Ninepoint Partners Announces April 2024 Cash Distributions for ETF Series Securities

23 April 2024 - 8:55PM

Ninepoint Partners LP (“Ninepoint Partners”) today announced the

April 2024 cash distributions for its ETF Series securities. The

record date for the distributions is April 30, 2024 for Ninepoint

High Interest Savings Fund and May 1, 2024 for Ninepoint

Diversified Bond Fund, Ninepoint Alternative Credit Opportunities

Fund, Ninepoint Energy Income Fund and Ninepoint Target Income

Fund. All distributions are payable on May 8, 2024.

The per-unit April distributions are detailed below:

|

Ninepoint ETF Series |

Ticker |

Distribution per unit |

Notional Distribution per unit |

CUSIP |

|

Ninepoint Diversified Bond Fund |

NBND |

$0.04965 |

$0.00000 |

65443H100 |

|

Ninepoint High Interest Savings Fund |

NSAV |

$0.17002 |

$0.00000 |

65443X105 |

|

Ninepoint Alternative Credit Opportunities Fund |

NACO |

$0.09323 |

$0.00000 |

65443Q100 |

|

Ninepoint Energy Income Fund |

NRGI |

$0.11865 |

$0.00000 |

65444A104 |

|

Ninepoint Target Income Fund |

TIF |

$0.10068 |

$0.00000 |

65446C108 |

About Ninepoint Partners

Based in Toronto, Ninepoint Partners LP is one

of Canada’s leading alternative investment management firms

overseeing approximately $7 billion in assets under management and

institutional contracts. Committed to helping investors explore

innovative investment solutions that have the potential to enhance

returns and manage portfolio risk, Ninepoint offers a diverse set

of alternative strategies including Alternative Income and Real

Assets, in addition to North American and Global Equities.

For more information on Ninepoint Partners LP,

please visit www.ninepoint.com or please contact us at 416.362.7172

or 1.888.362.7172 or invest@ninepoint.com.

Ninepoint Partners LP is the investment manager

to the Ninepoint Funds (collectively, the “Funds”). Commissions,

trailing commissions, management fees, performance fees (if any),

and other expenses all may be associated with investing in the

Funds. Please read the prospectus carefully before investing. The

information contained herein does not constitute an offer or

solicitation by anyone in the United States or in any other

jurisdiction in which such an offer or solicitation is not

authorized or to any person to whom it is unlawful to make such an

offer or solicitation. Prospective investors who are not resident

in Canada should contact their financial advisor to determine

whether securities of the Fund may be lawfully sold in their

jurisdiction.

Please note that distribution factors (breakdown

between income, capital gains and return of capital) can only be

calculated when a fund has reached its year-end. Distribution

information should not be relied upon for income tax reporting

purposes as this is only a component of total distributions for the

year. For accurate distribution amounts for the purpose of filing

an income tax return, please refer to the appropriate T3/T5 slips

for that particular taxation year. Please refer to the prospectus

or offering memorandum of each Fund for details of the Fund’s

distribution policy.

The payment of distributions and distribution

breakdown, if applicable, is not guaranteed and may fluctuate. The

payment of distributions should not be confused with a Fund's

performance, rate of return, or yield. If distributions paid by the

Fund are greater than the performance of the Fund, then an

investor’s original investment will shrink. Distributions paid as a

result of capital gains realized by a Fund and income and dividends

earned by a Fund are taxable in the year they are paid. An

investor’s adjusted cost base will be reduced by the amount of any

returns of capital. If an investor’s adjusted cost base goes below

zero, then capital gains tax will have to be paid on the amount

below zero.

Sales Inquiries:

Ninepoint Partners LPNeil

Ross416-945-6227nross@ninepoint.com

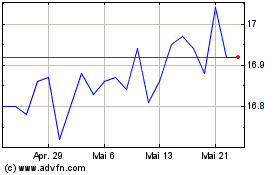

Ninepoint Alternative Cr... (NEO:NACO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Ninepoint Alternative Cr... (NEO:NACO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024