Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 Juni 2023 - 12:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2023.

Commission File Number 001-10882

Aegon N.V.

Aegonplein 50

P.O. Box 85

2501 CB The Hague

The

Netherlands

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

The Unaudited Pro Forma Financial Information and notes thereto of Aegon N.V. (the “Company”) herein are hereby incorporated by reference in the

Company’s Registration Statements under the Securities Act of 1933, as amended, on Form F-3 (Registration No. 333-240037) and on Form S-8 (Registration Nos. 333-238186, 333-196156, 333-183176, 333-157843, and

333-150774).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Aegon N.V. |

|

|

|

|

| Date: June 30, 2023 |

|

|

|

By: |

|

/s/ J.H.P.M. van Rossum |

|

|

|

|

|

|

J.H.P.M. van Rossum |

|

|

|

|

|

|

Head of Corporate Financial Center |

Pro forma financial information of Aegon N.V. relating to the proposed disposition of the

Aegon NL businesses in the ASR transaction

As of and for the year ended

December 31, 2022

Introductory paragraph

The pro forma financial information presented below reflects the pro forma impact on Aegon N.V.’s (Aegon) consolidated financial statements of the

disposition (the ASR transaction) to ASR Nederland N.V., a publicly traded company on Euronext Amsterdam (a.s.r.), of Aegon’s Dutch pension, life and non-life insurance, banking and mortgage origination

activities (Aegon NL) that was announced on October 27, 2022. In connection with such disposition, Aegon will receive EUR 2.2 billion in gross cash proceeds and a 29.99% strategic equity stake in a.s.r. ordinary shares, with associated

governance rights. Aegon’s Dutch asset management activities will remain part of Aegon’s global asset manager. Aegon will enter into a long-term asset management agreement with a.s.r. to manage parts of the combination’s general

account investments, the investments of the Premium Pension Institution (PPI) offering of Aegon Cappital, and a.s.r.’s mortgage funds. Aegon’s Extraordinary Meeting of Shareholders (EGM) approved the ASR transaction on January 17,

2023. Furthermore, the works council of Aegon has rendered a positive recommendation in relation to the ASR transaction. The ASR transaction is subject to customary closing conditions, including regulatory and antitrust approvals, and is expected to

close in the second half of 2023.

The assets and liabilities of Aegon NL were classified, for purposes of Aegon’s consolidated financial statements

included in its 2022 Annual Report on Form 20-F and filed with the U.S. Securities and Exchange Commission (SEC) on March 22, 2023, as held for sale and discontinued operations.

The pro forma financial information below presents Aegon N.V.’s consolidated financial information as of and for the year ended December 31, 2022,

on a pro forma basis, excluding Aegon NL as if the ASR transaction had been consummated as of January 1, 2022. The pro forma financial information is presented in EUR millions.

Further information on the pro forma adjustments can be found in the notes to this pro forma financial information.

1

Pro forma Condensed consolidated statement of comprehensive income of Aegon N.V.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

For the year ended

December 31, 2022 |

|

| EUR millions |

|

Note |

|

|

Historical |

|

|

Pro forma

adjustments |

|

|

Pro forma

(unaudited) |

|

| Net result from continuing and discontinued operations |

|

|

1 |

|

|

|

(1,404 |

) |

|

|

(178 |

) |

|

|

(1,582 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items that will not be reclassified to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in revaluation reserve real estate held for own use |

|

|

|

|

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

| Remeasurements of defined benefit plans |

|

|

|

|

|

|

(43 |

) |

|

|

— |

|

|

|

(43 |

) |

| Income tax relating to items that will not be reclassified |

|

|

|

|

|

|

(4 |

) |

|

|

— |

|

|

|

(4 |

) |

| Discontinued operations that will not be reclassified |

|

|

2 |

|

|

|

703 |

|

|

|

(703 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items that may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gains / (losses) on revaluation of

available-for-sale investments |

|

|

|

|

|

|

(13,061 |

) |

|

|

— |

|

|

|

(13,061 |

) |

| Gains / (losses) transferred to income statement on disposal and impairment of available-for-sale investments |

|

|

|

|

|

|

557 |

|

|

|

— |

|

|

|

557 |

|

| Changes in cash flow hedging reserve |

|

|

|

|

|

|

(192 |

) |

|

|

— |

|

|

|

(192 |

) |

| Movement in foreign currency translation and net foreign investment hedging reserves |

|

|

|

|

|

|

1,072 |

|

|

|

— |

|

|

|

1,072 |

|

| Equity movements of joint ventures |

|

|

|

|

|

|

(63 |

) |

|

|

— |

|

|

|

(63 |

) |

| Equity movements of associates |

|

|

|

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

| Disposal of group assets |

|

|

|

|

|

|

164 |

|

|

|

— |

|

|

|

164 |

|

| Income tax relating to items that may be reclassified |

|

|

|

|

|

|

2,710 |

|

|

|

— |

|

|

|

2,710 |

|

| Discontinued operations that may be reclassified |

|

|

3 |

|

|

|

(1,426 |

) |

|

|

1,426 |

|

|

|

— |

|

| Other |

|

|

|

|

|

|

38 |

|

|

|

— |

|

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other comprehensive income/ (loss) |

|

|

|

|

|

|

(9,545 |

) |

|

|

723 |

|

|

|

(8,823 |

) |

| Total comprehensive income/ (loss) |

|

|

|

|

|

|

(10,950 |

) |

|

|

545 |

|

|

|

(10,405 |

) |

| Total comprehensive income/ (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Owners of Aegon N.V. |

|

|

|

|

|

|

(10,991 |

) |

|

|

545 |

|

|

|

(10,446 |

) |

| Non-controlling interests |

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

Pro forma Condensed consolidated statement of financial position of Aegon N.V.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

As of

December 31, 2022 |

|

| EUR millions |

|

Note |

|

|

Historical |

|

|

Pro forma

adjustments |

|

|

Pro forma

(unaudited) |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

4 |

|

|

|

3,407 |

|

|

|

2,368 |

|

|

|

5,775 |

|

| Assets held for sale |

|

|

5 |

|

|

|

89,752 |

|

|

|

(89,752 |

) |

|

|

— |

|

| Investments |

|

|

|

|

|

|

76,825 |

|

|

|

— |

|

|

|

76,825 |

|

| Investments for account of policyholders |

|

|

|

|

|

|

180,006 |

|

|

|

— |

|

|

|

180,006 |

|

| Derivatives |

|

|

|

|

|

|

2,760 |

|

|

|

— |

|

|

|

2,760 |

|

| Investments in joint ventures |

|

|

|

|

|

|

1,443 |

|

|

|

— |

|

|

|

1,443 |

|

| Investments in associates |

|

|

6 |

|

|

|

165 |

|

|

|

2,564 |

|

|

|

2,729 |

|

| Reinsurance assets |

|

|

|

|

|

|

21,184 |

|

|

|

— |

|

|

|

21,184 |

|

| Defined benefit assets |

|

|

|

|

|

|

87 |

|

|

|

— |

|

|

|

87 |

|

| Deferred tax assets |

|

|

|

|

|

|

1,827 |

|

|

|

— |

|

|

|

1,827 |

|

| Deferred expenses |

|

|

|

|

|

|

12,886 |

|

|

|

— |

|

|

|

12,886 |

|

| Other assets and receivables |

|

|

7 |

|

|

|

10,204 |

|

|

|

1,159 |

|

|

|

11,363 |

|

| Intangible assets |

|

|

|

|

|

|

1,240 |

|

|

|

— |

|

|

|

1,240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

|

|

|

|

401,786 |

|

|

|

(83,661 |

) |

|

|

318,125 |

|

| Equity and liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’ equity |

|

|

8 |

|

|

|

12,071 |

|

|

|

(557 |

) |

|

|

11,514 |

|

| Other equity instruments |

|

|

|

|

|

|

1,943 |

|

|

|

— |

|

|

|

1,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issued capital and reserves attributable to equity holders of Aegon N.V. |

|

|

|

|

|

|

14,014 |

|

|

|

(557 |

) |

|

|

13,457 |

|

| Non-controlling interests |

|

|

|

|

|

|

176 |

|

|

|

— |

|

|

|

176 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Group equity |

|

|

|

|

|

|

14,190 |

|

|

|

(557 |

) |

|

|

13,633 |

|

| Subordinated borrowings |

|

|

|

|

|

|

2,295 |

|

|

|

— |

|

|

|

2,295 |

|

| Trust pass-through securities |

|

|

|

|

|

|

118 |

|

|

|

— |

|

|

|

118 |

|

| Insurance contracts |

|

|

|

|

|

|

87,309 |

|

|

|

— |

|

|

|

87,309 |

|

| Insurance contracts for account of policyholders |

|

|

|

|

|

|

100,409 |

|

|

|

— |

|

|

|

100,409 |

|

| Investment contracts |

|

|

|

|

|

|

10,658 |

|

|

|

— |

|

|

|

10,658 |

|

| Investment contracts for account of policyholders |

|

|

|

|

|

|

80,555 |

|

|

|

— |

|

|

|

80,555 |

|

| Derivatives |

|

|

|

|

|

|

6,094 |

|

|

|

— |

|

|

|

6,094 |

|

| Borrowings |

|

|

|

|

|

|

4,051 |

|

|

|

— |

|

|

|

4,051 |

|

| Provisions |

|

|

|

|

|

|

99 |

|

|

|

— |

|

|

|

99 |

|

| Defined benefit liabilities |

|

|

|

|

|

|

496 |

|

|

|

— |

|

|

|

496 |

|

| Deferred gains |

|

|

|

|

|

|

9 |

|

|

|

— |

|

|

|

9 |

|

| Deferred tax liabilities |

|

|

|

|

|

|

4 |

|

|

|

— |

|

|

|

4 |

|

| Liabilities held for sale |

|

|

5 |

|

|

|

84,339 |

|

|

|

(84,339 |

) |

|

|

— |

|

| Other liabilities |

|

|

7 |

|

|

|

10,785 |

|

|

|

1,235 |

|

|

|

12,020 |

|

| Accruals |

|

|

|

|

|

|

373 |

|

|

|

— |

|

|

|

373 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

|

|

|

|

387,596 |

|

|

|

(83,104 |

) |

|

|

304,492 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity and liabilities |

|

|

|

|

|

|

401,786 |

|

|

|

(83,661 |

) |

|

|

318,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

Notes to the pro forma Condensed financial statements adjustments

(all EUR amounts in millions except per share amounts)

| |

1. |

Adjustment to “Net result from continuing and discontinued operations” |

This adjustment of (€178) relates to mainly

| |

• |

|

The exclusion of the net result from discontinued operations of €379, and |

the inclusion of the remaining impairment (€941) to be recognized upon the completion of the sale of Aegon NL. Refer to page 126

“Consolidated income statement of Aegon N.V.” of the 2022 Annual Report on Form 20-F and to Note 51 “Discontinued operations” on page 288 of the 2022 Annual Report on Form 20-F.

| |

• |

|

The inclusion of the fair value adjustment of a.s.r. as of January 1, 2022 of (€136), reflecting a

lower share price as of January 1, 2022 compared to December 31, 2022. The valuation of Aegon’s 29.99% strategic equity stake in a.s.r. ordinary shares will be dependent on the actual share price of these shares, listed on the

Euronext stock exchange in Amsterdam, at the closing date of the transaction. For purposes of this pro forma financial information, which assumes the transaction had been consummated as of January 1, 2022, a share price of €40.50 per

ordinary share has been used. The closing share price on June 16, 2023 was €38.58 per ordinary share. |

| |

• |

|

The inclusion of the fair value adjustment of Aegon NL as of January 1, 2022 of €327 reflecting a lower

book value of Aegon NL as of January 1, 2022 compared to December 31, 2022. |

| |

• |

|

The inclusion of the 2022 result of the share in the associate a.s.r. assumed to reflect the dividends paid in

2022 by a.s.r. amounting to €163. |

No adjustment has been made for possible stranded cost – head-office cost

that were previously recharged to Aegon NL for services provided to these businesses.

The long-term asset management agreement between

Aegon and a.s.r. as part of the transaction is expected to lead to an immaterial benefit to the earnings of Aegon N.V. For the purpose of this document, we have assumed that the additional asset management mandates obtained by Aegon Asset Management

following this transaction lead to a zero impact on our results when considering the mandates lost from the completion of the transaction with a.s.r.

| |

2. |

Adjustment to “Discontinued operations that will not be reclassified” |

This adjustment of (€703) relates to the exclusion of the “other comprehensive income items that will not be reclassified to

profit or loss” of the discontinued operations. Refer to page 127 “Consolidated statement of comprehensive income of Aegon N.V.” of the 2022 Annual Report on Form 20-F.

| |

3. |

Adjustment to “Discontinued operations that may be reclassified” |

This adjustment of €1,426 relates to the exclusion of the “other comprehensive income items that may be reclassified subsequently to

profit or loss” of the discontinued operations. Refer to page 127 “Consolidated statement of comprehensive income of Aegon N.V.” of the 2022 Annual Report on Form 20-F.

| |

4. |

Adjustment to “Cash and cash equivalents” |

This adjustment of €2,368 relates to the non-discounted cash proceeds from a.s.r. relating to the

sale of Aegon NL. Refer to Note 51 “Discontinued operations” on page 288 of the 2022 Annual Report on Form 20-F. The amount of €2,175 which is shown in the Annual Report on Form 20-F has been adjusted for the purpose of these pro forma condensed financial statements to unwind the discounting of the cash receivable, as this discounting is not applicable for this pro forma financial

information and including the dividends that would have been received in 2022.

4

| |

5. |

Adjustment to “Assets held for sale” and “Liabilities held for sale” |

These adjustments of (€89,752) and (€84,339), relate to the exclusion of the “Assets held for sale” and the

“Liabilities held for sale” respectively of Aegon NL. Refer to page 128 “Consolidated statement of financial position of Aegon N.V.” of the 2022 Annual Report on Form 20-F.

| |

6. |

Adjustment to “Investments in associates” |

This adjustment of €2,564 relates to recognition of the 29.99% stake in a.s.r. which is part of the consideration received relating to the

sale of Aegon NL. The amount is calculated using the closing price on Euronext Amsterdam of a.s.r. shares on December 31, 2021. Refer to Note 51 “Discontinued operations” on page 288 of the 2022 Annual Report on Form 20-F. The amount of €2,700 which is shown in the 2022 Annual Report on Form 20-F has been adjusted for the purpose of these pro forma condensed financial statements to

adjust for the inclusion of the fair value adjustment of a.s.r. as of January 1, 2022 of (€136).

| |

7. |

Adjustment to “Other assets and receivables” and “Other liabilities” |

These adjustments of €1,159 and €1,235 to “Other assets and receivables” and “Other liabilities” respectively,

mainly relate to the recognition of positions between Aegon NL and other Aegon companies on the pro forma consolidated statement of financial position. In the historical financial statements, these intercompany positions were eliminated in the

consolidation process as at that time Aegon NL was considered an Aegon Group company.

| |

8. |

Adjustment to “Shareholders’ equity” |

This adjustment of (€557) relates to the inclusion of the remaining impairment to be recognized upon the completion of the sale of

Aegon NL of €941. Refer to Note 51 “Discontinued operations” on page 288 of the 2022 Annual Report on Form 20-F. The amount of €941 which is shown in the 2022 Annual Report on Form 20-F has been adjusted for the pro forma condensed financial statements to exclude, mainly, the items listed in note 1 above.

5

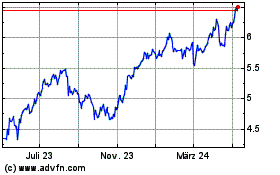

Aegon (NYSE:AEG)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

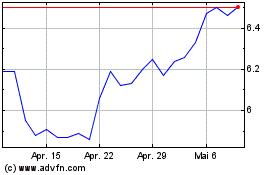

Aegon (NYSE:AEG)

Historical Stock Chart

Von Jan 2024 bis Jan 2025