false000112297600011229762024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 6, 2024

| | | | | | | | |

| | |

| Avient Corporation |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | | | | | | |

| Ohio | 1-16091 | 34-1730488 |

| | |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

33587 Walker Road

Avon Lake, Ohio 44012

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (440) 930-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, par value $.01 per share | AVNT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, the Registrant issued a press release, furnished herewith as Exhibit 99.1, announcing earnings for the second quarter of 2024. The press release shall not be deemed to be “filed” under the Securities Exchange Act of 1934.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Number | Exhibit |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| AVIENT CORPORATION |

| |

| By: /s/ Jamie A. Beggs |

| |

| Name: Jamie A. Beggs |

| Title: Senior Vice President and Chief Financial Officer |

Dated: August 6, 2024

NEWS RELEASE

FOR IMMEDIATE RELEASE

Avient Announces Second Quarter 2024 Results

•Second quarter sales grew to $850 million, a 3% increase over the prior year quarter and a 5% organic increase when excluding the impact of foreign exchange

•Second quarter GAAP EPS from continuing operations of $0.36 compared to $0.24 in the prior year quarter

•Second quarter adjusted EPS of $0.76 exceeded guidance of $0.71 and increased 21% over prior year quarter, driven by organic revenue growth in all regions, favorable input costs and lower interest expense

•Increasing 2024 full-year adjusted EPS guidance range to $2.55 to $2.70, from prior guidance of $2.50 to $2.65 given strong second quarter results; Revised guidance reflects 8% to 14% growth in adjusted EPS over the prior year

•2023 Sustainability Report published online, detailing progress toward 2030 Sustainability Goals and ESG performance ratings

•Investor Day to be held December 4th in New York City to highlight the company strategy

CLEVELAND – August 6, 2024 – Avient Corporation (NYSE: AVNT), a leading provider of specialized and sustainable materials solutions, today announced its second quarter 2024 results. The company reported second quarter sales of $849.7 million compared to $824.4 million in the prior year quarter.

Second quarter GAAP earnings per share (EPS) from continuing operations was $0.36 compared to $0.24 in the prior year quarter. The company noted that second quarter 2024 GAAP EPS includes $0.24 of special items (see Attachment 3) and $0.16 of intangible amortization expense (see Attachment 1). Second quarter 2024 adjusted EPS was $0.76 compared to $0.63 in the prior year.

“Building on the positive start to the year, we delivered a strong second quarter, highlighted by broad-based growth across all regions and most end markets,” said Dr. Ashish Khandpur, President and Chief Executive Officer of Avient Corporation. “Consolidated sales expanded for the first time in seven quarters with contributions from both our Color, Additives and Inks, and Specialty Engineered Materials segments. This performance reflects our team's focus to capitalize on growth opportunities across the many end markets we serve, with particular success this quarter in packaging and consumer, our two largest end markets.”

Dr. Khandpur added, "On a geographic basis, all regions delivered year-over-year organic sales growth. The US and Canada grew organic sales 5% and Latin America had a strong quarter growing organic sales by 19%. Growth in the Americas was driven by improving underlying demand trends, as well as winning new specifications and gaining share in markets supported by secular trends. We also generated 4% and 1% organic sales growth in EMEA and Asia, respectively. Europe and Asia regions benefited largely from restocking and share gains, particularly in the packaging end market."

2024 Outlook

"Looking ahead to the third quarter, we expect adjusted EPS of $0.62, a 9% increase over the prior year," said Jamie Beggs, Senior Vice President and Chief Financial Officer of Avient Corporation. "We anticipate continued year-over-year organic sales growth, with both segments growing earnings."

Ms. Beggs continued, "Our demand outlook for the second half of the year remains largely unchanged from our previous outlook in May, so we are updating our full-year guidance to reflect the strong second quarter results. Accordingly, our revised full-year guidance for adjusted EBITDA is now $515 million to $540 million, from our previous range of $510 million to $535 million. Our revised range for adjusted EPS is between $2.55 to $2.70, from our previous range of $2.50 to $2.65."

"I'm pleased with how we have delivered during the first half of the year," added Dr. Khandpur. "As we look to the second half, we expect growth momentum to continue with our teams focused on providing innovative materials and processing solutions to solve our customers' challenges to enable a sustainable world. I look forward to sharing more details in our third quarter earnings call and at our upcoming investor day in New York City on December 4th."

Sustainability Report Release

The company also announced the release of its latest Sustainability Report, now available at www.avient.com/sustainability.

The report provides an update on Avient's contributions and impact in creating a more sustainable future, including progress that the company has made towards its 2030 goals.

"We're extremely proud to share our latest achievements in this year's report, particularly our upgraded ratings by Ecovadis to Gold and by CDP to A-. Sustainability is a responsibility we have to all of our stakeholders, and it is a growth driver for our company as we enable our customers to achieve their sustainability goals, ultimately creating value for our shareholders," explained Ms. Beggs.

Webcast Details

Avient will provide additional details on its 2024 second quarter and 2024 full-year outlook during its webcast scheduled for 8:00 a.m. Eastern Time on August 6, 2024.

The webcast can be viewed live at avient.com/investors, or by clicking on the webcast link here. Conference call participants in the question and answer session should pre-register using the link at avient.com/investors, or here, to receive the dial-in numbers and personal PIN. This information is required to access the conference call. The question and answer session will follow the company’s presentation and prepared remarks.

A recording of the webcast and the slide presentation will be available at avient.com/investors/events-presentations immediately following the conference call and will be accessible for one year.

Non-GAAP Financial Measures

The Company uses both GAAP (generally accepted accounting principles) and non-GAAP financial measures. The non-GAAP financial measures include adjusted EPS, adjusted operating income, adjusted EBITDA and adjusted EBITDA margins. Avient's chief operating decision maker uses these financial measures to monitor and evaluate the ongoing performance of the Company and each business segment and to allocate resources.

The Company does not provide reconciliations of forward-looking non-GAAP financial measures, such as adjusted EPS and adjusted EBITDA, to the most comparable GAAP financial measures on a forward-looking basis because the Company is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and amount of certain items, such as, but not limited to, environmental remediation costs, mark-to-market adjustments associated with benefit plans, acquisition related costs, and other non-routine costs. Each of such adjustments has not yet occurred, are out of the Company's control and/or cannot be reasonably predicted. For the same reasons, the Company is unable to address the probable significance of the unavailable information.

To access Avient’s news library online, please visit www.avient.com/news-events.

About Avient

Avient Corporation (NYSE: AVNT) provides specialized and sustainable materials solutions that transform customer challenges into opportunities, bringing new products to life for a better world. Examples include:

•Dyneema®, the world’s strongest fiber™, enables unmatched levels of performance and protection for end-use applications, including ballistic personal protection, marine and sustainable infrastructure and outdoor sports

•Unique technologies that improve the recyclability of products and enable recycled content to be incorporated, thus advancing a more circular economy

•Light-weighting solutions that replace heavier traditional materials like metal, glass and wood, which can improve fuel efficiency in all modes of transportation and reduce carbon footprint

•Sustainable infrastructure solutions that increase energy efficiency, renewable energy, natural resource conservation and fiber optic / 5G network accessibility

Avient is certified ACC Responsible Care®, a founding member of the Alliance to End Plastic Waste and certified Great Place to Work®. For more information, visit https://www.avient.com.

Forward-looking Statements

In this press release, statements that are not reported financial results or other historical information are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give current expectations or forecasts of future events and are not guarantees of future performance. They are based on management's expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. They use words such as "will," "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," and other words and terms of similar meaning in connection with any discussion of future operating or financial condition, performance and/or sales. Factors that could cause actual results to differ materially from those implied by these forward-looking statements include, but are not limited to: disruptions, uncertainty or volatility in the credit markets that could adversely impact the availability of credit already arranged and the availability and cost of credit in the future; the effect on foreign operations of currency fluctuations, tariffs and other political, economic and regulatory risks; disruptions or inefficiencies in our supply chain, logistics, or operations; changes in laws and regulations in jurisdictions where we conduct business, including with respect to plastics and climate change; fluctuations in raw material prices, quality and supply, and in energy prices and supply; demand for our products and services; production outages or material costs associated with scheduled or unscheduled maintenance programs; unanticipated developments that could occur with respect to contingencies such as litigation and environmental matters; our ability to pay regular quarterly cash dividends and the amounts and timing of any future dividends; information systems failures and cyberattacks; amounts for cash and non-cash charges related to restructuring plans that may differ from original estimates, including because of timing changes associated with the underlying actions; our ability to achieve strategic objectives and successfully integrate acquisitions, including the implementation of a cloud-based enterprise resource planning system, S/4HANA; and other factors affecting our business beyond our control, including without limitation, changes in the general economy, changes in interest rates, changes in the rate of inflation, geopolitical conflicts and any recessionary conditions. The above list of factors is not exhaustive.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any further disclosures we make on related subjects in our reports on Form 10-Q, 8-K and 10-K that we provide to the Securities and Exchange Commission.

Investor Relations Contact:

Giuseppe (Joe) Di Salvo

Vice President, Treasurer and Investor Relations

Avient Corporation

+1 440-930-1921

giuseppe.disalvo@avient.com

Media Contact:

Kyle G. Rose

Vice President, Marketing and Communications

Avient Corporation

+1 440-930-3162

kyle.rose@avient.com

Attachment 1

Avient Corporation

Summary of Condensed Consolidated Statements of Income (Unaudited)

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Sales | $ | 849.7 | | | $ | 824.4 | | | $ | 1,678.7 | | | $ | 1,670.1 | |

| Operating Income | 72.5 | | | 62.3 | | | 166.5 | | | 119.4 | |

| Net income from continuing operations attributable to Avient shareholders | 33.6 | | | 22.1 | | | 83.0 | | | 42.9 | |

| | | | | | | |

Diluted earnings per share from continuing operations attributable to Avient shareholders | $ | 0.36 | | | $ | 0.24 | | | $ | 0.90 | | | $ | 0.47 | |

Senior management uses comparisons of adjusted net income from continuing operations attributable to Avient shareholders and diluted adjusted earnings per share (EPS) from continuing operations attributable to Avient shareholders, excluding special items, to assess performance and facilitate comparability of results. Further, as a result of Avient's portfolio shift to a pure play specialty formulator, it has completed several acquisitions and divestitures which have resulted in a significant amount of intangible asset amortization. Management excludes intangible asset amortization from adjusted EPS as it believes excluding acquired intangible asset amortization is a useful measure of current period earnings per share. Senior management believes these measures are useful to investors because they allow for comparison to Avient's performance in prior periods without the effect of items that, by their nature, tend to obscure Avient's operating results due to the potential variability across periods based on timing, frequency and magnitude. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, or solely as alternatives to, financial measures prepared in accordance with GAAP. Below is a reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with GAAP. See Attachment 3 for a definition and summary of special items.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, |

| 2024 | | 2023 |

| Reconciliation to Condensed Consolidated Statements of Income | $ | | EPS | | $ | | EPS |

| | | | | | | |

| Net income from continuing operations attributable to Avient shareholders | $ | 33.6 | | | $ | 0.36 | | | $ | 22.1 | | | $ | 0.24 | |

| Special items, after-tax (Attachment 3) | 21.8 | | | 0.24 | | | 19.6 | | | 0.21 | |

| Amortization expense, after-tax | 14.8 | | | 0.16 | | | 16.2 | | | 0.18 | |

| | | | | | | |

| Adjusted net income / EPS | $ | 70.2 | | | $ | 0.76 | | | $ | 57.9 | | | $ | 0.63 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| Reconciliation to Condensed Consolidated Statements of Income | $ | | EPS | | $ | | EPS |

| | | | | | | |

| Net income from continuing operations attributable to Avient shareholders | $ | 83.0 | | | $ | 0.90 | | | $ | 42.9 | | | $ | 0.47 | |

| Special items, after-tax (Attachment 3) | 27.3 | | | 0.30 | | | 41.9 | | | 0.46 | |

| Amortization expense, after-tax | 29.7 | | | 0.32 | | | 31.3 | | | 0.34 | |

| | | | | | | |

| Adjusted net income / EPS | $ | 140.0 | | | $ | 1.52 | | | $ | 116.1 | | | $ | 1.27 | |

Attachment 2

Avient Corporation

Condensed Consolidated Statements of Income (Unaudited)

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Sales | $ | 849.7 | | | $ | 824.4 | | | $ | 1,678.7 | | | $ | 1,670.1 | |

| Cost of sales | 592.1 | | | 583.7 | | | 1,142.9 | | | 1,181.8 | |

| Gross margin | 257.6 | | | 240.7 | | | 535.8 | | | 488.3 | |

| Selling and administrative expense | 185.1 | | | 178.4 | | | 369.3 | | | 368.9 | |

| | | | | | | |

| Operating income | 72.5 | | | 62.3 | | | 166.5 | | | 119.4 | |

| Interest expense, net | (26.6) | | | (29.4) | | | (53.2) | | | (58.2) | |

| | | | | | | |

| Other (expense) income, net | (0.9) | | | (0.2) | | | (1.8) | | | 0.5 | |

| Income from continuing operations before income taxes | 45.0 | | | 32.7 | | | 111.5 | | | 61.7 | |

| Income tax expense | (11.2) | | | (10.4) | | | (28.0) | | | (18.1) | |

| Net income from continuing operations | 33.8 | | | 22.3 | | | 83.5 | | | 43.6 | |

| Loss from discontinued operations, net of income taxes | — | | | — | | | — | | | (0.9) | |

| Net income | $ | 33.8 | | | $ | 22.3 | | | $ | 83.5 | | | $ | 42.7 | |

| Net income attributable to noncontrolling interests | (0.2) | | | (0.2) | | | (0.5) | | | (0.7) | |

| Net income attributable to Avient common shareholders | $ | 33.6 | | | $ | 22.1 | | | $ | 83.0 | | | $ | 42.0 | |

| | | | | | | |

| Earnings (loss) per share attributable to Avient common shareholders - Basic: | | | | |

| Continuing operations | $ | 0.37 | | | $ | 0.24 | | | $ | 0.91 | | | $ | 0.47 | |

| Discontinued operations | — | | | — | | | — | | | (0.01) | |

| Total | $ | 0.37 | | | $ | 0.24 | | | $ | 0.91 | | | $ | 0.46 | |

| | | | | | | |

| Earnings (loss) per share attributable to Avient common shareholders - Diluted: | | | | |

| Continuing operations | $ | 0.36 | | | $ | 0.24 | | | $ | 0.90 | | | $ | 0.47 | |

| Discontinued operations | — | | | — | | | — | | | (0.01) | |

| Total | $ | 0.36 | | | $ | 0.24 | | | $ | 0.90 | | | $ | 0.46 | |

| | | | | | | |

| Cash dividends declared per share of common stock | $ | 0.2575 | | | $ | 0.2475 | | | $ | 0.5150 | | | $ | 0.4950 | |

| | | | | | | |

| Weighted-average shares used to compute earnings per common share: | | | | | | | |

| Basic | 91.3 | | | 91.1 | | | 91.3 | | | 91.1 | |

| Diluted | 92.2 | | | 91.9 | | | 92.0 | | | 91.9 | |

Attachment 3

Avient Corporation

Summary of Special Items (Unaudited)

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

Special items (1) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Cost of sales: | | | | | | | |

Restructuring costs, including accelerated depreciation | $ | 0.2 | | | $ | (1.2) | | | $ | 3.8 | | | $ | (7.8) | |

Environmental remediation costs | (21.8) | | | (13.0) | | | (25.8) | | | (14.4) | |

| | | | | | | |

| | | | | | | |

Impact on cost of sales | (21.6) | | | (14.2) | | | (22.0) | | | (22.2) | |

| | | | | | | |

| Selling and administrative expense: | | | | | | | |

Restructuring and employee separation costs | (2.8) | | | (0.5) | | | (3.5) | | | (11.9) | |

| Legal and other | (2.3) | | | (6.4) | | | (5.8) | | | (10.6) | |

| | | | | | | |

Acquisition related costs | (0.5) | | | (0.7) | | | (2.1) | | | (4.2) | |

Impact on selling and administrative expense | (5.6) | | | (7.6) | | | (11.4) | | | (26.7) | |

| | | | | | | |

Impact on operating income | (27.2) | | | (21.8) | | | (33.4) | | | (48.9) | |

| | | | | | | |

| Interest expense, net - financing costs | (1.0) | | | — | | | (1.0) | | | — | |

| | | | | | | |

| | | | | | | |

Other income (loss) | 0.1 | | | 0.1 | | | 0.1 | | | (0.1) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Impact on income from continuing operations before income taxes | (28.1) | | | (21.7) | | | (34.3) | | | (49.0) | |

Income tax benefit on above special items | 7.0 | | | 5.5 | | | 8.4 | | | 12.4 | |

Tax adjustments(2) | (0.7) | | | (3.4) | | | (1.4) | | | (5.3) | |

Impact of special items on net income from continuing operations | $ | (21.8) | | | $ | (19.6) | | | $ | (27.3) | | | $ | (41.9) | |

| | | | | | | |

| Diluted earnings per common share impact | $ | (0.24) | | | $ | (0.21) | | | $ | (0.30) | | | $ | (0.46) | |

| | | | | | | |

Weighted average shares used to compute adjusted earnings per share: | | | | | | | |

| Diluted | 92.2 | | 91.9 | | 92.0 | | 91.9 |

(1) Special items include charges related to specific strategic initiatives or financial restructuring such as: consolidation of operations; debt extinguishment costs; costs incurred directly in relation to acquisitions or divestitures; employee separation costs resulting from personnel reduction programs, plant realignment costs, executive separation agreements; asset impairments; settlement gains or losses and mark-to-market adjustments associated with gains and losses on pension and other post-retirement benefit plans; environmental remediation costs, fines, penalties and related insurance recoveries related to facilities no longer owned or closed in prior years; gains and losses on the divestiture of operating businesses, gains and losses on facility or property sales or disposals; results of litigation, fines or penalties, where such litigation (or action relating to the fines or penalties) arose prior to the commencement of the performance period; one-time, non-recurring items; and the effect of changes in accounting principles or other such laws or provisions affecting reported results.

(2) Tax adjustments include the net tax impact from non-recurring income tax items, adjustments to uncertain tax position reserves and the establishment, reversal or changes to valuation allowances.

Attachment 4

Avient Corporation

Condensed Consolidated Balance Sheets

(In millions)

| | | | | | | | | | | |

| (Unaudited) June 30, 2024 | | December 31, 2023 |

| | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 489.4 | | | $ | 545.8 | |

| Accounts receivable, net | 486.6 | | | 399.9 | |

| Inventories, net | 365.9 | | | 347.0 | |

| | | |

| Other current assets | 117.2 | | | 114.9 | |

| Total current assets | 1,459.1 | | | 1,407.6 | |

| Property, net | 1,019.9 | | | 1,028.9 | |

| Goodwill | 1,685.1 | | | 1,719.3 | |

| Intangible assets, net | 1,515.7 | | | 1,590.8 | |

| | | |

| | | |

| Other non-current assets | 228.0 | | | 221.9 | |

| Total assets | $ | 5,907.8 | | | $ | 5,968.5 | |

| | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Short-term and current portion of long-term debt | $ | 657.7 | | | $ | 9.5 | |

| Accounts payable | 435.2 | | | 432.3 | |

| | | |

| | | |

| Accrued expenses and other current liabilities | 405.3 | | | 331.8 | |

| Total current liabilities | 1,498.2 | | | 773.6 | |

| Non-current liabilities: | | | |

| Long-term debt | 1,420.8 | | | 2,070.5 | |

| Pension and other post-retirement benefits | 63.3 | | | 67.2 | |

| Deferred income taxes | 276.3 | | | 281.6 | |

| | | |

| | | |

| Other non-current liabilities | 315.0 | | | 437.6 | |

| Total non-current liabilities | 2,075.4 | | | 2,856.9 | |

| | | |

| SHAREHOLDERS' EQUITY | | | |

| Avient shareholders’ equity | 2,317.5 | | | 2,319.2 | |

| Noncontrolling interest | 16.7 | | | 18.8 | |

| Total equity | 2,334.2 | | | 2,338.0 | |

| Total liabilities and equity | $ | 5,907.8 | | | $ | 5,968.5 | |

Attachment 5

Avient Corporation

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In millions)

| | | | | | | | | | | |

| | Six Months Ended

June 30, |

| | 2024 | | 2023 |

| Operating Activities | | | |

| Net income | $ | 83.5 | | | $ | 42.7 | |

| Adjustments to reconcile net income to net cash provided (used) by operating activities: | | | |

| | | |

| Depreciation and amortization | 88.4 | | | 96.2 | |

| Accelerated depreciation | 0.8 | | | 1.9 | |

| | | |

| | | |

| | | |

| | | |

| Share-based compensation expense | 9.0 | | | 6.5 | |

| | | |

| | | |

| Changes in assets and liabilities: | | | |

| Increase in accounts receivable | (97.0) | | | (66.6) | |

| (Increase) decrease in inventories | (27.3) | | | 14.0 | |

| Increase (decrease) in accounts payable | 11.9 | | | (26.2) | |

| | | |

| | | |

| | | |

| | | |

| Taxes paid on gain on sale of business | — | | | (103.0) | |

| Accrued expenses and other assets and liabilities, net | (6.2) | | | 9.8 | |

| | | |

| Net cash provided (used) by operating activities | 63.1 | | | (24.7) | |

| | | |

| Investing activities | | | |

| Capital expenditures | (55.8) | | | (45.9) | |

| | | |

| | | |

| Net proceeds from divestiture | — | | | 7.3 | |

| Proceeds from plant closures | 3.4 | | | — | |

| Other investing activities | (2.1) | | | — | |

| Net cash used by investing activities | (54.5) | | | (38.6) | |

| | | |

| Financing activities | | | |

| | | |

| | | |

| | | |

| | | |

| Cash dividends paid | (47.0) | | | (45.0) | |

| | | |

| Repayment of long-term debt | (4.5) | | | (1.0) | |

| | | |

| | | |

| | | |

| | | |

| Other financing activities | (3.3) | | | (2.3) | |

| Net cash used by financing activities | (54.8) | | | (48.3) | |

| Effect of exchange rate changes on cash | (10.2) | | | (0.8) | |

| Decrease in cash and cash equivalents | (56.4) | | | (112.4) | |

| Cash and cash equivalents at beginning of year | 545.8 | | | 641.1 | |

| Cash and cash equivalents at end of period | $ | 489.4 | | | $ | 528.7 | |

Attachment 6

Avient Corporation

Business Segment Operations (Unaudited)

(In millions)

Operating income and earnings before interest, taxes, depreciation and amortization (EBITDA) at the segment level does not include: special items as defined in Attachment 3; corporate general and administration costs that are not allocated to segments; intersegment sales and profit eliminations; share-based compensation costs; and certain other items that are not included in the measure of segment profit and loss that is reported to and reviewed by the chief operating decision maker. These costs are included in Corporate.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Sales: | | | | | | | |

| Color, Additives and Inks | $ | 542.0 | | | $ | 524.5 | | | $ | 1,057.3 | | | $ | 1,061.5 | |

| Specialty Engineered Materials | 308.1 | | | 300.8 | | | 622.5 | | | 610.5 | |

| | | | | | | |

| Corporate | (0.4) | | | (0.9) | | | (1.1) | | | (1.9) | |

| Sales | $ | 849.7 | | | $ | 824.4 | | | $ | 1,678.7 | | | $ | 1,670.1 | |

| | | | | | | |

| Gross margin: | | | | | | | |

| Color, Additives and Inks | $ | 184.5 | | | $ | 164.1 | | | $ | 355.7 | | | $ | 326.1 | |

| Specialty Engineered Materials | 94.7 | | | 91.5 | | | 201.7 | | | 185.4 | |

| | | | | | | |

| Corporate | (21.6) | | | (14.9) | | | (21.6) | | | (23.2) | |

| Gross margin | $ | 257.6 | | | $ | 240.7 | | | $ | 535.8 | | | $ | 488.3 | |

| | | | | | | |

| Selling and administrative expense: | | | | | | | |

| Color, Additives and Inks | $ | 98.4 | | | $ | 96.1 | | | $ | 194.8 | | | $ | 192.5 | |

| Specialty Engineered Materials | 51.9 | | | 51.8 | | | 105.5 | | | 102.6 | |

| | | | | | | |

| Corporate | 34.8 | | | 30.5 | | | 69.0 | | | 73.8 | |

| Selling and administrative expense | $ | 185.1 | | | $ | 178.4 | | | $ | 369.3 | | | $ | 368.9 | |

| | | | | | | |

| Operating income: | | | | | | | |

| Color, Additives and Inks | $ | 86.1 | | | $ | 68.0 | | | $ | 160.9 | | | $ | 133.6 | |

| Specialty Engineered Materials | 42.8 | | | 39.7 | | | 96.2 | | | 82.8 | |

| | | | | | | |

| Corporate | (56.4) | | | (45.4) | | | (90.6) | | | (97.0) | |

| Operating income | $ | 72.5 | | | $ | 62.3 | | | $ | 166.5 | | | $ | 119.4 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Depreciation & amortization: | | | | | | | |

| Color, Additives and Inks | $ | 21.8 | | | $ | 25.7 | | | $ | 43.7 | | | $ | 51.5 | |

| Specialty Engineered Materials | 20.8 | | | 19.9 | | | 40.4 | | | 41.1 | |

| | | | | | | |

| Corporate | 2.3 | | | 2.0 | | | 5.1 | | | 5.5 | |

| Depreciation & amortization | $ | 44.9 | | | $ | 47.6 | | | $ | 89.2 | | | $ | 98.1 | |

| | | | | | | |

Earnings before interest, taxes, depreciation and amortization (EBITDA): | | | | | | | |

| Color, Additives and Inks | $ | 107.9 | | | $ | 93.7 | | | $ | 204.6 | | | $ | 185.1 | |

| Specialty Engineered Materials | 63.6 | | | 59.6 | | | 136.6 | | | 123.9 | |

| | | | | | | |

| Corporate | (54.1) | | | (43.4) | | | (85.5) | | | (91.5) | |

| Other (expense) income, net | (0.9) | | | (0.2) | | | (1.8) | | | 0.5 | |

| EBITDA from continuing operations | $ | 116.5 | | | $ | 109.7 | | | $ | 253.9 | | | $ | 218.0 | |

| Special items, before tax | 28.1 | | | 21.7 | | | 34.3 | | | 49.0 | |

| Interest expense included in special items | (1.0) | | | — | | | (1.0) | | | — | |

| Depreciation & amortization included in special items | (0.3) | | | (0.1) | | | (0.8) | | | (1.9) | |

| Adjusted EBITDA | $ | 143.3 | | | $ | 131.3 | | | $ | 286.4 | | | $ | 265.1 | |

Attachment 7

Avient Corporation

Reconciliation of Non-GAAP Financial Measures (Unaudited)

(In millions, except per share data)

Senior management uses gross margin before special items and operating income before special items to assess performance and allocate resources because senior management believes that these measures are useful in understanding current profitability levels and how it may serve as a basis for future performance. In addition, operating income before the effect of special items is a component of Avient's annual incentive plans and is used in debt covenant computations. Senior management believes these measures are useful to investors because they allow for comparison to Avient's performance in prior periods without the effect of items that, by their nature, tend to obscure Avient's operating results due to the potential variability across periods based on timing, frequency and magnitude. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, or solely as alternatives to, financial measures prepared in accordance with GAAP. Below is a reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with GAAP. See Attachment 3 for a definition and summary of special items.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| Reconciliation to Consolidated Statements of Income | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Sales | $ | 849.7 | | | $ | 824.4 | | | $ | 1,678.7 | | | $ | 1,670.1 | |

| | | | | | | |

| Gross margin - GAAP | 257.6 | | | 240.7 | | | 535.8 | | | 488.3 | |

| Special items in gross margin (Attachment 3) | 21.6 | | | 14.2 | | | 22.0 | | | 22.2 | |

| Adjusted gross margin | $ | 279.2 | | | $ | 254.9 | | | $ | 557.8 | | | $ | 510.5 | |

| | | | | | | |

| Adjusted gross margin as a percent of sales | 32.9 | % | | 30.9 | % | | 33.2 | % | | 30.6 | % |

| | | | | | | |

| Operating income - GAAP | 72.5 | | | 62.3 | | | 166.5 | | | 119.4 | |

| Special items in operating income (Attachment 3) | 27.2 | | | 21.8 | | | 33.4 | | | 48.9 | |

| Adjusted operating income | $ | 99.7 | | | $ | 84.1 | | | $ | 199.9 | | | $ | 168.3 | |

| | | | | | | |

| Adjusted operating income as a percent of sales | 11.7 | % | | 10.2 | % | | 11.9 | % | | 10.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended June 30, | | Six Months Ended

June 30, |

| Reconciliation to EBITDA and Adjusted EBITDA: | | | | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income from continuing operations – GAAP | | | | | $ | 33.8 | | | $ | 22.3 | | | $ | 83.5 | | | $ | 43.6 | |

| Income tax expense | | | | | 11.2 | | | 10.4 | | | 28.0 | | | 18.1 | |

| Interest expense, net | | | | | 26.6 | | | 29.4 | | | 53.2 | | | 58.2 | |

| | | | | | | | | | | |

| Depreciation & amortization | | | | | 44.9 | | | 47.6 | | | 89.2 | | | 98.1 | |

| EBITDA from continuing operations | | | | | $ | 116.5 | | | $ | 109.7 | | | $ | 253.9 | | | $ | 218.0 | |

| Special items, before tax | | | | | 28.1 | | | 21.7 | | | 34.3 | | | 49.0 | |

| Interest expense included in special items | | | | | (1.0) | | | — | | | (1.0) | | | — | |

| Depreciation & amortization included in special items | | | | | (0.3) | | | (0.1) | | | (0.8) | | | (1.9) | |

| Adjusted EBITDA | | | | | $ | 143.3 | | | $ | 131.3 | | | $ | 286.4 | | | $ | 265.1 | |

| | | | | | | | | | | |

| Adjusted EBITDA as a percent of sales | | | | | 16.9 | % | | 15.9 | % | | 17.1 | % | | 15.9 | % |

| | | | | | | | | | | |

| Year Ended

December 31, 2023 |

| Reconciliation to Condensed Consolidated Statements of Income | $ | | EPS |

| | | |

| Net income from continuing operations attributable to Avient shareholders | $ | 75.8 | | | $ | 0.83 | |

| Special items, after-tax | 79.3 | | | 0.86 | |

| Amortization expense, after-tax | 61.5 | | | 0.67 | |

| | | |

| Adjusted net income / EPS | $ | 216.6 | | | $ | 2.36 | |

| | | | | | | | | | | |

| Three Months Ended

September 30, 2023 |

| Reconciliation to Condensed Consolidated Statements of Income | $ | | EPS |

| | | |

| Net income from continuing operations attributable to Avient shareholders | $ | 5.1 | | | $ | 0.06 | |

| Special items, after-tax | 32.0 | | | 0.35 | |

| Amortization expense, after-tax | 15.2 | | | 0.16 | |

| | | |

| Adjusted net income / EPS | $ | 52.3 | | | $ | 0.57 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

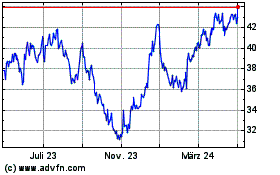

Avient (NYSE:AVNT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Avient (NYSE:AVNT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024