Adjusted EBITDA and gross margins at

midpoint or top end of guidance estimates

ASGN Incorporated (NYSE: ASGN), a leading provider of IT

services and solutions to the commercial and government sectors,

reported financial results for the quarter ended September 30,

2024.

Highlights

- Revenues were $1.031 billion

- Net income was $47.5 million

- Adjusted EBITDA (a non-GAAP measure) was $116.9 million (11.3

percent of revenues)

- Operating cash flows were $135.8 million and Free Cash Flow (a

non-GAAP measure) was $127.9 million

- Repurchased approximately 1.0 million shares of the Company's

common stock for $95.6 million

IT Consulting Revenues - Approximately 57.9 percent of

total revenues

- Commercial Segment - New bookings for the trailing-twelve-month

period ("TTM") were $1.2 billion; book-to-bill ratio was 1.1 to

1

- Federal Government Segment - New contract awards for the TTM

were $1.1 billion; book-to-bill ratio was 0.9 to 1

Management Commentary

"Our results for the third quarter of 2024 show that market

demand remains relatively stable,” said ASGN’s Chief Executive

Officer, Ted Hanson. “Revenues of $1.031 billion were similar to

the second quarter and within our guidance range. Adjusted EBITDA

margin of 11.3 percent was at the midpoint of our guidance range

and reflects the continued evolution of our business toward

higher-end, high-value IT consulting work, which is approaching 60

percent of total revenues.”

Hanson continued, “Despite tight budgets, clients know that

advancing their IT strategies is essential to sustaining their

competitive edge. Strong commercial and government bookings in the

quarter demonstrate the continued need for ASGN’s IT services and

are a sign of pent-up demand. As we complete the final quarter of

the year, ASGN remains focused on being positioned to support the

business and technology needs of our clients.”

Third Quarter 2024 Financial Results - Summary

Three Months Ended,

September 30,

June 30,

(In millions, except per share data)

2024

2023

2024

Revenues

Commercial Segment

$

718.8

$

782.4

$

725.7

Federal Government Segment

312.2

334.4

309.0

1,031.0

1,116.8

1,034.7

Gross Margin

Commercial Segment

32.8

%

32.5

%

32.7

%

Federal Government Segment

20.7

%

20.4

%

20.6

%

Consolidated

29.1

%

28.9

%

29.1

%

Net income

$

47.5

$

59.4

$

47.2

Earnings per diluted share

$

1.06

$

1.23

$

1.02

Non-GAAP Financial Measures

Adjusted Net Income

$

64.3

$

81.1

$

62.6

Adjusted Net Income per diluted share

$

1.43

$

1.68

$

1.36

Adjusted EBITDA

$

116.9

$

137.5

$

117.1

Adjusted EBITDA margin

11.3

%

12.3

%

11.3

%

__________

Definitions of non-GAAP measures and

reconciliation to GAAP measurements are included in the tables that

accompany this release.

Consolidated revenues for the quarter were $1.03 billion,

compared with $1.12 billion in the third quarter of 2023. From an

industry perspective, the Company operates in six broad industry

verticals. Commercial Segment revenues (69.7 percent of total

revenues) totaled $718.8 million, compared with $782.4 million in

the third quarter of 2023. Commercial Segment revenues are

categorized into five verticals: (i) Consumer and Industrial, (ii)

Financial Services, (iii) Technology, Media and Telecom ("TMT"),

(iv) Healthcare, and (v) Business Services. Two of these five

industry verticals saw growth in the third quarter. TMT increased

double digits year-over-year, while Consumer and Industrial

improved modestly and was up low single digits year-over-year, and

the remaining three verticals declined year-over-year. Federal

Government Segment revenues (30.3 percent of total revenues), the

sixth industry vertical, were $312.2 million, compared with $334.4

million in the prior-year period.

Total IT consulting revenues were $597.2 million (57.9 percent

of total revenues), compared with $608.6 million (54.5 percent of

total revenues) in the third quarter of 2023. Commercial Segment

consulting revenues were $285.0 million, up 3.9 percent

year-over-year. Federal Government Segment revenues, which are all

consulting revenues, were $312.2 million, as stated above.

Assignment revenues totaled $433.8 million (42.1 percent of total

revenues), compared with $508.2 million in the prior-year period,

and reflect continued softness in the more cyclical portions of the

Commercial Segment business.

Gross margin for the third quarter of 2024 was 29.1 percent, an

expansion of 20 basis points from the third quarter of 2023. Gross

margin for the Commercial Segment was up 30 basis points,

reflecting a higher mix of consulting revenues as well as margin

expansion in these revenues. Gross margin for the Federal

Government Segment was up 30 basis points.

Selling, general, and administrative (“SG&A”) expenses were

$207.5 million, compared with $206.0 million in the third quarter

of 2023. SG&A expenses included $1.1 million in acquisition,

integration, and strategic planning expenses, and a $3.6 million

legal settlement accrual, both of which were not included in the

Company's previously-announced guidance estimates.

Net income was $47.5 million ($1.06 per diluted share), compared

with $59.4 million ($1.23 per diluted share) in the third quarter

of 2023.

Adjusted EBITDA (a non-GAAP measure) was $116.9 million, or 11.3

percent of revenues ("Adjusted EBITDA margin," a non-GAAP measure),

compared with $137.5 million or 12.3 percent of revenues in the

third quarter of 2023.

Capital Resources and Capital Allocation

At September 30, 2024, the Company had:

- Cash and cash equivalents of $166.6 million

- Full availability under its $500.0 million Senior Secured

Revolving Credit Facility (due 2028)

- Senior Secured Debt of $495.0 million (term loan B facility due

2030)

- Senior unsecured notes totaling $550.0 million at 4.625 percent

(due 2028)

In the third quarter of 2024 the Company repurchased 1.0 million

shares of its common stock for $95.6 million at an average price of

$92.26 per share. Approximately $572.9 million remained available

at quarter end for repurchases under the Company's stock repurchase

plan.

Fourth Quarter 2024 Financial Estimates

The Company's financial estimates for the fourth quarter of

2024, which are set forth below, assume no deterioration in the

markets ASGN serves. These estimates do not include any

acquisition, integration, or strategic planning expenses.

Reconciliations of estimated net income to the estimated non-GAAP

financial measures are included in the tables that accompany this

release.

(In millions, except per share data)

Low

High

Revenues

$

990.0

$

1,010.0

SG&A expenses(1)

197.8

201.5

Amortization of intangible assets

13.9

13.9

Net income

39.2

42.1

Earnings per diluted share

$

0.88

$

0.94

Gross margin

28.4

%

28.6

%

Effective tax rate(2)

28.0

%

28.0

%

Non-GAAP Financial Measures:

Adjusted EBITDA

$

103.0

$

107.0

Adjusted Net Income(3)

$

52.5

$

55.4

Adjusted Net Income per diluted

share(3)

$

1.18

$

1.24

Adjusted EBITDA margin

10.4

%

10.6

%

___________

(1)

Includes non-cash expenses totaling $19.2

million, comprised of: (i) $9.8 million of stock-based

compensation, (ii) $7.7 million of depreciation, and (iii) $1.7

million of amortization related to capitalized cloud-based

application implementation costs.

(2)

Estimated effective tax rate before any

excess tax benefits related to stock-based compensation.

(3)

Does not include the “Cash Tax Savings on

Indefinite-lived Intangible Assets.” These savings total $8.5

million each quarter, or $0.19 per diluted share, and represent the

benefit of the tax deduction that ASGN receives from the

amortization of goodwill and trademarks.

The financial estimates above are based on an estimate of

“Billable Days,” which are Business Days (calendar days for the

period less weekends and holidays) adjusted for other factors, such

as the day of the week a holiday occurs, additional time taken off

around holidays, year-end client furloughs, and inclement weather.

There are 61 Billable Days in the fourth quarter of 2024, which is

one more day than the year ago period, and 2.5 fewer days than the

third quarter of 2024.

Conference Call

The Company will hold a conference call today at 4:30 p.m. ET to

review its financial results for the third quarter of 2024 and to

provide fourth quarter 2024 estimates. The dial-in number is

877-407-0792 (+1-201-689-8263 outside the United States), and the

conference ID number is 13748597. Participants should dial in ten

minutes before the call. The prepared remarks, supplemental

materials and webcast for this call can be accessed at

www.asgn.com.

A replay of the conference call will be available beginning

today at 7:30 p.m. ET until November 6, 2024. The access number for

the replay is 844-512-2921 (+1-412-317-6671 outside the United

States for callers outside the United States) and the conference ID

number is 13748597.

About ASGN Incorporated

ASGN Incorporated (NYSE: ASGN) is a leading provider of IT

services and solutions to the commercial and government sectors.

ASGN helps corporate enterprises and government organizations

develop, implement, and operate critical IT and business solutions

through its integrated offerings. For more information, please

visit asgn.com.

Safe Harbor

Certain statements made in this news release are

“forward-looking statements” within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended, and involve a high

degree of risk and uncertainty. Forward-looking statements include

statements regarding our anticipated financial and operating

performance.

All statements in this news release, other than those setting

forth strictly historical information, are forward-looking

statements. Forward-looking statements are not guarantees of future

performance and actual results might differ materially. In

particular, we make no assurances that the proposed revenue,

expense, and profit estimates outlined above will be achieved.

Additional examples of forward-looking statements in this press

release include, without limitation, statements regarding our

ability to attract, train, and retain qualified internal employees,

the availability of qualified billable professionals, management of

our growth, continued performance and improvement of our

enterprise-wide information systems, our ability to successfully

adapt to, integrate, and leverage new and developing technologies,

including generative artificial intelligence, our ability to manage

our litigation matters, the successful integration of acquisitions,

and other risks detailed from time-to-time in our reports filed

with the SEC, including our Annual Report on Form 10-K for the year

ended December 31, 2023 as filed with the SEC on February 23, 2024.

We specifically disclaim any intention or duty to update any

forward-looking statements contained in this news release.

CONSOLIDATED SELECTED

FINANCIAL DATA (Unaudited)

(In millions, except per share

data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

June 30,

2024

2023

2024

2024

2023

Results of Operations:

Revenues

$ 1,031.0

$ 1,116.8

$ 1,034.7

$ 3,114.7

$ 3,376.5

Costs of services

730.6

794.4

733.6

2,217.0

2,401.4

Gross profit

300.4

322.4

301.1

897.7

975.1

Selling, general, and administrative

expenses

207.5

206.0

205.6

623.3

640.6

Amortization of intangible assets

14.0

17.8

15.1

44.2

53.8

Operating income

78.9

98.6

80.4

230.2

280.7

Interest expense

(16.0)

(18.5)

(15.8)

(49.4)

(49.7)

Income before income taxes

62.9

80.1

64.6

180.8

231.0

Provision for income taxes

15.4

20.7

17.4

48.0

62.0

Net income

$ 47.5

$ 59.4

$ 47.2

$ 132.8

$ 169.0

Earnings per share:

Basic

$ 1.07

$ 1.23

$ 1.03

$ 2.93

$ 3.46

Diluted

$ 1.06

$ 1.23

$ 1.02

$ 2.89

$ 3.43

Number of shares and share equivalents

used to calculate earnings per share:

Basic

44.5

48.1

45.7

45.4

48.8

Diluted

45.0

48.4

46.1

45.9

49.2

CONSOLIDATED SELECTED

FINANCIAL DATA (Continued) (Unaudited)

(In millions)

Three Months Ended

Nine Months Ended

September 30,

September 30,

June 30,

2024

2023

2024

2024

2023

Summary Statements of Cash Flow

Data:

Cash provided by operating activities

$ 135.8

$ 147.5

$ 90.7

$ 299.8

$ 340.5

Cash used in investing activities

(8.0)

(9.8)

(5.2)

(24.0)

(33.3)

Cash used in financing activities

(92.9)

(85.6)

(110.7)

(283.6)

(231.6)

Reconciliation of GAAP to Non-GAAP

Measure:

Cash provided by operating activities

$ 135.8

$ 147.5

$ 90.7

$ 299.8

$ 340.5

Capital expenditures

(7.9)

(9.8)

(5.3)

(24.0)

(32.7)

Free Cash Flow (non-GAAP measure)

$ 127.9

$ 137.7

$ 85.4

$ 275.8

$ 307.8

September 30,

December 31,

2024

2023

Summary Balance Sheet Data:

Cash and cash equivalents

$ 166.6

$ 175.9

Working capital

503.7

579.2

Goodwill and intangible assets, net

2,348.0

2,392.0

Total assets

3,431.7

3,544.6

Long-term debt

1,034.4

1,036.6

Total liabilities

1,657.3

1,652.5

Total stockholders’ equity

1,774.4

1,892.1

RECONCILIATIONS OF GAAP TO

NON-GAAP MEASURES (Unaudited)

(In millions, except per share

data)

Three Months Ended

Nine Months Ended September

30,

September 30,

June 30,

2024

2023

2024

2024

2023

Net income

$

47.5

$

59.4

47.2

$

132.8

$

169.0

Interest expense

16.0

18.5

15.8

49.4

49.7

Provision for income taxes

15.4

20.7

17.4

48.0

62.0

Depreciation and other amortization(1)

9.4

7.0

9.4

28.2

20.8

Amortization of intangible assets

14.0

17.8

15.1

44.2

53.8

EBITDA (non-GAAP measure)

102.3

123.4

104.9

302.6

355.3

Stock-based compensation

9.9

10.3

11.0

32.6

33.7

Legal settlement expense

3.6

2.7

—

3.6

2.7

Acquisition, integration, and strategic

planning expenses

1.1

1.1

1.2

3.5

4.5

Adjusted EBITDA (non-GAAP measure)

$

116.9

$

137.5

$

117.1

$

342.3

$

396.2

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

2024

2023

2024

2024

2023

Net income

$

47.5

$

59.4

$

47.2

$

132.8

$

169.0

Credit facility amendment expenses

—

2.3

—

1.5

2.3

Legal settlement expense

3.6

2.7

—

3.6

2.7

Acquisition, integration, and strategic

planning expenses

1.1

1.1

1.2

3.5

4.5

Tax effect on adjustments

(1.3

)

(1.6

)

(0.3

)

(2.3

)

(2.5

)

Non-GAAP net income

50.9

63.9

48.1

139.1

176.0

Amortization of intangible assets

14.0

17.8

15.1

44.2

53.8

Other

(0.6

)

(0.6

)

(0.6

)

(1.8

)

(1.8

)

Adjusted Net Income (non-GAAP

measure)(2)

$

64.3

$

81.1

$

62.6

$

181.5

$

228.0

Per diluted share:

Net income

$

1.06

$

1.23

$

1.02

$

2.89

$

3.43

Adjustments

0.37

0.45

0.34

1.06

1.20

Adjusted Net Income (non-GAAP

measure)(2)

$

1.43

$

1.68

$

1.36

$

3.95

$

4.63

Common shares and share equivalents

(diluted)

45.0

48.4

46.1

45.9

49.2

_________

(1)

The three and nine months ended

September 30, 2024, include $1.6 million and $4.1 million,

respectively, of amortization related to capitalized cloud-based

application implementation costs included in SG&A expenses.

(2)

Does not include the “Cash Tax

Savings on Indefinite-lived Intangible Assets,” which currently

total approximately $8.5 million per quarter (approximately $0.19

per diluted share) and represent the benefit of the tax deduction

for amortization of goodwill and trademarks.

FINANCIAL ESTIMATES FOR THE

FOURTH QUARTER OF 2024

RECONCILIATIONS OF ESTIMATED

GAAP TO NON-GAAP MEASURES

(In millions, except per share

data)

Low

High

Net income(1)

$

39.2

$

42.1

Interest expense

15.0

15.0

Provision for income taxes

15.3

16.4

Depreciation and other amortization(2)

9.8

9.8

Amortization of intangible assets

13.9

13.9

EBITDA (non-GAAP measure)

93.2

97.2

Stock-based compensation

9.8

9.8

Adjusted EBITDA (non-GAAP measure)

$

103.0

$

107.0

Low

High

Net income(1)

$

39.2

$

42.1

Amortization of intangible assets

13.9

13.9

Other

(0.6

)

(0.6

)

Adjusted Net Income (non-GAAP

measure)(3)

$

52.5

$

55.4

Per diluted share:

Net income

$

0.88

$

0.94

Adjustments

0.30

0.30

Adjusted Net Income (non-GAAP

measure)(3)

$

1.18

$

1.24

_______

(1)

Does not include acquisition,

integration, and strategic planning expenses, or excess tax

benefits related to stock-based compensation.

(2)

Comprised of (i) $7.7 million of

depreciation included in SG&A expenses, (ii) $1.7 million of

amortization related to capitalized cloud-based application

implementation costs included in SG&A expenses, and (iii) $0.4

million of depreciation included in costs of services.

(3)

Does not include the "Cash Tax

Savings on Indefinite-lived Intangible Assets". These savings total

$8.5 million per quarter ($0.19 per diluted share) and represent

the benefit of the tax deduction for amortization of goodwill and

trademarks.

Non-GAAP Financial Measures

Statements in this release include financial information

presented in accordance with accounting principles generally

accepted in the United States ("GAAP") and also include non-GAAP

financial measures that are provided as additional information to

enhance the overall understanding of the Company's current

financial performance and not as an alternative to the consolidated

interim financial statements presented in accordance with GAAP.

Management uses these non-GAAP measures (earnings before interest,

taxes, depreciation, and amortization ("EBITDA"), Adjusted EBITDA,

Adjusted EBITDA margin, Adjusted Net Income, Adjusted Net Income

per diluted share, Free Cash Flow, and Revenues on a same Billable

Days basis) to evaluate the Company's financial performance. These

terms might not be calculated in the same manner as, and thus might

not be comparable to, similarly titled measures reported by other

companies. The financial information tables that accompany this

press release include reconciliations of net income to non-GAAP

financial measures.

EBITDA, Adjusted EBITDA, and Adjusted EBITDA margin provide a

measure of the Company's operating results in a manner that is

focused on the performance of the Company's core business on an

ongoing basis, by removing the effects of non-operating and certain

non-cash expenses. These non-operating and non-cash items are

specifically identified in the reconciliations of GAAP measures to

Non-GAAP measures that accompany this release.

Adjusted Net Income provides a method for assessing the

Company's operating results in a manner that is focused on the

performance of the Company's core business on an ongoing basis by

removing the effects of non-operating and certain non-cash

expenses, adjusted for some of the cash flows associated with

amortization of intangible assets to more fully present the

performance of the Company's acquisitions. The calculation of

Adjusted Net Income is presented in the reconciliations of GAAP

measures to Non-GAAP measures that accompany this release.

Free Cash Flow provides useful information to investors about

the amount of cash generated by the business that can be used for

strategic opportunities and is computed as presented in the tables

that accompany this release.

Commercial consulting bookings are defined as the value of new

contracts entered into during a specified period, including

adjustments for the effects of changes in contract scope and

contract terminations. The book-to-bill ratio for the Commercial

consulting business is the ratio of bookings to revenues for a

specified period.

Federal Government Segment new contract awards are defined as

the estimated amount of future revenues to be recognized under

contracts awarded during a specified period, including adjustments

to estimates for contracts awarded in previous periods. The

book-to-bill ratio for the Federal Government Segment is the ratio

of New Contract Awards to revenues for a specified period.

Revenues calculated on a Same Billable Days basis provide more

comparable information by removing the effect of differences in the

number of billable days on a year-over-year basis. Revenues on a

Same Billable Days basis are adjusted for the following items:

differences in billable days during the period by taking the

current-period average revenue per billable day, multiplied by the

number of billable days from the same period in the prior year;

Billable Days are business days (calendar days for the period less

weekends and holidays) adjusted for other factors, such as the day

of the week a holiday occurs, additional time taken off around

holidays, year-end client furloughs, and inclement weather.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023177164/en/

Kimberly Esterkin Vice President, Investor Relations

kimberly.esterkin@asgn.com

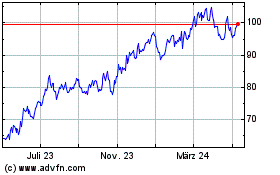

ASGN (NYSE:ASGN)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

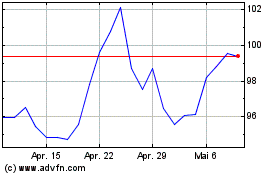

ASGN (NYSE:ASGN)

Historical Stock Chart

Von Nov 2023 bis Nov 2024