0001232582truePursuant to Item 9.01 of Form 8-K, this Current Report on Form 8-K/A amends the Registrant’s Current Report on Form 8-K filed on June 13, 2024, for the event dated June 10, 2024, to include the pro forma financial information required by Item 9.01 (b) of Form 8-K.00012325822024-06-102024-06-100001232582us-gaap:CommonStockMember2024-06-102024-06-100001232582us-gaap:SeriesDPreferredStockMember2024-06-102024-06-100001232582us-gaap:SeriesFPreferredStockMember2024-06-102024-06-100001232582us-gaap:SeriesGPreferredStockMember2024-06-102024-06-100001232582us-gaap:SeriesHPreferredStockMember2024-06-102024-06-100001232582aht:SeriesIPreferredStockMember2024-06-102024-06-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): June 10, 2024

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-31775 | | 86-1062192 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | |

| 14185 Dallas Parkway, Suite 1200 | | | | |

| Dallas | | | | |

| Texas | | | | 75254 |

| (Address of principal executive offices) | | | | (Zip code) |

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | AHT | | New York Stock Exchange |

| Preferred Stock, Series D | | AHT-PD | | New York Stock Exchange |

| Preferred Stock, Series F | | AHT-PF | | New York Stock Exchange |

| Preferred Stock, Series G | | AHT-PG | | New York Stock Exchange |

| Preferred Stock, Series H | | AHT-PH | | New York Stock Exchange |

| Preferred Stock, Series I | | AHT-PI | | New York Stock Exchange |

EXPLANATORY NOTE: Pursuant to Item 9.01 of Form 8-K, this Current Report on Form 8-K/A amends the Registrant’s Current Report on Form 8-K filed on June 13, 2024, for the event dated June 10, 2024, to include the pro forma financial information required by Item 9.01 (b) of Form 8-K.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(b) Pro Forma Financial Information.

The unaudited pro forma financial information for Ashford Hospitality Trust, Inc. as of and for the three months ended March 31, 2024, and for the year ended December 31, 2023, is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

(d) Exhibits

Exhibit Number Description

104 Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ASHFORD HOSPITALITY TRUST, INC. |

| | |

| Dated: June 13, 2024 | By: | /s/ Deric S. Eubanks |

| | Deric S. Eubanks |

| | Chief Financial Officer |

On June 10, 2024, Ashford Hospitality Trust, Inc. (“Ashford Trust” or the “Company”) completed the sale of the 90-room SpringHill Suites Kennesaw and the 86-room Fairfield Inn Kennesaw located in Kennesaw, Georgia (collectively the “Hotel Group”) for $17.1 million in cash, net of selling expenses. Additionally, the Company repaid approximately $10.9 million on the mortgage loan secured by the Hotel Group.

The following unaudited pro forma financial information of the Company, as of and for the three months ended March 31, 2024 and for the year ended December 31, 2023 has been prepared for informational purposes only and does not purport to be indicative of what would have resulted had the disposition occurred on the date indicated or what may result in the future. The unaudited pro forma consolidated balance sheet assumes the disposition closed on March 31, 2024. The unaudited pro forma consolidated statements of operations for the year ended December 31, 2023, and the three months ended March 31, 2024, assume the disposition closed on January 1, 2023. The unaudited pro forma financial information of the Company reflects the removal of the assets and liabilities of the Hotel Group and its results of operations, which contains a non-recurring gain associated with the disposition of the hotel properties. The pro forma gain resulting from the disposition of the Hotel Group is preliminary. Therefore, the actual results may differ from the amounts reflected in the pro forma financial statements. There are no other non-recurring items associated with the transaction.

ASHFORD HOSPITALITY TRUST, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

March 31, 2024

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Ashford Trust Consolidated

Historical (A) | | Hotel Group (B) | | Adjustments | | Ashford Trust

Consolidated

Pro Forma |

| ASSETS | | | | | | | |

| | | | | | | |

| | | | | | | |

| Investments in hotel properties, net ($129,063 attributable to VIEs). | $ | 2,538,470 | | | $ | 7,619 | | | $ | — | | | $ | 2,530,851 | |

| Contract asset | 378,160 | | | — | | | — | | | 378,160 | |

| Cash and cash equivalents ($3,675 attributable to VIEs) | 111,065 | | | 345 | | | 17,111 | | (C) (i) | 117,360 | |

| | | | | 410 | | (C) (i) | |

| | | | | (10,881) | | (C) (ii) | |

| Restricted cash ($9,600 attributable to VIEs) | 132,949 | | | 298 | | | — | | | 132,651 | |

| | | | | | | |

| Accounts receivable, net of allowance ($218 attributable to VIEs) | 56,041 | | | 110 | | | — | | | 55,931 | |

| Inventories ($4 attributable to VIEs) | 3,754 | | | 4 | | | — | | | 3,750 | |

| Notes receivable, net | 9,642 | | | — | | | — | | | 9,642 | |

| | | | | | | |

| | | | | | | |

| Investments in unconsolidated entities | 9,426 | | | — | | | — | | | 9,426 | |

| | | | | | | |

| | | | | | | |

| Deferred costs, net ($206 attributable to VIEs) | 1,750 | | | 31 | | | — | | | 1,719 | |

| Prepaid expenses ($867 attributable to VIEs) | 22,133 | | | 121 | | | — | | | 22,012 | |

| Derivative assets | 12,398 | | | — | | | — | | | 12,398 | |

| Operating lease right-of-use assets | 43,975 | | | — | | | — | | | 43,975 | |

| Other assets ($1,645 attributable to VIEs) | 18,948 | | | 1 | | | — | | | 18,947 | |

| Intangible assets | 797 | | | — | | | — | | | 797 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Due from third-party hotel managers | 23,531 | | | — | | | — | | | 23,531 | |

| Assets held for sale | 176,178 | | | — | | | — | | | 176,178 | |

| Total assets | $ | 3,539,217 | | | $ | 8,529 | | | $ | 6,640 | | | $ | 3,537,328 | |

| LIABILITIES AND EQUITY/DEFICIT | | | | | | | |

| Liabilities: | | | | | | | |

| Indebtedness, net ($70,546 attributable to VIEs) | $ | 2,934,894 | | | $ | 10,871 | | | $ | — | | | $ | 2,924,023 | |

| Debt associated with hotels in receivership | 355,120 | | | — | | | — | | | 355,120 | |

| Finance lease liability | 18,387 | | | — | | | — | | | 18,387 | |

| Other finance liability ($26,908 attributable to VIEs) | 26,908 | | | — | | | — | | | 26,908 | |

| Accounts payable and accrued expenses ($12,582 attributable to VIEs) | 130,613 | | | 477 | | | — | | | 130,136 | |

| Accrued interest payable ($520 attributable to VIEs) | 12,511 | | | 45 | | | — | | | 12,466 | |

| Accrued interest associated with hotels in receivership | 23,040 | | | — | | | — | | | 23,040 | |

| Dividends and distributions payable ($1 attributable to VIEs) | 3,651 | | | — | | | — | | | 3,651 | |

| | | | | | | |

| Due to Ashford Inc., net ($3,553 attributable to VIEs) | 9,732 | | | (4) | | | — | | | 9,736 | |

| | | | | | | |

| Due to related parties, net ($48 attributable to VIEs) | 2,003 | | | (49) | | | — | | | 2,052 | |

| Due to third-party hotel managers ($122 attributable to VIEs) | 1,487 | | | — | | | — | | | 1,487 | |

| Intangible liabilities, net | 2,005 | | | — | | | — | | | 2,005 | |

| Operating lease liabilities | 44,661 | | | — | | | — | | | 44,661 | |

| | | | | | | |

| Other liabilities | 3,443 | | | — | | | — | | | 3,443 | |

| Liabilities related to assets held for sale | 101,720 | | | — | | | — | | | 101,720 | |

| Total liabilities | 3,670,175 | | | 11,340 | | | — | | | 3,658,835 | |

| Commitments and contingencies | | | | | | | |

| Redeemable noncontrolling interests in operating partnership | 22,300 | | | — | | | — | | | 22,300 | |

| Series J Redeemable Preferred Stock, $0.01 par value, 4,353,135 shares issued and outstanding at March 31, 2024 | 100,192 | | | — | | | — | | | 100,192 | |

| Series K Redeemable Preferred Stock, $0.01 par value, 262,060 shares issued and outstanding at March 31, 2024 | 6,434 | | | — | | | — | | | 6,434 | |

| Equity (deficit): | | | | | | | |

| Preferred stock, $0.01 par value, 50,000,000 shares authorized: | | | | | | | |

| Series D Cumulative Preferred Stock, 1,159,927 shares issued and outstanding at March 31, 2024 | 12 | | | — | | | — | | | 12 | |

| Series F Cumulative Preferred Stock, 1,104,344 shares issued and outstanding at March 31, 2024 | 11 | | | — | | | — | | | 11 | |

| Series G Cumulative Preferred Stock, 1,531,996 shares issued and outstanding at March 31, 2024 | 15 | | | — | | | — | | | 15 | |

| Series H Cumulative Preferred Stock, 1,099,325 shares issued and outstanding at March 31, 2024 | 11 | | | — | | | — | | | 11 | |

| Series I Cumulative Preferred Stock, 1,143,923 shares issued and outstanding at March 31, 2024 | 11 | | | — | | | — | | | 11 | |

| Common stock, $0.01 par value, 400,000,000 shares authorized, 40,167,334 shares issued and outstanding at March 31, 2024 | 402 | | | — | | | — | | | 402 | |

| Additional paid-in capital | 2,383,814 | | | (2,811) | | | 7,650 | | (C) (i) | 2,383,814 | |

| | | | | 410 | | (C) (i) | |

| | | | | (10,871) | | (C) (ii) | |

| Accumulated deficit | (2,661,080) | | | — | | | 9,461 | | (C) (i) | (2,651,629) | |

| | | | | (10) | | (C) (ii) | |

| Total stockholders’ equity (deficit) of the Company | (276,804) | | | (2,811) | | | 6,640 | | | (267,353) | |

| Noncontrolling interest in consolidated entities | 16,920 | | | — | | | — | | | 16,920 | |

| Total equity (deficit) | (259,884) | | | (2,811) | | | 6,640 | | | (250,433) | |

| Total liabilities and equity/deficit | $ | 3,539,217 | | | $ | 8,529 | | | $ | 6,640 | | | $ | 3,537,328 | |

See accompanying notes.

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

(A)Represents the historical consolidated balance sheet of Ashford Trust as of March 31, 2024, as reported in its Quarterly Report on Form 10-Q, filed on May 9, 2024.

(B)Represents the removal of the historical balance sheet of the Hotel Group as of March 31, 2024.

(C)Represents adjustments for Ashford Trust’s disposition of the Hotel Group as of March 31, 2024, which includes: (i) an adjustment for the cash consideration received of $17.1 million, net of selling expenses and cash received for hotel net working capital; and (ii) the cash paid to repay the mortgage loan secured by the Hotel Group.

ASHFORD HOSPITALITY TRUST, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

Year Ended December 31, 2023

(in thousands, except share and per share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ashford Trust Consolidated

Historical (A) | | Hotel Group (B) | | Adjustments | | | | | | | | Ashford Trust

Consolidated

Pro Forma |

| REVENUE | | | | | | | | | | | | | |

| Rooms | $ | 1,059,155 | | | $ | 5,741 | | | $ | — | | | | | | | | | $ | 1,053,414 | |

| Food and beverage | 232,829 | | | — | | | — | | | | | | | | | 232,829 | |

| Other hotel revenue | 72,748 | | | 134 | | | — | | | | | | | | | 72,614 | |

| Total hotel revenue | 1,364,732 | | | 5,875 | | | — | | | | | | | | | 1,358,857 | |

| Other | 2,801 | | | — | | | — | | | | | | | | | 2,801 | |

| Total revenue | 1,367,533 | | | 5,875 | | | — | | | | | | | | | 1,361,658 | |

| EXPENSES | | | | | | | | | | | | | |

| Hotel operating expenses: | | | | | | | | | | | | | |

| Rooms | 249,434 | | | 1,334 | | | — | | | | | | | | | 248,100 | |

| Food and beverage | 161,300 | | | — | | | — | | | | | | | | | 161,300 | |

| Other expenses | 464,058 | | | 2,555 | | | — | | | | | | | | | 461,503 | |

| Management fees | 50,645 | | | 396 | | | — | | | | | | | | | 50,249 | |

| Total hotel expenses | 925,437 | | | 4,285 | | | — | | | | | | | | | 921,152 | |

| Property taxes, insurance and other | 70,226 | | | 217 | | | — | | | | | | | | | 70,009 | |

| Depreciation and amortization | 187,807 | | | 941 | | | — | | | | | | | | | 186,866 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Advisory services fee | 48,927 | | | — | | | — | | | | | | | | | 48,927 | |

| Corporate, general and administrative | 16,181 | | | — | | | — | | | | | | | | | 16,181 | |

| Total operating expenses | 1,248,578 | | | 5,443 | | | — | | | | | | | | | 1,243,135 | |

| Gain (loss) on consolidation of VIE and disposition of assets | 11,488 | | | — | | | 9,461 | | | | | | | | (C) (i) | 20,949 | |

| OPERATING INCOME (LOSS) | 130,443 | | | 432 | | | 9,461 | | | | | | | | | 139,472 | |

| Equity in earnings (loss) of unconsolidated entities | (1,134) | | | — | | | — | | | | | | | | | (1,134) | |

| Interest income | 8,978 | | | — | | | — | | | | | | | | | 8,978 | |

| Other income (expense) | 310 | | | — | | | — | | | | | | | | | 310 | |

| Interest expense and amortization of discounts and loan costs | (366,148) | | | (572) | | | — | | | | | | | | | (365,576) | |

| Write-off of premiums, loan costs and exit fees | (3,469) | | | — | | | (10) | | | | | | | | (C) (ii) | (3,479) | |

| Gain (loss) on extinguishment of debt | 53,386 | | | — | | | — | | | | | | | | | 53,386 | |

| | | | | | | | | | | | | |

| Realized and unrealized gain (loss) on derivatives | (2,200) | | | — | | | — | | | | | | | | | (2,200) | |

| INCOME (LOSS) BEFORE INCOME TAXES | (179,834) | | | (140) | | | 9,451 | | | | | | | | | (170,243) | |

| Income tax (expense) benefit | (900) | | | — | | | — | | | | | | | | | (900) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| NET INCOME (LOSS) | (180,734) | | | (140) | | | 9,451 | | | | | | | | | (171,143) | |

| (Income) loss attributable to noncontrolling interest in consolidated entities | 6 | | | — | | | — | | | | | | | | | 6 | |

| Net (income) loss attributable to redeemable noncontrolling interests in operating partnership | 2,239 | | | — | | | (118) | | | | | | | | (C) (iii) | 2,121 | |

| NET INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY | (178,489) | | | (140) | | | 9,333 | | | | | | | | | (169,016) | |

| Preferred dividends | (15,921) | | | — | | | — | | | | | | | | | (15,921) | |

| Deemed dividends on redeemable preferred stock | (2,673) | | | — | | | — | | | | | | | | | (2,673) | |

| Gain (loss) on extinguishment of preferred stock | 3,390 | | | — | | | — | | | | | | | | | 3,390 | |

| NET INCOME (LOSS) ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | (193,693) | | | $ | (140) | | | $ | 9,333 | | | | | | | | | $ | (184,220) | |

| INCOME (LOSS) PER SHARE - BASIC: | | | | | | | | | | | | | |

| Net income (loss) attributable to common stockholders | $ | (5.61) | | | | | | | | | | | | | $ | (5.34) | |

| Weighted average common shares outstanding—basic | 34,523 | | | | | | | | | | | | | 34,523 | |

| INCOME (LOSS) PER SHARE - DILUTED: | | | | | | | | | | | | | |

| Net income (loss) attributable to common stockholders | $ | (5.61) | | | | | | | | | | | | | $ | (5.34) | |

| Weighted average common shares outstanding—diluted | 34,523 | | | | | | | | | | | | | 34,523 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

See accompanying notes.

ASHFORD HOSPITALITY TRUST, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

Three Months Ended March 31, 2024

(in thousands, except share and per share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ashford Trust Consolidated

Historical (A) | | Hotel Group (B) | | | | Adjustments | | Ashford Trust

Consolidated

Pro Forma |

| REVENUE | | | | | | | | | |

| Rooms | $ | 229,207 | | | $ | 1,217 | | | | | $ | — | | | $ | 227,990 | |

| Food and beverage | 57,358 | | | — | | | | | — | | | 57,358 | |

| Other hotel revenue | 16,692 | | | 32 | | | | | — | | | 16,660 | |

| Total hotel revenue | 303,257 | | | 1,249 | | | | | — | | | 302,008 | |

| Other | 639 | | | — | | | | | — | | | 639 | |

| Total revenue | 303,896 | | | 1,249 | | | | | — | | | 302,647 | |

| EXPENSES | | | | | | | | | |

| Hotel operating expenses: | | | | | | | | | |

| Rooms | 54,680 | | | 312 | | | | | — | | | 54,368 | |

| Food and beverage | 37,831 | | | — | | | | | — | | | 37,831 | |

| Other expenses | 106,826 | | | 612 | | | | | — | | | 106,214 | |

| Management fees | 11,550 | | | 101 | | | | | — | | | 11,449 | |

| Total hotel expenses | 210,887 | | | 1,025 | | | | | — | | | 209,862 | |

| Property taxes, insurance and other | 17,364 | | | 66 | | | | | — | | | 17,298 | |

| Depreciation and amortization | 40,544 | | | 226 | | | | | — | | | 40,318 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Advisory services fee | 15,201 | | | — | | | | | — | | | 15,201 | |

| Corporate, general and administrative | 8,272 | | | — | | | | | — | | | 8,272 | |

| Total operating expenses | 292,268 | | | 1,317 | | | | | — | | | 290,951 | |

| Gain (loss) on disposition of assets and hotel properties | 6,956 | | | — | | | | | — | | | 6,956 | |

| Gain (loss) on derecognition of assets | 133,909 | | | — | | | | | — | | | 133,909 | |

| OPERATING INCOME (LOSS) | 152,493 | | | (68) | | | | | — | | | 152,561 | |

| Equity in earnings (loss) of unconsolidated entities | (534) | | | — | | | | | — | | | (534) | |

| Interest income | 1,984 | | | — | | | | | — | | | 1,984 | |

| Other income (expense) | 36 | | | — | | | | | — | | | 36 | |

| Interest expense and amortization of discounts and loan costs | (73,961) | | | (141) | | | | | — | | | (73,820) | |

| Interest expense associated with hotels in receivership | (12,098) | | | — | | | | | — | | | (12,098) | |

| Write-off of premiums, loan costs and exit fees | (18) | | | — | | | | | — | | | (18) | |

| Gain (loss) on extinguishment of debt | 45 | | | — | | | | | — | | | 45 | |

| | | | | | | | | |

| Realized and unrealized gain (loss) on derivatives | 4,761 | | | — | | | | | — | | | 4,761 | |

| INCOME (LOSS) BEFORE INCOME TAXES | 72,708 | | | (209) | | | | | — | | | 72,917 | |

| Income tax (expense) benefit | (303) | | | — | | | | | — | | | (303) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| NET INCOME (LOSS) | 72,405 | | | (209) | | | | | — | | | 72,614 | |

| (Income) loss attributable to noncontrolling interest in consolidated entities | 9 | | | — | | | | | — | | | 9 | |

| Net (income) loss attributable to redeemable noncontrolling interests in operating partnership | (853) | | | — | | | | | 3 | | (C) (iii) | (850) | |

| NET INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY | 71,561 | | | (209) | | | | | 3 | | | 71,773 | |

| Preferred dividends | (5,011) | | | — | | | | | — | | | (5,011) | |

| Deemed dividends on redeemable preferred stock | (682) | | | — | | | | | — | | | (682) | |

| Gain (loss) on extinguishment of preferred stock | 1,573 | | | — | | | | | — | | | 1,573 | |

| NET INCOME (LOSS) ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | 67,441 | | | $ | (209) | | | | | $ | 3 | | | $ | 67,653 | |

| Income (loss) per share – basic: | | | | | | | | | |

| Income (loss) attributable to common stockholders | $ | 1.74 | | | | | | | | | $ | 1.75 | |

| Weighted average common shares outstanding—basic | 38,458 | | | | | | | | | 38,458 | |

| Income (loss) per share – diluted: | | | | | | | | | |

| Income (loss) attributable to common stockholders | $ | 0.60 | | | | | | | | | $ | 0.60 | |

| Weighted average common shares outstanding—diluted | 116,729 | | | | | | | | | 116,729 | |

| | | | | | | | | |

| | | | | | | | | |

See accompanying notes.

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(A)Represents the historical consolidated statement of operations of Ashford Trust for the year ended December 31, 2023, as reported in its Annual Report on Form 10-K for the year ended December 31, 2023, filed on March 14, 2024 and the historical consolidated statement of operations of Ashford Trust for the three months ended March 31, 2024, as reported in its Quarterly Report on Form 10-Q, filed on May 9, 2024.

(B)Represents the removal of the historical consolidated statements of operations of the Hotel Group for the year ended December 31, 2023, and the three months ended March 31, 2024.

(C)Represents adjustments for the Company’s sale of the Hotel Group, which includes: (i) the estimated non-recurring gain on the disposition of the Hotel Group for the year ended December 31, 2023; (ii) an adjustment for the write-off of deferred loan costs for the year ended December 31, 2023, and (iii) the net (income) loss allocated to redeemable noncontrolling interests in operating partnership related to the disposition of the Hotel Group, including the estimated non-recurring income for the year ended December 31, 2023, based on an ownership percentage of 1.27% for the year ended December 31, 2023 and 1.25% for the three months ended March 31, 2024. There is no estimated tax effect of the hotel no longer being part of the consolidated group for the year ended December 31, 2023 and the three months ended March 31, 2024. The pro forma gain resulting from the disposition of the Hotel Group is preliminary. The actual results may differ from the amounts reflected in the pro forma financial statements.

v3.24.1.1.u2

Document and Entity Information

|

Jun. 10, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Jun. 10, 2024

|

| Entity Registrant Name |

ASHFORD HOSPITALITY TRUST, INC.

|

| Entity Central Index Key |

0001232582

|

| Amendment Flag |

true

|

| Amendment Description |

Pursuant to Item 9.01 of Form 8-K, this Current Report on Form 8-K/A amends the Registrant’s Current Report on Form 8-K filed on June 13, 2024, for the event dated June 10, 2024, to include the pro forma financial information required by Item 9.01 (b) of Form 8-K.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-31775

|

| Entity Tax Identification Number |

86-1062192

|

| Entity Address, Address Line One |

14185 Dallas Parkway, Suite 1200

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75254

|

| City Area Code |

972

|

| Local Phone Number |

490-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AHT

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series D |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series D

|

| Trading Symbol |

AHT-PD

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series F |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series F

|

| Trading Symbol |

AHT-PF

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series G |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series G

|

| Trading Symbol |

AHT-PG

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series H |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series H

|

| Trading Symbol |

AHT-PH

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series I |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series I

|

| Trading Symbol |

AHT-PI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aht_SeriesIPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

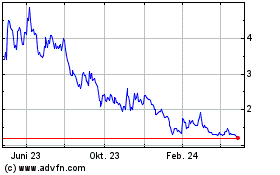

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

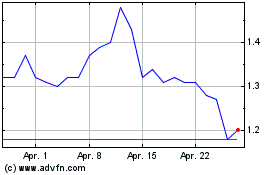

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024