Base Carbon Inc. (Cboe CA: BCBN) (OTCQX: BCBNF) with operations

through its wholly-owned subsidiary, Base Carbon Capital Partners

Corp. (“

BCCPC”, together, with affiliates,

“

Base Carbon”, or the “

Company”),

is pleased to announce its year-end 2023 consolidated financial

results and operational highlights. All financial references are

denominated in U.S. dollars, unless otherwise noted.

Annual Corporate and Financial

Highlights as of December 31, 2023:

- Monetized 1.1

million carbon credits generated from the Vietnam household devices

project with aggregate contractual offtake proceeds of

approximately US$6.4 million, or C$0.072 per share1 during

2023.

- Rwanda

cookstoves project received Verra’s first ever corresponding

adjusted or “Article 6 Authorized Label” in December 2023. First

Article 6 Authorized Label tagged carbon credits anticipated to be

transferred to the Company during Q2 2024.

- Execution of a

Letter of Intent for a partnership with STX during December 2023,

to establish and launch an innovative fund for institutional

investors to participate in offtake supported high quality carbon

removal projects.

- In August 2023,

executed a project agreement for the India afforestation,

reforestation, and revegetation (ARR) project, a high-quality

nature-based carbon removal project.

- As of December

31, 2023, the Company had total assets of $141.2 million, including

$1.4 million in cash and cash equivalents, and $137.1 million in

investments into carbon credit projects.

“2023 was the milestone year in which Base

Carbon began to transition its project development portfolio to

production. During the year, our Company achieved a number of key

objectives including the first issuance, credit sale and ensuing

cash flow on our Vietnam project, continued measured capital

deployment into high-quality carbon projects managed by experienced

developers with the addition of our India project with project

partner, VNV, all while continuing our deep focus on underwriting

positive asymmetric risk-reward, with margin of safety through

diligence and structure, within the developing voluntary carbon

markets. In the near-term, during Q2 2024, we continue to

anticipate the next credit issuance from our Vietnam project and to

receive the first issuance of credits from our Rwanda project

tagged as being correspondingly adjusted credits with Verra’s

Article 6 Authorized Label,” stated Michael Costa, Chief Executive

Officer of Base Carbon.

Vietnam Household Devices Project

Update

The Company anticipates issuances of carbon

credits generated from the project during Q2 2024 to be sold to the

project offtaker pursuant to the fixed price offtake arrangement

consistent with the previous sales. BCCPC has deployed 92% of the

committed project capital with the remaining commitments, primarily

tied to project monitoring and verification activities, anticipated

to be fully deployed by year end 2024.

BCCPC expects to fully recover its deployed

project capital, as well as receive significant initial returns,

during 2024.

Rwanda Cookstoves Project

Update

The DelAgua Group was recently issued

approximately 815,000 carbon credits with respect to Base Carbon’s

250,000 cookstoves each tagged by Verra with the “Article 6

Authorized Label” or as correspondingly adjusted carbon

credits. BCCPC and the DelAgua Group are currently in

discussions with respect to the implementation of the letter of

authorization with the Government of Rwanda. It is currently

anticipated each carbon credit tagged with the “Article 6

Authorized Label” will be equal to approximately 1.14 carbon

credits for the purposes of the 7.5 million carbon credits subject

to the revenue sharing arrangement between the BCCPC and the

DelAgua Group. The Company believes that the correspondingly

adjusted carbon credits designation will expand the pool of buyers

with potential pricing upside for such carbon credits.

In aggregate, the Company expects to receive

approximately 2.1 million carbon credits, or 1.85 million

correspondingly adjusted carbon credits, from the Rwanda project

during 2024 for sale into the market according to the project

agreement and revenue sharing arrangement, pursuant to which BCCPC

maintains a contractual preferential share of proceeds from the

sale of such credits.

India Afforestation, Reforestation, and

Revegetation (ARR) Project Update

The Company, through BCCPC, executed a project

agreement with Value Network Ventures Advisory Services Pte Ltd. to

fund an expected $13.6 million related to the reforestation of

degraded rural farmlands in the northern Indian state of Uttar

Pradesh. The project's aim is to facilitate the planting of

approximately 6.5 million trees, from which it is expected 1.6

million high-quality nature-based removal carbon credits will be

generated over an expected 20-year project life.

As of March 31, 2024, Base Carbon has funded 32%

of the committed project capital with 5 million of the planned 6.5

million trees planted to date. The project’s registration with

Verra is currently on track for the end of 2024.

2023 Year-end Financial

Results

As of December 31, 2023, the Company had total

assets of $141.2 million, primarily comprised of $1.4 million in

cash and cash equivalents, $137.1 million in investments in carbon

credit projects, equity investments in ACX Holdings Ltd.

(AirCarbon) and Hardwick Climate Business Limited (HCBL) of $1.4

million and $0.6 million, respectively. The Company had total

liabilities of $6.6 million comprised primarily of deferred income

tax liabilities.

In 2023, the Company recorded a net profit of

$98.3 million, of which $111.1 million was due to gains on

investments in carbon credit projects, with $6.4 million and $104.7

million attributable to realized and unrealized gains,

respectively. Primary operating expenses in 2023 were attributable

to consulting fees ($1.3 million), professional fees ($1.2

million), salaries and wages ($2.1 million), and general and

administrative expenses ($0.7 million).

Pursuant to Base Carbon’s normal course issuer

bid program (NCIB), which was renewed on June 21, 2023, a total of

4,983,920 shares were purchased and cancelled during the year ended

December 31, 2023.

About Base Carbon

Base Carbon is a financier of projects involved

primarily in the global voluntary carbon markets. We endeavor to be

the preferred carbon project partner in providing capital and

management resources to carbon removal and abatement projects

globally and, where appropriate, will utilize technologies within

the evolving environmental industries to enhance efficiencies,

commercial credibility, and trading transparency. For more

information, please visit www.basecarbon.com.

Media and Investor

Inquiries

Base Carbon Inc.Investor RelationsTel: +1 647

952 3979E-mail: investorrelations@basecarbon.com

Media InquiriesE-mail: media@basecarbon.com

Cautionary Statement Regarding Forward

Looking Information

This press release contains “forward-looking

information” within the meaning of applicable securities laws

relating to the focus of Base Carbon’s business, the expected

issuance, and timing, of carbon credits, the application of Article

6 of the Paris Agreement and the “Article 6 Authorized Label” and

market reaction thereto, the receipt of proceeds from the

disposition of carbon credits, project registration and the

continued development of the India afforestation, reforestation,

and revegetation project and the future partnership with STX and

the launch of an innovative investment vehicle. In some cases, but

not necessarily in all cases, forward-looking information may be

identified by the use of forward-looking terminology such as

“expects”, “anticipates”, “intends”, “contemplates”, “believes”,

“projects”, “plans” or variations of such words and similar

expressions or state that certain actions, events or results “may”,

“could”, “would”, “might”, “will” or “will be taken”, “occur” or

“be achieved”. In addition, any statements that refer to

expectations, projections or other characterizations of future

events or circumstances contain forward-looking information.

Statements containing forward-looking information are not

historical facts but instead represent management’s expectations,

estimates and projections regarding future events. These statements

should not be read as guarantees of future performance, results, or

achievements.

Although management believes that the

anticipated future results, performance or achievements expressed

or implied by the forward-looking information are based upon

reasonable assumptions and expectations, readers should not place

undue reliance on forward-looking information because it involves

assumptions, known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements to differ materially from anticipated future results,

performance or achievements expressed or implied by such

forward-looking information.

In respect of the Rwanda cookstoves project and

the Vietnam household devices project, certain factors that

influence the commercial success of such projects and successfully

meeting the milestones related to such projects, including the

timing and number of expected carbon credits, include among other

things: (i) the Company has retained industry leading

experts/consultants/advisors to assist with the evaluation,

planning, negotiation and execution of such projects, (ii) the work

product, including monitoring reports, of each project’s validation

and verification Body (“VVB”), (iii) project costs and carbon

credit market prices, (iv) the verification of ongoing project

monitoring reports and issuance of carbon credits by Verra, (v)

changes to laws and regulation in applicable jurisdictions, and

(vi) the Company has sufficient funds on hand to make carbon credit

purchase price payments. In respect of the Rwanda cookstoves

project and the Vietnam household devices project, certain

assumptions that influence the commercial success of such projects,

including the timing and number of expected carbon credits, include

among other things: (i) distributed cookstoves and water purifiers

perform to specification when used and participating households use

the devices as contemplated by project estimates, (ii) the

Company’s in-country project partners, being the DelAgua Group in

the case of the Rwanda cookstoves project and SIPCO and the project

offtaker in the case of the Vietnam household devices project,

perform their obligations in connection with the development and

operation of the projects, (iii) with respect to the Rwanda

cookstoves project, the anticipated outcome of the discussions with

respect to the implementation of the letter of authorization with

the Government of Rwanda (iv) with respect to the Vietnam household

devices project, the acceptance of the verification by Verra of the

performance of the project set out in the VVB reports occurs during

the first half of 2024, and (v) continued participant involvement

and public support of the voluntary carbon market.

In respect of the India afforestation,

reforestation, and revegetation project, certain factors that

influence the commercial success of the project include, among

other things: (i) the Company’s expertise with respect to the

evaluation, planning and negotiation of the project, (ii) the

conduct of the Project counterparties, including cooperation with

local small-land owners, (iii) project costs and carbon credit

market prices, (iv) ongoing project monitoring and issuance of

carbon credits by Verra, (v) changes to laws and regulation in the

Republic of India, and (vi) extreme weather event and natural

disasters.

In respect of the India afforestation,

reforestation, and revegetation project, certain assumptions that

influence the commercial success of the project include, among

other things: (i) the development the project remains in line with

anticipated timelines and costs, (ii) project counterparties,

including project partner Value Network Ventures Advisory Services

Pte Ltd., its subcontractors and local small-land owners, perform

their contractual and/or standard operating procedures, (iii) the

successful planting and survival of trees, (iv) the growth rates of

trees are consistent with the expectations under the project which

is then reflected by monitor reports accepted by Verra, (v) the

Company has sufficient funds on hand to make carbon credit purchase

price payments, and (vi) continued participant involvement and

public support of the voluntary carbon market.

The forward-looking statements made herein are

subject to a variety of risk factors and uncertainties, many of

which are beyond the Company’s control, which could cause actual

events or results to differ materially and adversely from those

reflected in the forward-looking statements. Readers are cautioned

that forward-looking statements are not guarantees of future

performance. Specific reference is made to the management

discussion and analysis for the Company’s fiscal year ended

December 31, 2023 and the most recent Annual Information Form on

file with the Canadian provincial securities regulatory authorities

(and available on www.sedarplus.ca) for a more detailed discussion

of some of the factors underlying forward-looking statements and

the risks that may affect the Company’s ability to achieve the

expectations set forth in the forward-looking statements contained

in this press release.

Should one or more of the risks and

uncertainties materialize, or should underlying assumptions prove

incorrect, actual events or results may vary materially and

adversely from those described in the forward-looking information.

The forward-looking information contained in this press release is

provided as of the date of this press release, and the Company

expressly disclaims any obligation to update or alter statements

containing any forward-looking information, or the factors or

assumptions underlying them, whether as a result of new

information, future events or otherwise, except as required by

law.

______________________

1 Based on 117,918,182 issued and outstanding

common shares as of December 31, 2023, and Bank of Canada US/CA

exchange rate of 1.3226 on December 29, 2023.

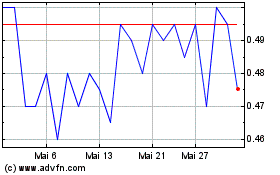

Base Carbon (NEO:BCBN)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Base Carbon (NEO:BCBN)

Historical Stock Chart

Von Nov 2023 bis Nov 2024