UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| ARGO GROUP INTERNATIONAL HOLDINGS,

LTD. |

(Name of Registrant as Specified In Its Charter)

|

| |

CAPITAL RETURNS

MASTER, LTD.

CAPITAL RETURNS

MANAGEMENT, LLC

THE CAPITAL

RETURNS 2016 FAMILY TRUST

RONALD D. BOBMAN

DAVID W. MICHELSON

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Capital Returns Master, Ltd.,

a Cayman Islands exempted company, together with the other participants named herein (collectively, “Capital Returns”), has

filed a definitive proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission in connection

with the 2022 annual general meeting of shareholders (the “Annual General Meeting”) of Argo Group International Holdings,

Ltd., a Bermuda exempted company limited by shares (the “Company”), to be used to solicit votes for the election of Capital

Returns’ slate of highly qualified nominees at the Annual General Meeting.

On November 21, 2022, Capital

Returns issued the following press release:

Capital Returns Reacts to Argo Group’s Insincere

Investor Presentation

Presentation Shows Utter Lack of Recognition for

the $1 Billion of Shareholder Capital Destroyed Over the Last Eleven Months

NEW YORK, November 20, 2022 /PRNewswire/ -- Capital Returns Management,

LLC (together with its affiliates, “Capital Returns,” “we” or “us”), one of the largest shareholders

among actively managed funds of Argo Group International Holdings, Ltd. (“Argo” or the “Company”) (NYSE: ARGO),

today responded to the investor presentation released by Argo’s Board of Directors last week

Capital Returns had the following reaction:

“To hear the story from Argo’s Board, all is well

and getting better at Argo.

Shareholders should be forgiven if, after reading through Argo’s

investor presentation, they are inclined to reboot their Bloomberg terminal to ensure the stock quotes and charts are correct. The reality,

for anyone with a functioning Bloomberg terminal, is quite different than the Board portrays it.

There is no objective evidence that things are well at Argo.

The stock is down 54% this year and the disastrous strategic

decisions and performance of this Company have led to $1 billion of losses for shareholders since the beginning of this year. The Company

has underperformed its self-selected peer group on a total returns basis this year and the last one, two, three, four, five, six, seven,

eight, nine and ten years; during the tenure of every sitting director; during the tenure of the current CEO, the last CEO and Mr. Watson

(three CEOs ago); during the tenure of the current CFO; since the announcement of the strategic review process and nearly any other relevant

period. (And while Argo ballyhoos a recent 68-day period in which its stock outperformed the peers, we, at least, are focused on the creation

of sustainable, long-term value. Of that, there is none.)

The Company remains undervalued, with investors assigning a value

less than book value to the Company and its net assets. This suggests that despite all the talk from this Board about transformation and

future opportunity, shareholders have concluded that further value will likely be destroyed. A dollar in the hands of this Company and

Board is, according to our Bloomberg terminal, now worth just $0.78.

This Board – though seemingly unable to successfully complete

even simple tasks like filing a 10-K on time (twice late in consecutive years) or ensuring Argo has appropriate reserves for losses (having

incurred surprise and adverse loss reserve expenses in 13 of the last 14 quarters) – would have shareholders believe that absolutely

no change is needed. Shareholders, down $1 billion in the last eleven months, are being urged by this Board to sit passively and allow

the incumbent directors to continue their stewardship uninterrupted.

Color us skeptical.

The Board’s self-serving recommendation does not seem like

a good one to us. We think adding two new objective, sophisticated directors to this Board is very likely to help and certainly cannot

hurt. With a dollar at Argo worth only seventy-eight cents, we are inclined to believe some change is needed.

We also do not believe that Mr. Plants, who was added to the

Board recently and who heads the Strategic Review Committee, is a substitute for our candidates. To be very clear, we have enormous respect

for Mr. Plants and welcome his participation on the Board. But public market shareholders may not be perfectly aligned with him. We understand

that Argo was the largest investment ever made by Mr. Plants. He did laudable and important research undercovering the rotten core of

Argo. But now Mr. Plants has a problem. His position is down significantly (FactSet estimates that he and his limited partners have a

cost basis of $56 per share), and if he were to approve a sale of Argo today – even at a 50% premium (~$40 per share) – he

would crystalize those substantial losses, significantly impacting his partners, fund and business. In other words, Mr. Plants has a strong

incentive to oppose the sale of the Company. And so, Mr. Plants may not be the best leader for the strategic review. His commercial

needs, hope and interest, we fear, are in a chimeric rise from the ashes for Argo. We do not think most shareholders want to bet on such

an improbable future.

We encourage shareholders to check their Bloomberg terminals

and vote for modest change to help increase the odds that Argo truly enters a new era and objectively considers a sale.”

Shareholders with any questions about how to vote should contact Capital

Returns’ proxy solicitor, Saratoga Proxy Consulting, LLC, at info@saratogaproxy.com or (212) 257-1311.

Disclaimer

This press release does not constitute an offer to sell or a solicitation

of an offer to buy any of the securities described herein in any state to any person. In addition, the discussions and opinions in this

press release and the material contained herein are for general information only and are not intended to provide investment advice. All

statements contained in this press release that are not clearly historical in nature or that necessarily depend on future events are “forward-looking

statements,” which are not guarantees of future performance or results, and the words “anticipate,” “believe,”

“expect,” “potential,” “could,” “opportunity,” “estimate,” and similar expressions

are generally intended to identify forward-looking statements. The projected results and statements contained in this press release and

the material contained herein that are not historical facts are based on current expectations, speak only as of the date of this press

release and involve risks that may cause the actual results to be materially different. Capital Returns Management, LLC disclaims any

obligation to update the information herein and reserves the right to change any of its opinions expressed herein at any time as it deems

appropriate.

About Capital Returns

Capital Returns was founded in 2003 and since its inception has been a

sector focused fund that invests exclusively in the insurance industry.

Investor and Media Contacts:

Ronald Bobman

Capital Returns Management, LLC

(212) 813-0860

Ron@CapReturns.com

John Ferguson / Joe Mills

Saratoga Proxy Consulting

(212) 257-1311

info@saratogaproxy.com

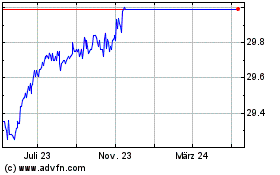

Argo (NYSE:ARGO)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

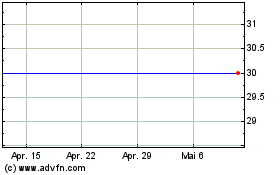

Argo (NYSE:ARGO)

Historical Stock Chart

Von Apr 2024 bis Apr 2025