The transaction extends Accel’s locals gaming footprint with

the purchase of the only active horse racing venue in the greater

St. Louis metropolitan area; including an Organization Gaming

License to offer casino gaming positions as well as a partnership

with FanDuel to participate in sport wagering in the state of

Illinois

- Purchasing Fairmount Holdings, Inc. (“Fairmount”), the owner of

the FanDuel Sportsbook & Racetrack for 3.45 million ACEL shares

(excluding adjustment for net working capital) from co-owners

William Stiritz, former CEO of Post Holdings and Ralston Purina,

and Robert Vitale, CEO and Chairman of Post Holdings

- Building on Accel’s strong distributed, ‘route-based’ platform

with advantaged, single-site locals gaming assets – one of two

active horse racing venues in Illinois and the only one in the

greater St. Louis/southern Illinois market

- Acquiring, a.) an active racetrack with 55 annual race days,

b.) an opportunity to develop a legislatively authorized casino

project and, c.) a master sports betting license used in a revenue

share agreement with FanDuel

- Supporting the mission of the Illinois Racing Board to enhance

the Illinois horse racing industry

- Implementing capital efficient plans to build Phase I and Phase

II casino facilities, improve the quality of horse racing

experience for both participants and fans, deliver an enhanced

F&B experience, and provide live entertainment

- Engaged with RRC Gaming Management LLC, including Tony Rodio,

former CEO of Caesars Entertainment, and Holly Gagnon, CEO of HGC

Gaming Hospitality and former CEO of several casino companies,

including the Seneca Gaming Corporation, for casino development and

operations

- Transaction is compelling first move in Local Gaming assets –

focused on convenience, with lower capex requirements and

competitive intensity, and leveraging Accel expertise in player

experience, cash logistics, regulatory compliance, and capital

allocation

Accel Entertainment, Inc. (NYSE: ACEL) and Fairmount

Holdings, Inc. today announced the successful closure of their

transaction where Accel has acquired the owner of the FanDuel

Sportsbook & Racetrack, for total consideration of

approximately 3.45 million shares of Accel Class A-1 common stock.

The strategic transaction adds a promising single site racetrack

and future casino to extend Accel’s convenience gaming expertise to

a larger and more concentrated form factor – an adjacency in locals

gaming that is complementary to Accel’s steadily growing,

route-based footprint.

During the year ended December 31, 2023, Fairmount generated $29

million of revenue and modest Adjusted EBITDA from the site’s

existing sportsbook, racetrack and 3 OTB locations. Accel plans to

invest $85-95 million to fund Phase I and then Phase II casino

construction and modest track investments. Accel’s five-year

forecast suggests an Adjusted EBITDA potential of $20 to $25

million and over 75% free cash flow conversion – pointing to a

compelling cash flow return on capital. The asset will be the

cornerstone in a local gaming platform that builds on Accel’s

capabilities and strengths as a leading route-based operator.

“We are excited to close the acquisition of Fairmount and eager

to refresh and revitalize an iconic racing and gaming asset. Our

plan and timeline are ambitious and achievable, and we look forward

to welcoming investors and visitors to our Phase I casino opening

in Q2, 2025,” said Andy Rubenstein, Accel co-founder, President,

CEO and Director.

Mark, Phelan, Accel’s President of U.S. Gaming added “Over the

past few months, our team has been hard at work. We’ve hired a

Casino General Manager, received approvals from both the Illinois

Gaming Board and Illinois Racing Board and finalized design and

development plans for the first phase of the casino.”

Compelling Strategic Rationale

- Natural Adjacency

- Accel’s organic and tuck-in M&A growth model has been

proven over 14 years, scaling route-based gaming in Illinois,

Louisiana, Montana, Nevada, Nebraska and Georgia

- Accel has built a deep expertise in player experience,

commercial partnerships, regulatory relationships and

procurement

- The acquisition of the FanDuel Sportsbook and Racetrack extends

route-based capabilities to a convenient single site for

locals

- The casino Accel’s developing targets consumer segments

adjacent to route-based gaming, owns the relationship with the

player and leverages partner expertise in real estate development,

food and beverage, and hospitality

- Attractive Return Profile

- The transaction has two parts – acquisition of Fairmount, the

holder of the license and underlying site assets, for approximately

3.45 million shares of Accel Class A-1 common stock, and $85-95

million of expected casino build out and track investments funded

from Accel’s revolver

- Projections of five-year adjusted EBITDA and robust free cash

flow conversion point to an attractive return on capital – in-line

with existing Accel’s route-based footprint

- Platform for Future Growth

- This transaction accesses a ‘locals gaming’ total addressable

market (“TAM”) estimated by Eilers & Krejcik to be ~$15 billion

in size

- Locals gaming assets remain largely unconsolidated, under

family or small business ownership and far less often contested by

larger gaming players

The transaction has been approved by Accel’s Board of Directors,

the Board of Directors and shareholders of Fairmount Holdings.

Wells Fargo acted as exclusive financial advisor and Lewis Rice LLC

acted as legal counsel to Fairmount Holdings in connection with the

transaction.

About Accel Accel is a leading distributed gaming

operator in the United States and a preferred partner for local

business owners in the markets it serves. Accel offers turnkey

full-service gaming solutions to authorized non-casino locations

such as bars, restaurants, convenience stores, truck stops, and

fraternal and veteran establishments across the country. Accel

installs, maintains, operates and services gaming terminals and

related equipment for its location partners as well as redemption

devices, stand-alone ATMs and amusement devices, including

jukeboxes, dartboards, pool tables, and other entertainment related

equipment. Accel also designs and manufactures gaming terminals and

related equipment.

Forward-Looking Statements This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements, other

than statements of historical fact, contained in this press release

are forward-looking statements, including, but not limited to, any

statements regarding the proposed acquisition, including statements

regarding the anticipated benefits of the acquisition, investment

and expansion plans, projected future results and market

opportunities, as well as our estimates of number of gaming

terminals, locations, revenues, Adjusted EBITDA and capital

expenditures, our ability to generate returns on capital and

improve our trading multiple. The words “predict,” “estimated,”

“anticipates,” “believes,” “estimates,” “expects,” “intends,”

“may,” “plans,” “projects,” “will,” “would,” “continue,” and

similar expressions or the negatives thereof are intended to

identify forward-looking statements. These forward-looking

statements represent our current reasonable expectations, as well

as assumptions made by, and information currently available to,

Accel regarding Fairmount, the acquisition or its anticipated

effects or benefits, and involve known and unknown risks,

uncertainties and other factors that may cause our or Fairmount’s

actual results, performance and achievements, or industry results,

to be materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. We cannot guarantee the accuracy of the forward-looking

statements, and you should be aware that results and events could

differ materially and adversely from those contained in the

forward-looking statements due to a number of factors including,

but not limited to: Accel’s ability to integrate Fairmount’s

operations with Accel’s own, to complete the casino development on

a timely basis and within budget, and to operate the race track and

casino businesses successfully; Accel’s ability to operate in

existing markets or expand into new jurisdictions; Accel’s ability

to offer new and innovative products and services that fulfill the

needs of location partners and create strong and sustained player

appeal; Accel’s dependence on relationships with key manufacturers,

developers and third parties to obtain gaming terminals, amusement

machines, and related supplies, programs, and technologies for its

business on acceptable terms; the negative impact on Accel’s future

results of operations by the slow growth in demand for gaming

terminals and by the slow growth of new gaming jurisdictions;

Accel’s heavy dependency on its ability to win, maintain and renew

contracts with location partners; unfavorable macroeconomic

conditions or decreased discretionary spending due to other factors

such as interest rate volatility, persistent inflation, actual or

perceived instability in the U.S. and global banking systems, high

fuel rates, recessions, epidemics or other public health issues,

terrorist activity or threat thereof, civil unrest or other

macroeconomic or political uncertainties, that could adversely

affect Accel’s business, results of operations, cash flows and

financial conditions, Accel’s ability to integrate, develop and

operate FanDuel Sportsbook & Racetrack and other risks and

uncertainties indicated from time to time in documents filed or to

be filed with the Securities and Exchange Commission (“SEC”).

Accordingly, forward-looking statements, including any

projections or analysis, should not be viewed as factual and should

not be relied upon as an accurate prediction of future results. The

forward-looking statements contained in this press release are

based on our current expectations and beliefs concerning future

developments and their potential effects on Accel. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond our control), or other assumptions that

may cause actual results or performance to be materially different

from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to, those factors described in the section entitled “Risk

Factors” in the Annual Report on Form 10-K for the fiscal year

ended December 31,2023 filed by Accel with the SEC on February 28,

2024 (the "Form 10-K"), as well as Accel’s other filings with the

SEC. Except as required by law, we do not undertake publicly to

update or revise these statements, even if experience or future

changes make it clear that any projected results expressed in this

or other press releases or future quarterly reports, or company

statements will not be realized. In addition, the inclusion of any

statement in this press release does not constitute an admission by

us that the events or circumstances described in such statement are

material. We qualify all of our forward-looking statements by these

cautionary statements. In addition, the industry in which we

operate is subject to a high degree of uncertainty and risk due to

a variety of factors including those described in the section

entitled “Risk Factors” in the Form 10-K, as well as Accel’s other

filings with the SEC. These and other factors could cause our

results to differ materially from those expressed in this press

release.

Non-GAAP Financial Information This press release

includes certain financial information not prepared in accordance

with Generally Accepted Accounting Principles in the United States

(“GAAP”), including Adjusted EBITDA, Free Cash Flow, and Net Debt.

EBITDA, Free Cash Flow and Net Debt are non-GAAP financial measures

and are key metrics used to monitor ongoing core operations.

Management of Accel believes such non-GAAP financial measures

enhance the understanding of Accel’s underlying drivers of

profitability and trends in Accel’s business and facilitates

company-to-company and period-to-period comparisons, because these

non-GAAP financial measures exclude the effects of certain non-cash

items, represents certain nonrecurring items that are unrelated to

core performance, or excludes non-core operations. Management of

Accel also believes that these non-GAAP financial measures are used

by investors, analysts and other interested parties as measures of

financial performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202466306/en/

Investors Mathew Ellis Chief Financial Officer Accel

Entertainment, Inc. 630-972-2235 ir@accelentertainment.com

Media Eric Bonach H/Advisors Abernathy 212-371-5999

eric.bonach@h-advisors.global

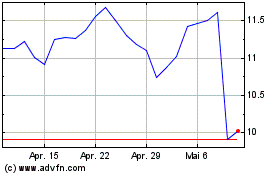

Accel Entertainment (NYSE:ACEL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

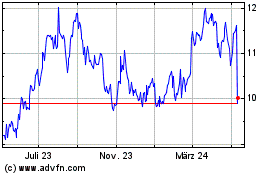

Accel Entertainment (NYSE:ACEL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024