Atlantic Union Bankshares Corporation (“Atlantic Union”) (NYSE:

AUB) and Sandy Spring Bancorp (“Sandy Spring”) (Nasdaq: SASR)

jointly announced today that they have entered into a definitive

merger agreement for Atlantic Union to acquire Sandy Spring in an

all-stock transaction valued at approximately $1.6 billion.

Combining the two organizations will create the largest regional

bank headquartered in the lower Mid-Atlantic, and significantly

enhance the combined company’s presence in Northern Virginia and

Maryland.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241021025221/en/

Founded in 1868, Sandy Spring is headquartered in Olney,

Maryland and has $14.4 billion in assets, $11.7 billion in total

deposits and $11.5 billion in total loans as of September 30, 2024.

The combined company will have pro forma total assets of $39.2

billion, total deposits of $32.0 billion and gross loans of $29.8

billion, based on financial data as of September 30, 2024. The

combined company’s Mid-Atlantic banking presence will be enhanced

through the addition of 53 branch locations and Atlantic Union will

approximately double its wealth business by increasing assets under

management by more than $6.5 billion.

“At our 2018 investor day, I noted that part of our long-term

vision was to complete the ‘Golden Crescent’ from Baltimore,

through Washington D.C. and Richmond to Hampton Roads and recreate

a banking franchise that had not existed since the 1990s,” said

John C. Asbury, President and Chief Executive Officer of Atlantic

Union. “With today’s announcement of our partnership with Sandy

Spring, Atlantic Union will create a preeminent regional bank, with

Virginia as its linchpin, that spans the lower mid-Atlantic into

the Southeast and that is committed to the communities it

serves.”

“Our partnership with Atlantic Union is the right long-term

decision for our shareholders, clients and employees. This

combination will deliver enhanced scale, diversity in the market,

and capabilities for our clients, and it will provide greater

opportunities for our employees to grow within a larger

organization,” said Daniel J. Schrider, Chair, President and CEO of

Sandy Spring Bank. “Sandy Spring Bank and Atlantic Union Bank share

a people-first approach to doing business and serving our

communities, and together we will add even greater value to the

individuals, families and businesses we serve across our expanded

footprint.”

“As Dan said, we are excited about the opportunity to bring two

of the preeminent regional banks headquartered in Virginia and

Maryland together,” said Ron Tillett, Chairman of Atlantic Union’s

Board of Directors. “We believe that the combination of our two

companies creates a uniquely valuable franchise that is able to

better serve our customers as well as our communities, while

creating long-term shareholder value.”

Under the terms of the merger agreement, each outstanding share

of Sandy Spring common stock will be converted into the right to

receive 0.900 shares of Atlantic Union common stock. This values

the transaction at approximately $34.93 per Sandy Spring common

share, based on Atlantic Union’s closing stock price on October 18,

2024.

Three members of the Sandy Spring board of directors, including

Dan Schrider, will join the Atlantic Union board of directors upon

the closing of the transaction.

The merger agreement has been unanimously approved by the board

of directors of each company. The companies expect to complete the

transaction by the end of the third quarter of 2025, subject to the

satisfaction of customary closing conditions, including regulatory

approvals and approval by Atlantic Union shareholders and Sandy

Spring stockholders.

Morgan Stanley & Co. LLC is acting as financial advisor to

Atlantic Union and Davis Polk & Wardwell LLP is acting as its

legal advisor in the transaction. Keefe, Bruyette & Woods,

Inc., A Stifel Company, is acting as financial advisor to Sandy

Spring and Kilpatrick Townsend & Stockton LLP is acting as its

legal advisor in the transaction.

Joint Investor Conference Call

Atlantic Union will host a conference call to discuss its third

quarter earnings at 9:00 a.m. Eastern Time today, Monday, October

21, 2024, and Sandy Spring will join to discuss today’s

announcement. This call has been rescheduled from the previously

announced date and time.

The webcast with investor presentation can be accessed

at:https://edge.media-server.com/mmc/p/6q92at5j. For analysts who

wish to participate in the conference call, please register at the

following URL

https://register.vevent.com/register/BI352e42e841fa454e85cc98ae24ac2697.

To participate in the conference call, you must use the link to

receive an audio dial-in number and an Access PIN.

Presentation slides for the conference call are available on

Atlantic Union’s investor website:

http://investors.atlanticunionbank.com and on Sandy Spring’s

investor website:

https://sandyspringbancorp.q4ir.com/overview/default.aspx. A replay

of the conference call will be posted on Atlantic Union’s investor

website.

Media Availability

Senior leadership of Atlantic Union will be available virtually

to members of the news media from 3:00 p.m. to 3:45 p.m. Eastern

Time today, Monday, October 21, 2024. To participate, please

contact Susan Rowland, Corporate Communications Manager for

Atlantic Union at: 804.802.4069

About Atlantic Union Bankshares Corporation

Headquartered in Richmond, Virginia, Atlantic Union Bankshares

Corporation (NYSE: AUB) is the holding company for Atlantic Union

Bank. Atlantic Union Bank had 129 branches and approximately 150

ATMs located throughout Virginia and in portions of Maryland and

North Carolina as of September 30, 2024. Certain non-bank financial

services affiliates of Atlantic Union Bank include: Atlantic Union

Equipment Finance, Inc., which provides equipment financing;

Atlantic Union Financial Consultants, LLC, which provides brokerage

services; and Union Insurance Group, LLC, which offers various

lines of insurance products.

About Sandy Spring Bancorp, Inc.

Sandy Spring Bancorp, Inc., headquartered in Olney, Maryland, is

the holding company for Sandy Spring Bank, a premier community bank

in the Greater Washington, D.C. region. With over 50 locations, the

bank offers a broad range of commercial and retail banking,

mortgage, private banking, and trust services throughout Maryland,

Virginia, and Washington, D.C. Through its subsidiaries, Rembert

Pendleton Jackson and West Financial Services, Inc., Sandy Spring

Bank also offers a comprehensive menu of wealth management

services.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934,

as amended, and Rule 3b-6 promulgated thereunder, which statements

involve inherent risks and uncertainties. Examples of

forward-looking statements include, but are not limited to,

statements regarding the outlook and expectations of Atlantic Union

and Sandy Spring, respectively, with respect to the proposed

transaction, the strategic benefits and financial benefits of the

proposed transaction, including the expected impact of the proposed

transaction on the combined company’s future financial performance

(including anticipated accretion to earnings per share, the

tangible book value earn-back period and other operating and return

metrics), the timing of the closing of the proposed transaction,

and the ability to successfully integrate the combined businesses.

Such statements are often characterized by the use of qualified

words (and their derivatives) such as “may,” “will,” “anticipate,”

“could,” “should,” “would,” “believe,” “contemplate,” “expect,”

“estimate,” “continue,” “plan,” “project” and “intend,” as well as

words of similar meaning or other statements concerning opinions or

judgment of Atlantic Union or Sandy Spring or their respective

management about future events. Forward-looking statements are

based on assumptions as of the time they are made and are subject

to risks, uncertainties and other factors that are difficult to

predict with regard to timing, extent, likelihood and degree of

occurrence, which could cause actual results to differ materially

from anticipated results expressed or implied by such

forward-looking statements. Such risks, uncertainties and

assumptions, include, among others, the following:

- the occurrence of any event, change or other circumstances that

could give rise to the right of one or both of the parties to

terminate the merger agreement;

- the failure to obtain necessary regulatory approvals (and the

risk that such approvals may result in the imposition of conditions

that could adversely affect the combined company or the expected

benefits of the proposed transaction) and the possibility that the

proposed transaction does not close when expected or at all because

required regulatory approval, the approval by Atlantic Union’s

shareholders or Sandy Spring’s stockholders, or other approvals and

the other conditions to closing are not received or satisfied on a

timely basis or at all;

- the outcome of any legal proceedings that may be instituted

against Atlantic Union or Sandy Spring;

- the possibility that the anticipated benefits of the proposed

transaction, including anticipated cost savings and strategic

gains, are not realized when expected or at all, including as a

result of changes in, or problems arising from, general economic

and market conditions, interest and exchange rates, monetary

policy, laws and regulations and their enforcement, and the degree

of competition in the geographic and business areas in which

Atlantic Union and Sandy Spring operate;

- the possibility that the integration of the two companies may

be more difficult, time-consuming or costly than expected;

- the impact of purchase accounting with respect to the proposed

transaction, or any change in the assumptions used regarding the

assets acquired and liabilities assumed to determine their fair

value and credit marks;

- the possibility that the proposed transaction may be more

expensive or take longer to complete than anticipated, including as

a result of unexpected factors or events;

- the diversion of management’s attention from ongoing business

operations and opportunities;

- potential adverse reactions of Atlantic Union’s or Sandy

Spring’s customers or changes to business or employee

relationships, including those resulting from the announcement or

completion of the proposed transaction;

- a material adverse change in the financial condition of

Atlantic Union or Sandy Spring; changes in Atlantic Union’s or

Sandy Spring’s share price before closing;

- risks relating to the potential dilutive effect of shares of

Atlantic Union’s common stock to be issued in the proposed

transaction;

- general competitive, economic, political and market

conditions;

- major catastrophes such as earthquakes, floods or other natural

or human disasters, including infectious disease outbreaks;

- other factors that may affect future results of Atlantic Union

or Sandy Spring, including, among others, changes in asset quality

and credit risk; the inability to sustain revenue and earnings

growth; changes in interest rates; deposit flows; inflation;

customer borrowing, repayment, investment and deposit practices;

the impact, extent and timing of technological changes; capital

management activities; and other actions of the Federal Reserve

Board and legislative and regulatory actions and reforms.

These factors are not necessarily all of the factors that could

cause Atlantic Union’s, Sandy Spring’s or the combined company’s

actual results, performance or achievements to differ materially

from those expressed in or implied by any of the forward-looking

statements. Other factors, including unknown or unpredictable

factors, also could harm Atlantic Union’s, Sandy Spring’s or the

combined company’s results.

Although each of Atlantic Union and Sandy Spring believes that

its expectations with respect to forward-looking statements are

based upon reasonable assumptions within the bounds of its existing

knowledge of its business and operations, there can be no assurance

that actual results of Atlantic Union or Sandy Spring will not

differ materially from any projected future results expressed or

implied by such forward-looking statements. Additional factors that

could cause results to differ materially from those described above

can be found in Atlantic Union’s most recent annual report on Form

10-K for the fiscal year ended December 31, 2023 (and which is

available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000088394824000030/aub-20231231x10k.htm),

quarterly reports on Form 10-Q, and other documents subsequently

filed by Atlantic Union with the Securities Exchange Commission

(“SEC”), and in Sandy Spring’s most recent annual report on Form

10-K for the fiscal year ended December 31, 2023 (and which is

available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000082441024000011/sasr-20231231.htm),

and its other filings with the SEC and quarterly reports on Form

10-Q, and other documents subsequently filed by Sandy Spring with

the SEC. The actual results anticipated may not be realized or,

even if substantially realized, they may not have the expected

consequences to or effects on Atlantic Union, Sandy Spring or each

of their respective businesses or operations. Investors are

cautioned not to rely too heavily on any such forward-looking

statements. Atlantic Union and Sandy Spring urge you to consider

all of these risks, uncertainties and other factors carefully in

evaluating all such forward-looking statements made by Atlantic

Union and Sandy Spring. Forward-looking statements speak only as of

the date they are made and Atlantic Union and/or Sandy Spring

undertake no obligation to update or clarify these forward-looking

statements, whether as a result of new information, future events

or otherwise, except to the extent required by applicable law.

Important Additional Information about the Transaction and

Where to Find It

In connection with the proposed transaction, Atlantic Union

intends to file with the SEC a Registration Statement on Form S-4

(the “Registration Statement”) to register the shares of Atlantic

Union capital stock to be issued in connection with the proposed

transaction and that will include a joint proxy statement of

Atlantic Union and Sandy Spring and a prospectus of Atlantic Union

(the “Joint Proxy Statement/Prospectus”), and each of Atlantic

Union and Sandy Spring may file with the SEC other relevant

documents concerning the proposed transaction. A definitive Joint

Proxy Statement/Prospectus will be sent to the shareholders of

Atlantic Union and the stockholders of Sandy Spring to seek their

approval of the proposed transaction. BEFORE MAKING ANY VOTING OR

INVESTMENT DECISION, INVESTORS, SHAREHOLDERS OF ATLANTIC UNION AND

STOCKHOLDERS OF SANDY SPRING ARE URGED TO READ THE REGISTRATION

STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE

PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT ATLANTIC UNION, SANDY SPRING AND THE PROPOSED

TRANSACTION AND RELATED MATTERS.

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities or the solicitation

of any vote or approval with respect to the proposed transaction

between Atlantic Union and Sandy Spring. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of the Securities Act of 1933, as amended, and no

offer to sell or solicitation of an offer to buy shall be made in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such jurisdiction.

A copy of the Registration Statement, Joint Proxy

Statement/Prospectus, as well as other filings containing

information about Atlantic Union and Sandy Spring, may be obtained,

free of charge, at the SEC’s website (http://www.sec.gov). You will

also be able to obtain these documents, when they are filed, free

of charge, from Atlantic Union by accessing Atlantic Union’s

website at https://investors.atlanticunionbank.com or from Sandy

Spring by accessing Sandy Spring’s website at

https://sandyspringbancorp.q4ir.com/overview/default.aspx. Copies

of the Registration Statement on Form S-4, the Joint Proxy

Statement/Prospectus and the filings with the SEC that will be

incorporated by reference therein can also be obtained, without

charge, by directing a request to Atlantic Union Investor

Relations, Atlantic Union Bankshares Corporation, 4300 Cox Road,

Glen Allen, Virginia 23060, or by calling (804) 448-0937, or to

Sandy Spring by directing a request to Sandy Spring Investor

Relations, Sandy Spring Bancorp, Inc., 17801 Georgia Avenue, Olney,

Maryland 20832 or by calling (301) 774-8455. The information on

Atlantic Union’s or Sandy Spring’s respective websites is not, and

shall not be deemed to be, a part of this communication or

incorporated into other filings either company makes with the

SEC.

Participants in the Solicitation

Atlantic Union, Sandy Spring and certain of their respective

directors, executive officers and employees may be deemed to be

participants in the solicitation of proxies from the shareholders

of Atlantic Union and stockholders of Sandy Spring in connection

with the proposed transaction. Information about the interests of

the directors and executive officers of Atlantic Union and Sandy

Spring and other persons who may be deemed to be participants in

the solicitation of shareholders of Atlantic Union and stockholders

of Sandy Spring in connection with the proposed transaction and a

description of their direct and indirect interests, by security

holdings or otherwise, will be included in the Joint Proxy

Statement/Prospectus related to the proposed transaction, which

will be filed with the SEC. Information about the directors and

executive officers of Atlantic Union and their ownership of

Atlantic Union common stock is also set forth in the definitive

proxy statement for Atlantic Union’s 2024 Annual Meeting of

Shareholders, as filed with the SEC on Schedule 14A on March 26,

2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000155837024003888/aub-20240507xdef14a.htm).

Information about the directors and executive officers of Atlantic

Union, their ownership of Atlantic Union common stock, and Atlantic

Union’s transactions with related persons is set forth in the

sections entitled “Directors, Executive Officers and Corporate

Governance,” “Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters,” and “Certain

Relationships and Related Transactions, and Director Independence”

included in Atlantic Union’s annual report on Form 10‑K for the

fiscal year ended December 31, 2023, which was filed with the SEC

on February 22, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000088394824000030/aub-20231231x10k.htm),

and in the sections entitled “Corporate Governance,” “Executive

Officers” and “Stock Ownership of Directors, Executive Officers and

Certain Beneficial Owners” included in Atlantic Union’s definitive

proxy statement in connection with its 2024 Annual Meeting of

Stockholders, as filed with the SEC on March 3, 2024 (and which is

available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000155837024003888/aub-20240507xdef14a.htm).

To the extent holdings of Atlantic Union’s common stock by the

directors and executive officers of Atlantic Union have changed

from the amounts of Atlantic Union’s common stock held by such

persons as reflected therein, such changes have been or will be

reflected on Statements of Change in Ownership on Form 4 filed with

the SEC. Information about the directors and executive officers of

Sandy Spring and their ownership of Sandy Spring common stock can

also be found in Sandy Spring’s definitive proxy statement in

connection with its 2024 Annual Meeting of Stockholders, as filed

with the SEC on April 10, 2024 (and which is available at:

https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000119312524091479/d784978ddef14a.htm)

and other documents subsequently filed by Sandy Spring with the

SEC. Information about the directors and executive officers of

Sandy Spring, their ownership of Sandy Spring common stock, and

Sandy Spring’s transactions with related persons is set forth in

the sections entitled “Directors, Executive Officers and Corporate

Governance,” “Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters,” and “Certain

Relationships and Related Transactions, and Director Independence”

included in Sandy Spring’s annual report on Form 10-K for the

fiscal year ended December 31, 2023, which was filed with the SEC

on February 20, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000082441024000011/sasr-20231231.htm),

and in the sections entitled “Corporate Governance,” “Transactions

with Related Persons” and “Stock Ownership Information” included in

Sandy Spring’s definitive proxy statement in connection with its

2024 Annual Meeting of Stockholders, as filed with the SEC on April

10, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000119312524091479/d784978ddef14a.htm).

To the extent holdings of Sandy Spring common stock by the

directors and executive officers of Sandy Spring have changed from

the amounts of Sandy Spring common stock held by such persons as

reflected therein, such changes have been or will be reflected on

Statements of Change in Ownership on Form 4 filed with the SEC.

Free copies of these documents may be obtained as described in the

preceding paragraph.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021025221/en/

Bill Cimino (804) 448-0937, SVP and Director of Investor

Relations of Atlantic Union Jennifer Schell (301) 570-8331,

Division Executive, Marketing & Corporate Communications for

Sandy Spring Bank

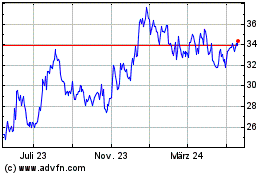

Atlantic Union Bankshares (NYSE:AUB)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Atlantic Union Bankshares (NYSE:AUB)

Historical Stock Chart

Von Nov 2023 bis Nov 2024