory

88,435

84,177

Total current assets

231,649

221,747

PROPERTY AND EQUIPMENT—NET

23,425

25,540

INTANGIBLE ASSETS—NET

8,010

11,921

OPERATING LEASE RIGHT-OF-USE ASSETS

30,268

32,793

OTHER NONCURRENT ASSETS

8,220

6,587

TOTAL ASSETS

$

301,572

$

298,588

LIABILITIES, AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

33,701

$

13,737

Operating lease liabilities, current

5,541

5,294

Accrued and other current liabilities

33,209

30,490

Deferred revenue

23,436

25,957

Total current liabilities

95,887

75,478

LONG-TERM DEBT

40,128

39,926

OPERATING LEASE LIABILITIES

39,765

42,599

OTHER LONG-TERM LIABILITIES

2,236

1,202

Total liabilities

178,016

159,205

COMMITMENTS AND CONTINGENCIES (Note 8)

STOCKHOLDERS’ EQUITY:

Common stock, par value $0.0001 per

share—500,000,000 shares authorized; 182,674,940 and 180,176,725

shares issued

1

1

Treasury stock, at cost, 8,186,449 and

4,643,589 shares, respectively

(11,409

)

(6,225

)

Additional paid-in capital

497,139

492,427

Accumulated deficit

(362,175

)

(346,820

)

Total stockholders’ equity

123,556

139,383

TOTAL LIABILITIES, AND STOCKHOLDERS’

EQUITY

$

301,572

$

298,588

BARK, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

Six Months Ended

September 30,

September 30,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net loss

$

(15,302

)

$

(22,000

)

Adjustments to reconcile net loss to cash

used in operating activities:

Depreciation & amortization

5,679

5,941

Impairment of assets

2,142

2,970

Non-cash lease expense

2,524

2,120

Loss on disposal of assets

—

72

Amortization of deferred financing fees

and debt discount

202

374

Bad debt expense

—

34

Stock-based compensation expense

5,898

6,914

Provision for inventory obsolescence

1,355

879

Change in fair value of warrant

liabilities and derivatives

913

(1,434

)

Changes in operating assets and

liabilities:

Accounts receivable

(9,205

)

(5,869

)

Inventory

(5,613

)

14,065

Prepaid expenses and other current

assets

(499

)

(988

)

Other noncurrent assets

(1,336

)

(125

)

Accounts payable and accrued expenses

22,905

(6,426

)

Deferred revenue

(2,521

)

(3,431

)

Proceeds from tenant improvement

allowances

—

—

Operating lease liabilities

(2,587

)

(1,800

)

Other liabilities

11

788

Net cash provided by (used in) operating

activities

4,566

(7,916

)

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures

(3,851

)

(4,933

)

Net cash used in investing activities

(3,851

)

(4,933

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Payment of finance lease obligations

(112

)

(106

)

Proceeds from the exercise of stock

options

293

94

Proceeds from issuance of common stock

under ESPP

193

286

Tax payments related to the issuance of

common stock

(1,620

)

(819

)

Excise tax from stock repurchases

(52

)

—

Payments to repurchase common stock

(5,184

)

(4,120

)

Net cash used in financing activities

(6,482

)

(4,665

)

Effect of exchange rate changes on

cash

(53

)

55

NET DECREASE IN CASH, CASH EQUIVALENTS AND

RESTRICTED CASH

(5,820

)

(17,459

)

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH—BEGINNING OF PERIOD

130,704

183,068

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH—END OF PERIOD

$

124,884

$

165,609

RECONCILIATION OF CASH, CASH EQUIVALENTS

AND RESTRICTED CASH:

Cash and cash equivalents

115,243

160,541

Restricted cash - prepaid expenses and

other current assets, other noncurrent assets

9,641

5,068

Total cash, cash equivalents and

restricted cash

$

124,884

$

165,609

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION:

Purchases of property and equipment

included in accounts payable and accrued liabilities

$

—

$

11

Cash paid for interest

$

75

$

75

Non-GAAP Financial Measures

We report our financial results in accordance with U.S. GAAP.

However, management believes that Adjusted Net Income (Loss),

Adjusted Net Income (Loss) Margin, Adjusted Net Income (Loss) Per

Common Share, Adjusted EBITDA, Adjusted EBITDA Margin, and Free

Cash Flow, all non-GAAP financial measures (together the “Non-GAAP

Measures”), provide investors with additional useful information in

evaluating our performance.

We calculate Adjusted Net Income (Loss) as net loss, adjusted to

exclude: (1) stock-based compensation expense, (2) change in fair

value of warrants and derivatives, (3) sales and use tax income,

(4) restructuring charges related to reduction in force payment,

(5) litigation expenses, (6) warehouse restructuring costs, (7)

non-cash impairment of previously capitalized software, (8)

technology modernization costs, and (9) other items (as defined

below).

We calculate Adjusted Net Income (Loss) Margin by dividing

Adjusted Net Income (Loss) for the period by Revenue for the

period.

We calculate Adjusted Net Income (Loss) Per Common Share by

dividing Adjusted Net Income (Loss) for the period by weighted

average common shares used to compute net loss per share

attributable to common stockholders for the period.

We calculate Adjusted EBITDA as net loss, adjusted to exclude:

(1) interest income, (2) interest expense, (3) depreciation and

amortization, (4) stock-based compensation expense, (5) change in

fair value of warrants and derivatives, (6) capitalized cloud

computing amortization, (7) sales and use tax income, (8)

restructuring charges related to reduction in force payment, (9)

litigation expenses, (10) warehouse restructuring costs, (11)

non-cash impairment of previously capitalized software, (12)

technology modernization costs, and (13) other items (as defined

below).

We calculate Adjusted EBITDA Margin by dividing Adjusted EBITDA

for the period by revenue for the period.

We calculate Free Cash Flow as net cash provided by (used in)

operating activities less capital expenditures.

The Non-GAAP Measures are financial measures that are not

required by, or presented in accordance with U.S. GAAP. We believe

that the Non-GAAP Measures, when taken together with our financial

results presented in accordance with U.S. GAAP, provides meaningful

supplemental information regarding our operating performance and

facilitates internal comparisons of our historical operating

performance on a more consistent basis by excluding certain items

that may not be indicative of our business, results of operations

or outlook. In particular, we believe that the use of the Non-GAAP

Measures are helpful to our investors as they are measures used by

management in assessing the health of our business, determining

incentive compensation and evaluating our operating performance, as

well as for internal planning and forecasting purposes.

The Non-GAAP Measures are presented for supplemental

informational purposes only, have limitations as an analytical tool

and should not be considered in isolation or as a substitute for

financial information presented in accordance with U.S. GAAP. Some

of the limitations of the Non-GAAP Measures include that (1) the

measures do not properly reflect capital commitments to be paid in

the future, (2) although depreciation and amortization are non-cash

charges, the underlying assets may need to be replaced and Adjusted

EBITDA and Adjusted EBITDA Margin do not reflect these capital

expenditures, (3) Adjusted EBITDA and Adjusted EBITDA Margin do not

consider the impact of stock-based compensation expense, which is

an ongoing expense for our company, (4) Adjusted EBITDA and

Adjusted EBITDA Margin do not reflect other non-operating expenses,

including interest expense. In addition, our use of the Non-GAAP

Measures may not be comparable to similarly titled measures of

other companies because they may not calculate the Non-GAAP

Measures in the same manner, limiting their usefulness as a

comparative measure. Because of these limitations, when evaluating

our performance, you should consider the Non-GAAP Measures

alongside other financial measures, including our net income (loss)

and other results stated in accordance with U.S. GAAP, and (5) Free

cash flow does not represent the total residual cash flow available

for discretionary purposes and does not reflect our future

contractual commitments.

The following table presents a reconciliation of Adjusted Net

Income (Loss) to Net loss, the most directly comparable financial

measure stated in accordance with U.S. GAAP, and the calculation of

net loss margin, Adjusted Net Income (Loss) Margin and Adjusted Net

Income (Loss) Per Common Share for the periods presented:

Adjusted Net Income (Loss)

Three Months Ended

September 30,

Six Months Ended

September 30,

2024

2023

2024

2023

(in thousands, except per

share data)

Net Loss

$

(5,263

)

$

(10,337

)

$

(15,302

)

$

(22,000

)

Stock compensation expense

2,957

3,689

5,898

6,914

Change in fair value of warrants and

derivatives

521

(130

)

913

(1,434

)

Sales and use tax income (1)

(246

)

(68

)

(1,549

)

(137

)

Restructuring

731

1,442

1,504

1,543

Litigation expenses (2)

251

—

638

—

Warehouse restructuring costs

359

161

899

161

Impairment of assets

1,344

2,970

2,142

2,970

Technology Modernization (3)

498

—

1,206

—

Other items (4)

107

833

925

1,002

Adjusted net income (loss)

$

1,259

$

(1,440

)

$

(2,726

)

$

(10,981

)

Net income (loss) margin

(4.17

)%

(8.40

)%

(6.31

)%

(9.03

)%

Adjusted net income (loss) margin

1.00

%

(1.17

)%

(1.12

)%

(4.51

)%

Adjusted net income (loss) per common

share - basic and diluted

$

0.01

$

(0.01

)

$

(0.02

)

$

(0.06

)

Weighted average common shares used to

compute adjusted net income (loss) per share attributable to common

stockholders - basic and diluted

175,063,942

176,975,883

175,311,379

177,150,161

The following table presents a reconciliation of Adjusted EBITDA

to net loss, the most directly comparable financial measure stated

in accordance with U.S. GAAP, and the calculation of net loss

margin and Adjusted EBITDA margin for the periods presented:

Adjusted EBITDA

Three Months Ended

September 30,

Six Months Ended

September 30,

2024

2023

2024

2023

(in thousands)

(in thousands)

Net Loss

$

(5,263

)

$

(10,337

)

$

(15,302

)

$

(22,000

)

Interest income

(1,353

)

(1,996

)

(2,832

)

(4,133

)

Interest expense

687

1,366

1,398

2,745

Depreciation and amortization expense

2,800

3,074

5,679

5,941

Stock compensation expense

2,957

3,689

5,898

6,914

Change in fair value of warrants and

derivatives

521

(130

)

913

(1,434

)

Cloud computing amortization

93

—

172

—

Sales and use tax income (1)

(246

)

(68

)

(1,549

)

(137

)

Restructuring

731

1,442

1,504

1,543

Litigation expenses (2)

251

—

638

—

Warehouse restructuring costs

359

161

899

161

Impairment of assets

1,344

2,970

2,142

2,970

Technology Modernization (3)

498

—

1,206

—

Other items (4)

107

833

925

1,002

Adjusted EBITDA

$

3,486

$

1,004

$

1,691

$

(6,428

)

Net loss margin

(4.17

)%

(8.40

)%

(6.31

)%

(9.03

)%

Adjusted EBITDA margin

2.76

%

0.82

%

0.70

%

(2.64

)%

(1)

Sales and use tax expense relates to

recording a liability for sales and use tax we did not collect from

our customers. Historically, we had collected state or local sales,

use, or other similar taxes in certain jurisdictions in which we

only had physical presence. On June 21, 2018, the U.S. Supreme

Court decided, in South Dakota v. Wayfair, Inc., that state and

local jurisdictions may, at least in certain circumstances, enforce

a sales and use tax collection obligation on remote vendors that

have no physical presence in such jurisdiction. A number of states

have positioned themselves to require sales and use tax collection

by remote vendors and/or by online marketplaces. The details and

effective dates of these collection requirements vary from state to

state and accordingly, we recorded a liability in those periods in

which we created economic nexus based on each state’s requirements.

Accordingly, we now collect, remit, and report sales tax in all

states that impose a sales tax. Subsequently, as certain of these

liabilities are waived by tax authorities or the applicable statute

of limitations expires, the related accrued liability is

reversed.

(2)

Litigation expenses related to a

shareholder class action complaint, see Item 1. Legal Proceedings

in the Company's quarterly report on Form 10-Q.

(3)

Includes consulting fees related to

technology transformation activities, and payroll costs for

employees that dedicate significant time to this project. We

believe that these costs are discrete and non-recurring in nature,

as they relate to a one-time unification of our product offerings

on our new commerce platform. As such, they are not normal,

recurring operating expenses and are not reflective of ongoing

trends in the cost of doing business.

(4)

For the three months ended September 30,

2024, other items is comprised of executive transition costs

including recruiting costs of less than $0.1 million, costs

associated with the share repurchase program of less than $0.1

million, and duplicate headquarters rent of less than $0.1 million.

For the three months ended September 30, 2023, other items is

comprised of executive transition costs including recruiting costs

of $0.4 million and non-recurring retention payments to management

of $0.4 million. For the six months ended September 30, 2024, other

items is comprised of executive transition costs including

recruiting costs of $0.4 million, non-recurring retention payments

to management of $0.2 million, costs associated with the share

repurchase program of $0.2 million, and duplicate headquarters rent

of less than $0.1 million. For the six months ended September 30,

2023, other items is comprised of non-recurring retention payments

to management of $0.6 million, executive transition costs including

recruiting costs of $0.4 million, and duplicate headquarters rent

of less than $0.1 million.

The following table presents a reconciliation of Free Cash Flow

to Net cash used in operating activities, the most directly

comparable financial measure prepared in accordance with U.S. GAAP,

for each of the periods indicated:

Free Cash Flow

Three Months Ended

September 30,

Six Months Ended

September 30,

2024

2023

2024

2023

Free cash flow reconciliation:

Net cash provided by (used in) operating

activities

$

2,773

$

2,825

$

4,566

$

(7,916

)

Capital expenditures

(1,807

)

(1,961

)

(3,851

)

(4,933

)

Free cash flow

$

966

$

864

$

715

$

(12,849

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107512717/en/

Investors: Michael Mougias investors@barkbox.com

Media: Garland Harwood press@barkbox.com

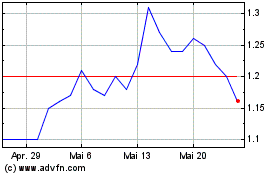

BARK (NYSE:BARK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

BARK (NYSE:BARK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024