~ Global net sales grew 9 percent in the first

quarter compared to the prior year fiscal quarter ~

~ Management reiterates fiscal year 2025

guidance ~

WD-40 Company (NASDAQ:WDFC), a global marketing organization

dedicated to creating positive lasting memories by developing and

selling products that solve problems in workshops, factories and

homes around the world, today reported financial results for its

first fiscal quarter ended November 30, 2024.

First Quarter Highlights and Summary:

- Total net sales were $153.5 million, an increase of 9 percent

compared to the prior year fiscal quarter.

- Translation of the Company’s foreign subsidiaries’ results from

their functional currencies to U.S. dollars had a favorable impact

on net sales of approximately $1.5 million for the current

quarter.

- Total maintenance product sales were $145.5 million, an

increase of 10 percent compared to the prior year fiscal

quarter.

- Gross margin was 54.8 percent compared to 53.8 percent in the

prior year fiscal quarter.

- Selling, general, and administrative expenses were $50.5

million, up 14 percent compared to the prior year fiscal

quarter.

- Advertising and sales promotion expenses were $8.4 million, up

20 percent compared to the prior year fiscal quarter. These

expenses accounted for 5.5 percent of total net sales, up from 5.0

percent in the prior year fiscal quarter.

- Operating income was $25.1 million, an increase of 4 percent

from the prior year fiscal quarter.

- Net income was $18.9 million, an increase of 8 percent from the

prior year fiscal quarter.

- Diluted earnings per share were $1.39 compared to $1.28 in the

prior year fiscal quarter, an increase of 9 percent.

- In the first fiscal quarter the Company reclassified its

homecare and cleaning business portfolios in the Americas and EIMEA

segments to held for sale. Total net sales for these brands were

$5.6 million and gross margin would have been favorably impacted by

60 basis points if those brands were excluded from first quarter

results. In addition, operating income and diluted EPS would have

been reduced by $1.5 million and $0.08, respectively.

“In the first quarter, we executed well against our strategic

priorities, with strong growth across multiple regions including

the United States, Latin America, and EIMEA,” said Steve Brass,

WD-40 Company's president and chief executive officer. “Global

maintenance products, our core strategic focus, delivered a third

consecutive quarter of double-digit growth. These results continue

to demonstrate the strength of our business model and reinforce our

confidence in achieving our long-term objectives.

“As I look around the world, all I see is opportunity. Looking

ahead to fiscal year 2025 and beyond, our focus is clear: stay true

to our Four-by-Four Strategic Framework while embracing our

principle of 'few things, many places, bigger impact.' This

approach will help us unlock value in high-potential markets while

continuing to drive greater operational efficiency and profitable

growth across our trade blocs,” concluded Brass.

Net Sales by Segment (in thousands):

Three Months Ended November

30,

2024

2023

Dollars

Change

Americas (1)

$

69,436

$

64,075

$

5,361

8

%

EIMEA (2)

57,483

48,754

8,729

18

%

Asia-Pacific (3)

26,576

27,587

(1,011

)

(4

)%

Total

$

153,495

$

140,416

$

13,079

9

%

First Quarter Highlights by Segment:

Americas

- The Americas segment represented 45 percent of total net sales

in the first quarter.

- Net sales in the Americas increased 8 percent in the first

quarter compared to the prior year fiscal quarter primarily due to

an increase in net sales of WD-40® Multi-Use Product of 9 percent.

WD-40® Multi-Use Product sales increased most significantly in the

United States and Latin America, which were up $2.4 million and

$2.3 million, respectively. These increases were slightly offset by

lower sales in Canada, which were down by $0.2 million.

- Net sales of WD-40 Specialist® increased 16 percent primarily

due to new distribution and successful promotional programs in the

United States.

- Translation of the Company’s foreign subsidiaries’ results from

their functional currencies to U.S. dollars had an unfavorable

impact on net sales in the Americas of approximately $1.1 million

for the current quarter.

EIMEA

- The EIMEA segment represented 38 percent of total net sales in

the first quarter.

- Net sales in EIMEA increased 18 percent in the first quarter

compared to the prior year fiscal quarter primarily due to an

increase in net sales of WD-40® Multi-Use Product of 21 percent.

WD-40® Multi-Use Product sales increased in almost all regions.

Sales increased most significantly in India, France, the Benelux

regions, and Iberia, which were up $1.9 million, $1.0 million, $0.9

million and $0.9 million, respectively, from period to period.

- Net sales of WD-40 Specialist® increased 17 percent primarily

due to higher sales volume as a result of increased distribution

and stronger levels of demand most significantly in Iberia, U.K.

and Italy.

- Translation of the Company’s foreign subsidiaries’ results from

their functional currencies to U.S. dollars had a favorable impact

on net sales in EIMEA of approximately $2.0 million for the current

quarter.

Asia-Pacific

- The Asia-Pacific segment represented 17 percent of total net

sales in the first quarter.

- Net sales in Asia-Pacific decreased 4 percent in the first

quarter compared to the prior year fiscal quarter primarily due to

a decrease in sales of WD-40® Multi-Use Product of 6 percent.

WD-40® Multi-Use Product sales decreased most significantly in the

Asia distributor markets, which declined $2.6 million from the

prior year comparison. This decrease was partially offset by higher

sales in the China and Australia, which were up by $1.0 million and

$0.3 million, respectively.

- Net sales of WD-40 Specialist® increased 2 percent primarily

due to new distribution in China.

- Homecare and cleaning product sales, which remain strategic

focus for the Company in this segment, increased 20 percent due to

higher sales volume in Australia attributable to successful

promotional activities and improved packaging.

- Translation of the Company’s foreign subsidiaries’ results from

their functional currencies to U.S. dollars had a favorable impact

on net sales in Asia-Pacific of approximately $0.6 million for the

current quarter.

Net Sales by Product Group (in thousands):

Three Months Ended November

30,

2024

2023

Dollars

Change

WD-40 Multi-Use Product

$

118,547

$

107,677

$

10,870

10

%

WD-40 Specialist

19,172

16,842

2,330

14

%

Other maintenance products

(4)

7,788

7,626

162

2

%

Total maintenance products

145,507

132,145

13,362

10

%

HCCP (5)

7,988

8,271

(283

)

(3

)%

Total

$

153,495

$

140,416

$

13,079

9

%

- Net sales of maintenance products, which are considered the

primary strategic focus for the Company, represented 95 percent of

total net sales in the first quarter. Net sales of maintenance

products increased 10 percent in the first quarter when compared to

the prior year fiscal quarter primarily due to higher sales of

WD-40® Multi-Use Product in EIMEA, the United States, and Latin

America.

- Net sales of homecare and cleaning products represented 5

percent of total net sales in the first quarter. Net sales of the

homecare and cleaning products declined 3 percent in the first

quarter when compared to the prior year fiscal quarter primarily

due to lower sales of homecare and cleaning products in the United

States and the United Kingdom, which were partially offset by

higher sales in Australia. The Company has previously disclosed its

intent to actively pursue the sale of its homecare and cleaning

product portfolios in the United States and United Kingdom.

Dividend and Share Repurchase Update

- On December 11, 2024, the Company’s board of directors declared

a regular quarterly dividend of $0.94 per share payable on January

31, 2025 to stockholders of record at the close of business on

January 17, 2025.

- On June 19, 2023, the Company’s board approved a share

repurchase plan that became effective on September 1, 2023. Under

the plan, the Company is authorized to acquire up to $50.0 million

of its outstanding shares through August 31, 2025.

- During the period from September 1, 2024 through the end of the

first quarter, the Company repurchased 13,750 shares at a total

cost of $3.6 million under this $50.0 million plan.

- The timing and amount of repurchases under the plan are based

on terms and conditions as may be acceptable to the Company’s chief

executive officer and chief financial officer, subject to present

loan covenants, and in compliance with all laws and regulations

applicable thereto.

Reiterated Fiscal Year 2025 Guidance

The Company reiterated the following fiscal year guidance on a

pro forma basis, excluding the full fiscal year financial impact of

the homecare and cleaning business portfolios the Company expects

to divest in fiscal year 2025 and the impacts of a favorable

non-cash income tax adjustment which the Company will discuss

during its first fiscal quarter earnings call:

- Net sales growth is from the pro-forma 2024 results is

projected to be between 6 and 11 percent with net sales between

$600 million and $630 million after adjusting for estimated

translation impacts of foreign currency.

- Gross margin for the full year is expected to be between 54 and

55 percent.

- Advertising and promotion investments are projected to be

around 6 percent of net sales.

- Operating income is projected to be between $95 million and

$100 million. This range reflects anticipated growth of between 6

to 12 percent compared to 2024 pro forma results.

- The provision for income tax is expected to be around 24

percent.

- Diluted earnings per share is expected to be between $5.20 and

$5.45 based on an estimated 13.5 million weighted average shares

outstanding. This range reflects anticipated growth of between 9 to

14 percent compared to 2024 pro forma results.

“Our first quarter results reflect strong execution and

significant progress on our gross margin expansion initiatives,”

said Sara Hyzer, WD-40 Company's vice president, finance and chief

financial officer. “We achieved gross margin of 54.8 percent, up

100 basis points from the prior year quarter, moving us

significantly closer to our target of 55 percent. This improvement

reflects favorable sales mix, and the benefit of various supply

chain initiatives executed across the globe. As we look ahead, we

remain confident in achieving our fiscal year 2025 guidance,”

concluded Hyzer.

This guidance is expressed in good faith and is based on

management’s current view of anticipated results on a pro forma

basis. Unanticipated inflationary headwinds and other unforeseen

events may further affect the Company’s financial results. Net

sales guidance is adjusted for estimated translation impact of

foreign currency use weighted average fiscal year 2024 foreign

currency exchange rates. In the event the Company is unsuccessful

in the divestiture of its assets currently held for sale, its

guidance would be positively impacted by approximately $23 million

in net sales, approximately $6 million in operating income, and

approximately $0.33 in diluted EPS for the full fiscal year.

Webcast Information

As previously announced, WD-40 Company management will host a

live webcast at approximately 2:00 p.m. PST today to discuss these

results. Other forward-looking and material information may also be

discussed during this call. Please visit

http://investor.wd40company.com for more information and to view

supporting materials.

About WD-40 Company

WD-40 Company is a global marketing organization dedicated to

creating positive lasting memories by developing and selling

products that solve problems in workshops, factories, and homes

around the world. The Company owns a wide range of well-known

brands that include maintenance products and homecare and cleaning

products: WD-40® Multi-Use Product, WD-40 Specialist®, 3-IN-ONE®,

GT85®, 2000 Flushes®, no vac®, 1001®, Spot Shot®, Lava®, Solvol®,

X-14®, and Carpet Fresh®.

Headquartered in San Diego, California, USA, WD-40 Company

recorded net sales of $590.6 million in fiscal year 2024 and its

products are currently available in more than 176 countries and

territories worldwide. WD-40 Company is traded on the NASDAQ Global

Select Market under the ticker symbol “WDFC.” For additional

information about WD-40 Company please visit

http://www.wd40company.com.

Forward-Looking Statements

Except for the historical information contained herein, this

press release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements reflect the Company’s current expectations with

respect to currently available operating, financial and economic

information. These forward-looking statements are subject to

certain risks, uncertainties and assumptions that could cause

actual results to differ materially from those anticipated in or

implied by the forward-looking statements. These forward-looking

statements are generally identified with words such as “believe,”

“expect,” “intend,” “plan,” “project,” “could,” “may,” “aim,”

“anticipate,” “target,” “estimate” and similar expressions.

Our forward-looking statements include, but are not limited to,

discussions about future financial and operating results,

including: expected benefits from the acquisition transaction or

divestiture transaction; acquired business not performing as

expected; assuming unexpected risks, liabilities and obligations of

the acquired business; disruption to the parties’ business as a

result of the announcement and acquisition transaction or

divestiture transaction; integration of acquired business and

operations into the company; the Company's ability to successfully

complete any planned divestiture; expected timing of the closing

for the divestiture; expected proceeds from the divestiture; the

intended use of proceeds by the Company from the divestiture

transaction; impact of the divestiture transaction on the Company's

stock price or EPS; growth expectations for maintenance products;

expected levels of promotional and advertising spending;

anticipated input costs for manufacturing and the costs associated

with distribution of our products; plans for and success of product

innovation; the impact of new product introductions on the growth

of sales; anticipated results from product line extension sales;

expected tax rates and the impact of tax legislation and regulatory

action; changes in the political conditions or relations between

the United States and other nations; the impacts from inflationary

trends and supply chain constraints; changes in interest rates; and

forecasted foreign currency exchange rates and commodity

prices.

The Company’s expectations, beliefs and forecasts are expressed

in good faith and are believed by the Company to have a reasonable

basis, but there can be no assurance that the Company’s

expectations, beliefs or forecasts will be achieved or

accomplished. All forward-looking statements reflect the Company’s

expectations as of January 10, 2025. We undertake no obligation to

revise or update any forward-looking statements.

Actual events or results may differ materially from those

projected in forward-looking statements due to various factors,

including, but not limited to, those identified in Part I—Item 1A,

“Risk Factors,” in the Company’s Annual Report on Form 10-K for the

fiscal year ended August 31, 2024 which the Company filed with the

SEC on October 21, 2024, and in the Company’s Quarterly Report on

Form 10-Q for the period ended November 30, 2024, which the Company

expects to file with the SEC on January 10, 2025.

Table Notes and General Definitions

(1)

The Americas segment consists of the U.S.,

Canada and Latin America.

(2)

The EIMEA segment consists of countries in

Europe, India, the Middle East and Africa.

(3)

The Asia-Pacific segment consists of

Australia, China and other countries in the Asia region.

(4)

The Company markets its other maintenance

products under the GT85® and 3-IN-ONE® brand names.

(5)

The Company markets its homecare and

cleaning products (“HCCP”) under the X-14®, 2000 Flushes®, Carpet

Fresh®, no vac®, Spot Shot®, 1001®, Lava®, and Solvol® brand

names.

WD-40 COMPANY

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited and in thousands,

except share and per share amounts)

November 30,

2024

August 31,

2024

Assets

Current assets:

Cash and cash equivalents

$

54,914

$

46,699

Trade and other accounts

receivable, net

111,433

117,493

Inventories

74,887

79,088

Other current assets

21,567

12,161

Total current assets

262,801

255,441

Property and equipment, net

59,384

62,983

Goodwill

96,584

96,985

Other intangible assets, net

2,287

6,222

Right-of-use assets

10,581

11,611

Deferred tax assets, net

948

993

Other assets

14,739

14,804

Total assets

$

447,324

$

449,039

Liabilities and Stockholders’ Equity

Current liabilities:

Accounts payable

$

32,212

$

35,960

Accrued liabilities

29,132

31,272

Accrued payroll and related

expenses

20,581

26,055

Short-term borrowings

23,429

8,659

Income taxes payable

2,148

1,554

Total current liabilities

107,502

103,500

Long-term borrowings

84,552

85,977

Deferred tax liabilities, net

9,228

9,066

Long-term operating lease

liabilities

5,297

5,904

Other long-term liabilities

14,448

14,066

Total liabilities

221,027

218,513

Commitments and Contingencies

Stockholders’ equity: Common stock — authorized 36,000,000

shares, $0.001 par value; 19,940,370 and 19,925,212 shares issued

at November 30, 2024 and August 31, 2024, respectively; and

13,549,989 and 13,548,581 shares outstanding at November 30, 2024

and August 31, 2024, respectively

20

20

Additional paid-in capital

174,258

175,642

Retained earnings

506,898

499,931

Accumulated other comprehensive

loss

(35,453

)

(29,268

)

Common stock held in treasury, at

cost — 6,390,381 and 6,376,631 shares at November 30, 2024 and

August 31, 2024, respectively

(419,426

)

(415,799

)

Total stockholders’ equity

226,297

230,526

Total liabilities and

stockholders’ equity

$

447,324

$

449,039

WD-40 COMPANY

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited and in thousands,

except per share amounts)

Three Months Ended November

30,

2024

2023

Net sales

$

153,495

$

140,416

Cost of products sold

69,408

64,863

Gross profit

84,087

75,553

Operating expenses:

Selling, general and

administrative

50,525

44,135

Advertising and sales

promotion

8,393

6,983

Amortization of definite-lived

intangible assets

47

251

Total operating expenses

58,965

51,369

Income from operations

25,122

24,184

Other income (expense):

Interest income

148

74

Interest expense

(873

)

(1,146

)

Other expense, net

(141

)

(40

)

Income before income taxes

24,256

23,072

Provision for income taxes

5,331

5,590

Net income

$

18,925

$

17,482

Earnings per common share:

Basic

$

1.39

$

1.28

Diluted

$

1.39

$

1.28

Shares used in per share

calculations:

Basic

13,548

13,560

Diluted

13,573

13,584

WD-40 COMPANY

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited and in

thousands)

Three Months Ended November

30,

2024

2023

Operating activities:

Net income

$

18,925

$

17,482

Adjustments to reconcile net

income to net cash provided by operating activities:

Depreciation and amortization

2,075

2,261

Amortization of cloud computing

implementation costs

416

57

Net gains on sales and disposals

of property and equipment

(41

)

(58

)

Deferred income taxes

522

625

Stock-based compensation

1,499

2,271

Unrealized foreign currency

exchange (gains) losses

(330

)

322

Provision for credit losses

994

42

Write-off of inventories

255

811

Changes in assets and

liabilities:

Trade and other accounts

receivable

(293

)

2,886

Inventories

(2,651

)

4,042

Other assets

(1,177

)

139

Operating lease assets and

liabilities, net

14

(8

)

Accounts payable and accrued

liabilities

(1,730

)

(4,697

)

Accrued payroll and related

expenses

(4,954

)

(998

)

Other long-term liabilities and

income taxes payable

1,406

1,739

Net cash provided by operating

activities

14,930

26,916

Investing activities:

Purchases of property and

equipment

(691

)

(786

)

Proceeds from sales of property

and equipment

124

115

Net cash used in investing

activities

(567

)

(671

)

Financing activities:

Treasury stock purchases

(3,627

)

(2,414

)

Dividends paid

(11,958

)

(11,297

)

Repayments of long-term senior

notes

(400

)

(400

)

Net proceeds (repayments) from

revolving credit facility

14,771

(9,713

)

Shares withheld to cover taxes

upon conversions of equity awards

(2,883

)

(678

)

Net cash used in financing

activities

(4,097

)

(24,502

)

Effect of exchange rate changes

on cash and cash equivalents

(2,051

)

431

Net increase in cash and cash

equivalents

8,215

2,174

Cash and cash equivalents at

beginning of period

46,699

48,143

Cash and cash equivalents at end

of period

$

54,914

$

50,317

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250110676157/en/

Media and Investor Contact: Wendy Kelley Vice President,

Stakeholder and Investor Engagement investorrelations@wd40.com

+1-619-275-9304

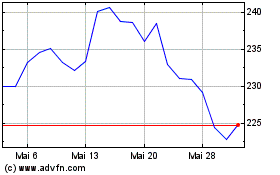

WD 40 (NASDAQ:WDFC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

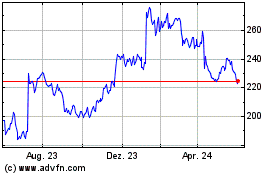

WD 40 (NASDAQ:WDFC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025