Form 8-K - Current report

13 August 2024 - 10:15PM

Edgar (US Regulatory)

0000825313false00008253132024-08-122024-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 13, 2024 (August 12, 2024)

ALLIANCEBERNSTEIN HOLDING L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-09818 | 13-3434400 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

501 Commerce Street, Nashville, TN 37203

(Address of principal executive offices)

(Zip Code)

(615) 622-0000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on which Registered |

| Units rep. assignments of beneficial ownership of limited partnership interests in AB Holding | AB | NYSE |

Item 7.01. Regulation FD Disclosure.

AllianceBernstein L.P. (“AB”) and AllianceBernstein Holding L.P. are furnishing a news release (“AUM Release”) issued on August 12, 2024 announcing AB’s preliminary assets under management as of July 31, 2024. The AUM Release is attached hereto as Exhibit 99.01.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | ALLIANCEBERNSTEIN HOLDING L.P. |

| Dated: August 13, 2024 | | By: | /s/ Mark Manley |

| | | Mark Manley

Corporate Secretary |

| | | | | | | | |

| Mark Griffin, Investors 629.213.5672 mark.griffin@alliancebernstein.com | Carly Symington, Media 629.213.5568 carly.symington@alliancebernstein.com |

AB Announces July 31, 2024 Assets Under Management

Nashville, TN, August 12, 2024 - AllianceBernstein L.P. (“AB”) and AllianceBernstein Holding L.P. (“AB Holding”) (NYSE: AB) today announced that preliminary assets under management increased to $777 billion during July 2024 from $770 billion at the end of June. The 1% increase was driven by market appreciation, partially offset by net outflows. By channel, solid net inflows in Retail were offset by net outflows in Institutions, coupled with modest net outflows in Private Wealth.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AllianceBernstein L.P. (The Operating Partnership) |

Assets Under Management ($ in Billions) |

|

| At July 31, 2024 | | Jun 30, |

| | | 2024 |

| | | | | | | | | |

| | | | | Private | | | | |

| Institutions | | Retail | | Wealth | | Total | | Total |

| | | | | | | | | |

Equity | | | | | | | | | |

Actively Managed | $ | 56 | | | $ | 154 | | | $ | 54 | | | $ | 264 | | | $ | 264 | |

Passive | 24 | | | 38 | | | 5 | | | 67 | | | 66 | |

Total Equity | 80 | | | 192 | | | 59 | | | 331 | | | 330 | |

| | | | | | | | | |

Fixed Income | | | | | | | | | |

Taxable | 116 | | | 71 | | | 19 | | | 206 | | | 216 | |

Tax-Exempt | 2 | | | 37 | | | 29 | | | 68 | | | 67 | |

Passive | — | | | | 11 | | | — | | | | 11 | | | 11 | |

Total Fixed Income(2) | 118 | | | 119 | | | 48 | | | 285 | | | 294 | |

| | | | | | | | | |

Alternatives/Multi-Asset Solutions(1),(2) | 128 | | | 8 | | | 25 | | | 161 | | | 146 | |

Total | $ | 326 | | | $ | 319 | | | | 132 | | | | 777 | | | | 770 | |

| | | | | | | | | |

| | | | | | | | | |

| At June 30, 2024 | | |

| | | | | | | | | |

Total | $ | 323 | | | $ | 317 | | | $ | 130 | | | $ | 770 | | | |

| | | | | | | | | |

(1) Includes certain multi-asset solutions and services not included in equity or fixed income services. |

(2) $12 billion of Private Placements AUM was re-classified from Taxable Fixed Income to Alternatives/Multi-Asset, as of July 31, 2024 |

www.alliancebernstein.com 1 of 2

Cautions Regarding Forward-Looking Statements

Certain statements provided by management in this news release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. The most significant of these factors include, but are not limited to, the following: the performance of financial markets, the investment performance of sponsored investment products and separately-managed accounts, general economic conditions, industry trends, future acquisitions, integration of acquired companies, competitive conditions, and government regulations, including changes in tax regulations and rates and the manner in which the earnings of publicly-traded partnerships are taxed. AB cautions readers to carefully consider such factors. Further, such forward-looking statements speak only as of the date on which such statements are made; AB undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. For further information regarding these forward-looking statements and the factors that could cause actual results to differ, see “Risk Factors” and “Cautions Regarding Forward-Looking Statements” in AB’s Form 10-K for the year ended December 31, 2023 or form 10-Q for the quarter ended June 30, 2024. Any or all of the forward-looking statements made in this news release, Form 10-K, Form 10-Q, other documents AB files with or furnishes to the SEC and any other public statements issued by AB, may turn out to be wrong. It is important to remember that other factors besides those listed in “Risk Factors” and “Cautions Regarding Forward-Looking Statements”, and those listed above, could also adversely affect AB’s financial condition, results of operations and business prospects.

About AllianceBernstein

AllianceBernstein is a leading global investment management firm that offers diversified investment services to institutional investors, individuals and private wealth clients in major world markets.

As of June 30, 2024, including both the general partnership and limited partnership interests in AllianceBernstein, AllianceBernstein Holding owned approximately 39.6% of AllianceBernstein and Equitable Holdings, Inc. ("EQH"), directly and through various subsidiaries, owned an approximate 61.1% economic interest in AllianceBernstein.

Additional information about AB may be found on our website, www.alliancebernstein.com.

www.alliancebernstein.com 2 of 2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

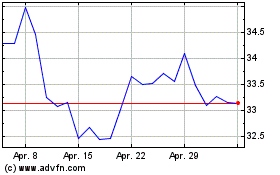

AllianceBernstein (NYSE:AB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

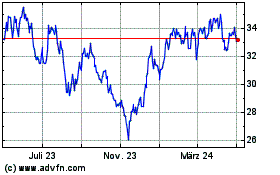

AllianceBernstein (NYSE:AB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025